- DIA has a bullish structure and high buying pressure.

- Rejection of weekly resistance and a 16% drop meant the market may be overextended.

Decentralized Information Asset (DIA) has surged on the price chart. Since September 29th, the token has increased by 68% and trading volume on Monday was 16 times the volume on September 28th.

The token has reached a resistance area on the weekly chart after this massive rise. Bitcoin (BTC) movement helped DIA sentiment. Should long-term holders cash out or wait for bigger gains?

Examples of continuous movement

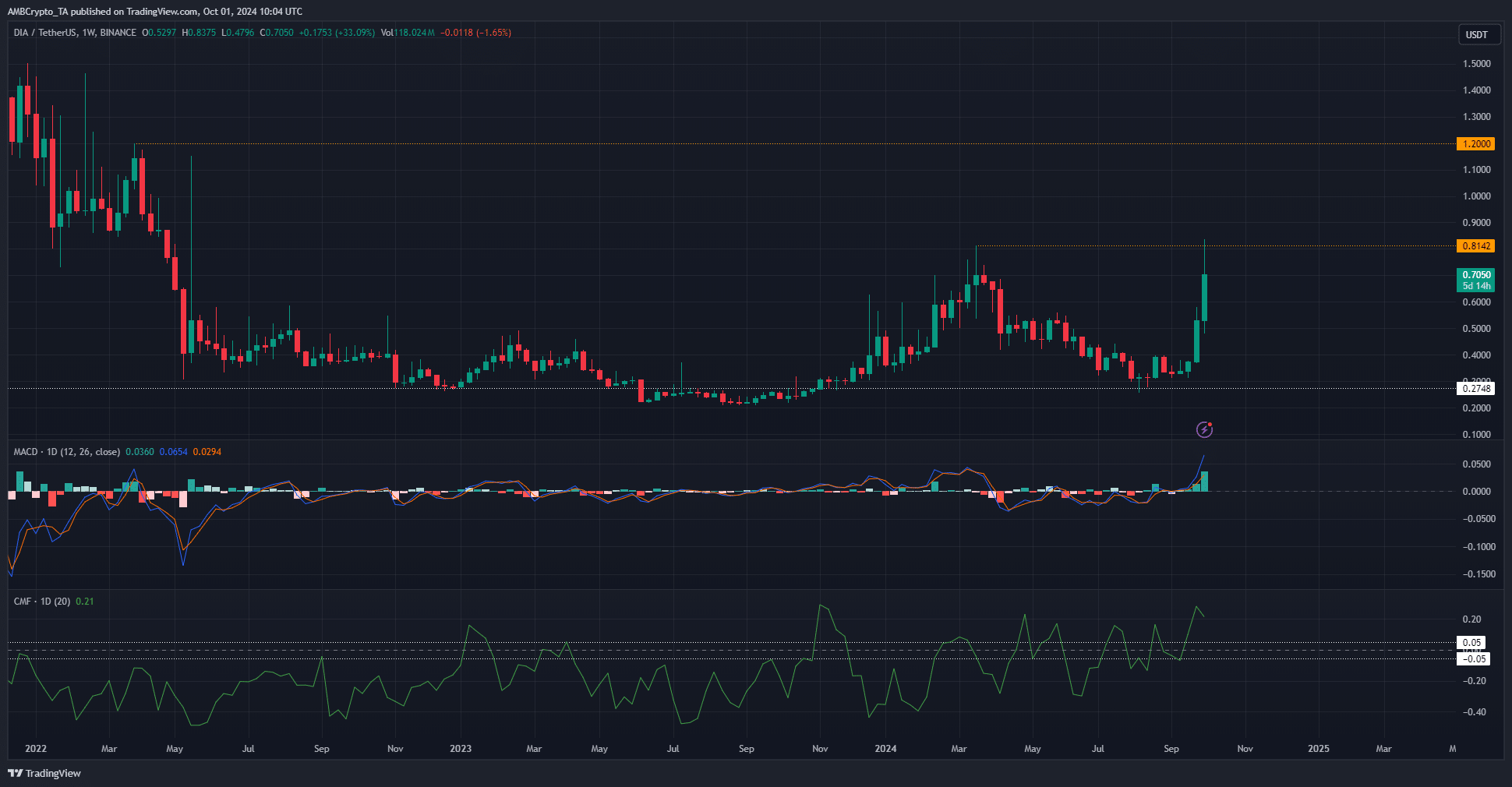

Source: DIA/USDT on TradingView

The strong and rapid surge has caused many traders to jump off the sidelines and rush to participate in DIA’s ongoing rally.

