- ETH Users Turn to Private Trading Rather than Preemptive Trading

- Private transactions accounted for 30% of total trading volume but consumed 50% of Ethereum gas.

Throughout this year, the cryptocurrency markets have experienced significant change, development, and increased volatility.

Amidst these market changes, Ethereum (ETH) has seen growth in network activity, revenue, and addresses. Likewise, private trading order flow has surged significantly in the past year.

Ethereum users prefer private transactions

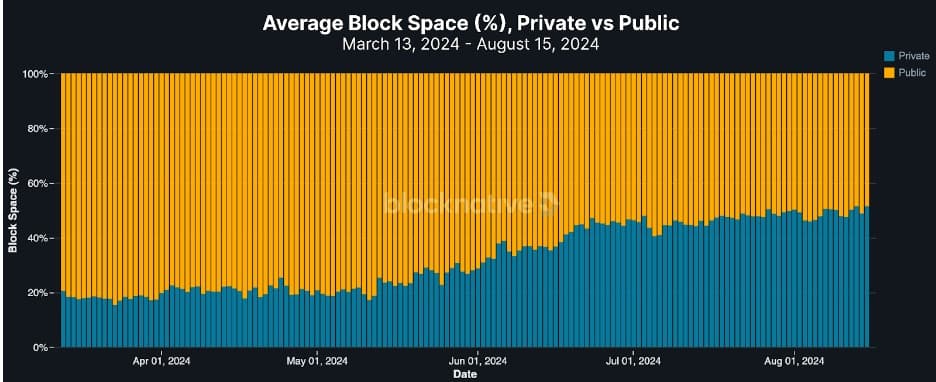

Source: Blocknative

According to research by Blocknative, there has been a significant increase in private trading order flow on the Ethereum network.

According to our data, private transactions consumed over 50% of the total ETH L1 block space in terms of gas usage. However, despite this fact, private transactions only account for 30% of all transactions within ETH L1 blocks.

Users choose to send transactions privately to protect their MEV, especially when performing complex transactions.

These transactions are inherently gas-intensive, consuming more gas per transaction than non-MEV transactions.

In essence, the gas used is directly related to the economic value of the block space. Therefore, every unit of gas represents a part of the block’s capacity and economic growth.

Increased base fee volatility

The increase in private transactions and gas usage has affected ETH’s base fee. The 2021 EPI-1559 upgrade changed the dynamic base fee to change based on the size of the space.

So the increase in private transactions has affected the base fee, which has increased its volatility. Private transactions therefore cause “vanilla blocks”, which makes the base fee volatile.

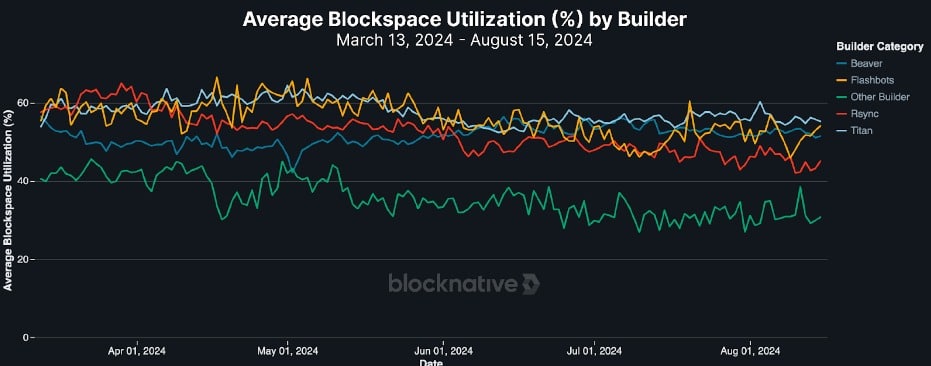

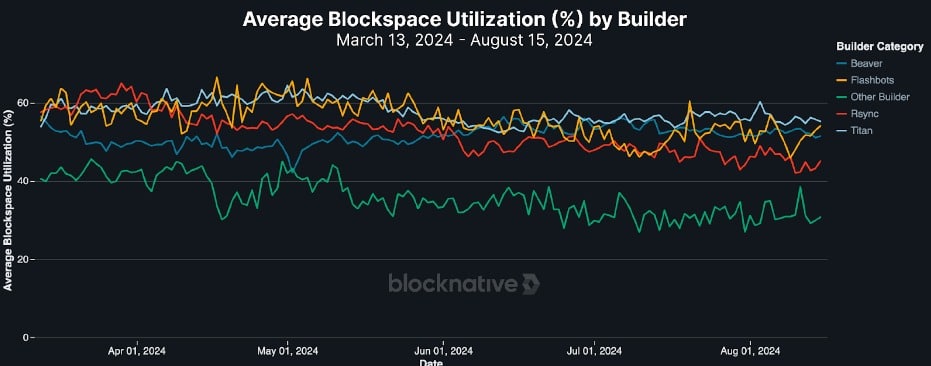

This volatility is a disadvantage for network users, as the increase in private transactions affects the base rate, especially when dealing with major users such as Titan, Rsync, Beaver, and Flashbots.

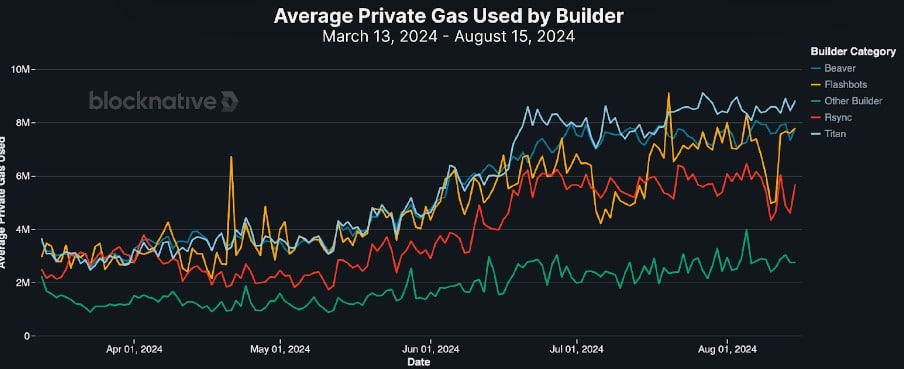

Source: Blocknative

For example, top construction companies increased private transactions throughout the year.

As reflected in the chart above, Titan has increased its gas usage from 3.5 million to 8.5 million via private transactions since March.

Is your portfolio green? Check out our ETH yield calculator

Other top vendors, including Beaver, saw usage grow from 3 million to 7.5 million, while Rsync’s usage grew from 2.5 million to 6 million.

This surge has huge implications and pushes a lot of users out of the game. This is evident as smaller builders are reducing their gas usage and most are struggling to reach the 15 million set by the EIP-1559 upgrade in 2021.

Source: Blocknative