In 2025, the imminent Altcoin season predictions were distributed several times. But no one has fruit. Some market watchers continue to hope for the resurrection, but other market watchers are growing skeptically..

Beincrypto discussed with several experts to discuss the potential of the Altcoin season at this cycle. They agree that the Alt Season is delayed but not dead.

What is the 2025 ALTCOIN season?

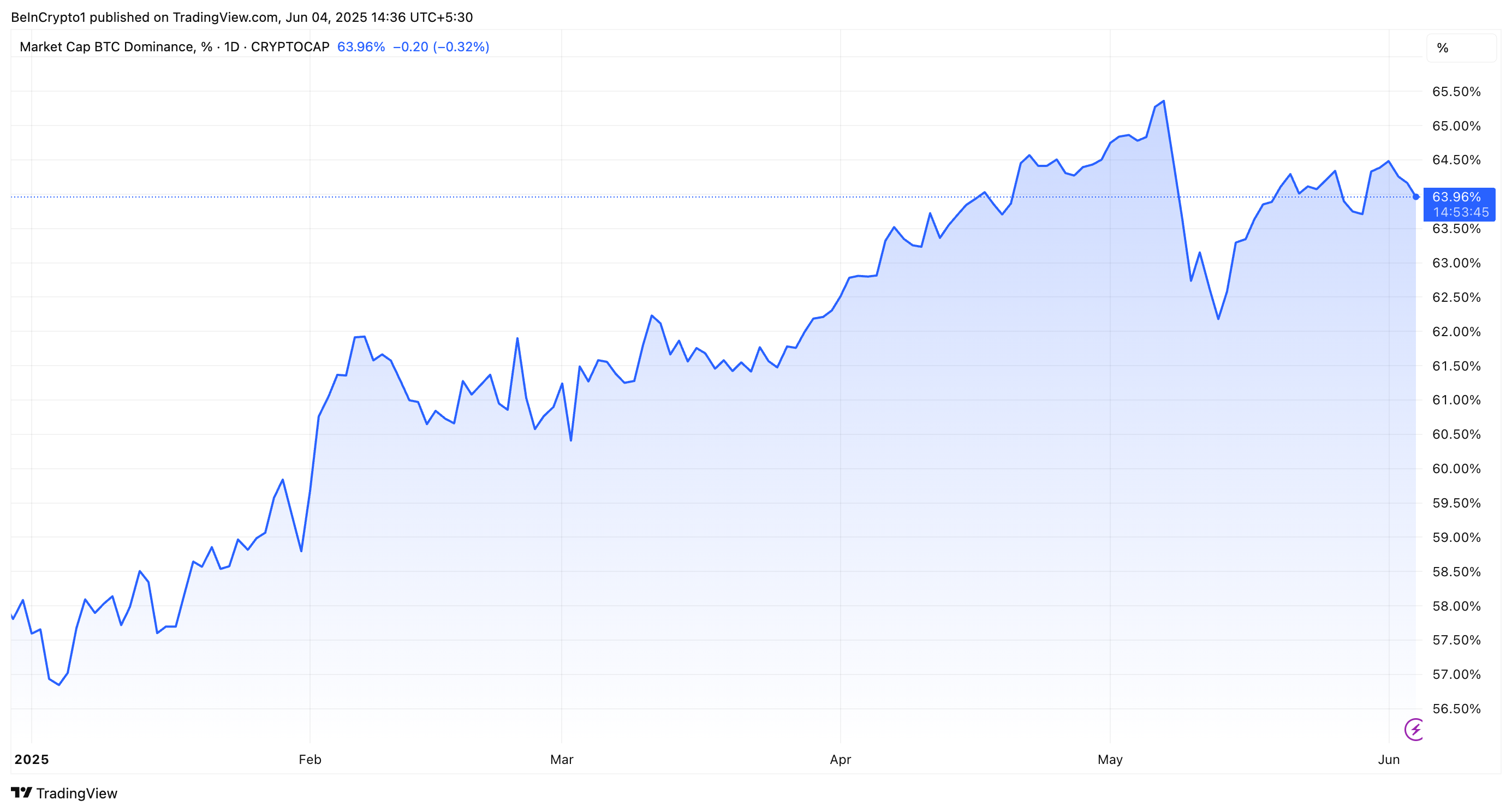

BTC (Bitcoin) is currently leading the cost of encryption and market dominance is steadily rising. In May, it has reached 65.3%, the highest level since 2021.

At the same time, the price of the BTC was also very grateful and the highest record of more than $ 111,800 last month. Historically, the Altcoin season follows Bitcoin’s rally as capital rotates as a small coin.

