- ETH is traded beyond the realized price, showing long -term holders’ profits and institutional central rally.

- Binance shows an institutional purchase and leads the ETH volume and shows the updated confidence.

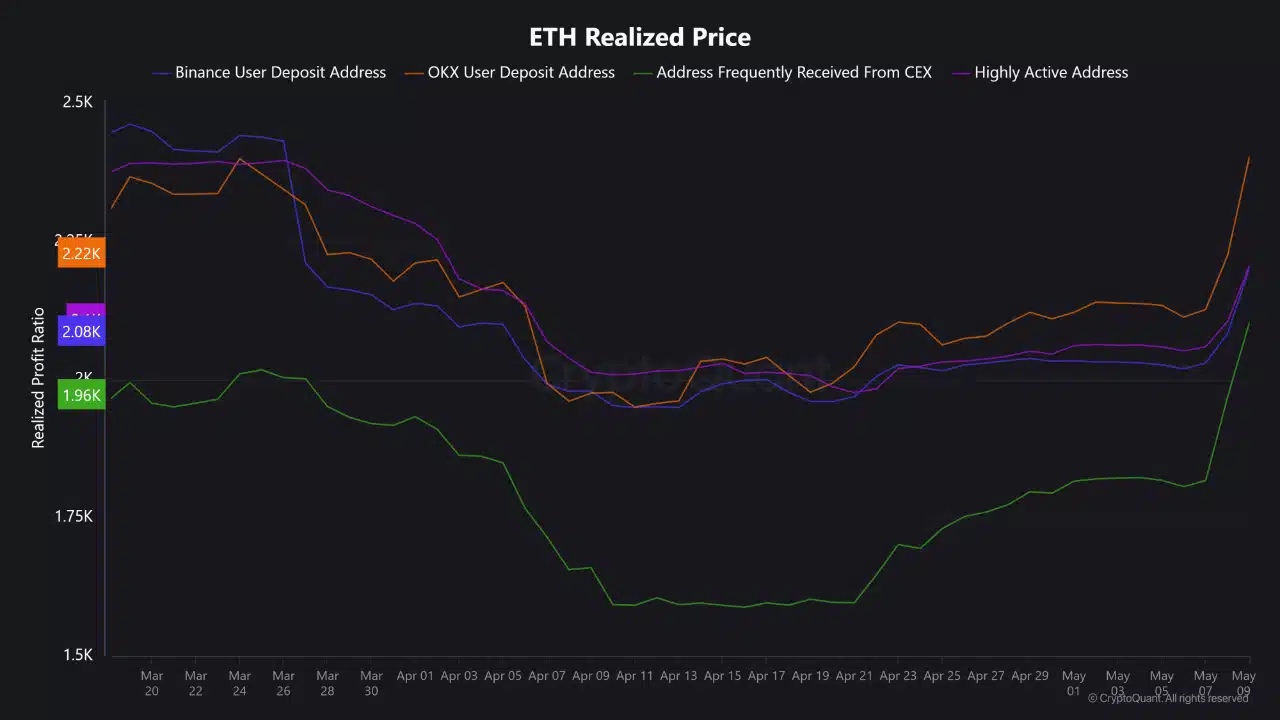

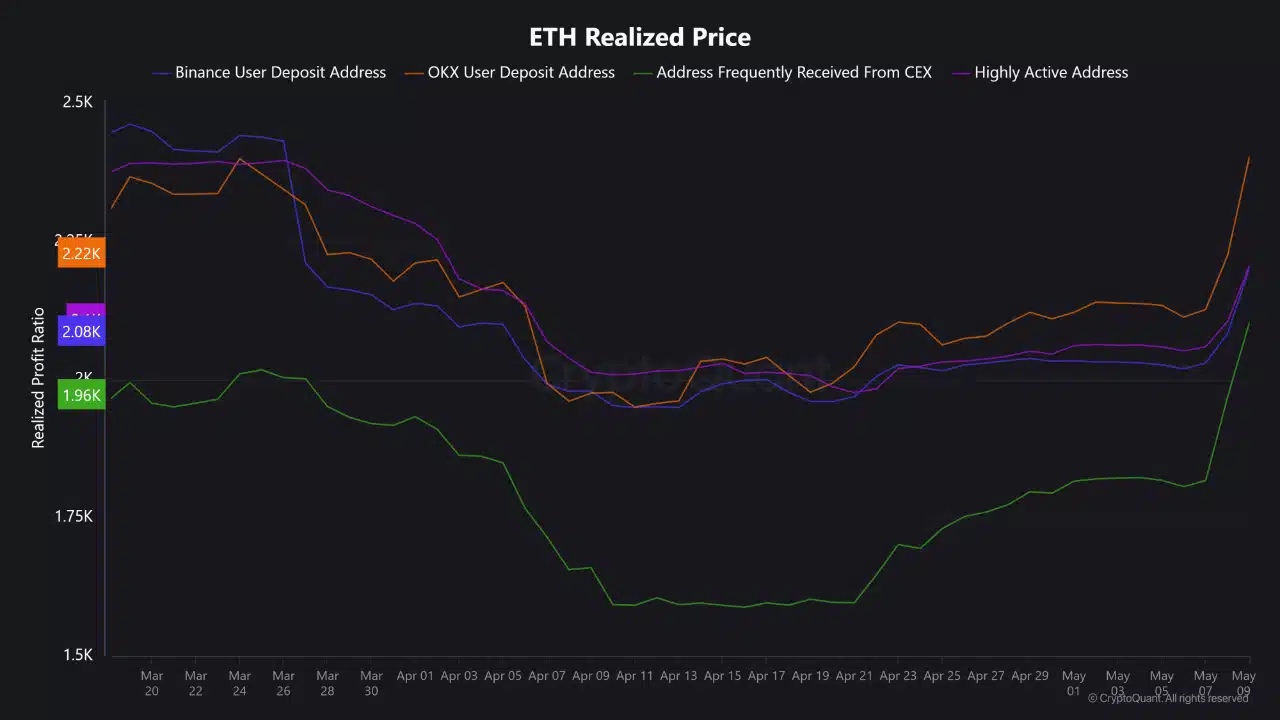

Ether Lee (ETH) has surpassed the critical threshold. Market prices have shown changes in emotions among long -term holders, exceeding the realization value.

There is no clearer place than Binance, and the point of profit generating to increase profits has increased due to increased trading volume, new liquidity, deeper liquidity and market leadership re -evaluation of Ethereum.

ETH long -term holders are currently gaining profits

At the time of writing, Ether Leeum was traded at more than $ 1,900 realized. The average ETH holder, especially the owners in the accumulation address, gained profits.

This acts as a marker of long -term investor trust. Historically, when the price rises up, it is associated with the powerful beliefs between the holders and the change of merchant psychology.

Source: cryptoquant

According to this chart, the wallet accumulation has begun to acquire less than $ 1,900, and the current price checks the position. This threshold flip often updates the inflow of capital and swing traders to utilize the amount of exercise.

This deer suggests that even larger investors are leading the movement, despite the weakness of the retail participation.

