Dogecoin (DOGE), a meme-inspired cryptocurrency with a loyal following, has been riding a wave of optimism recently. Over the past week, the price has surged nearly 8%, much to the delight of investors. However, recent moves by large DOGE holders have cast a shadow of uncertainty over the future of this naughty pup’s price trajectory.

Related Reading

Dogecoin buoyed by market uptrend and short squeeze

The broader cryptocurrency market sentiment has been bullish recently and DOGE has been happily wagging its tail. There has been a significant price increase over the past week, and it seems to have been on a roll, with a 3% increase in the last 24 hours alone.

This pushed the price of DOGE to $0.152, putting smiles back on the faces of many investors who had been waiting for a continued rise.

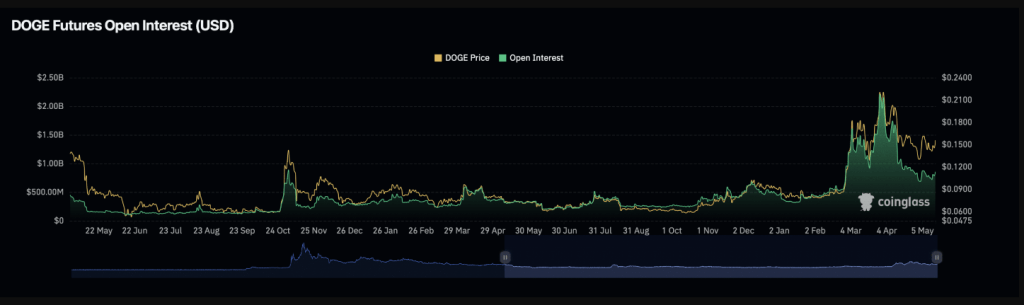

The party was not limited to the spot market. The derivatives market also saw a notable increase in activity, with Dogecoin futures open interest jumping by 9%.

This signals a renewed interest by traders, especially those seeking to capitalize on potential price movements through futures contracts.

Adding fuel to the fire, short sellers have been feeling the heat lately. According to Coinglass, they face liquidation totaling $2.27 million.

This could potentially trigger a short squeeze, a scenario where short sellers buy back DOGE to cover their positions, driving the price higher. However, these positive developments will depend on whether they can overwhelm potential selling pressure arising from recent whale movements.

Whale Alert: Mass Migration Sparks Speculation

Just as things looked bright for DOGE, transactions involving whales sent waves of concern throughout the Dogecoin community. Data from Whale Alert shows that a whopping 200 million DOGE worth about $30.86 million were transferred to trading platform Robinhood.

This huge move has led many to suspect that the whale may be preparing to liquidate a significant portion of its holdings. A large sell-off could create significant selling pressure and potentially derail DOGE’s current upward momentum.

Related Reading

Technical Analysis: Breaking Trends and Potential Downsides

Looking inside from a technical perspective, DOGE appears to be attempting to break the daily downtrend. This is a positive sign for an uptrend, indicating a potential change in market sentiment. Further analysis shows that DOGE has recently entered an order block, contributing to its continued price rise.

Featured image from War History Online, chart from TradingView