- Hyperklicade’s HLP VAULT lost $ 4 million after absorbing the liquidated high louvity louvity Etherum position.

- Eight large wallets withdrew $ 143.5 million in USDC after liquidation event.

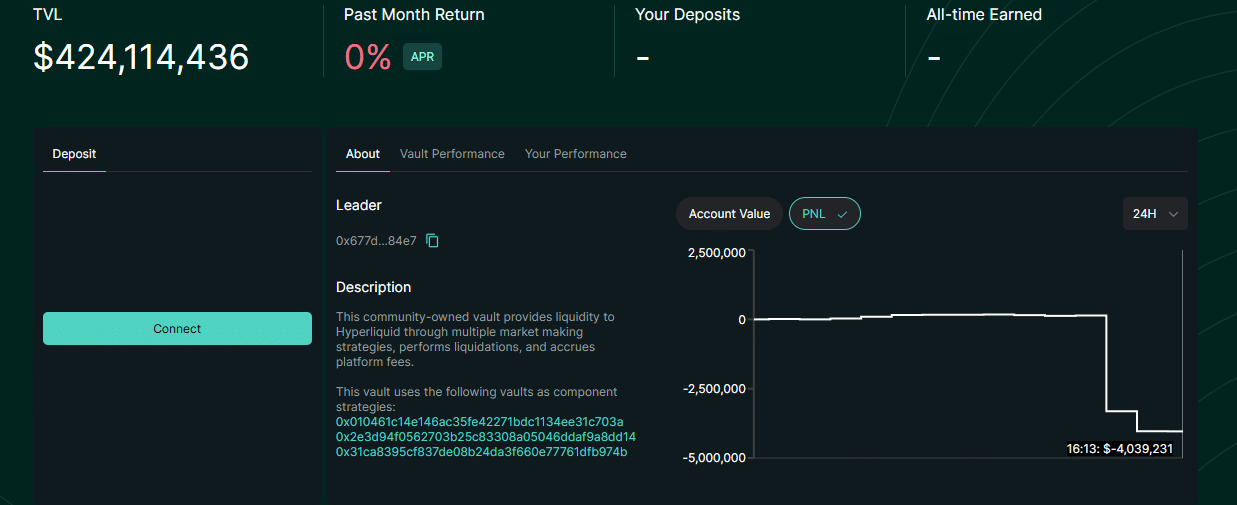

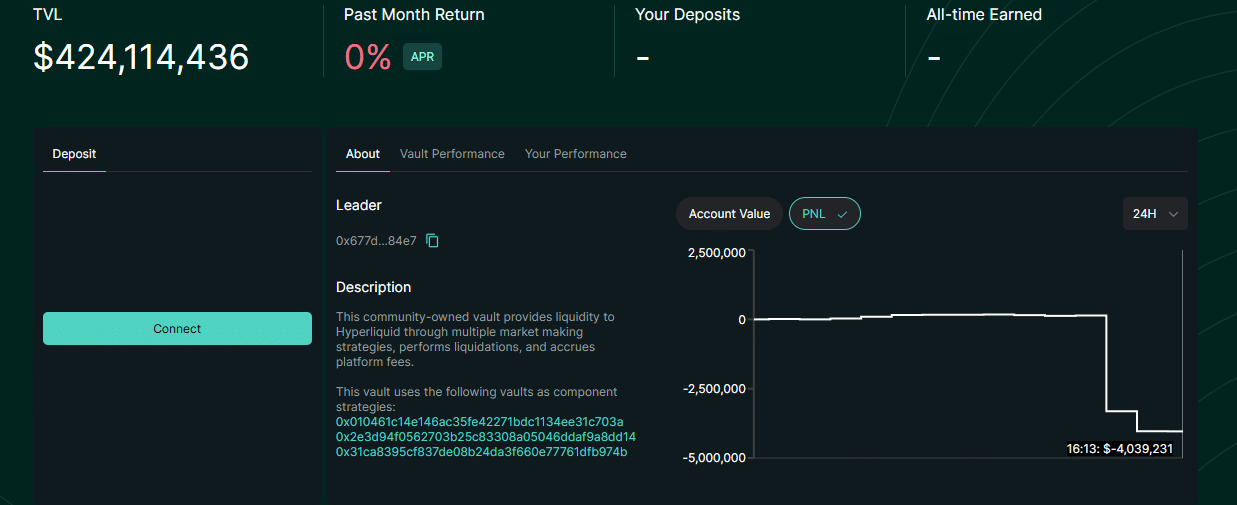

Hyper Liquid (overdue advertising) Designed to absorb the liquidation position, the HLP Vault recorded more than $ 4 million after forcibly liquidating the long position of the highly leverage Etherrium (ETH).

