The largest of the Ethereum whales has continued to buy recently as supply hit another all-time high, according to on-chain data.

The largest Ethereum wallets are rapidly accumulating

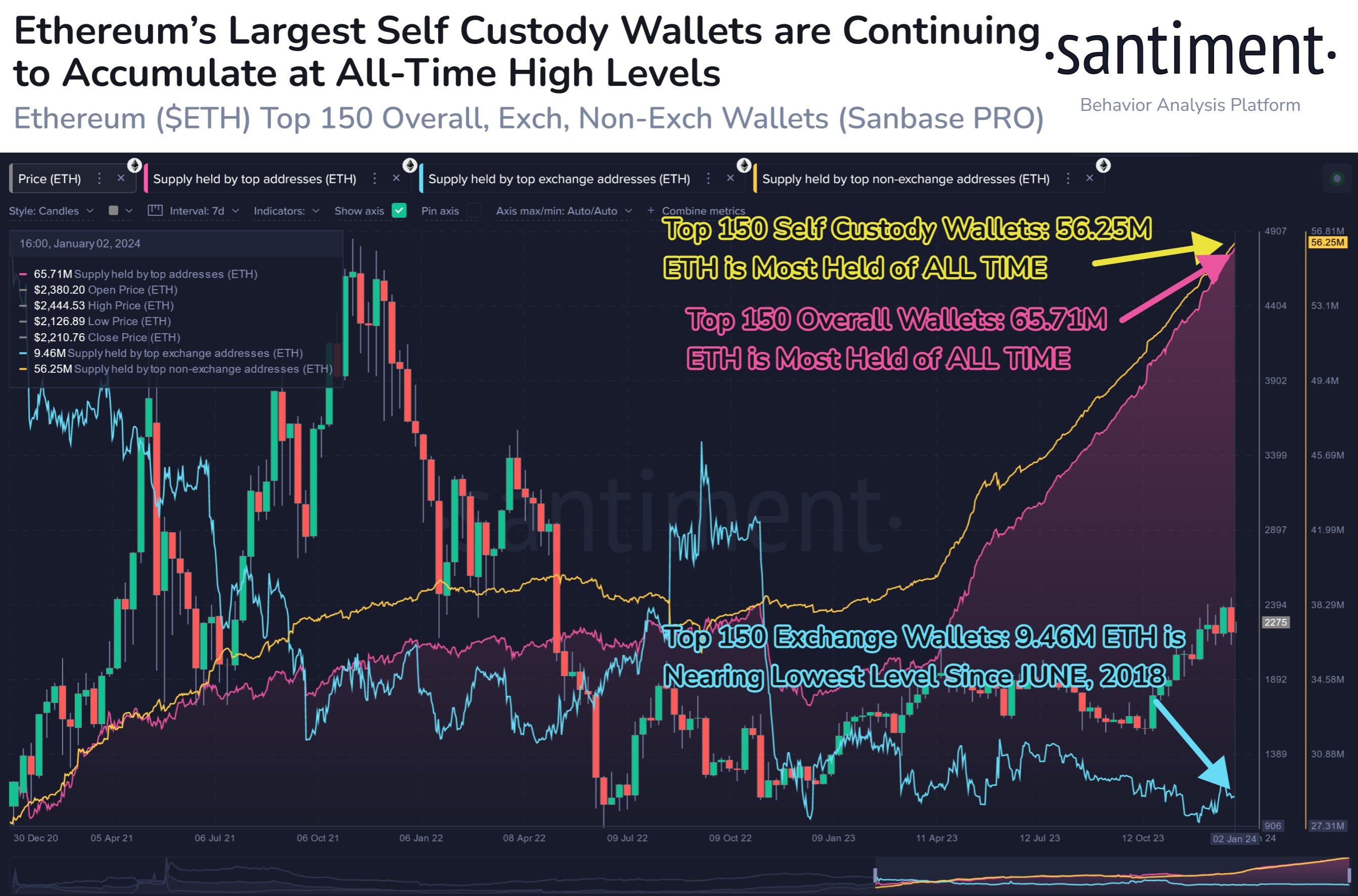

According to data from on-chain analytics firm st tlyThe largest non-exchange Ethereum wallets have continued to see rapid accumulation recently.

The relevant metric here is ‘Supply held by Top Non-Exchange Addresses’, which tracks the total amount of Ethereum currently held in combined balance by the 150 largest self-managed wallets.

Naturally, the 150 largest non-exchange wallets will be among the top whale entities on the network. Therefore, the trend of the indicator can give a hint about the sentiment towards the cryptocurrency among these huge holders.

When the indicator rises, it means the whales are expanding their current holdings. This trend naturally suggests that they are optimistic about their current assets.

On the other hand, indicators indicating a decline can be bad news for cryptocurrency prices. Because this means that large investors have decided to participate in some selling.

We now have a chart showing the supply trends of the top non-exchange Ethereum addresses over the past few years.

Looks like the metric's value has been constantly going up during the last few months | Source: Santiment on X

As you can see in the graph above, the supply held by these top 150 whales is increasing rapidly starting in April 2023. This means that the early-of-the-year rally captures the attention of these large whales and leads to accumulation.

Interestingly, the slump between August and October wasn’t enough to deter these holders. Because they kept buying more. Likewise, these whales have continued to ride out the recent plunge in cryptocurrency prices.

After the most recent bulk purchases, the supply of these top non-exchange Ethereum wallets reached 56.25 million ETH, a new high for that metric.

In the same chart, the analytics firm also attached data on the supply held by top exchange addresses. This metric naturally measures the total number of coins currently held by wallets connected to a centralized platform.

While self-managed whales increased supply, the top 150 exchange wallets were flat during the same period. Currently, the indicator is currently worth 9.46 million ETH, which is almost the lowest level observed since June 2018.

Typically, one of the main reasons investors deposit their coins on an exchange is to sell them. Therefore, it is a positive sign that the supply of these exchange whales remains low.

The rapid accumulation shown by self-managed whale entities and the low level of top exchange wallets could mean that the long-term outlook for Ethereum may be optimistic.

ETH price

While Bitcoin has already recovered somewhat from its plunge, Ethereum has only been able to bounce back slightly so far, with its price trading around $2,250.

The price of the asset appears to have been mostly moving flat since the plummet | Source: ETHUSD on TradingView

Featured image by Flavio on Unsplash.com, chart by TradingView.com, Santiment.net

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.