- Curve has experienced significant price spikes due to increased developer activity.

- In the derivatives market, there has been a noticeable increase in betting on predictions that CRV will be higher.

Last week, the curve (CRV) maintained its upward trajectory.

After an impressive 123.49% gain in last week’s rally, the token has gained an additional 44.13% in the last 24 hours, establishing itself as one of the best-performing assets on the market.

AMBCrypto examines the factors behind CRV’s recent price surge and assesses whether this momentum is likely to continue.

Investors are showing renewed interest in CRV.

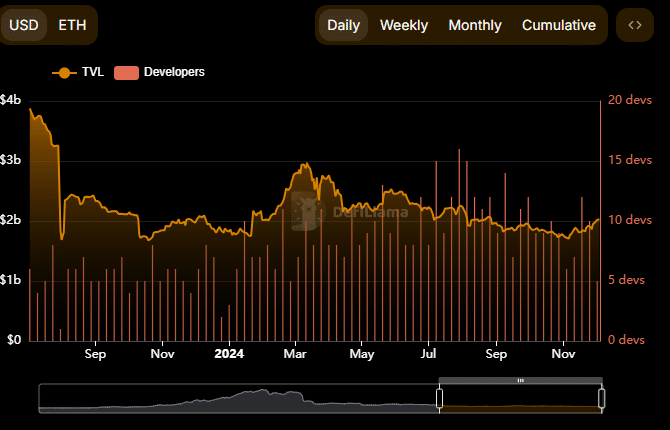

CRV showed notable increases in both developer activity and total value locked (TVL), demonstrating renewed investor confidence.

Total Value Lock (TVL) serves as a key indicator of investor activity within the blockchain ecosystem. This reflects the amount of assets deposited and staked to support development and operations.

After declining for several months since September, CRV’s TVL rebounded significantly, reaching $2.03 billion. This recovery represents a return to pre-decline levels and suggests growing bullish sentiment in the market.

As reported by DeFiLlama, the increase in TVL coincides with a surge in developer activity.

Increasing developer participation means continued improvement and innovation within the CRV ecosystem, which could lead to positive pricing momentum.

Source: DeFiLlama

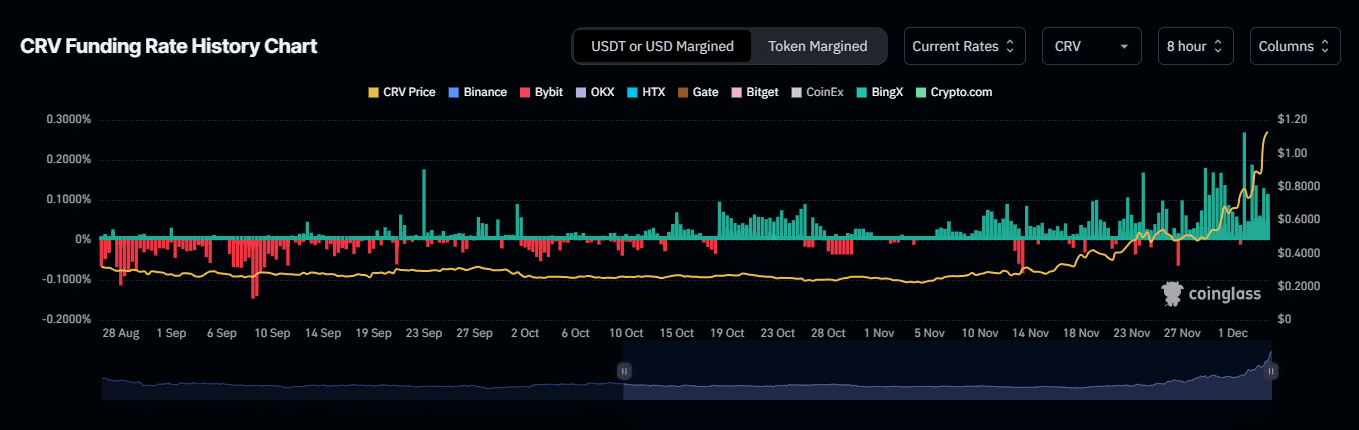

This wave of buying activity is evident not only from ecosystem investors, but also in the derivatives market, where traders are increasingly optimistic about CRV’s prospects.

Derivative traders further increase CRV’s momentum.

Derivatives traders are mirroring investor behavior by opening long positions in CRV, which shows strong bullish sentiment.

Over the past 24 hours, the funding rate has shown a significant rise, reaching 0.0820% at press time. These mainly optimistic numbers indicate the growing presence of long traders in the market.

Funding rates play an important role in regulating the imbalance between the spot and futures prices of an asset. As observed here, rising funding rates indicate that buyers (long-term traders) are dominating market activity.

Source: Coinglass

Open interest also soared, increasing 30.42% to $270.33 million.

This growth reflected a greater number of active buyers in the market, with open contracts and ongoing positions further driving the bullish outlook for CRV.

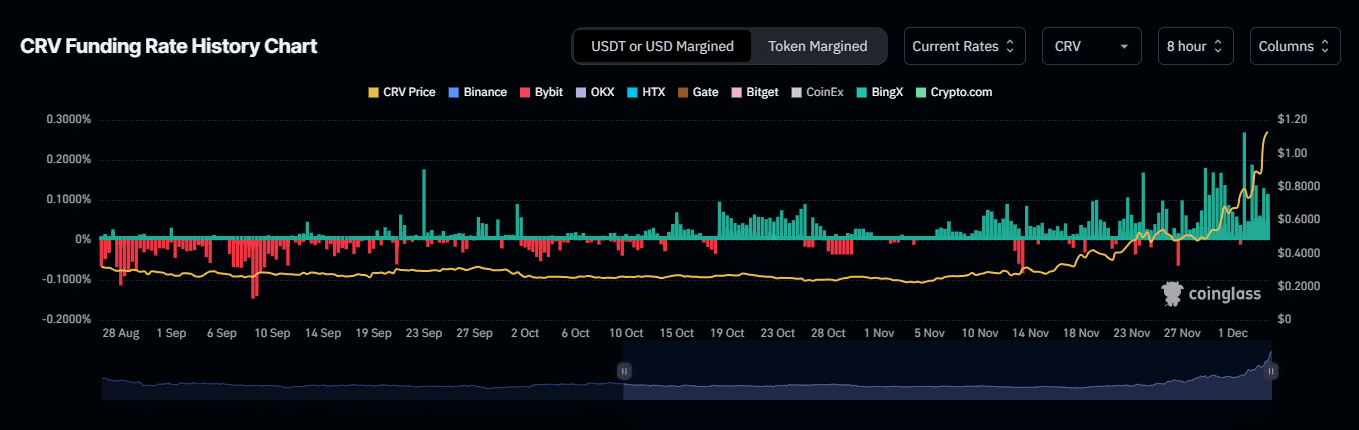

CRV’s buy position increases

Data from Coinglass shows an increase in long positions opened on the market, reflecting growing optimism among traders.

CRV (Read Curve) price forecast for 2024-2025

At press time, the long/short ratio had risen to 0.9739, indicating increased interest in CRV.

A ratio above 1 could further support a continued price surge for CRV, especially if investor and derivatives trader activity continues to strengthen.