Some coins have recently gained strong profits, but are isolated. In addition, according to CoingLass data, Altcoin Season Index showed that there were 16 prestations.

This raised concerns about why the capital rotation pattern was not repeated. Willy Chuang, co -founder of Truenorth, explained the factor of delay. He pointed out that institutional investors are currently leading Bitcoin rally and have little interest in Altcoin.

“BTC prefers Bitcoin as a” safe betting “, and capital rotation to Altcoin will mute, and it is also less attractive to structural risk -side capital such as smart contract vulnerabilities, regulatory uncertainty and failure.

The administration also recognized the isolated performance of memes coins in the short -term pump. Nevertheless, he argued that a wide range of market rotation is interfering with the increase in preference for short -term flip rather than macroeconomic uncertainty, liquidity reduction, and long -term alternative alcohol.

According to him, many people are now seeing traditional Altcoin models, now due to the high centralization and team -centered risk.

Gustavo H., chief business development of Kairon Labs, also shared a similar perspective. He stressed that the growth of Bitcoin is mainly led by the influx of institutional investment and clear regulatory clarity around the spot ETF.

Gustavo explained that ETF trading volume spreads liquidity to Bitcoin, increasing the overall market depth and reducing the liquidity of Altcoin. This is the effect of expanding the bidding spread, which is less attractive to large -scale investments in small assets and is less attractive to strengthen the dominance of Bitcoin.

Gustavo said, “SPOT ETF was able to directly provide BTC exposure to investors, and in the past, ALTS was an agent, and the system was still effectively reset while building a BTC position.

Both experts pointed out the surge in new tokens as an important factor. Chuang stressed that this diluted the interests of capital and investors.

Gustavo said, “The liquidity is thin, but 98%of the total market cap is still fixed in the top 100 coins, emphasizing how little capital is in the new project.However, low switching costs are the traders pursue short -term descriptions, while many founders inhibit durable lacquer conditions that inhibit a wide range of and continuous rotation. Optimize.

Why Altcoin Season 2025 can still be a reality

Despite these factors, experts believe that it is still potential in the upcoming Altcoin season.

Chuang said, “The condition refers to the delayed and unhappy Altcoin season.”

He believes that Bitcoin’s current achievements will continue in the short term. However, Chuang predicts that altcoin resurrection will appear at the beginning of the potential end of quantitative tightening (QT) and the beginning of a new quantitative (QE) cycle.

Gustavo pointed out that “the acting is more plausible. Once the BTC establishes a range, the dangerous appetite is historically changed.”

He said that the Altcoin season is more likely to be delayed than completely excluded until the new token supply speed is slowed or the new liquidity increases. Over time, Gustabo believes that this market shakes will be compensated for a team that is suitable for the true product market.

In addition, when the ETF stabilizes the ETF and the volatility compression of Bitcoin is stabilized, capital is generally confirmed to move to higher assets.

“As a result, the Date Season in the late 2012 or early 20126 remains plausible, not the prior party,” he predicted.

In particular, MEXC’s COO, Tracy Jin, said that signs have already begun to rise.

“The rapid contrast in ETF flow is one of the biggest signs of capital rotation in the market. Ethereum’s ETFS has recorded a total of $ 660 million in a total of $ 660 million for uneven macro economy and designated tension backgrounds.

She also mentioned the increase in Altcoin ETF applications and companies that adopt Altcoin’s financial strategy. JIN emphasized that as the market cycle progresses, institutional interest in Bitcoin is increasing.

MEXC COO is a recent altcoin rallies, but when Bitcoin’s dominance is greatly reduced, true altseason usually begins. Despite the current recovery of dangerous appetite, Bitcoin still has a large market share, but its dominance seems to be weak.

“Ether Lee is currently leading the rate for conversion and capital rotation from the market cycle to Altcoin, and other coins such as XMR, ENA, Hype, AAVE, and ARB have more than 5% of the benefits of 0.6% of BTC’s mutations in Tuesday recovery rally.”

In addition, at a high level, Jean insisted that the integration of Bitcoin generally generates the space for Altcoin, especially the risks, and the investor finds the space for Altcoin when looking for higher beta opportunities. She suggested that Bitcoin stabilized after 25 days of more than $ 100,000, and the actual adventure season could be closer.

JIN said, “If Altcoin momentum continues and institutional appetite develops further, you can see explosive movements by crossing high -satellite Altcoin in the next few weeks.

Altseason has not yet worked, but JIN emphasizes that conditions are being aligned. She also said that institutional capital is joining travel.

Is the post in the 2025 Altcoin season? Experts believe that it was delayed that it didn’t appear for the first time in Bai In Crypto.