- Bitcoin can decrease 6.5% for the next support of $ 77,400 if it is lower than 200 EMA.

- Violation of $ 1,780 at the core level can reduce Etherrium by 15%.

Customs tensions are already affecting the cryptocurrency market, and assets are experiencing a major drop in prices as investors take strategic measures prior to today’s announcement.

The tariff is afraid in the encryption market.

Since Donald Trump’s inauguration, the overall Cryptocurrency market has fallen significantly, and he will no longer decrease because his tariffs do not show signs of ending.

On April 2, the cryptographic analyst shared the post on X (previous Twitter), and SPOT BITCOIN ETFS leaked $ 150 million, and SPOT ETHEREUM ETFS earned $ 3.6 million in April 1.

This indicates that investors are withdrawn from this asset. Large leakage is often considered to be a significant sign of weakness because it often creates sales pressure and can cause additional prices.

Meanwhile, X’s posts also mentioned that the agency is reducing the risk before today’s tariffs.

Current price momentum

Despite this uncertainty, BTC and ETH remain positively, unlike other cryptocurrencies, maintaining 1% and 0.35% of the last 24 hours, respectively.

According to CoinmarketCap data, BTC has a nearly $ 84,300 transaction, while ETH has a transaction of nearly $ 1,860. However, the daily chart seemed to have disappeared as the price of the assets was disappearing as it flashed signs of potential reductions.

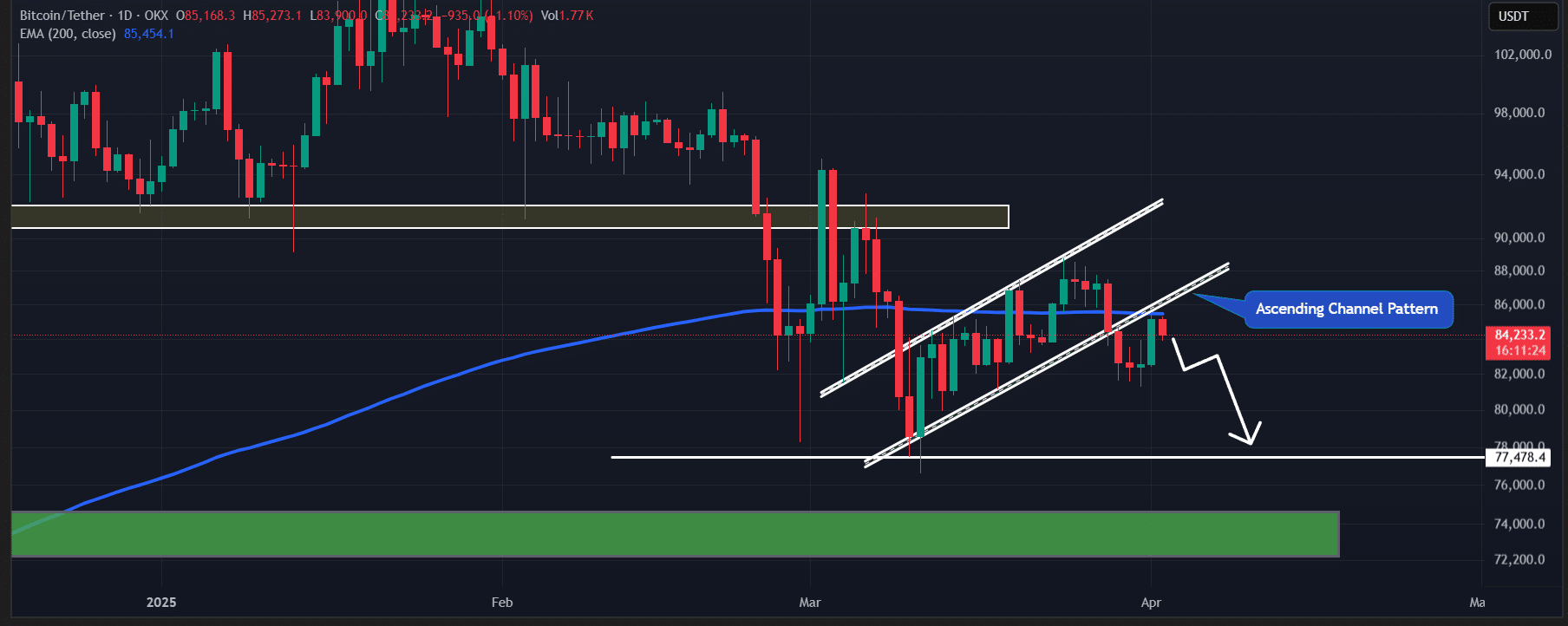

King Coin has successfully resumed the failure of the uphill channel pattern and is now faced with a decline after resistance in EMA (Exponential Moving Average) for a daily period.