The whale merchant identified as ‘0xF3F4’ participated in a high -level high -level leverage trading at Hyper Liquid, a decentralized permanent exchange.

The merchant first deposited $ 15.23 million USDC, built about 175,000 ETH long positions and reached about $ 340 million.

Source: Arkham

The position is $ 1,884.4 per ETH, and the liquidation price is $ 1,839 and is very vulnerable to price fluctuations.

At the highest point, the whale achieved untimled profits exceeding $ 8 million. The whale, which captured this opportunity, sold 15,000 ETH and moved $ 17 million in USDC to a wallet.

Source: ring type

One person moves too much. The domino effect begins

This measure had a remarkable effect. By reducing the margin of the account, the remaining 160,000 ETH long positions are more vulnerable to market volatility.

As the price of Etherrium fell, the position violated the liquidation threshold. Hyperliquid’s automation system has moved liquidation assets to HLP Vault.

The safe is a hit

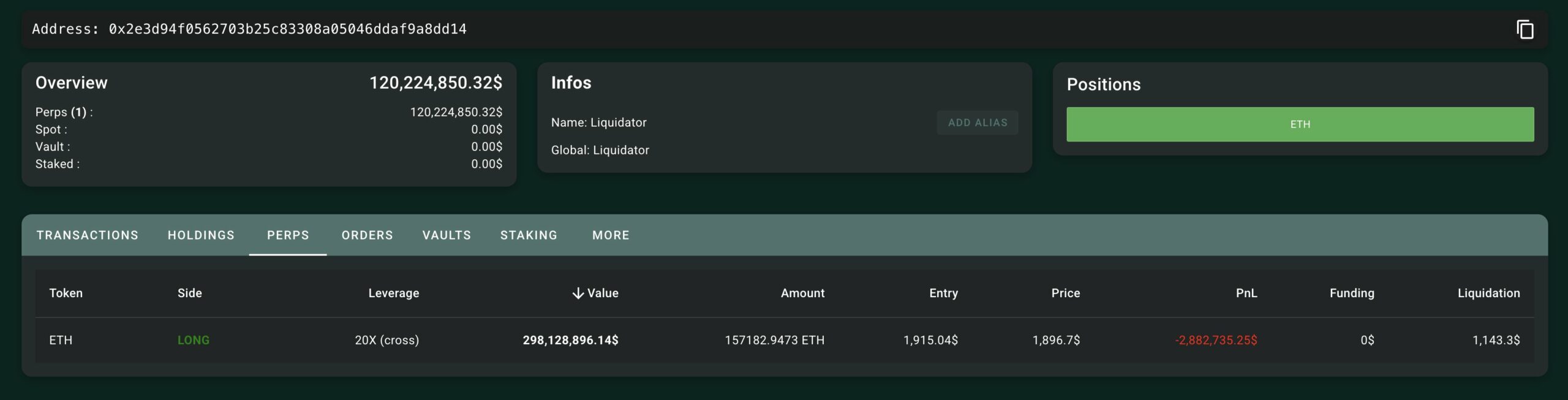

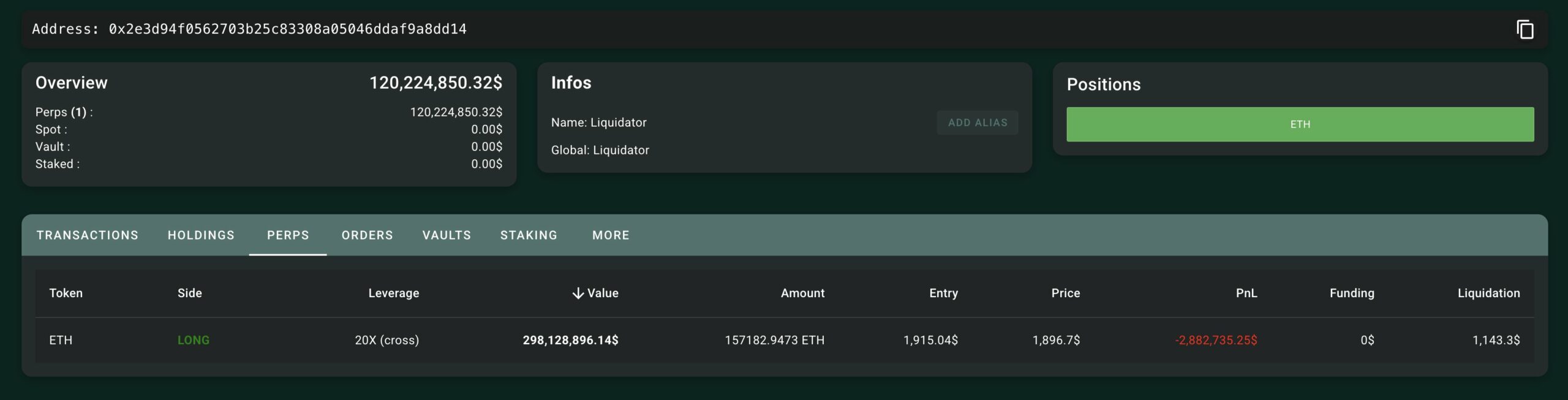

The safe has begun to sell its ETH position at $ 1,915 per ETH.

