- Whale sold all of his UNI and bought 329.3 billion PEPE.

- PEPE holders were growing at a faster rate than UNI.

According to AMBCrypto’s market analysis, traders seem convinced that DeFi tokens may not be able to replicate the performance they had during the 2021 bull cycle.

Evidence for this has appeared in the past as well. On April 30, further evidence emerged. The whale abandoned all Uniswap (UNI) tokens. What did he do instead? He accumulated 329.3 billion PEPE and withdrew it from Binance.

However, it is important to note that the traders mentioned made $7 million by holding UNI. However, dumping tokens at this early stage when the altcoin has not had the expected season indicates declining confidence in UNI’s potential.

No PEPE, no show

Moreover, PEPE accumulation signaled optimistic confidence in its long-term value. But for those who are “following the money,” this decision may not come as a surprise.

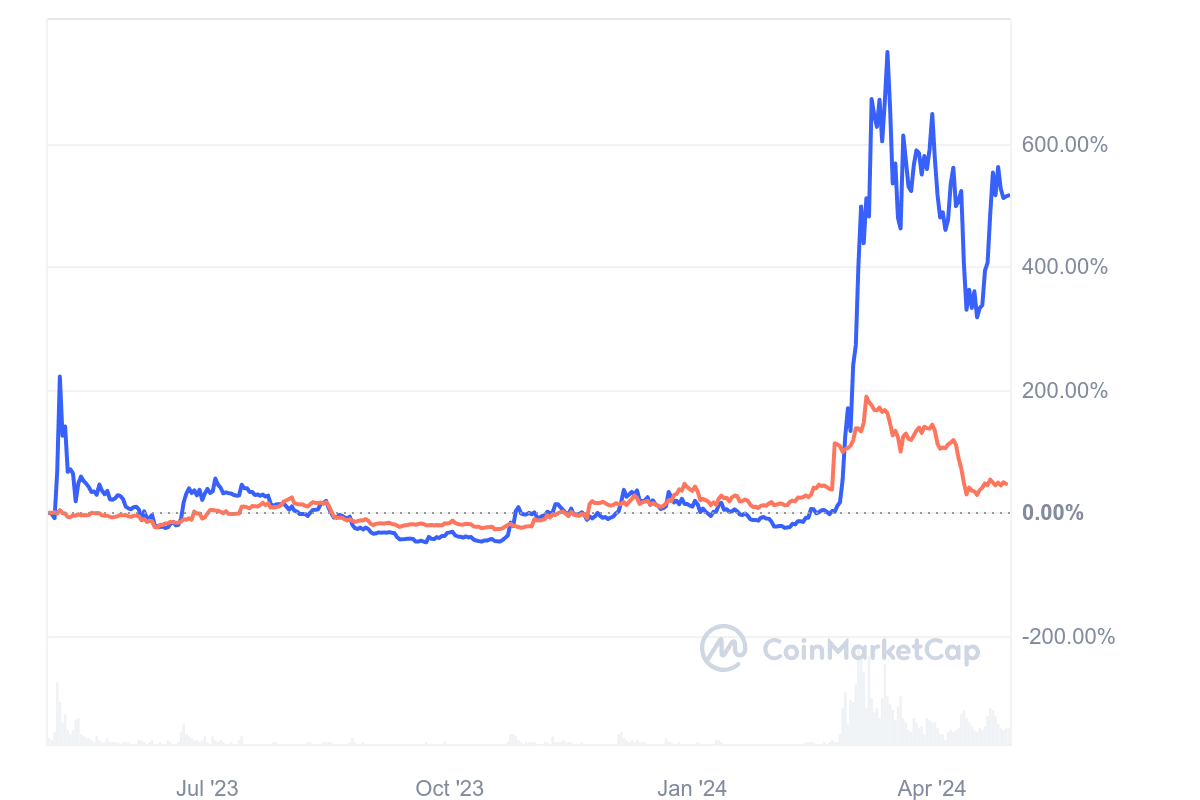

The price-performance of both tokens was also evidence of Memecoin’s dominance in the market. At press time, PEPE’s year-to-date (YTD) performance was up 420%.