Based on the recent price behavior and current market sentiment, if the BTC is lower than the 200 -day EMA, it is likely to decrease 6.5% to $ 77,400 for the next support.

The chart indicates that the core level of the BTC is a 200 -day EMA for a daily period.

Source: TradingView

Ether Leeum price analysis and major levels

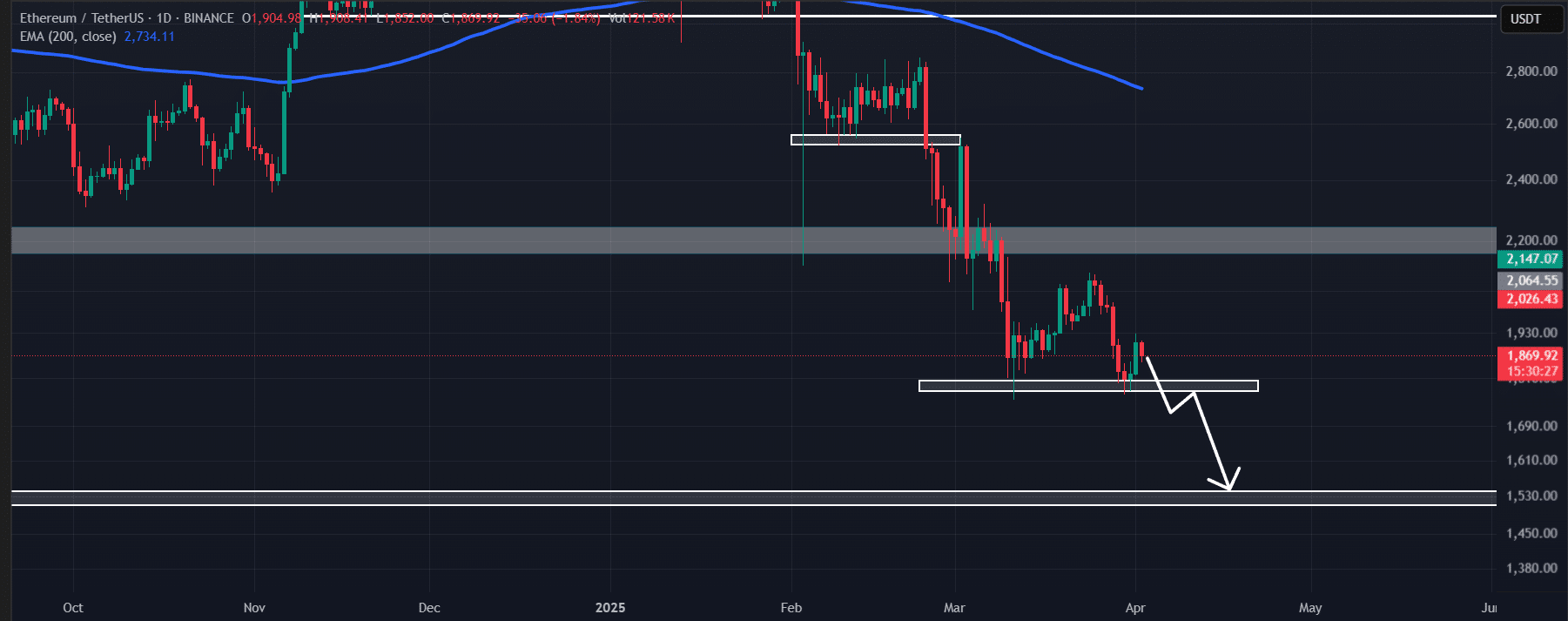

