- DOGS ranked third in number of owners.

- Market indicators show that the token will recover.

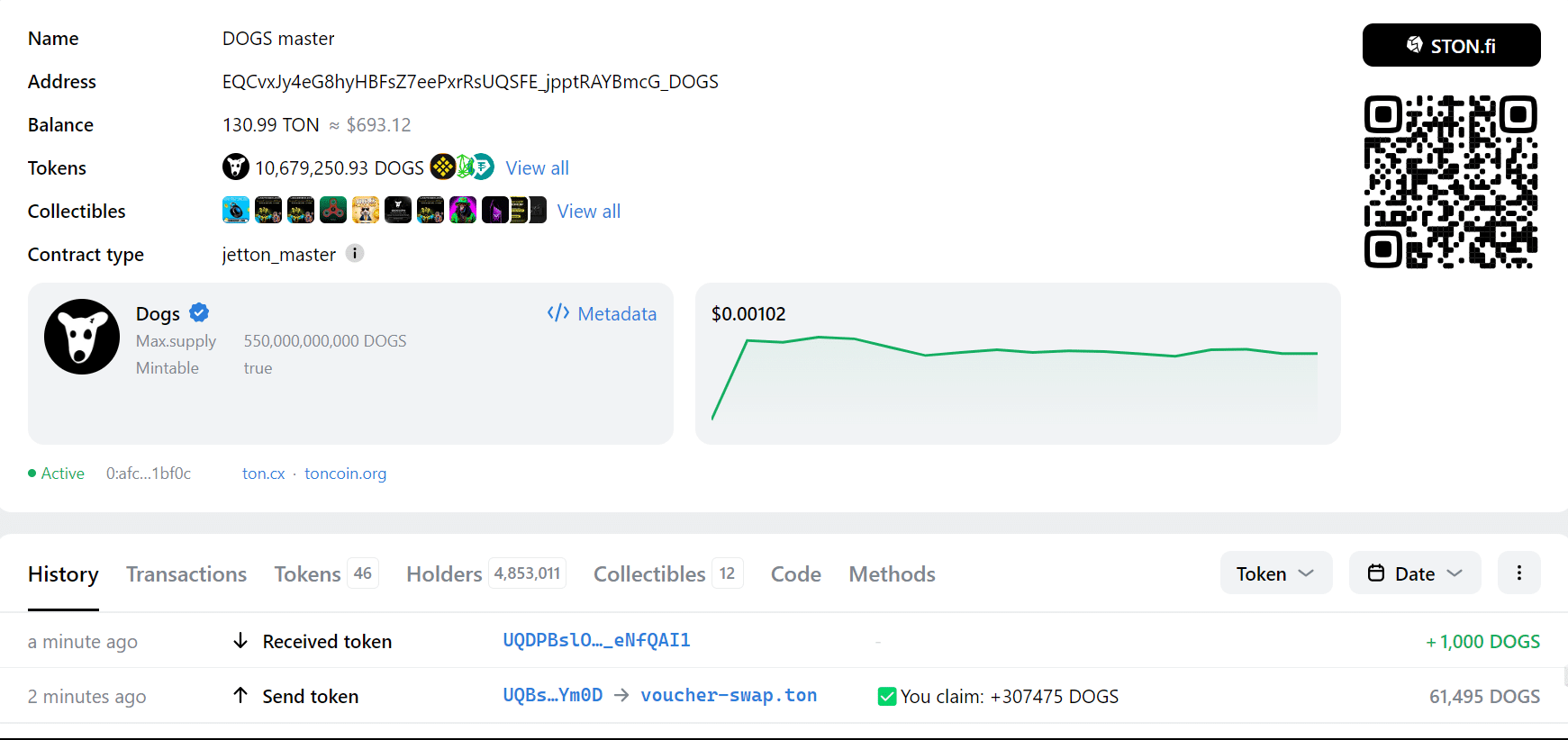

The Dogs (DOGS) token is quickly gaining popularity, currently ranking third in terms of holders, behind USDT and ETH.

DOGS has seen incredible growth since its launch on Telegram’s TON blockchain, with over 17 million token claims and 4.5 million unique wallets holding the tokens.

Inspired by Pavel Durov’s dog drawings, this memecoin quickly became one of the most widely held tokens in cryptocurrency history.

