- The asset is at risk of losing its current support levels within the bullish pattern it is trading in, potentially leading to a deeper correction.

- The indicators show active participation from both long and short traders, but there is a clear direction.

dogwifhat (WIF) was primarily weak with a monthly market performance of -43.11%. However, there are signs that the downtrend may stall in the upcoming trading sessions.

WIF is likely to experience further price declines from current levels before the rally materializes. The 14.69% drop in the last 24 hours may widen further.

WIF remains bullish, but there are near-term downside risks.

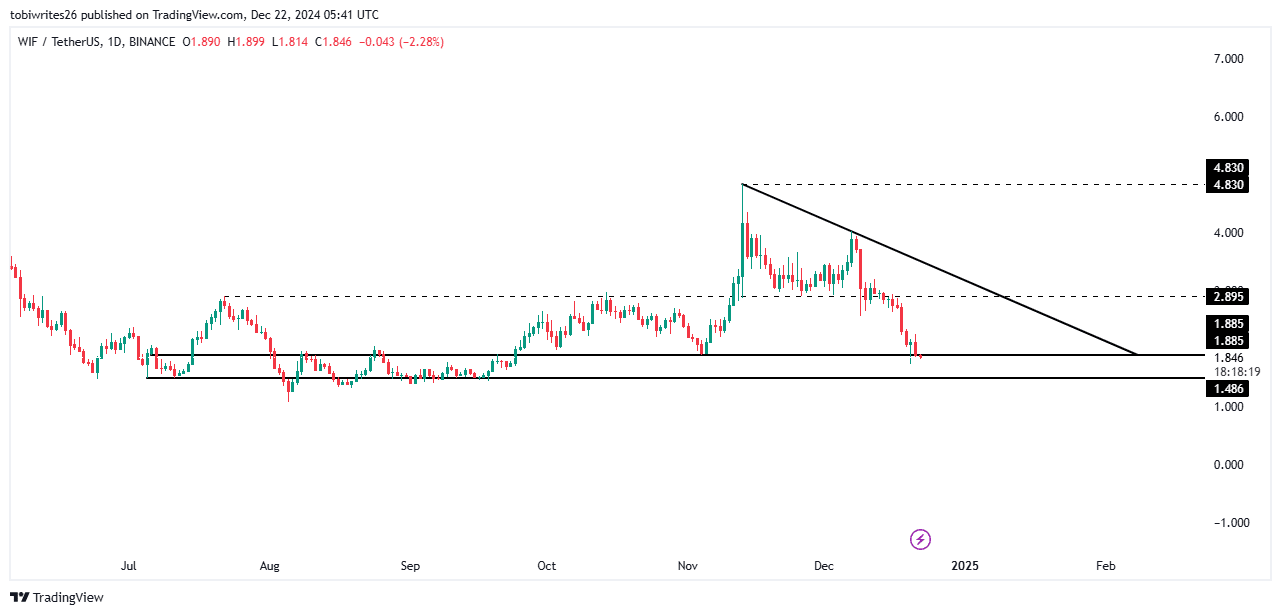

On the chart, WIF has formed a bullish pattern. It has now fallen to the support level of 1.885 for this structure, which usually triggers a bounce. However, this level of significant purchasing activity has not yet materialized.

Failure to hold the 1.885 support will likely result in WIF losing strength and falling into a range. The next potential support lies at 1.486, where the asset could find the necessary momentum for a rebound.

Source: Trading View

Once the bounce begins, WIF will face two major resistance levels on the rally path. The first is 2.895 and then the upper boundary of the bullish pattern. Overcoming these obstacles could allow WIF to hit its next high at $4.830.