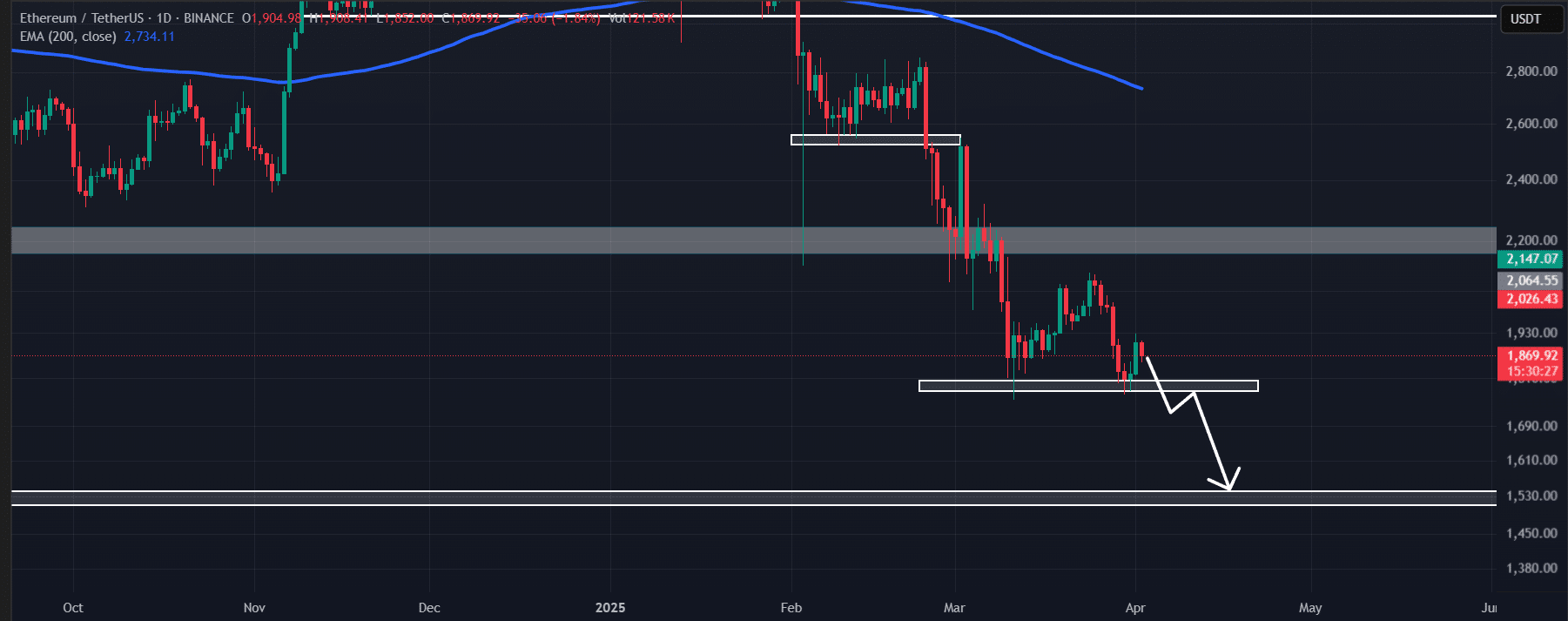

Ether Lee, meanwhile, was also close to $ 1,780. If the ETH continues to decline and violates this level, the price is likely to be lowered to $ 1,550 because it is more likely to fall by 15%.

The Ethereum Daily chart indicates that $ 1,780 is a key level that can determine the next movement of ETH.

