El Salvador’s President Nayib Bukele reaffirmed his country’s daily commitment to purchasing one Bitcoin.

Bukele has released transaction receipts for same-day purchases, reflecting the country’s ongoing commitment to the scheme.

One Bitcoin per day proves successful

In November 2022, Bukele announced a dollar-cost averaging (DCA) plan for El Salvador. At the time, he pledged to buy one BTC per day as part of the country’s cryptocurrency-friendly policy.

Despite facing initial criticism from various international financial institutions due to the sluggish cryptocurrency market at the time, the decision proved to be a strategic success. The recent surge in the value of Bitcoin has left El Salvador with significant unrealized profits.

Accordingly, President Bukele confirmed that El Salvador will continue its Bitcoin DCA strategy indefinitely. According to the data, the country spent over $15 million to acquire 485 BTC through this approach, with an average purchase price of $30,985. Today, this stash alone is worth over $33 million.

“(The 1 Bitcoin per day program) will continue until Bitcoin becomes unaffordable as fiat currency,” Bukele said.

Read more: Who will own the most Bitcoin in 2024?

It is worth noting that taking into account Bitcoin earnings from other channels, such as El Salvador’s previous purchases and citizenship programs, the total holdings amount to 5,690 BTC, worth $387.88 million.

Whales Continue Accumulating BTC

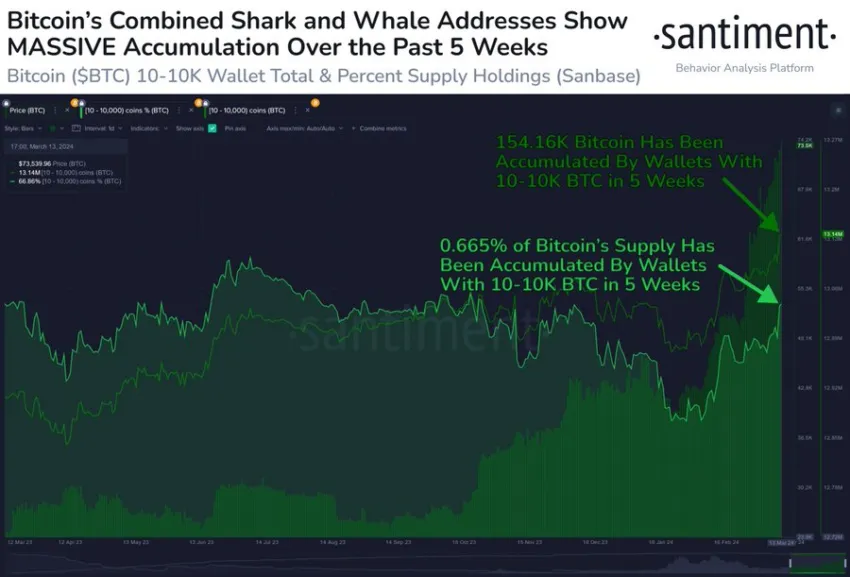

Bukele’s comments reflect a common sentiment. Over the past few weeks, Bitcoin whales have been working to increase their holdings. Wallets holding between 10 and 10,000 BTC have aggressively accumulated 154,160 BTC worth $10.6 billion over the past five weeks, according to on-chain data from Santiment.

These purchases have contributed significantly to the recent surge in Bitcoin price.

“Bitcoin’s key stakeholders have been largely responsible for the second wave of market capitalization growth over the past five weeks. Wallets holding 10-10K BTC have accumulated 154.16K coins (0.665% of supply) since February 4 and are currently worth over $10.9 billion.” Santiment said.

Read more: Bitcoin price prediction for 2024/2025/2030

During this period, MicroStrategy finalized a debt financing strategy to raise over 12,000 BTC for $821 million. Nonetheless, the company is actively pursuing expansion of its existing 205,000 BTC holdings by raising up to $600 million through a convertible bond offering.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.