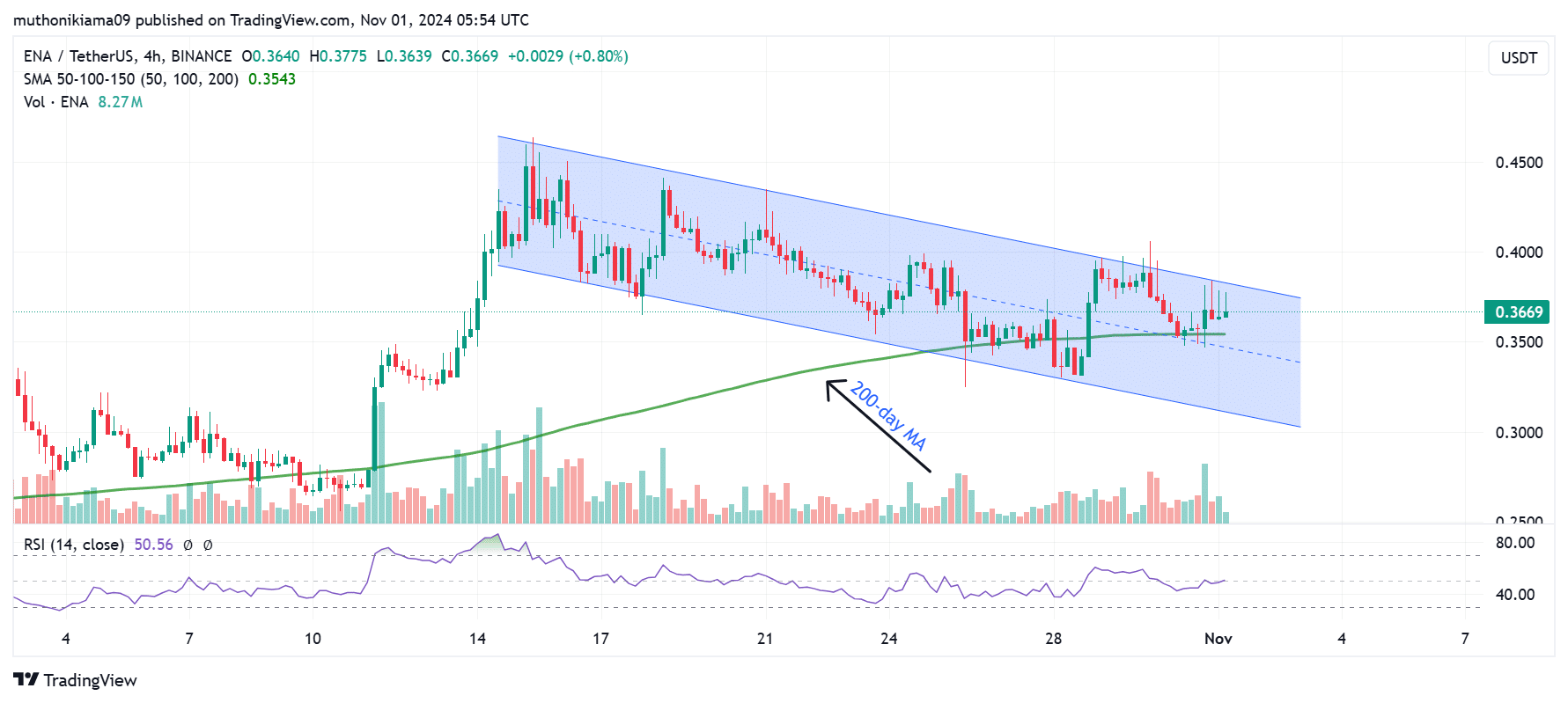

- At press time, Ethena appeared to be preparing for a bullish turnaround after its price breached its 200-day SMA.

- Whale activity has been impacted after a large ENA deal surged more than 400% from $26 million to $142 million.

Athena (ENA) It defied a bearish trend across the broader cryptocurrency market after rising 5% in 24 hours. At the time of reporting, ENA had a market capitalization of $0.36 and a market capitalization of $1.02 billion.

Following this uptrend, ENA could be ready for a full-fledged reversal in its bearish trend. For example, on the 4-hour chart, the altcoin appeared to be trading within a descending parallel channel. This is a sign of a long-term downward trend.

ENA may be bullish on this channel after overturning resistance at the 200-day simple moving average (SMA). A move above this resistance line would indicate that the recent uptrend is strengthening.

(Source: Trading View)

ENA will need high buying volumes to sustain this breakout. The Relative Strength Index also showed an upward trend, highlighting the same point, suggesting that the market uptrend is strong.