WIF price drop is imminent

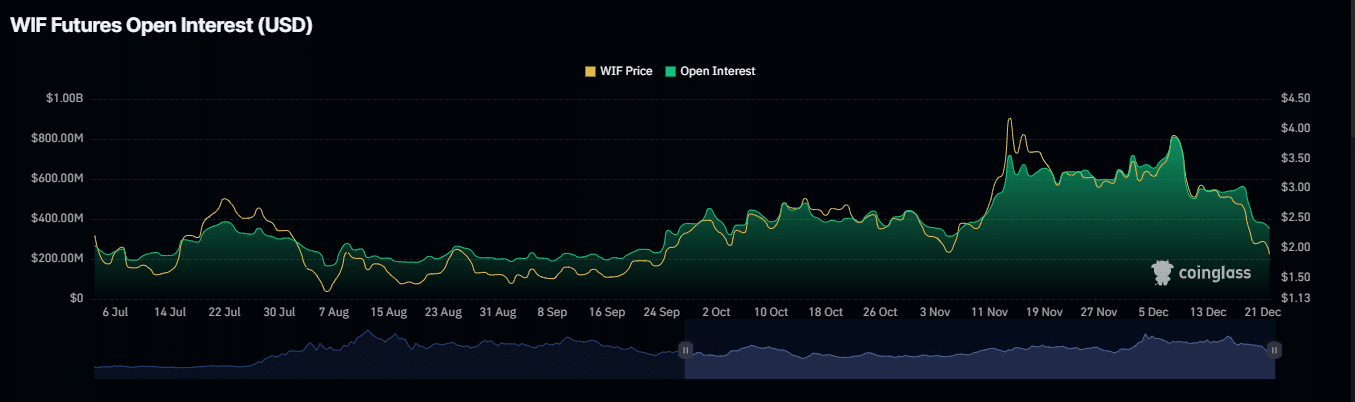

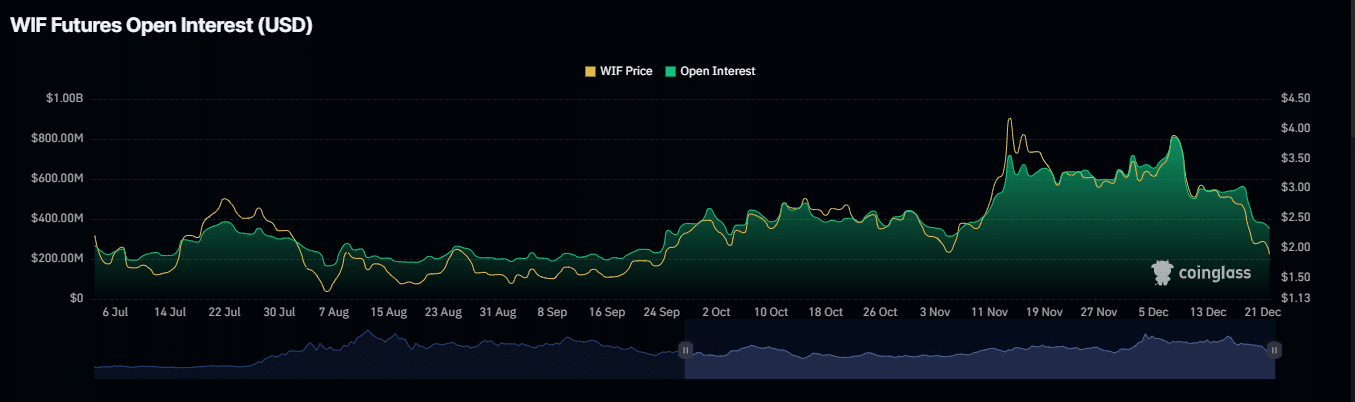

WIF’s open interest (OI) is steadily decreasing. As of this writing, OI was down 11.25% to $360.94 million.

This decline in OI is caused by derivatives traders actively closing positions as asset prices continue to fall. Accordingly, WIF’s market capitalization decreased by 14.29% to $1.88 billion, and trading volume decreased by 44.16% to $496.58 million.

Source: Coinglass

Additionally, market sentiment has shifted as short-term contracts outnumber long-term contracts. The current long-short ratio is 0.89, meaning there are more short positions than long positions.

If this ratio stays below 1, it indicates a bearish advantage in the market.

