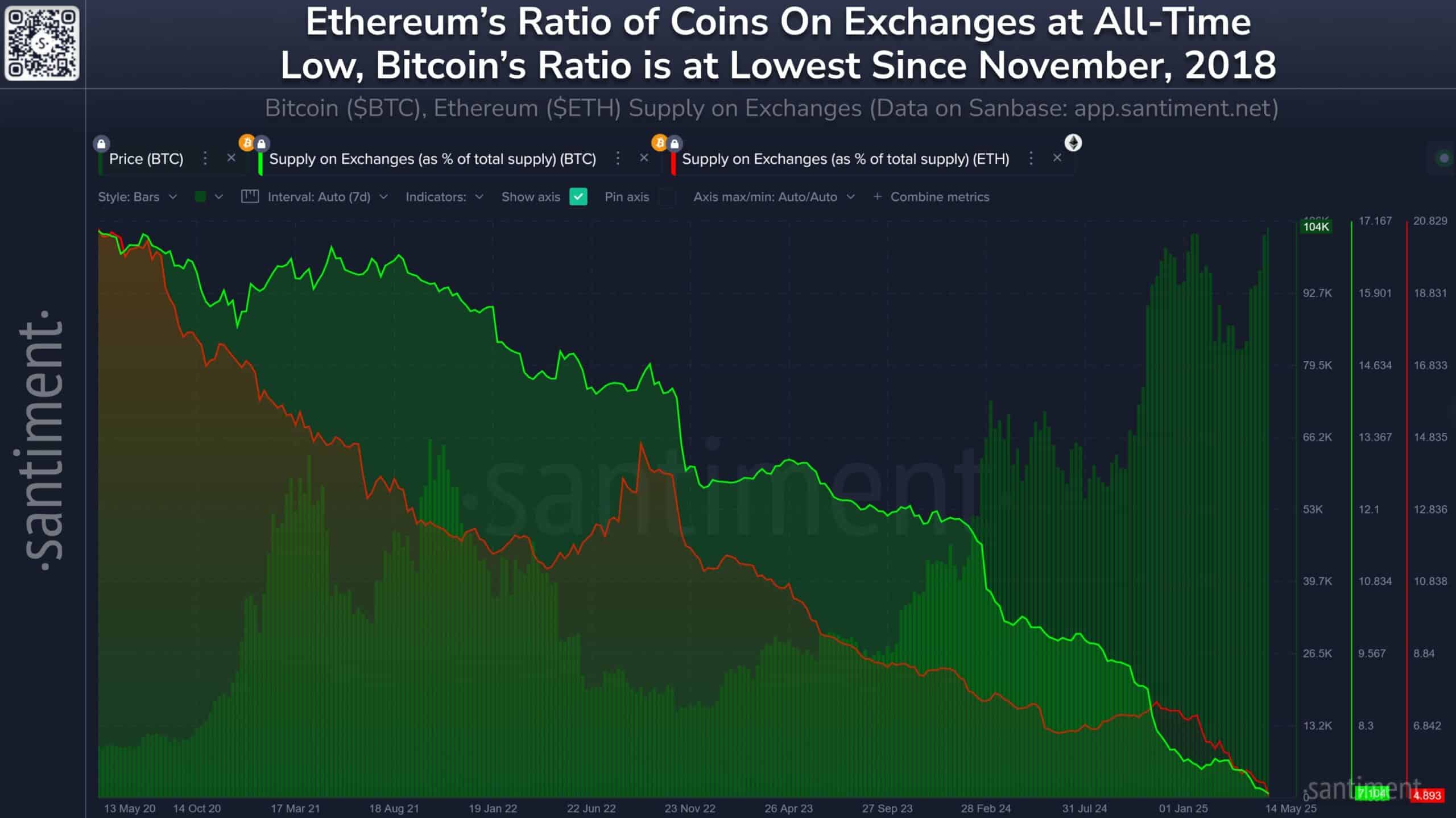

Bitcoin’s exchanges have fallen to 7.1%, the lowest level since November 2018, and Ether Lium decreased to less than 4.9% for the first time in history for more than 10 years.

The leakage speed over the past five years is impressive. More than 1.7 million BTC and 15.3 million ETH withdrew from CEXES.

This figure shows that the tendency for self -use and long -term retention increases, and when demand begins to accelerate, it potentially set the supply pressure stage.

Source: Santiment

Supply shock discussion

Supply shocks generally occur when the tokens available on the exchange decrease, as demand is increasing rapidly. It seems that the stage has been set at the lowest level of many years with the BTC and ETH balance.

Historically, similar trends were ahead of major rally as floats contracted sales side liquidity. But not everyone is convinced.

Some argue that whales are not just accumulated, but can be transferred to refrigerated storage for security. Others still point out the colorful retail crowds and the possible cooling buzz post ETF.

If your emotions change, the side job capital can enter the exchange again and quickly flip the trend.

Bitcoin: From Fringe to Liquor

About 50 million Americans currently own Bitcoin. This surpasses gold ownership depending on the river and the Nakamoto project. As long as the BTC disappears from the exchange, this change is huge.

Source: X

Bitcoin is no longer a fringe asset, but an increasing preliminary alternative. The rapid decline in exchange supply may not be associated with the long -term value fiscal speculation of the digital age.