However, considering that RSI has a neutral value of 50, more buying pressure may be needed to sustain the upward trend. This buying activity can come from whales or large traders.

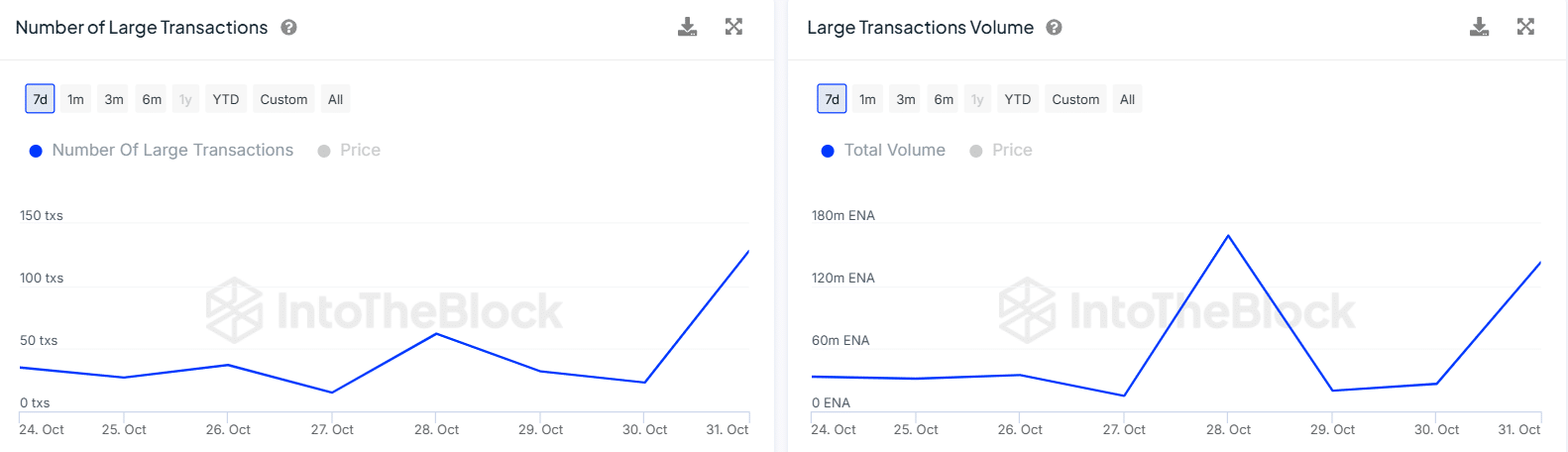

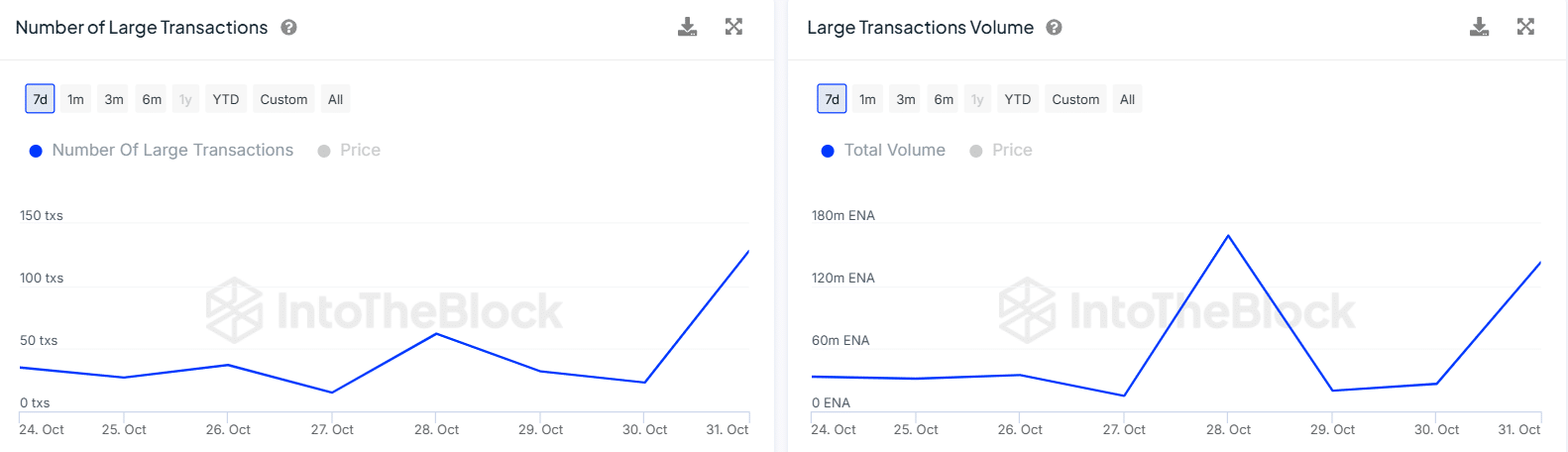

Whale activity could boost ENA’s upside

Ethena whales appear to be one of the catalysts for the recent price surge. In fact, data from IntoTheBlock shows that in the last 24 hours, the number of large ENA transactions exceeding $100,000 increased from 23 to 128.