With 1.1 million daily active users and a peak daily transaction volume of 14.4 million, DOGS has set records in terms of user engagement.

Source: TonViewer

As September progresses, TON anticipates a larger token generation event (TGE), potentially bringing millions of new users to the network.

This rapid growth may present technical challenges, but we are focused on scaling and problem-solving to support mass adoption.

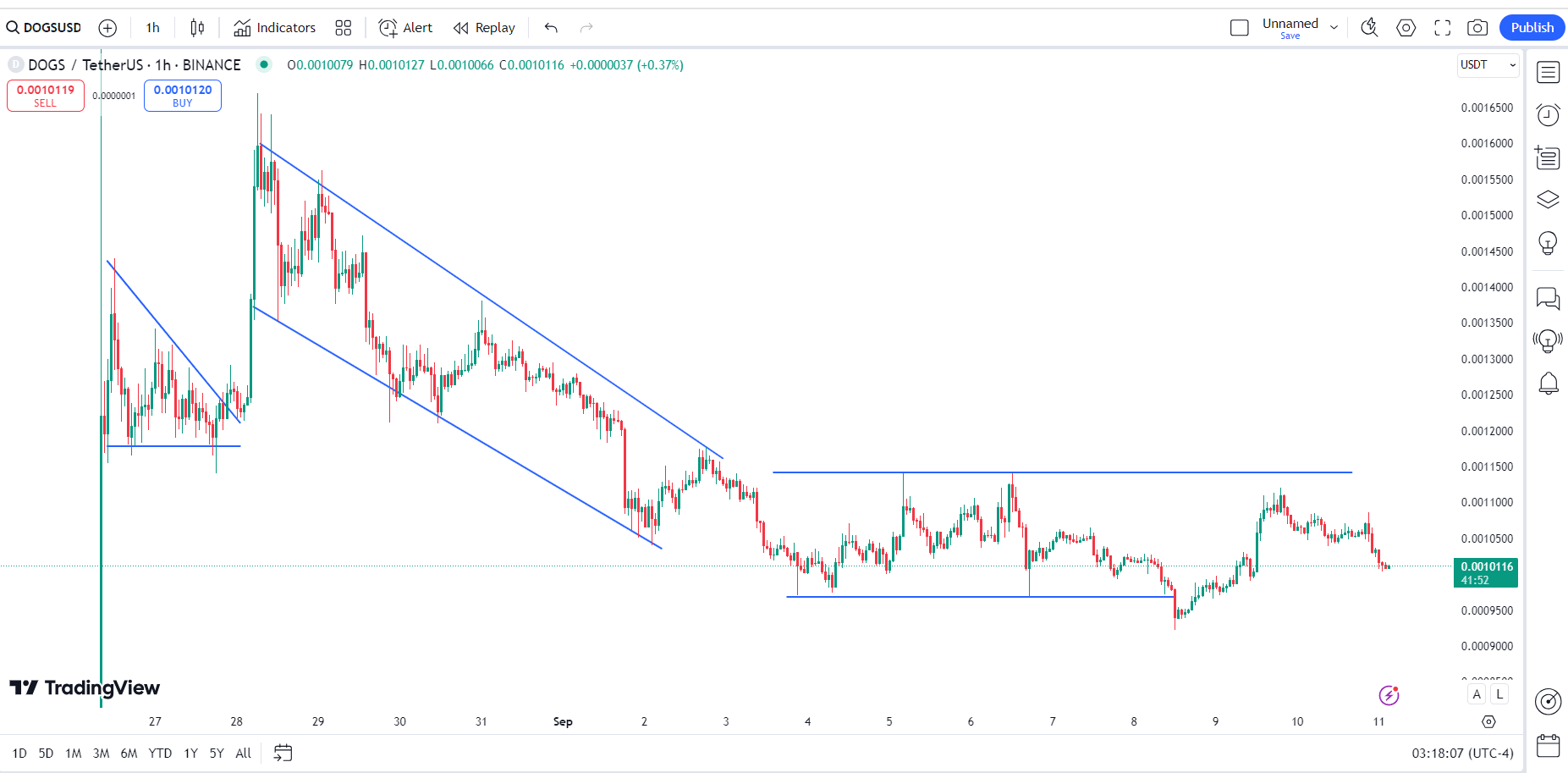

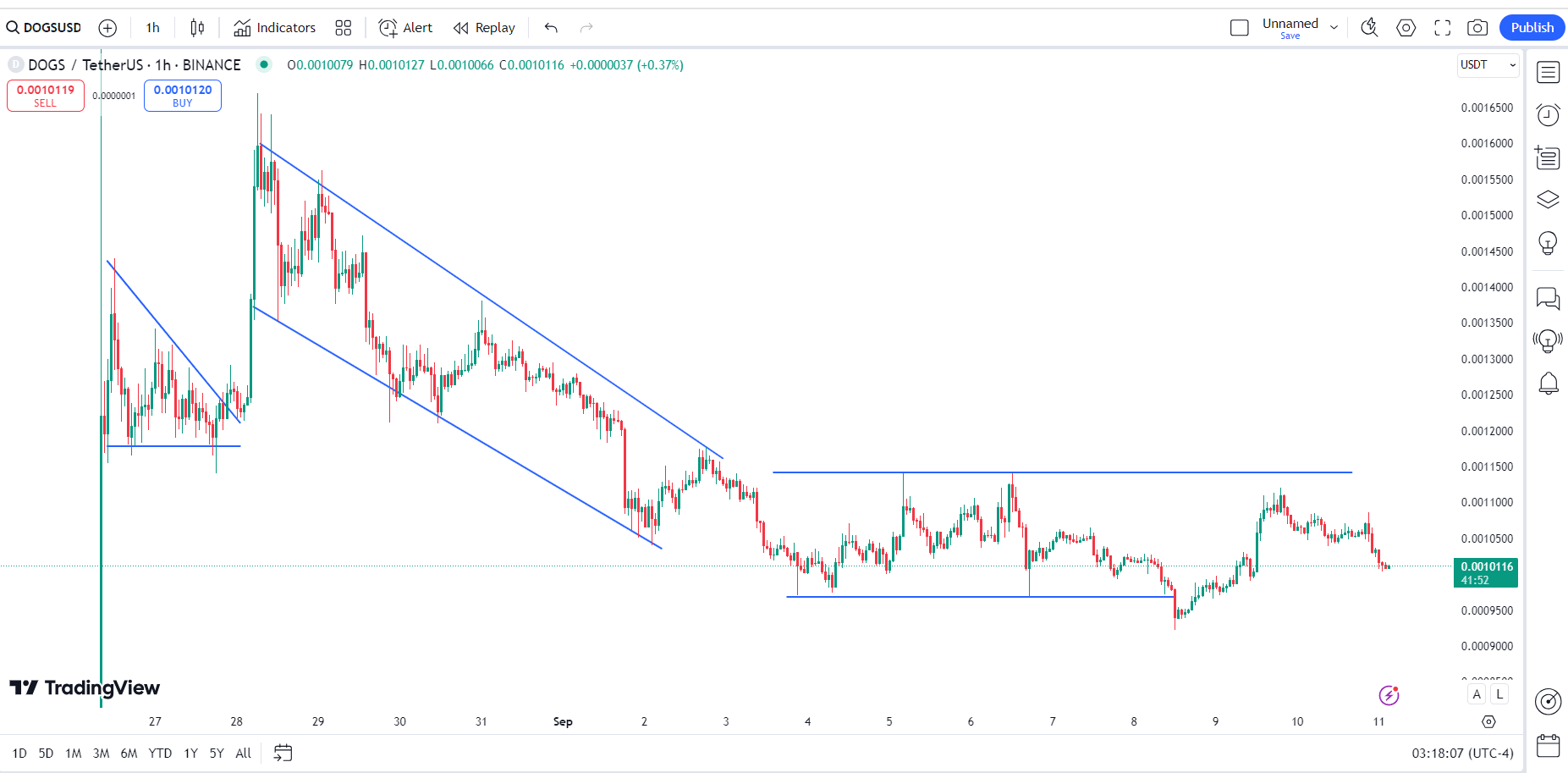

Price fluctuations of tokens within the range

Looking at the price movement of DOGS, the DOGS/USDT pair is currently in a bearish trend since the token launch.

After an initial surge followed by consolidation and another surge, the token began a downtrend, hitting a low of $0.0009233.

It traded within a sideways range throughout September, suggesting a bottom may have been found.

Source: TradingView

If the token holds above $0.0009233, there is a chance that the price will rise and reach the previous high of $0.00166, which would represent a 72% increase.

