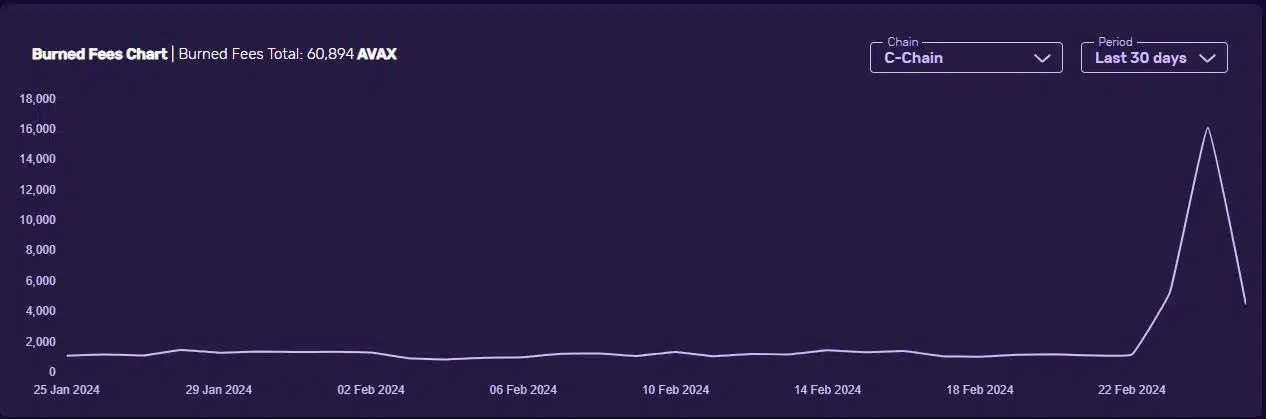

- Last week accounted for more than half of all AVAX tokens burned in the past 30 days.

- But the spike failed to exert upward pressure.

The burn rate of Avalanche (AVAX) has skyrocketed over the past week, accelerating the rate at which its native token enters circulation.

According to AMBCrypto’s analysis of Avascan data, approximately 31,650 AVAX coins went up in smoke over the past seven days, with more than half of them being burned on February 24 alone.

The dramatic spike followed several days of stability in which daily burn rates hovered in the 1,000 to 1,300 range. As a result, last week accounted for more than half of all tokens burned in the last 30 days.

Source: Avascan

More network activity means faster video speeds.

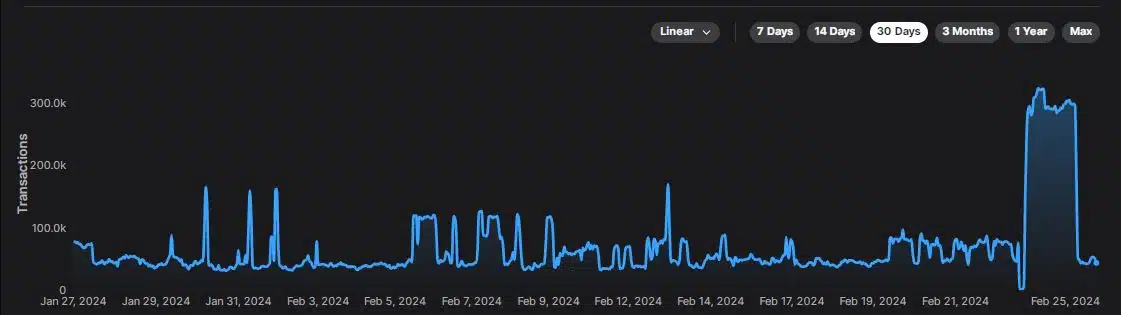

Using data from Avalanche Explorer, AMBCrypto found that the burn rate spike followed a similar surge in network transactions.

Following the existing framework, Avalanche burns all revenue generated from transaction fees.

This means that the higher the network activity, the higher the fees and consequently the greater the amount of AVAX burned.

Source: Avalanche Explorer

Typically, burn activity is interpreted as a bullish event due to the supply shortage it causes. However, last week’s surge failed to put upward pressure on AVAX.

As of this writing, the ninth-largest cryptocurrency is down 8.46% over the past week, according to CoinMarketCap.

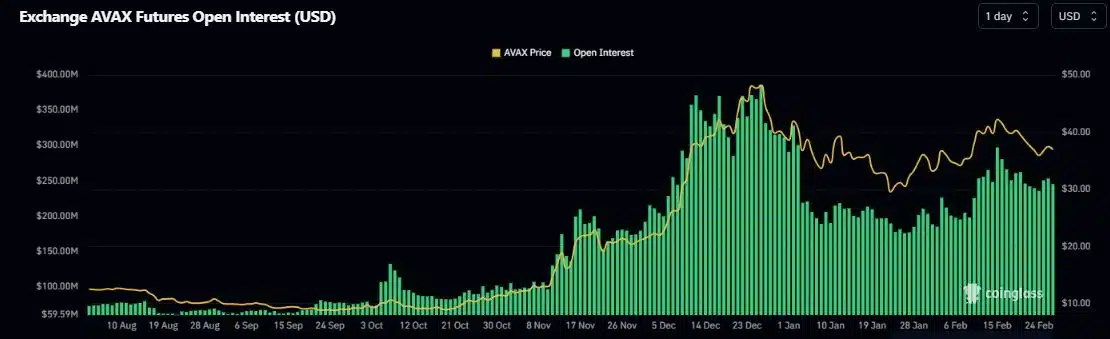

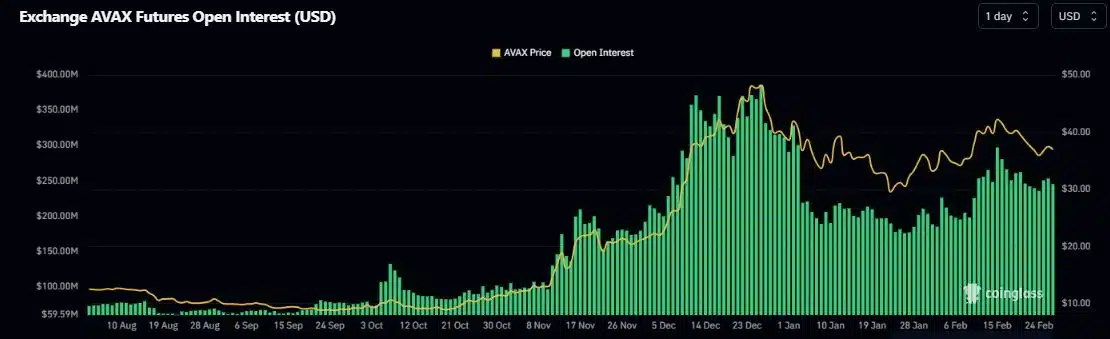

Derivatives markets are trending lower on AVAX.

AVAX’s price decline has impacted speculative interest in the token. AMBCrypto’s examination of Coinglass data shows that open interest (OI) for AVAX Futures has fallen 18% over the past 10 days.

Source: Coinglass

During the same period, AVAX’s long/short ratio has not exceeded 1, meaning that bearish leveraged traders clearly have the upper hand.

What do technical indicators say?

Examining AVAX’s daily chart provided some interesting clues as to its next move.

The Relative Strength Index (RSI) tested the neutral 50 level as resistance and pulled back. A successful breach of this level could inject some bullishness into AVAX going forward.

How much is 1,10,100 AVAX worth today?

At the time of writing, the moving average convergence divergence (MACD) line is below the signal line, indicating a retracement.

However, a bullish crossover looked plausible and AVAX was subsequently able to resume its upward trend.