- HBAR market interest and trading volume reach record highs

- With buyer fatigue at the $0.4 level increasing, will the HBAR pattern for 2021 emerge?

Hedera Hashgraph (HBAR) It’s done These are the main highlights of this cycle’s altcoin season.

In fact, it has risen 9x over the past month, surging from $0.04 to $0.35, surpassing Bitcoin (BTC). But what was behind this amazing pump?

What drives HBAR?

The main driver behind HBAR’s 9x pump was massive market interest, which led to volume quickly rising past 2021 highs.

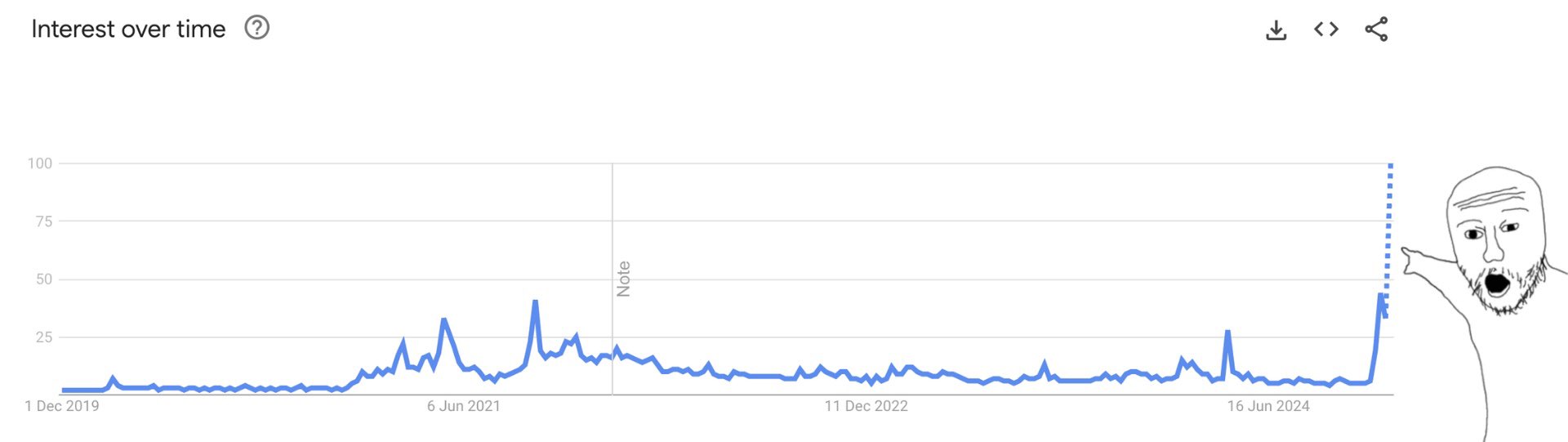

According to google trendsSearch interest for Hedera increased in November, reaching an all-time high in early December.