Source: TradingView

Merchants’ weakness of BTC and ETH

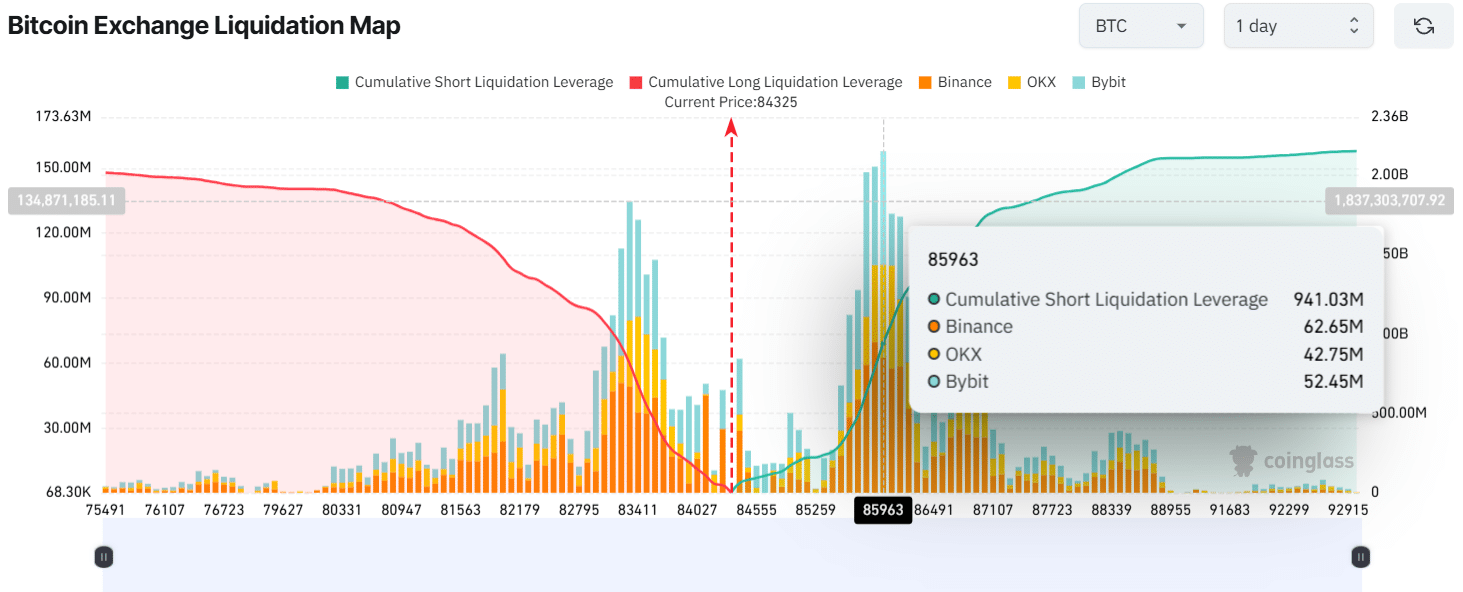

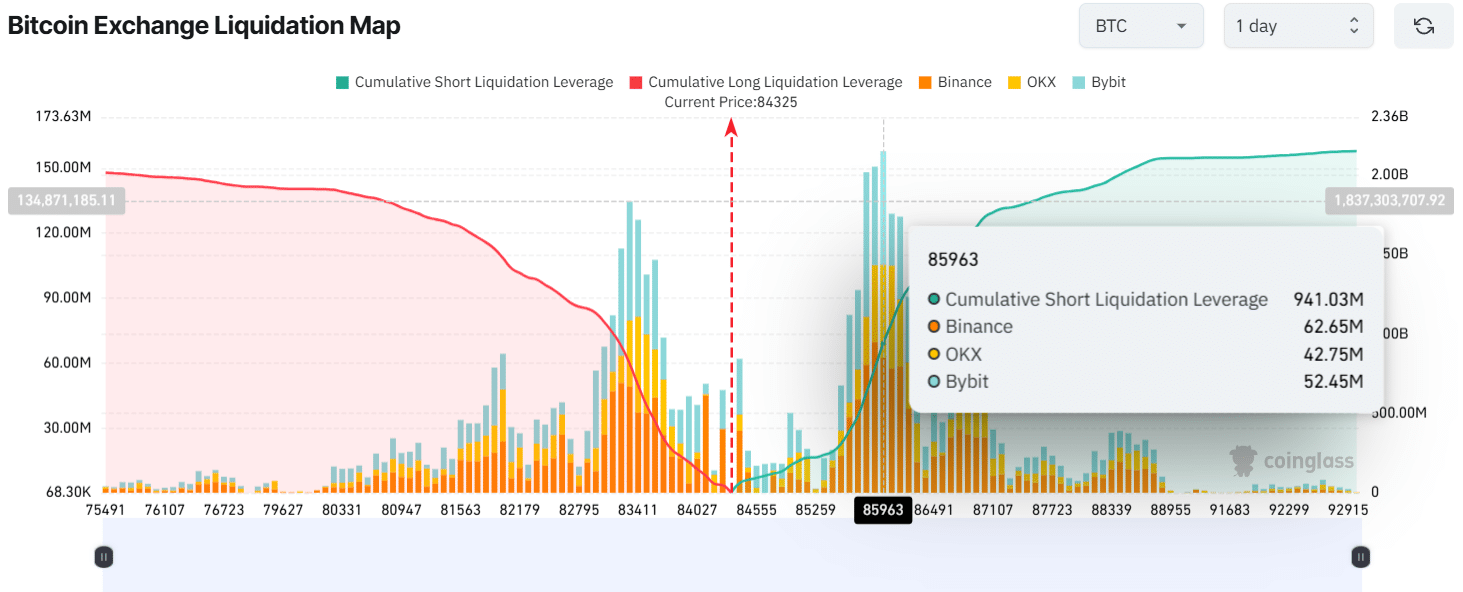

According to the data from CoingLass, a whole chain analysis company, the trader received excessive salary for the prestation time, the main level is $ 83,320 at the bottom and $ 85,960 at the top.

They each had a long, short position of $ 881 million, respectively.

In addition, the high bet in the short position has the potential to lower the price, which is the timelyness of the BTC.