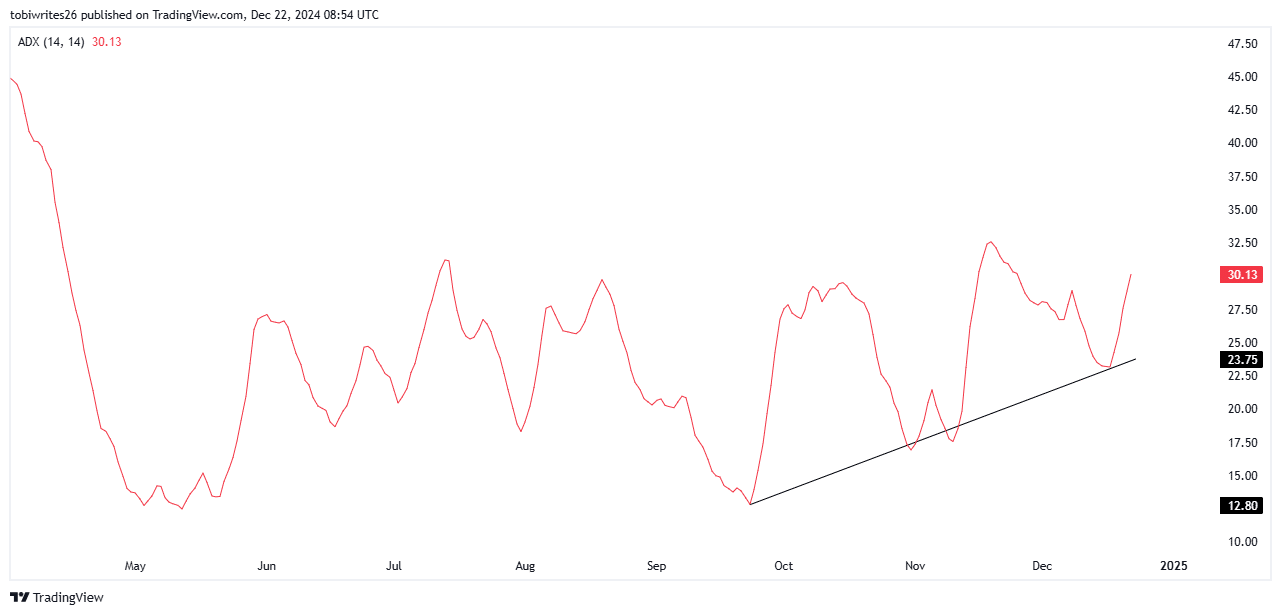

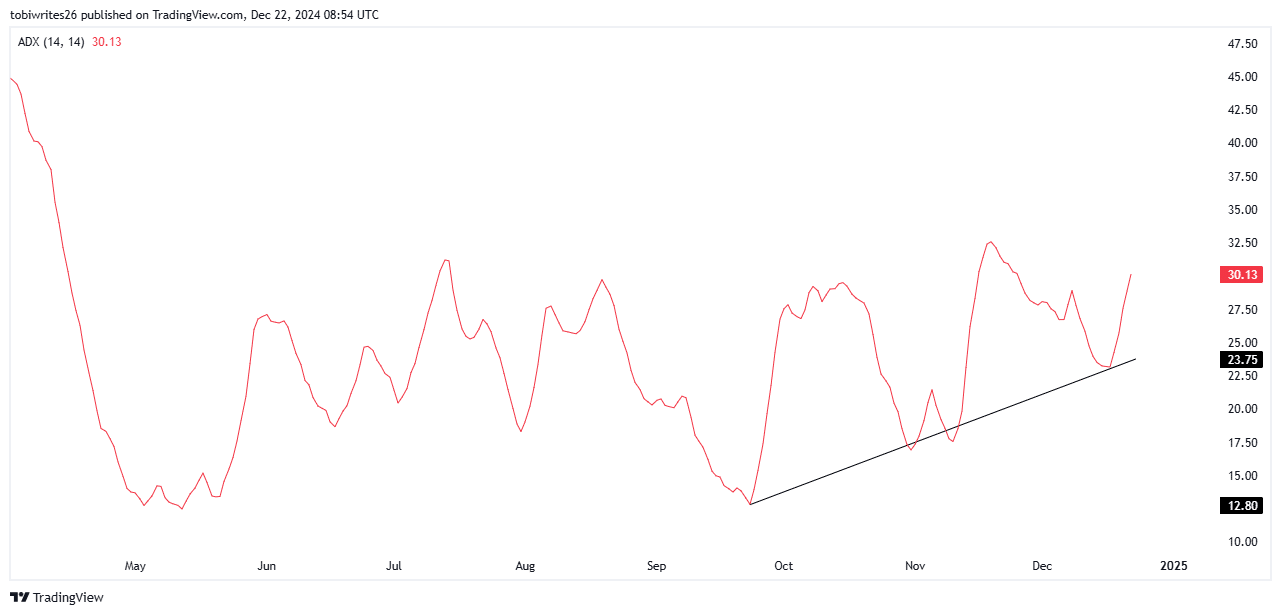

Further supporting the possibility of a price decline is the Average Directional Index (ADX), currently at 30.19, indicating a strong bearish trend. An increase in ADX during price declines indicates strengthening bearish momentum.