Source: Google Trends

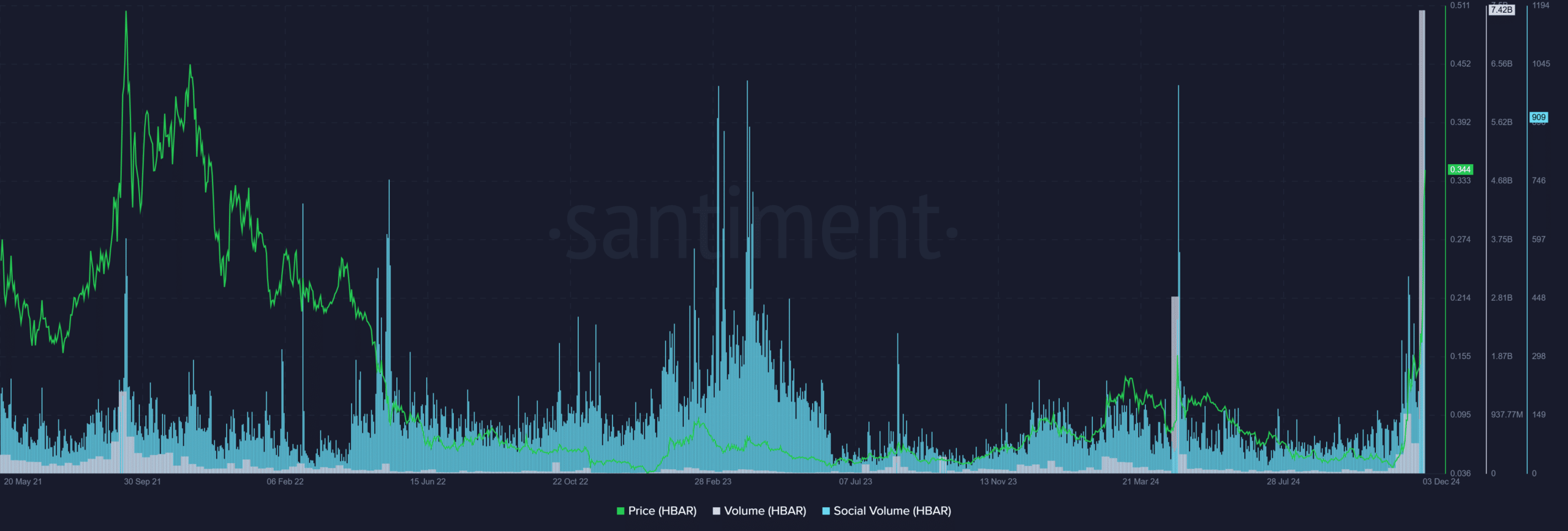

The rise in market interest has also had an impact on social trading volume, which is also reflected in trading volume. HBAR’s trading volume hit $7.42 billion ATH, surpassing its March 2024 and 2021 highs.

Trading volume peaked at $1.31 billion in 2021, and reached a record $2.84 billion in March 2024. This is approximately three times the trading volume.

Source: Santiment

It is also worth noting that rumors that President-elect Donald Trump had nominated Hedera board member Brian Brooks as SEC chairman also fueled the campaign.

Prediction markets are now preferred With the appointment of Paul Atkins, Brooks’ name has had an impact on altcoin scale. HBAR surged 63% this week after his name was floated as a potential successor to Gary Gensler.

So, despite the incredible partnerships and fundamentals, HBAR’s massive rally appears to have been driven by larger market interest.

