Ethereum (ETH) balances on several mainstream centralized exchanges, including Coinbase and Binance, have hit new lows. According to X’s Leon Waidmann, more than 7 million ETH were traded. withdrawn From April 2023.

Are DeFi, NFTs or EigenLayer taking ETH away from exchanges?

This decline signals net strength for the coin and could suggest that other on-chain activities, such as non-fungible token (NFT) issuance or decentralized finance (DeFi), are taking center stage.

Coincidentally, the decline also came amid an increase in “re-staking” enabled through protocols like EigenLayer. The platform is gaining traction due to ongoing airdrops to encourage participation.

Technically, coin outflow from centralized exchanges is a key indicator of increasing scarcity and optimistic sentiment.

Because users can easily purchase coins, they use centralized exchanges like Binance or Coinbase as a conduit to convert to stablecoins or fiat, or participate in DeFi or NFTs.

However, with less ETH readily available on exchanges and increased on-chain activity, demand for the coin may increase, supporting its price.

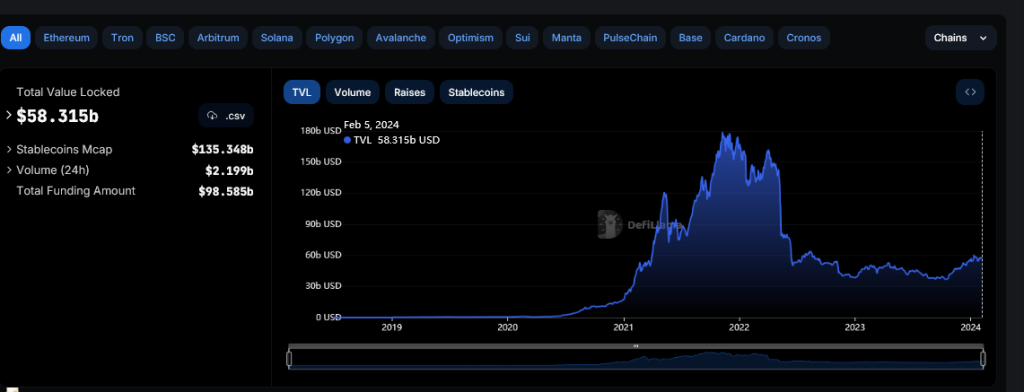

DeFiLlama data so far is show The broader DeFi ecosystem is improving as total value locked (TVL) expands. At the time of writing on February 5, DeFi’s TVL was over $58 billion, up from about $36 billion registered in mid-October 2023. Of these, the Ethereum protocol controls over $32 billion.

In addition to DeFi and NFTs, the decline in ETH held on exchanges can be attributed to EigenLayer’s incentives and expected airdrops.

EigenLayer attracts Ethereum Restaker

EigenLayer is a restocking platform that allows you to “re-stake” your ETH stakes on platforms like Rocket Pool, for example, and earn additional rewards by securing other protocols. With the promise of greater rewards, the proposal is likely to accelerate the withdrawal of centralized exchanges from the exchanges.

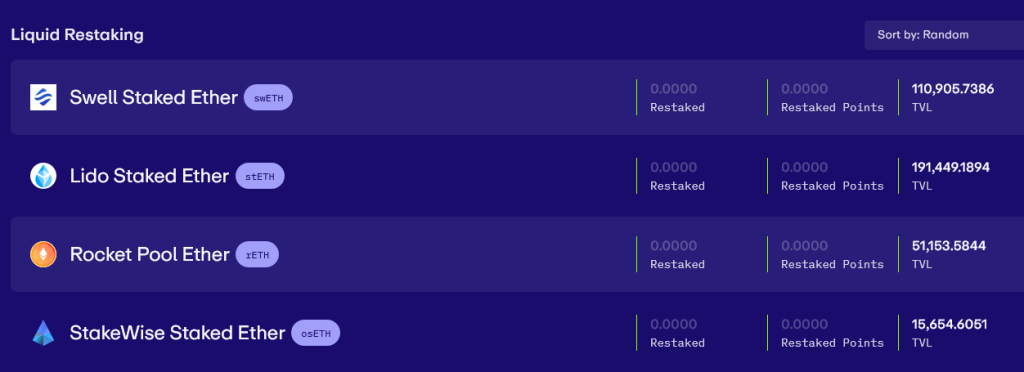

As of February 5, EigenLayer apply Get your staked ETH back from 10+ protocols including Swell, Lido, Rocket Pool, Ankr, and Coinbase. The platform also supports Beacon Chain node operators to earn rewards by re-staking.

As EigenLayer gains popularity, it is not immediately clear how that area will evolve or how ETH staking will develop.

However, to the benefit of the protocol, this idea means that the foundation can be customized to avoid complying with Ethereum’s strict staking requirements. At the same time, costs at launch are reduced.

Repeat users will receive more rewards, but experts worry this will overload Ethereum and negatively impact its performance.

Featured image from Canva, chart from TradingView