Source: Trading View

If these indicators coincide, the asset price is expected to fall below the current support level.

Despite the slight decline, bullishness remains high.

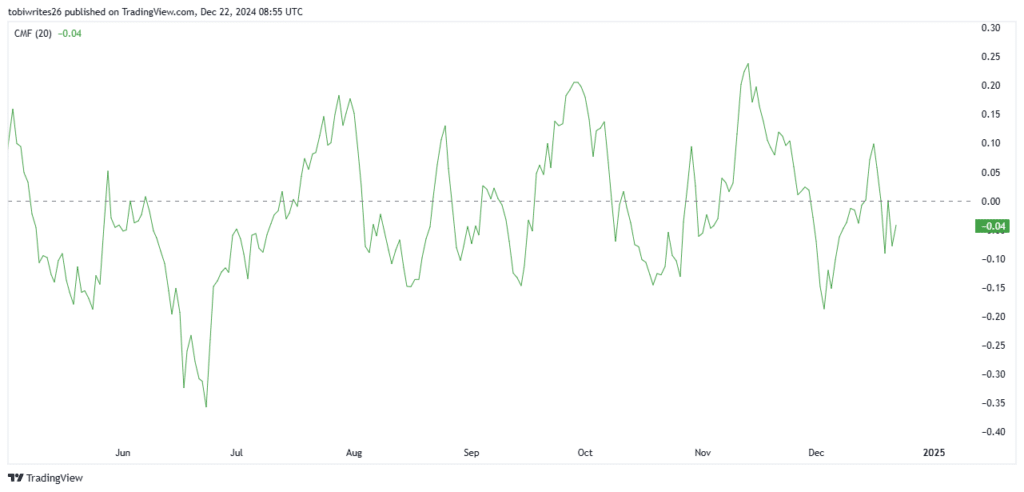

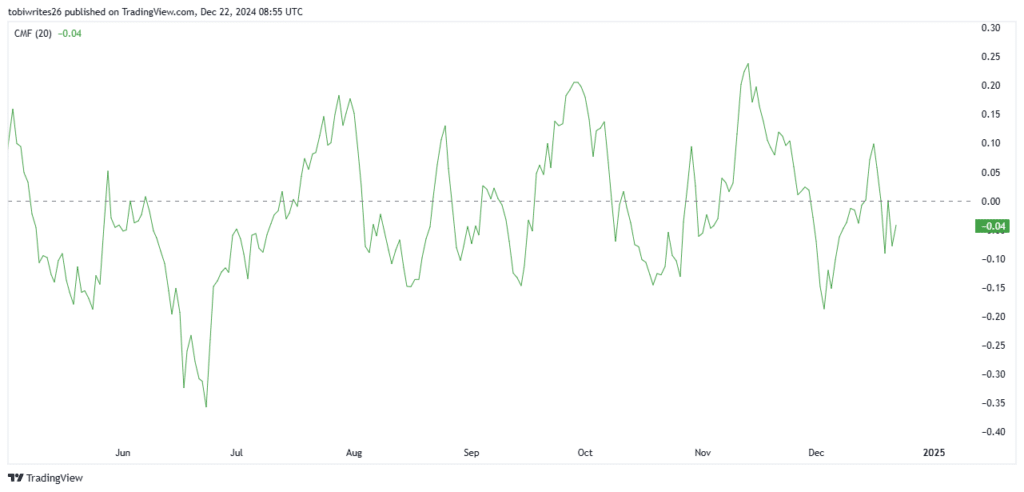

Bullish sentiment continues in the market, supported by Chaikin Money Flow (CMF), which is trending upward and approaching the zero threshold.

When the CMF trend is higher, it means that buying volume is exceeding selling volume and the possibility of an upward reversal is approaching. If CMF crosses above the neutral zero line, the price may move higher.

Source: Trading View

CMF’s current movements suggest continued accumulation at support levels. However, this accumulation may temporarily weigh on the price, resulting in a slight decline before the bullish momentum strengthens.

Read dogwifhat (WIF) price forecast for 2024-2025.

Spot traders are also increasingly moving their WIF holdings to personal wallets for long-term storage. Currently, approximately $5.5 million worth of WIF has been moved this way.

WIF remains optimistic overall, but the possibility of slight price declines in the near term remains.