Source: X

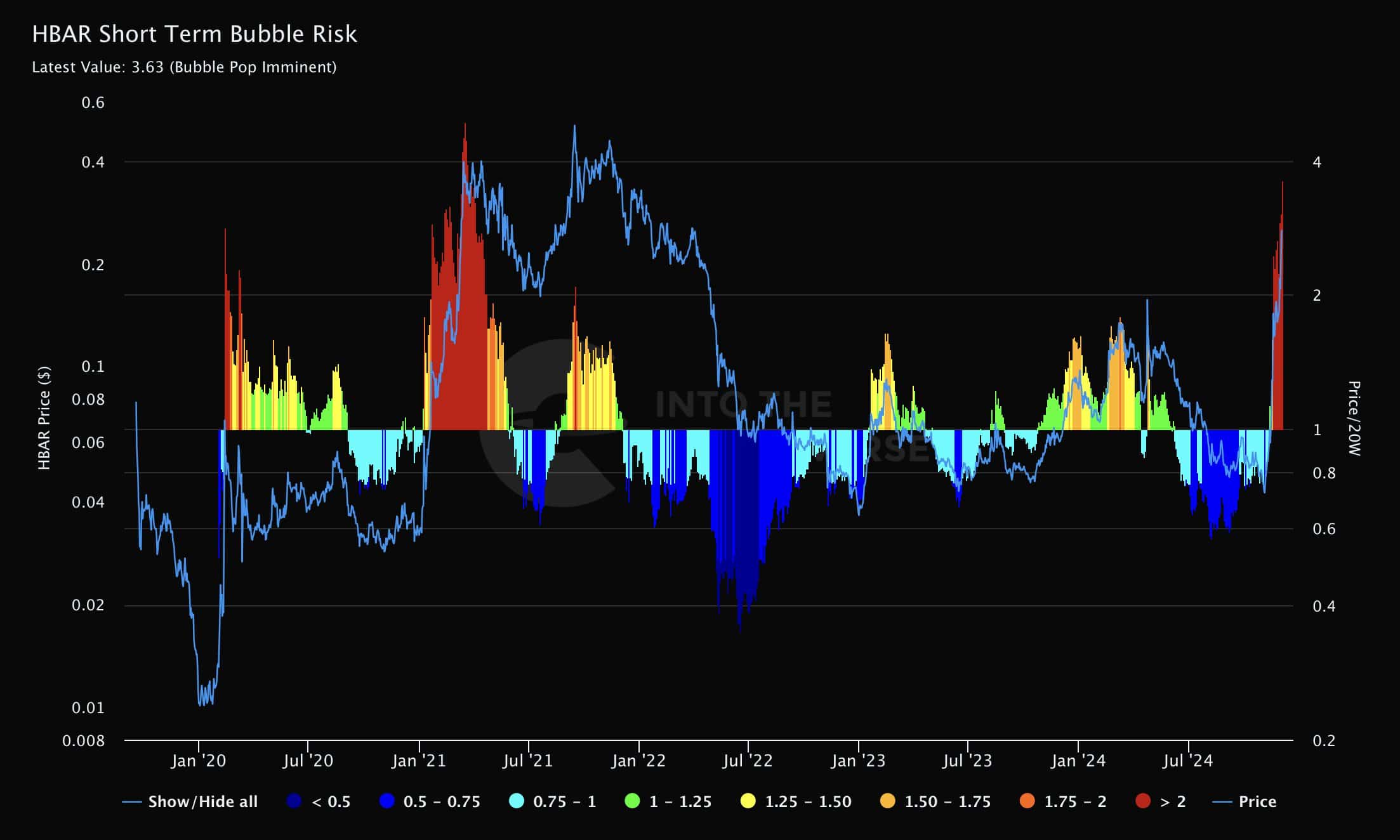

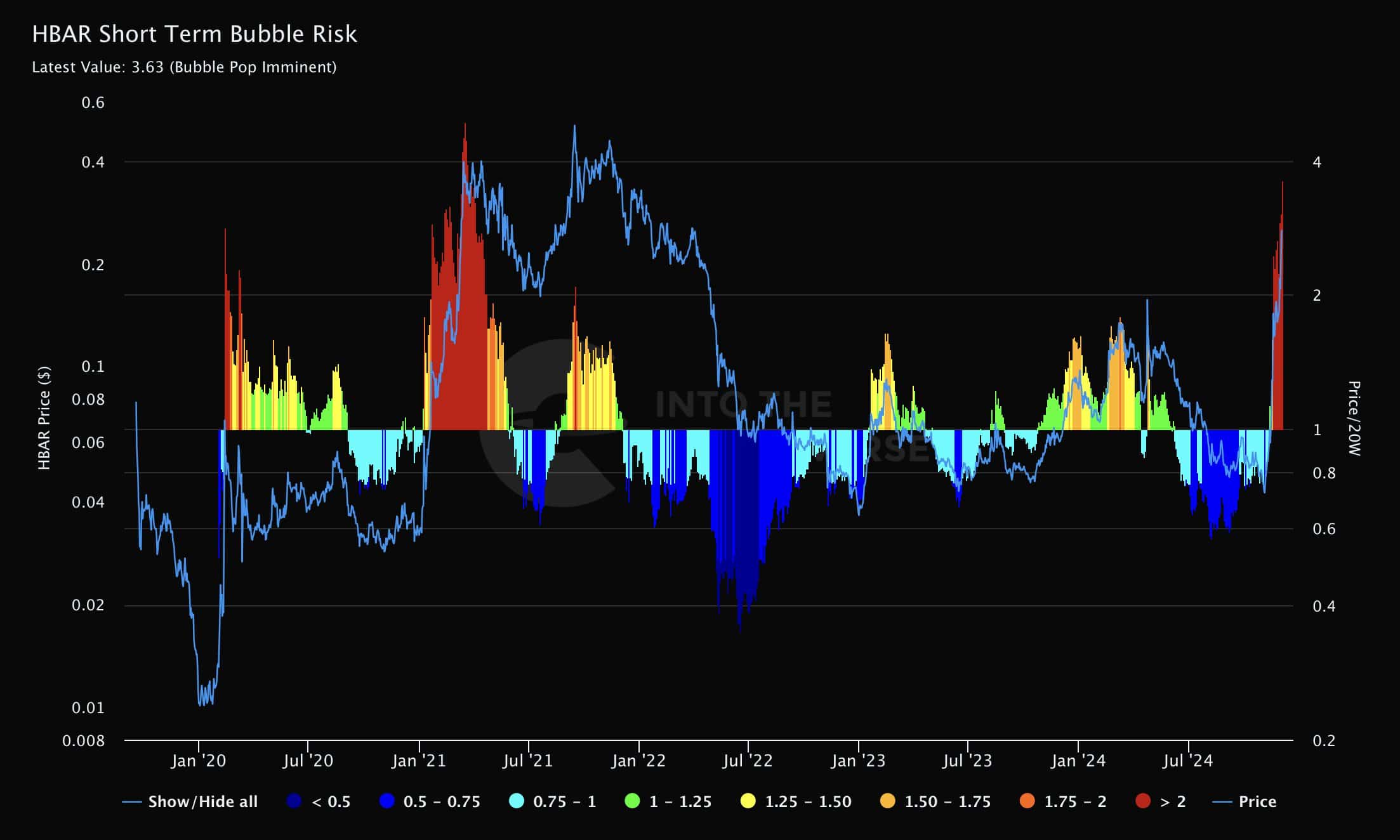

Cryptocurrency analyst Benjamin Cowen warning A rally signals the risk of a short-term bubble. This is a sign that the altcoin may soon plateau or reverse.

Read Hedera Hashgraph (HBAR) price prediction for 2024-2025

In the meantime, HBAR appears to be facing buyer exhaustion near the $0.4 level on the price chart, as evidenced by the long upper wick of the weekly candlestick.

In 2021, HBAR plateaued at the level, retraced to $0.2 and then rose higher to $0.57. So the question is – will this trend repeat itself?

Source: HBAR/USDT, TradingView