Source: COINGLASS

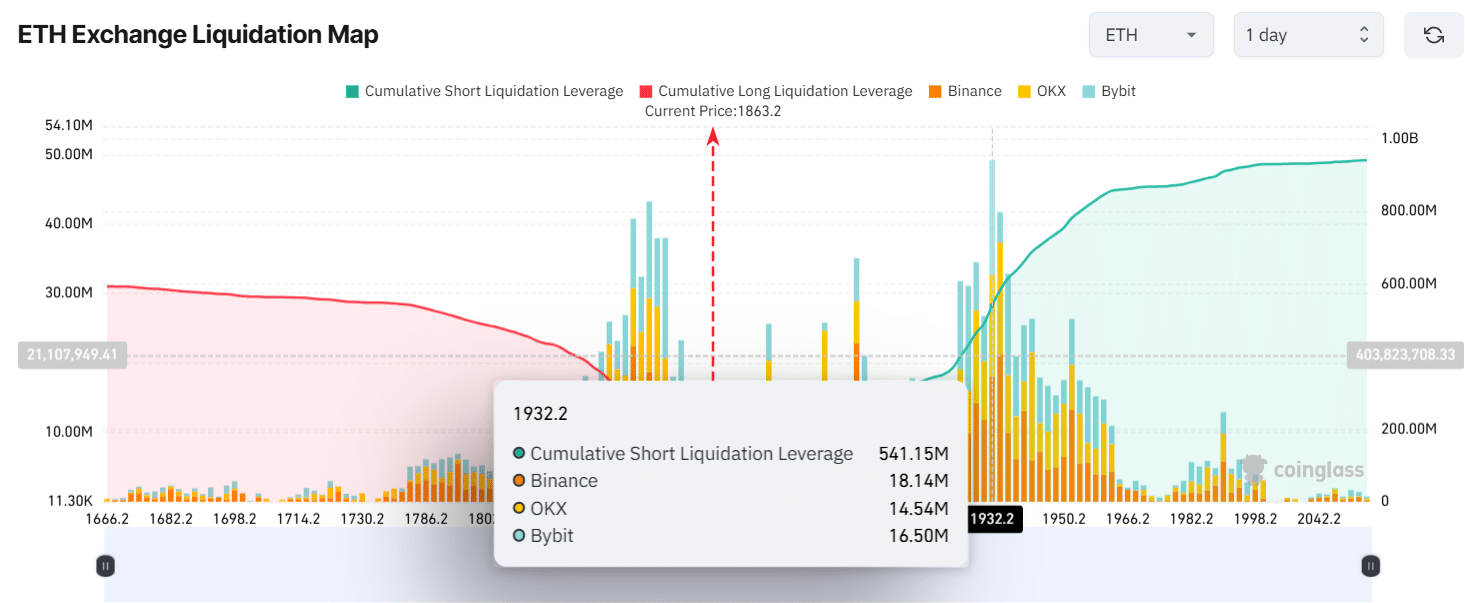

Merchants, on the other hand, were strongly weak in ETH.

According to the data, the excessive level of ETH is $ 1,932 and $ 1,840, and the trader has built $ 185 million in a long position of $ 550 million and $ 180 million over the last 24 hours.

This indicates that Bears is currently being controlled by the upcoming customs announcement.

Source: COINGLASS