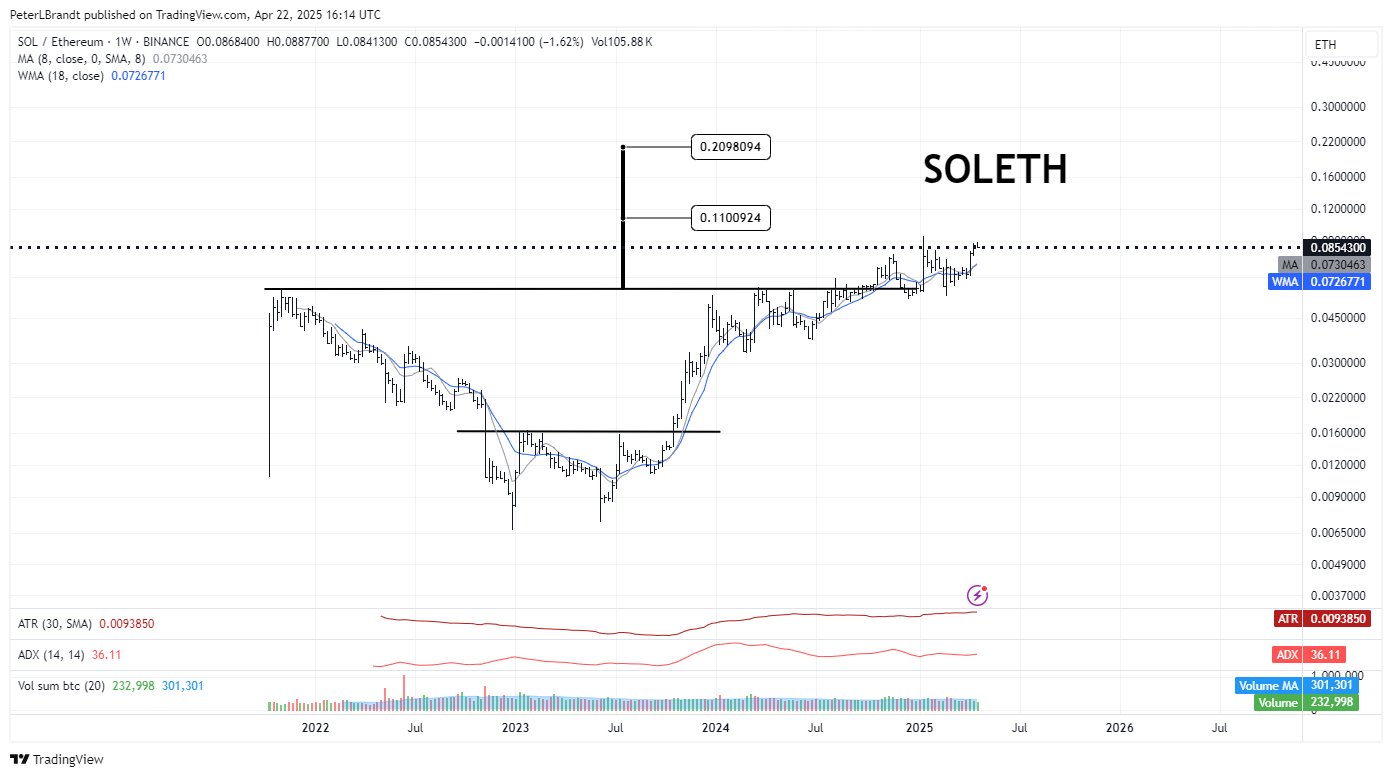

- Brandt expects SOL to exceed 30-140% of ETH in the long run.

- Galaxy Digital has changed $ 150 million to SOL.

Solana (SOL) It cost $ 150 and raised its recovery profit to 58%at the lowest level of $ 95.

For Ether Leeum (ETH) Investors rose 30% over the same period, providing strong leads to SOL.

SOL to the Eth Eth?

According to the famous merchant Peter Brandt, the above SOL relative performance for ETH can be extended to 90%in the middle or long term.

He quoted a cup and handle (C & H) pattern.

“This C & H is still still being played. SOL has a lot of room to get $ ETH, an invalid cousin.”

Source: X

Brandt’s chart has shown that when it is verified, the SOL/ETH ratio that tracks relative SOL price performance to ETH can reach 0.11 or 0.20. This suggests 90% or 245% rally at the breakout level 0.05.

The SOL/ETH ratio was evaluated as 0.08. This meant that SOL/ETH had an additional growth room for collecting 33%and 140%, respectively, to be hit by Brandt’s goal.

In short, SOL can excellent 30-140% of ETH in the long run.

The Galaxy dumps ETH for the brush

Interestingly, the transition from ETH to SOL seemed to be playing among large players.

According to the block chain quotation Arkham Intelligence Data, Galaxy Digital replaced ETH of $ 150 million for binance.

“Galaxy Digital has moved 65,600 ETHs (about $ 155 million) to Binance over the past two weeks, and implied that ethical replacement is possible by withdrawing 752,240 SOL (about $ 993 million) from Exchange.”

If the trend continues and more players follow the lawsuit, the project’s projection can be faster.

Source: Coinalyze

SOL’s market recovery reflects the demand for organic branches in which the cumulative volume delta (CVD) spot indicator has risen.

This rally shows the signs of sustainability that is supplied with clear points and derivatives at the spike.

The next key level is $ 160 in the 3 -day price chart, which plays a role in both overhead obstacles and moving average.

In order to continue the upward trend, SOL must decisively cut off the RSI neutral level. If you do not, the merchant can keep it carefully, leading to a $ 136 re -test.

Source: SOL/USDT, TradingView