However, if the price breaks below this key support level, the situation will need to be re-evaluated to determine the next price target.

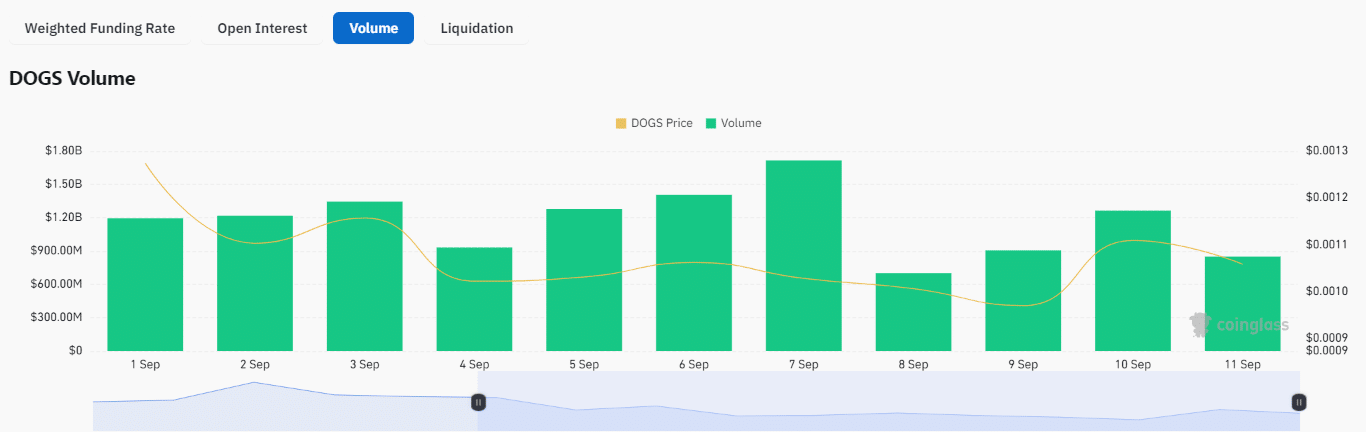

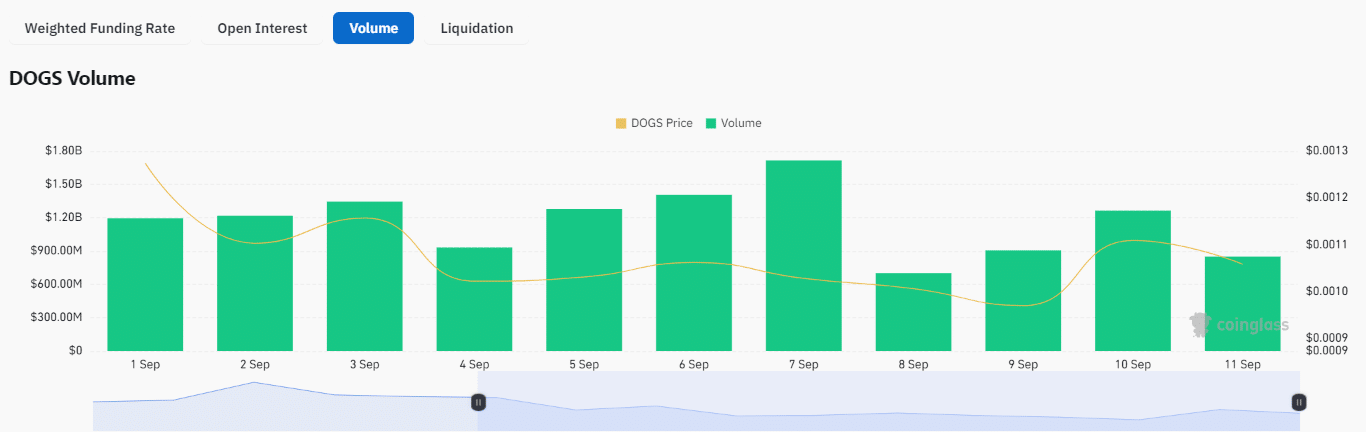

Trading volume and OI funding ratio

DOGS’s volume and open interest (OI) also provide positive signals. The volume has been strong in September, with today’s volume at $859.24 million at a price of $0.0011.