This surge in interest could push DIA higher, but it also has the potential to create volatility due to overly zealous and late-rising futures market activity.

A move to $0.81 led to a rejection and the price fell 16% from the local high of $0.837. Indicators on the daily time frame supported the bullish outlook.

CMF reached its last seen high in November 2023, while MACD surged higher than it has since September 2021.

However, since this is a lagging indicator, it follows the price and does not predict the next move.

Claims for recent regional surge

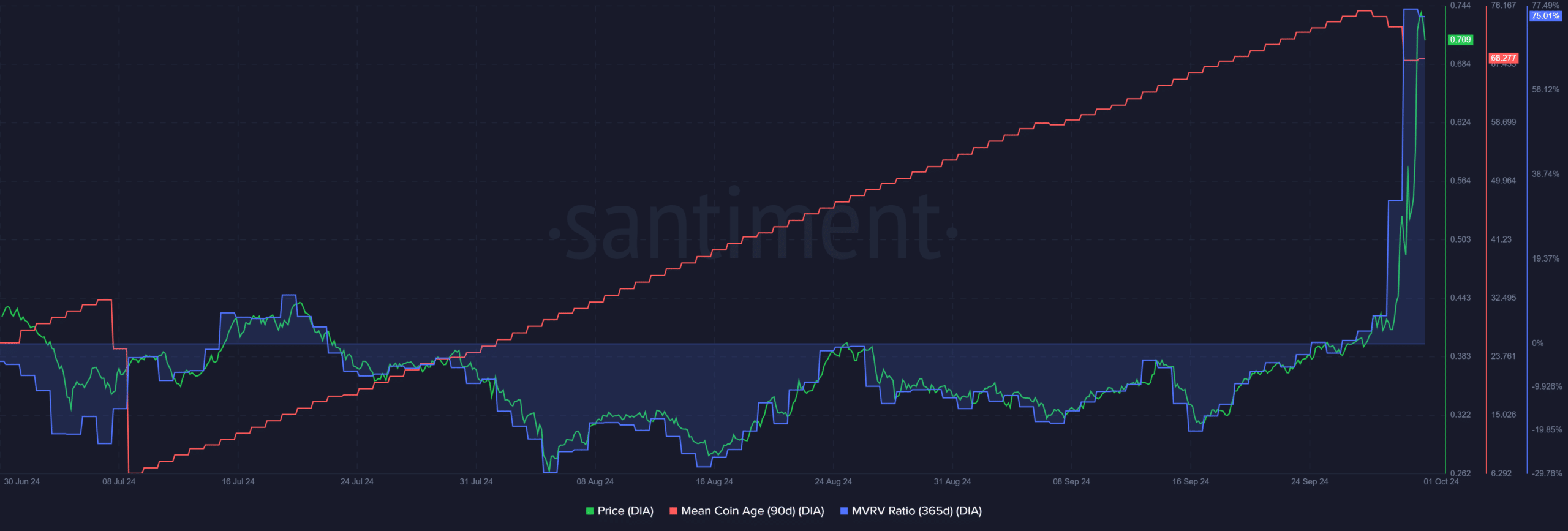

Source: Santiment

The weekly price chart showed a possible retracement to the 50% and 78.6% Fibonacci retracement levels of $0.54-$0.38.

Since the sudden move alienated many traders, a retracement and consolidation could give time for the next rally in the coming months.

The average monetary age has been on the rise since July and is showing a cumulative trend. The 365-day MVRV ratio shows that 75% of holders made a profit during this period.

Realistic or not, DIA’s market cap in BTC terms is:

This can lead to extreme profit-taking activity and price crashes.

AMBCrypto believed that bulls were unlikely to force the price beyond the $0.81 area. The market is likely to be overextended and a retracement to key Fib levels could trigger the next rally.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.