However, as ETH’s market prices fell to less than $ 1,896.7, the safe began to accumulate significant floating losses.

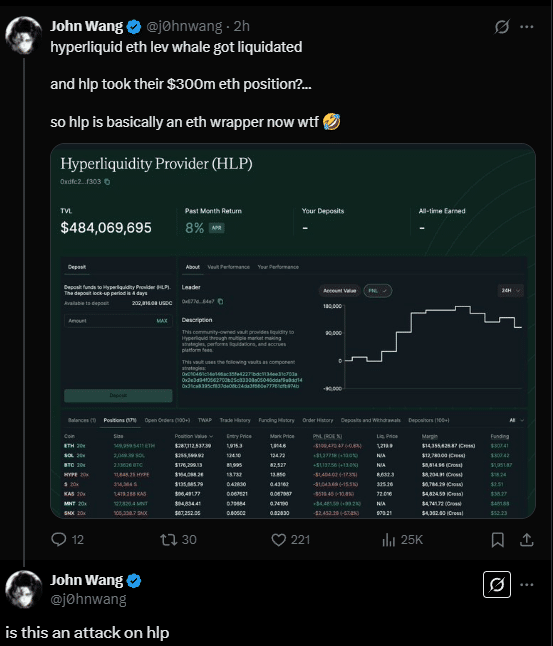

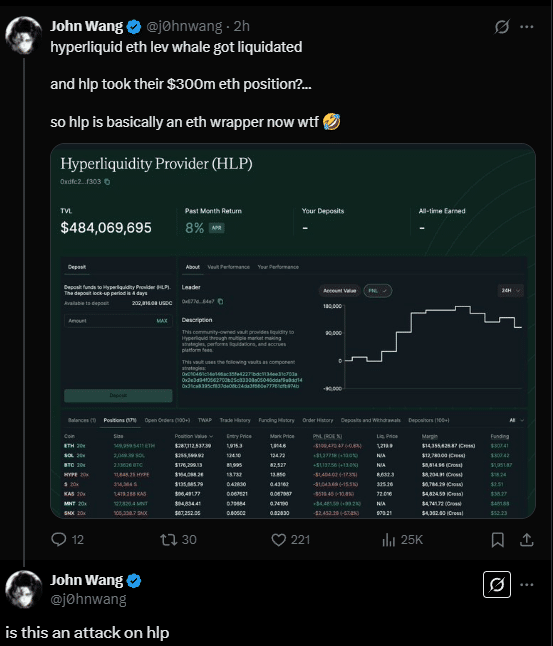

When the Hyperliquid Guards were publicly solved, the HLP safe lost more than $ 4 million in 24 hours, and the loss still increased as the vault continued to solve the large ET position.