Source: CoinMarketCap

UNI, on the other hand, changed hands at about the same price as when the year began. Despite this data, the market capitalization of DeFi tokens was $104.48 billion. For Memecoins, it was $49.5 billion.

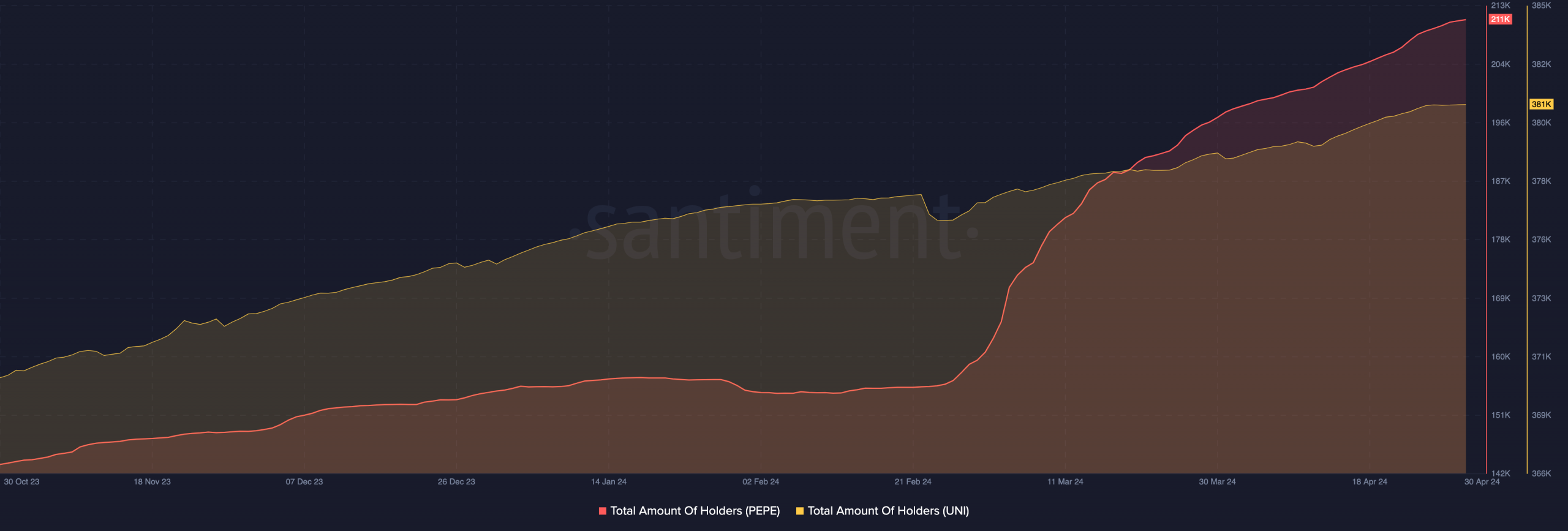

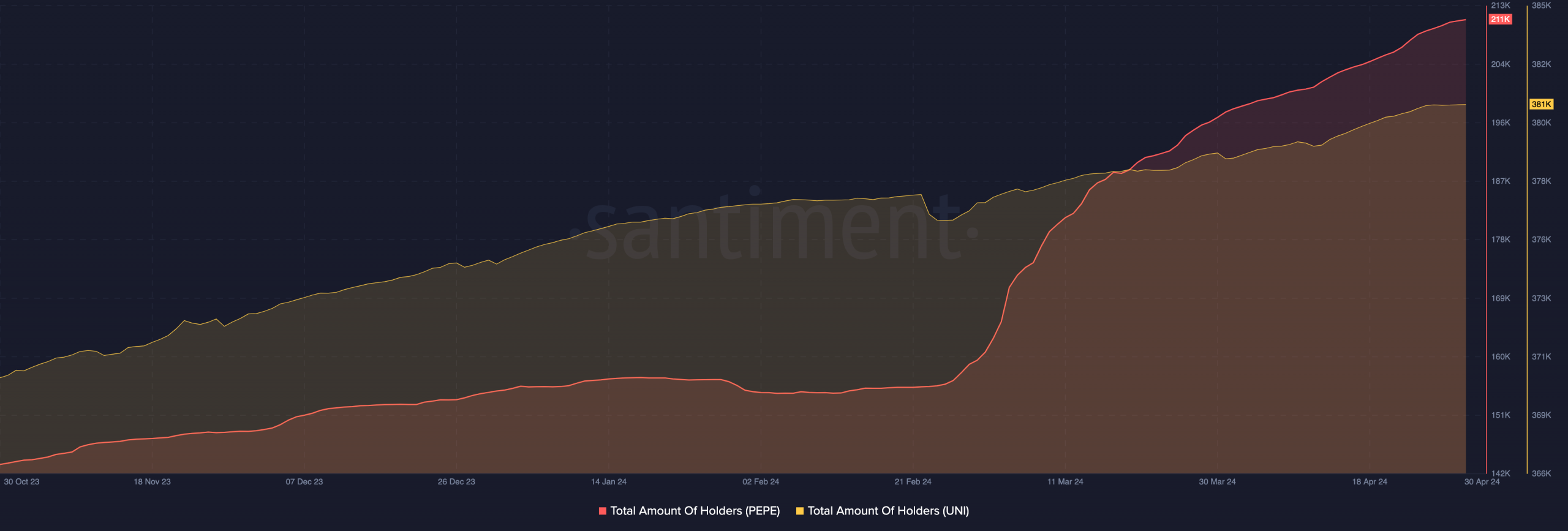

However, this difference does not give a clear picture as the latter recorded better growth last year. Also, looking at the number of holders, it appears that there are more UNI holders.

PEPE had 211,000 holders, while UNI had 381,000. However, like market capitalization, this figure does not provide a clear picture of the situation.

Source: Santiment

UNI may be able to pull together, but that much…

However, if you look closely, you can see that PEPE is attracting more holders faster than UNI. A simple interpretation of this is that the DeFi narrative may not be one of the best narratives to follow this cycle.