Current open interest stands at $124.57 million, indicating growing interest in the token, especially after many traders sold their tokens following the airdrop.

The OI weighted funding ratio currently stands at 0.0069%, signaling that holders are paying traders to liquidate their positions. This dynamic suggests a balance between long-term holders and short-term traders.

Source: Coinglass

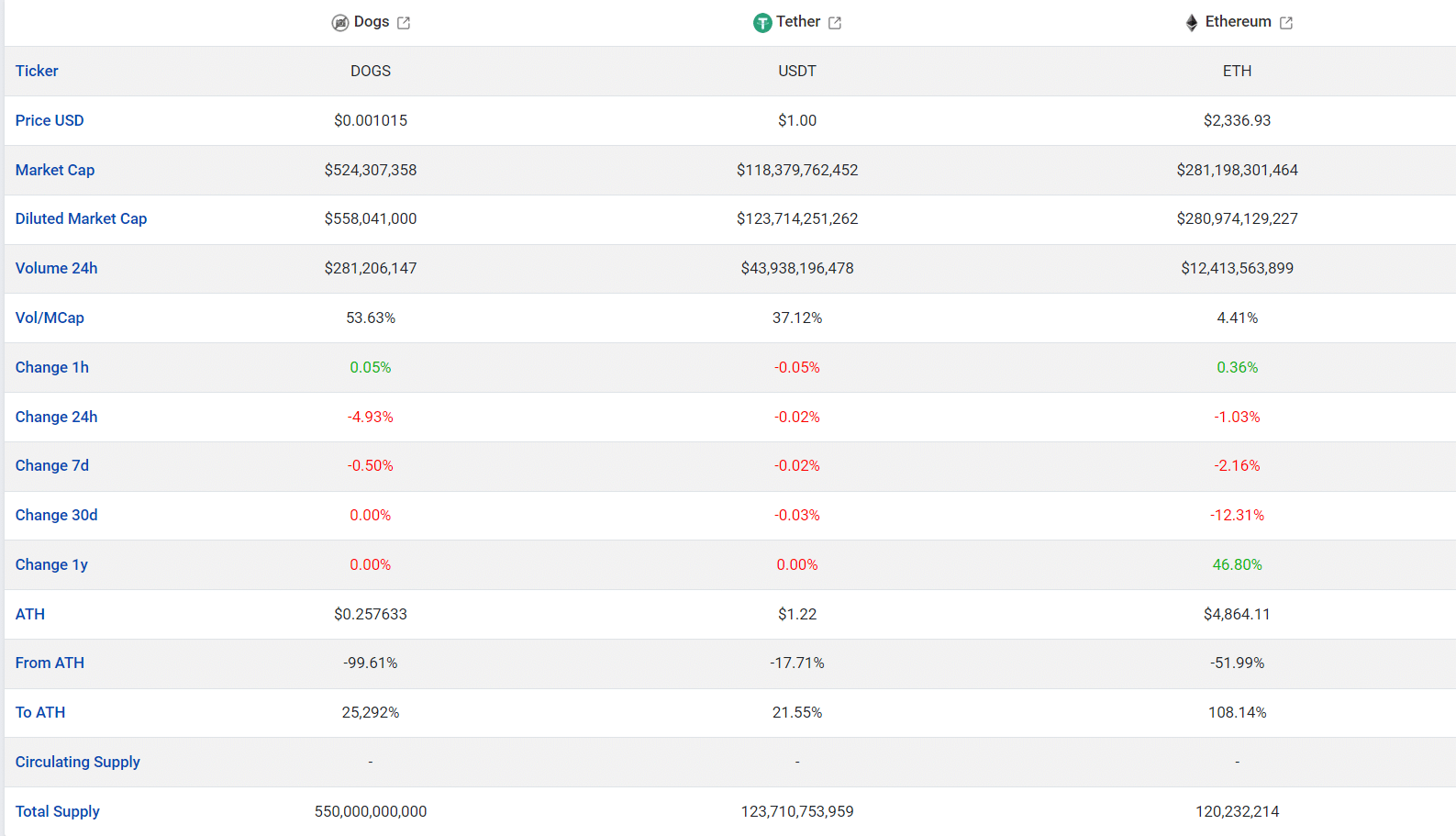

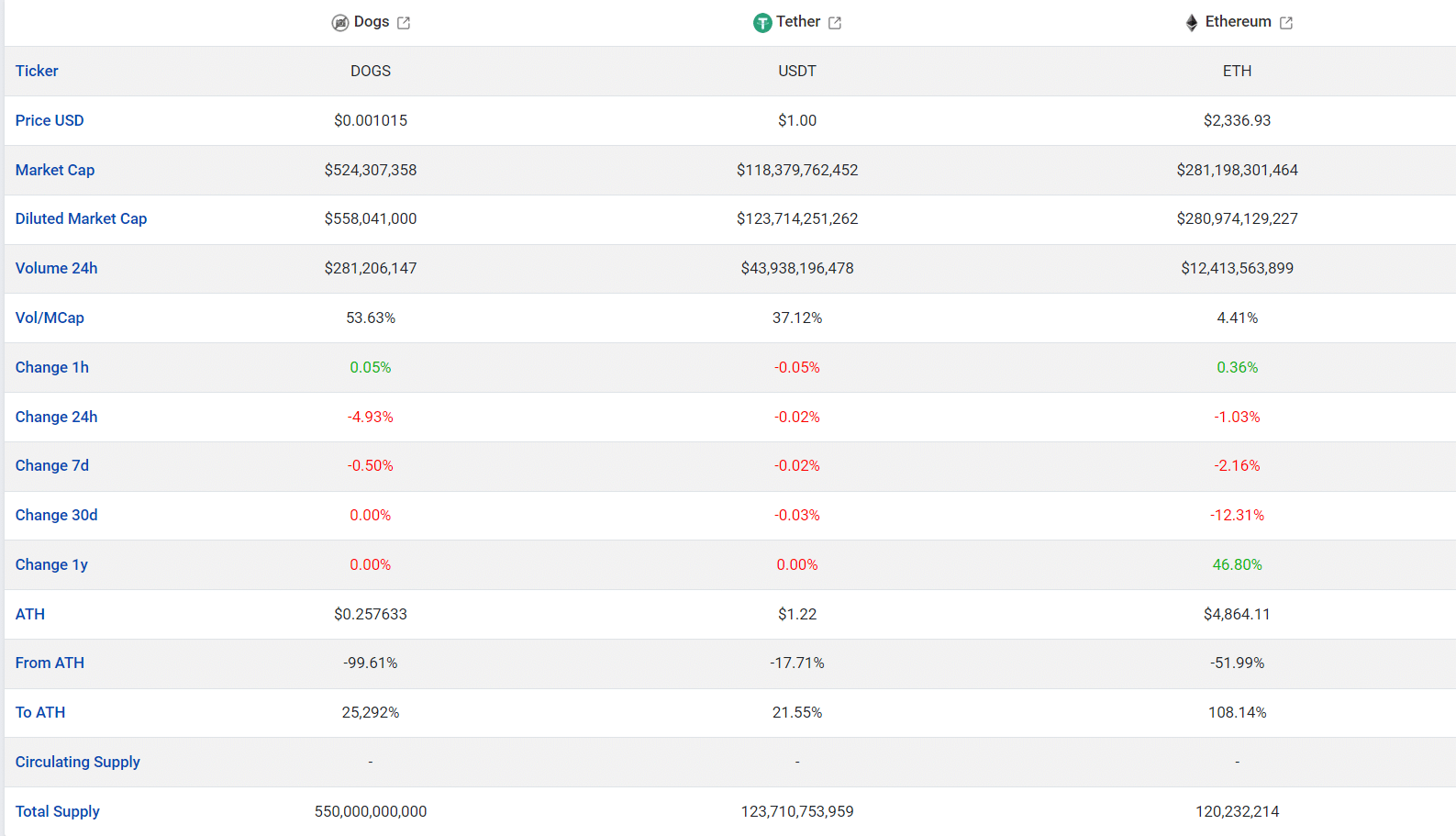

Comparison with USDT & ETH

Compared to USDT and ETH, DOGS shows strong liquidity. The volume to market cap ratio is 53.63%, suggesting that DOGS has enough liquidity to support increased trading activity.

These high ratios generally indicate strong investor interest, which may lead to more volatile price movements.

Source: Coinpare

Although the DOGS token has a small market cap compared to its competitors, its liquidity and growing user base could potentially allow the price to recover as selling pressure following the initial airdrop subsides.

As DOGS gain popularity in the market, their price may increase.