Source: ring type

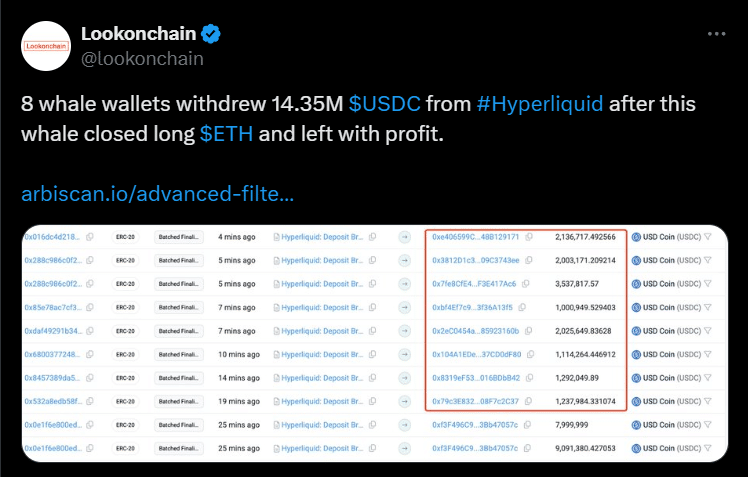

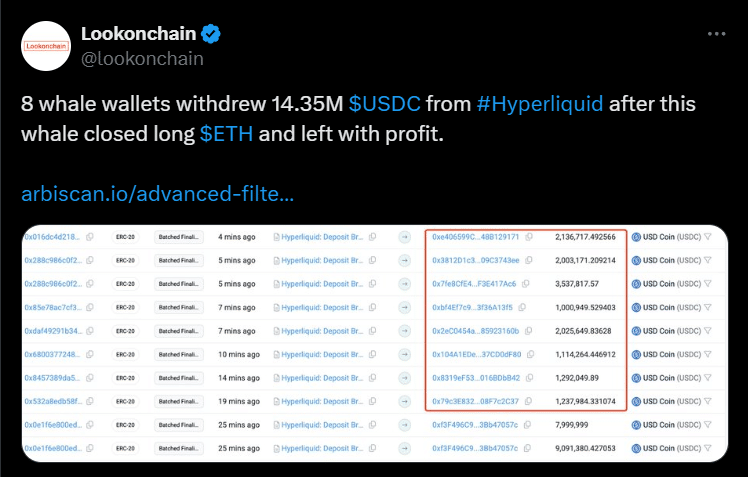

The Blockchain analysis of Lookonchain has been revealed about whale trading patterns and market reactions.

High value -added transactions showed the rapid flow of funds between hyper liquids and external liquidity pools. The portfolio of the wallet has greatly weighted Etherum -based assets (AETH/ETH) and gold support tokens (PAXG), suggesting strategies related to ETH location hedged by gold.

Meanwhile, EMBERCN’s market depth analysis struggled with Hyperliquid’s liquidation system, which had difficulty in handling whale positions without interfering with ETH’s price trajectory. This caused additional sales pressure, resulting in a deterioration in the loss of vaults.

The impact on large -scale liquidation and ring liquid liquidity systems has caused a wide range of industrial discussions.

Source: X

Analysts questioned whether this was simply a high -risk deal or intentional attempt to use the liquidation of hyperclicade.

Hyperliquid’s HLP Vault is operated as a community support risk management fund that absorbs liquidation locations in the automatic liquidation system of the platform.

This model is effective in most cases, but it can be vulnerable when an individual trader builds a large high leverage position that can struggle to effectively absorb the safe.

Was liquidation intentional?

All chain analysts believe that whales intentionally laid down and move the risk to HLP safe and avoid losses.

By withdrawing significant margins before liquidation, the trader raised the liquidation price to ensure the closure at a higher price. As a result, Hyperliquid’s engine was purchased at an expansive price and occupied an expensive position in HLP safes.

If the whale had a short position elsewhere, they would have benefited from the sales of the entire market due to their liquidation. The tactic, called the liquidation arbitrage trading, has shown in a case in which traders use the system for profits.

After the liquidation of the whale, Lookonchain reported that eight wallets withdrew $ 143.5 million in the hyper liquid.

Source: X

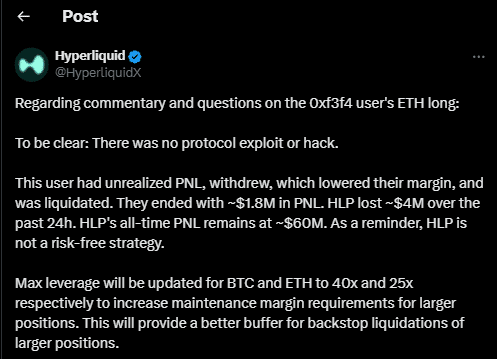

Hyperklicer reacts

Hyperliquid refused to frame the event as a result of high transactions and margin management instead of refusing to violate security or abuse in the official statement published in X (previous Twitter).

Source: X

The company emphasized that whales withdrew their margins to increase the risk of liquidation, and HLP safes were simply playing a role in absorbing positions.

Hyperliquid also announced an immediate change for utilizing the limit to prevent future similar events.

The exchange has reduced the maximum leverage of Bitcoin (BTC) transactions to 40 times and reduced Ethereum leverage to 25 times. They implement these adjustments to increase the margin requirements for large locations to provide more protection for the full body liquidation.

Is this the end of high liquidation manipulation?

The Hyperklicade Liquidation Event has aroused an important debate within the encryption community. Was this simply a high -risk deal or a calculated effort to use the system?

This is not the first time Hyper Clicade has faced concerns about potential market manipulation. A few weeks ago, a few weeks ago, Whale merchants executed 50 -fold profitable leverage transactions in Bitcoin and Ether Leeum.

This was consistent with US President Donald Trump’s announcement of Crypto included in the US encryption strategy reserve.

The merchant earned $ 6.8 million within 24 hours, raising allegations of rich trading. The similar point between Trump’s publication trade and recent liquidation events suggests that hyperclicades can strategically attract whales over time.

It is still uncertain whether such a deal is a coincidence or a deeper manipulation. The liquidation model of the hyperklicade generally usually exposes the platform to the fluid shock.

As the hyper clicade strengthens the leverage policy, is the problem enough to prevent future liquidation arbitrage?