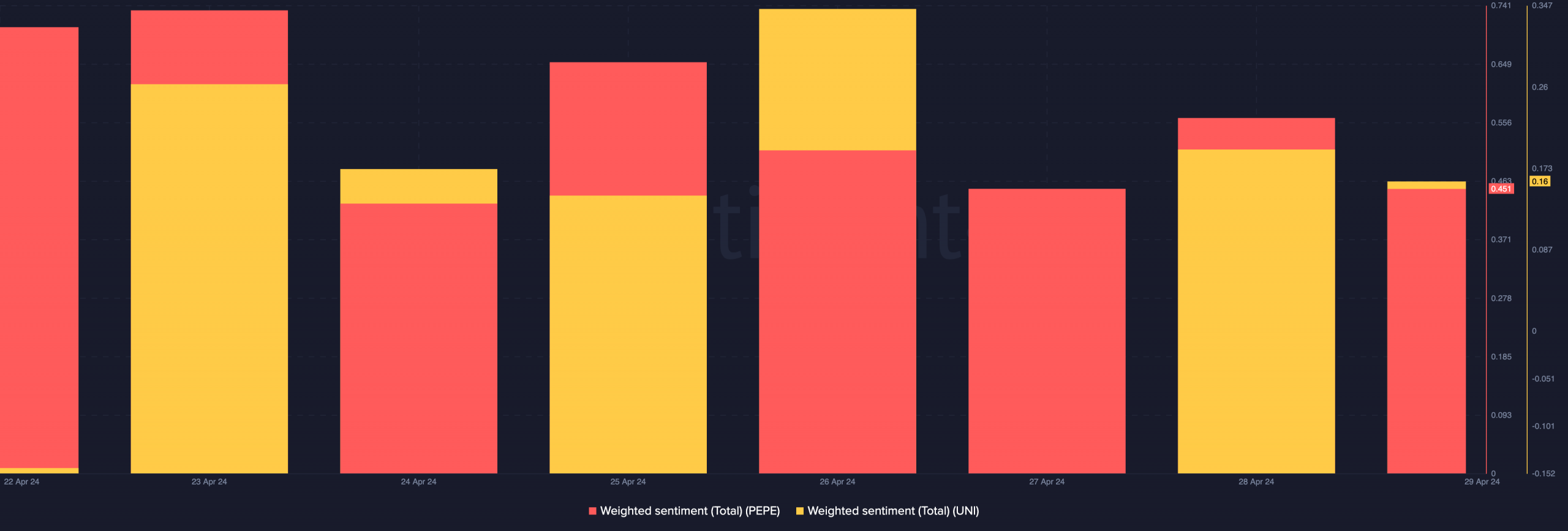

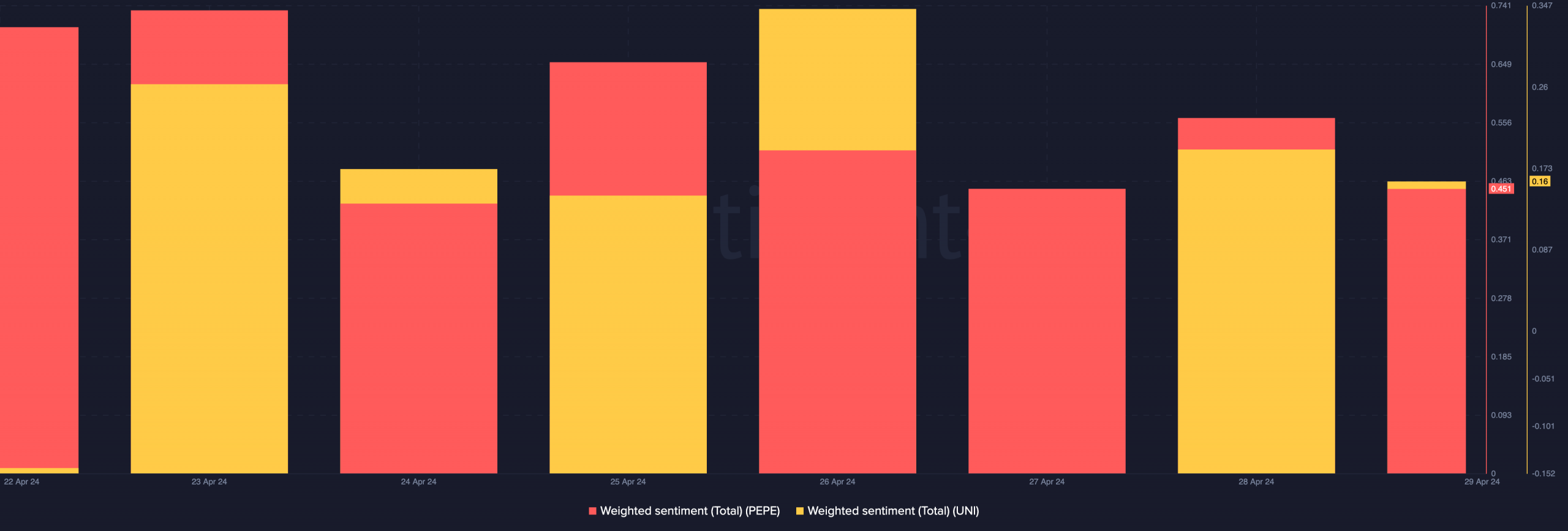

However, this does not mean that market sentiment remains unchanged. Following the insight, AMBCrypto also looked at Weighted Sentiment.

This indicator uses social volume to measure awareness of your project in the market. As of this writing, both PEPE and UNI’s Weighted Sentiment was positive.

PEPE is at 0.45 while UNI is at 0.16, reinforcing the notion that most traders are bullish on memecoins.

Source: Santiment

Moreover, the difference in sentiment doesn’t mean UNI won’t experience a notable uptick.

Realistic or not, PEPE’s market cap based on UNI is:

However, looking at history, fund flows, and trend narratives, PEPE could continue to outperform UNI.

And the important part is that it won’t be a few miles. In a very optimistic scenario, PEPE could rise 200% higher than UNI. This may not happen now, but it seems feasible in the coming months.