The value of large transactions also increased from $26 million to $142 million. This represents an increase of more than 400% in whale activity within 24 hours.

(Source: IntoTheBlock)

Increased whale activity is often a catalyst for price volatility and bullish trends.

In terms of ownership, whales control 88% of ENA’s supply. Therefore, when this cohort becomes active, ENA is bound to experience significant price fluctuations.

Is Ethena underrated?

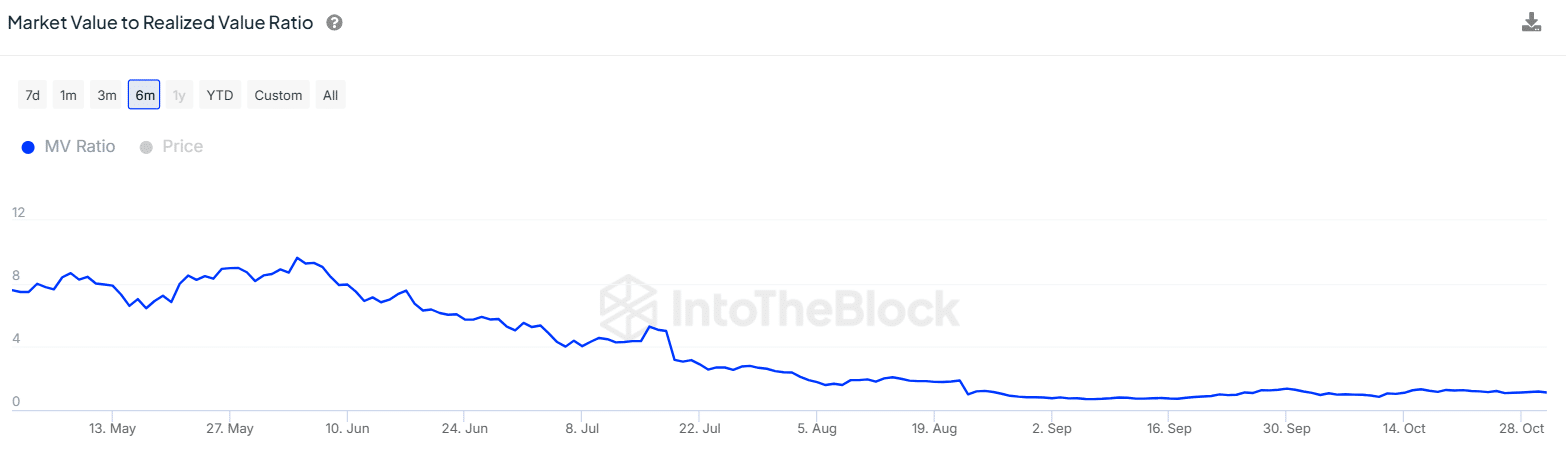

Ethena fell to an all-time low of $0.19 in September 2024, about five months after hitting an all-time high. ENA has since regained its all-time lows with an 87% price surge, but several indicators show that the altcoin remains undervalued.

