- The rise in BTC was limited by macroscopic uncertainty in the Trump tariff war.

- It still remains how the US Jobs report will set the next direction of the market.

President Donald Trump’s tariffs and inflation fear continue Bitcoin (BTC).

The price of the world’s largest cryptocurrency has decreased for three consecutive days, strengthening macroscopic uncertainty about wider cryptographic markets.

During the same period, the BTC did not recover $ 100K. Similarly, ETH struggled to jump to more than $ 3K. Solana (SOL) Good job to less than $ 200. Ripple (XRP) was also maintained in a muted state and was maintained at less than $ 2.5 based on prestation time.

Source: Coinmarketcap

Emotions weaker than US job reports

Considering Trump’s tariff impact on inflation pressure, the market will focus on the US January Job Report (Non -Farm Benefits) on Clues on the Fed.

According to the QCP CAPITAL Crypto Options Desk, the hemp activity has increased with the PUT option (Bear Rish Betting) ahead of the report.

This has proposed an increase in the increase in risks and potential weaknesses. company stated,,,

“If you head to the unpacking report tonight, the market sentiment is still cautious. The desk reflects on continuous attention despite the fact that it still prefers calls by continuously observing interest in the BTC 28FEB25 80K putt and BTC 21FEB25 90K foot. ”

In particular, according to FXSTREET data, economists expect jobs to increase to 170K in January after 256K profit in December.

If the actual report misses the January goal, the Fed may tend to reduce interest rates. This is positive for BTC and risk assets.

However, if the job report shows a greater profit than the estimate, this solid labor market will stimulate the regulatory agency to maintain the current interest rate longer. Due to continuous inflation fear, this is bad for BTC and Crypto.

