King Ferdinand of Spain, patron of Christopher Columbus, gave the conquistadors one command: “Get the gold! Humanely if possible, but at all risk!”

Five hundred years later, these feelings still seem to be the same, with new dangers added. Goldberg and Bitcoin advocates share a common belief that the fiat system is on the verge of collapse and is continually degrading itself to survive. solution? It is a commodity-based alternative that is not affected by depreciation and ensures the preservation of accrued value.

The fourth halving in April 2024, with the block subsidy going from 6.25 BTC to 3.125 BTC, will cause Bitcoin’s inflation rate (annual total supply growth) to be 0.9%. In addition to being more portable and divisible than traditional gold, the inflation rate of “digital gold” is lower than that of gold (~1.7%) and will continue to fall at a lower rate in the future.

However, when asked to choose a store of value, many investors say:

“I would choose gold. “Not Bitcoin because of the environment!” really?!

Contrary to that perception, studies have shown that Bitcoin mining could halve carbon emissions while enhancing the expansion of renewable energy (Bastian-Pinto 2021, Rudd 2023; Ibañez 2023; Lal 2023) and encouraging reductions in methane emissions. (Rudd 2023, Neumüller 2023). (70 Mt CO2e) Gold mining (126 Mt CO2e).

When people think of gold, they think of a pure and clean substance. But the reality of gold production looks very different. As I watched environmental scientists develop adsorbents for water pollutants, I learned that gold mining is one of the most polluting industries in the world. If we look more closely at the topic, we find the following:

Gold mining ranks second in land area after coal mining (7200 km2). The gold mining site (4600 km2) is larger than the next three metal mining sites combined (copper: 1700 km2, iron: 1300 km2, and aluminum: 470 km2).

As many high-yield gold mines are depleted, chemical processes such as cyanide leaching or coalescence, which make extensive use of toxic chemicals, are being used today. Water contaminated by gold mining, called acid mine drainage, is a toxic mixture for aquatic life and enters the food chain.

Colorado’s Animas River turned yellow after 3 million gallons of toxic wastewater spilled from the Gold King mine in August 2015. source:

In the United States, 90% of cyanide is used solely to recover hard-to-extract gold. Toxic substances and their production and transportation have a direct relationship with the gold market. It is estimated that gold mines use more than 100,000 tons of cyanide each year. This means mass production and transport of compounds whose lethal doses to humans are only a few milligrams.

In 2000, a tailings dam at a Romanian gold mine collapsed, releasing 100,000 cubic meters of cyanide-contaminated water into the Danube River basin. The spill killed large numbers of aquatic life in the river’s ecosystem and contaminated the drinking water of 2.5 million Hungarians. Mines in Brazil and China widely use the historic fusion method to generate mercury waste. Mining 1 kg of gold releases approximately 1 kg of mercury.

Gold produced primarily by artisanal and small-scale mines in the Global South accounts for 38% of global mercury emissions.

Since 1980, thousands of tons have been released into the environment in Latin America. 15 million small-scale mine workers were exposed to mercury vapor, and downstream residents ate fish heavily contaminated with methylmercury.

In these populations, mercury poisoning causes serious neurological problems such as vision and hearing loss, seizures, and memory problems. Similarly, in South Africa’s Johannesburg Township, poor communities are paying the price for the country’s rich gold mining.

Recognizing these risks, Western mining companies are increasingly relocating to developing countries in response to more stringent environmental and labor regulations at home. Surprisingly, only 7% of mined gold is used for material property purposes in industry (e.g. electronics). The remainder is processed for jewelry (46%) or purchased directly from retailers or central banks as a store of value (47%). This is why periods of high currency depreciation drive gold prices higher. Last year, the central bank bought a record 1,000 tonnes of gold bullion, bringing gold close to its nominal high (status: December 2023).

The last time gold demand caused its price to rise significantly was the currency depreciation following the 2008 global financial crisis. During that period, gold mining in Peru’s western Amazon forests increased by 400%, while annual rates of forest loss tripled.

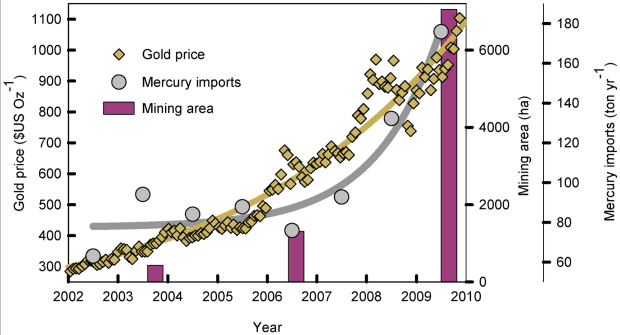

Because almost all of Peru’s mercury imports are used in gold mining, gold prices have coincided with an exponential increase in Peru’s mercury imports.

As a result of artisanal handling of mercury, large quantities of mercury were released into the atmosphere, sediments, and waterways.

Large-scale mercury exposure can be found in birds in Central America. This region is home to more than half of the world’s species.

Figure 1: Gold prices, Peruvian mercury imports and mining area taken from “Gold Mining in the Peruvian Amazon: Global Prices, Deforestation and Mercury Imports”. 2011, PLoS ONE 6(4): e18875.

Other natural areas with gold deposits, such as the Magadan region in northeastern Russia, have been experiencing similar expansions in mining activity over the past few years, including environmental destruction caused by high gold prices.

Gold mining, primarily driven by the need for a store of value, causes widespread ecological and social damage globally. Coal as a storage medium of value.

At least half of today’s gold mining could be prevented by using other stores of value, namely digital goods with greater portability, divisibility, and scarcity.

So the next time an environmentally conscious investor debates gold versus Bitcoin, say something like this:

Stores of value in the 21st century should not depend on huge areas of destruction and toxic hazards, but on electricity from non-competitive sources that subsidize renewable expansion.

This is a guest post by Weezel. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.