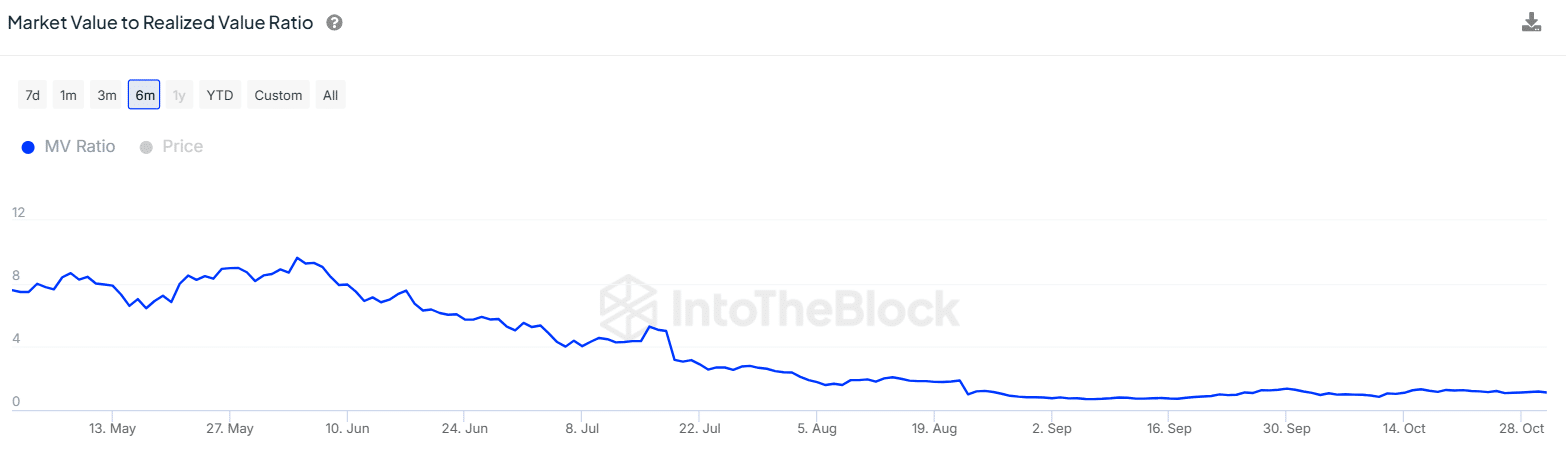

For example, the Market Value to Realized Value (MVRV) ratio has been gradually decreasing over the past six months. ENA’s MVRV ratio was 1.11 at press time, indicating the average trader was close to breaking even.

(Source: IntoTheBlock)

With fewer profitable traders, selling pressure may decrease and prices may stabilize. Moreover, ENA is undervalued, which could create an ideal entry position for buyers.

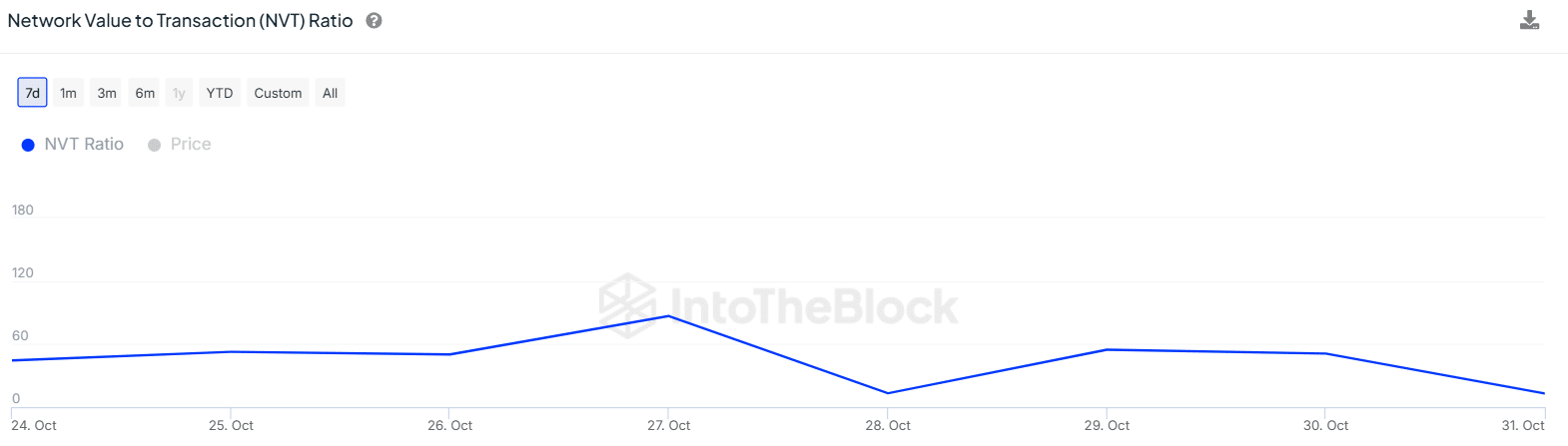

Lastly, the Network Value to Transaction (NVT) ratio showed a similar outlook. Over the past two days, the NVT rate has decreased by 77%.

(Source: IntoTheBlock)

The falling NVT ratio also means that ENA’s price is not reflecting the growth of the network. This is a bullish indicator because healthy network activity is a catalyst for long-term price growth.

Increased whale activity around Ethena, along with falling MVRV and NVT rates, supported the optimistic outlook. However, a positive reversal in market sentiment is needed to support a bullish breakout.

At the time of reporting, crowd sentiment at ENA was negative. Market Prophet. this It could hinder the increase in buying activity needed to support an upward trend.