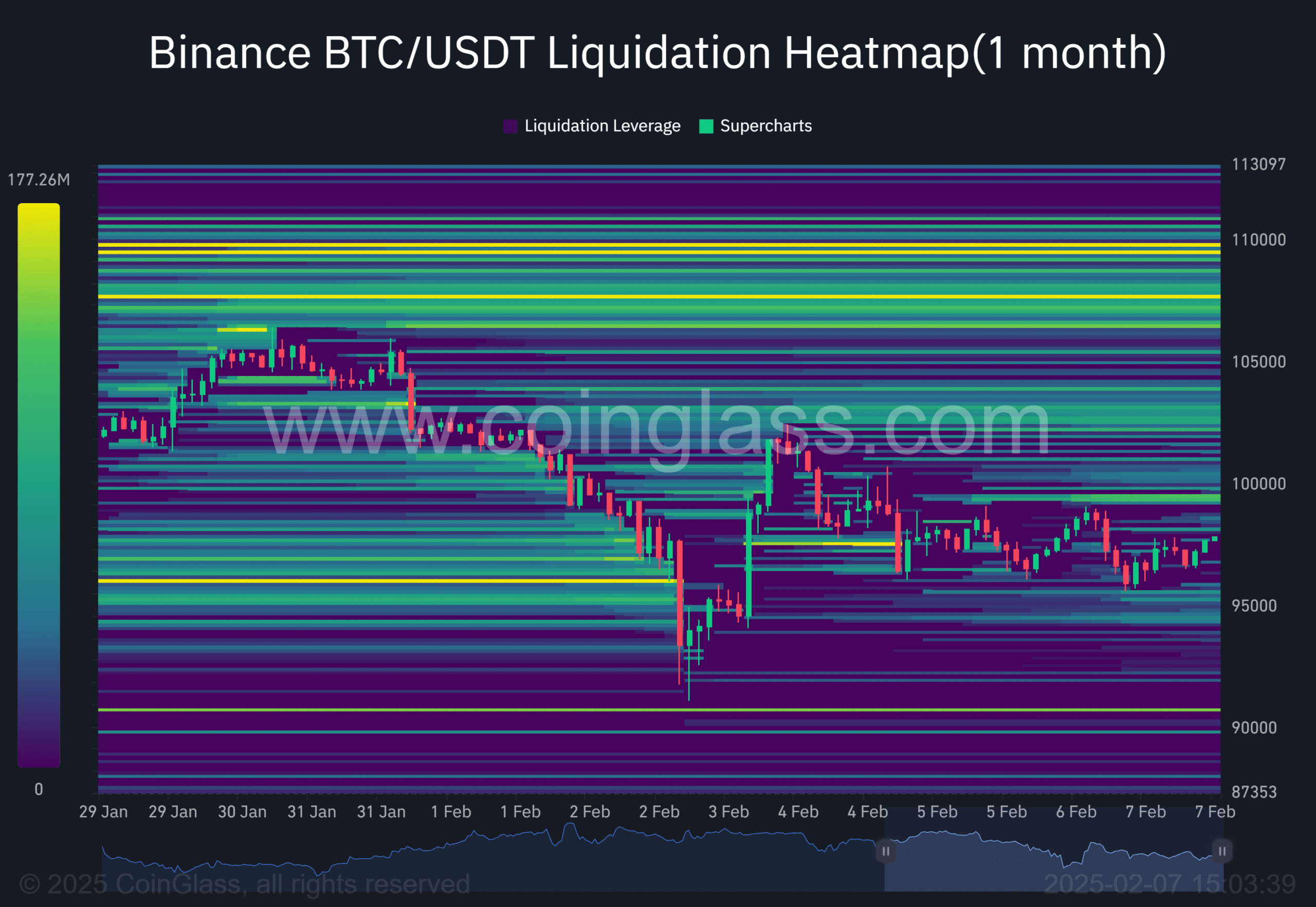

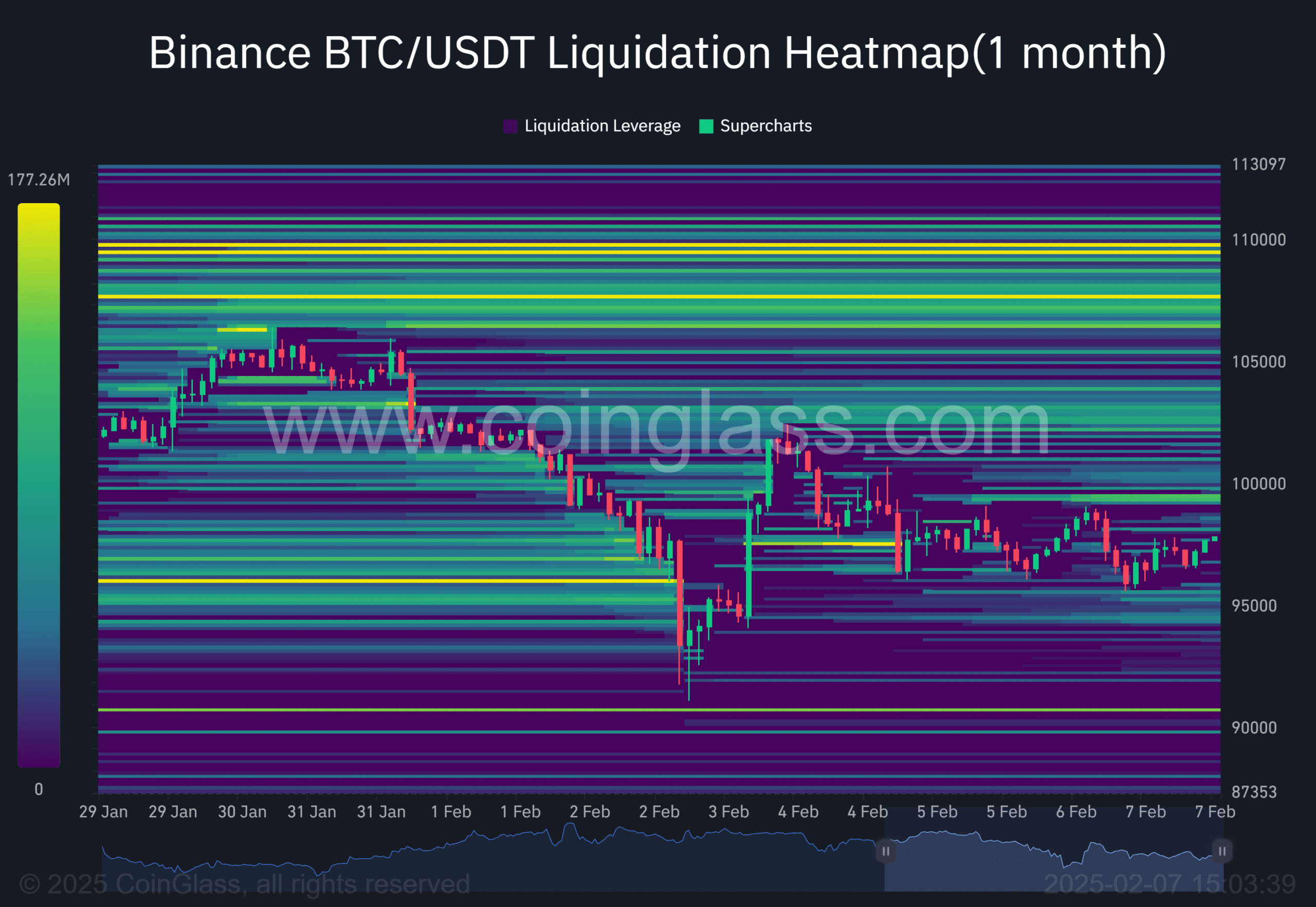

In other words, the main level to track according to the CoingLass liquidation heatmap is $ 90K, $ 100K and $ 110K. These major liquidity pockets generally act as price magnets in liquidity -centered rally.

Source: COINGLASS