It also strengthens that ETH’s rally is supported by strategic accumulation rather than pure speculation.

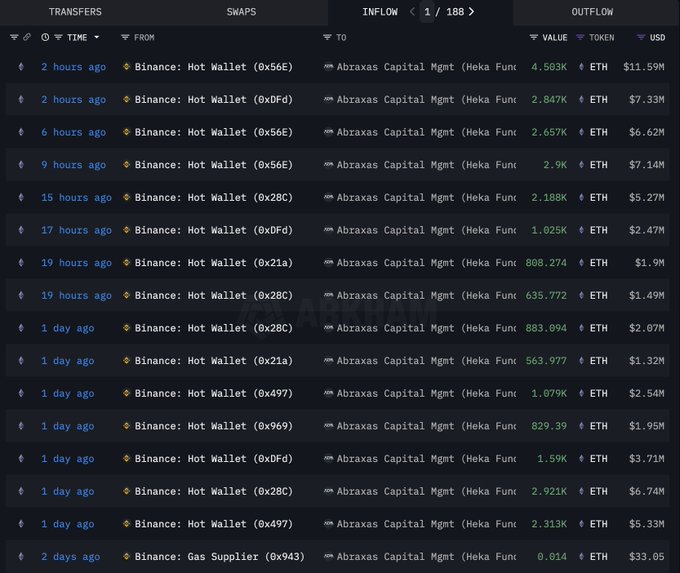

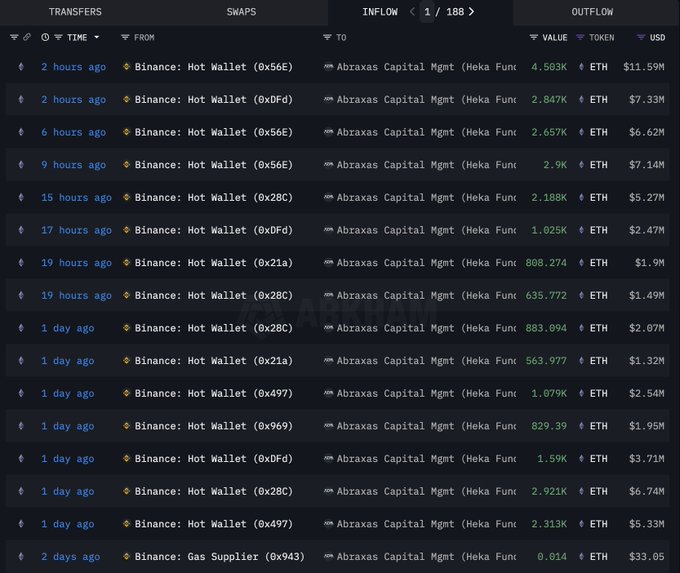

Binance takes the initiative

Recent inflows and leaks check the binance as the center of ETH transactions. The exchange has the highest ETH trading volume among all platforms, and the leak is leaked during the price increase.

Source: cryptoquant

This data shows that Binance users have been greatly accumulated in the deep of ETH and are now realizing profits as the price is recovered from the average input. Importantly, this epidemiology does not reflect the weaknesses of the market -it shows strategic reassurance on a platform known as high liquidity.

For example, the aggressive ETH of Abraxas Capital is an active accumulation through Binance recently.

Source: X

Ether Leeum’s price outlook

Ether Lee’s $ 2,600 surge in match with the launch of the PECTRA upgrade, which is likely to have added momentum to the recent optimistic wave.

However, technical indicators show that short -term reuse can follow. RSI violates scientific thresholds, and is currently 80 or more, and is historically related to fullback.

Source: TradingView

On the other hand, MACD supports upward momentum and suggests that all modifications can be short or shallow.

The ETH transaction is $ 2,518 for the press time, and the market structure is still optimistic, but the next 24-48 hours can be integrated as the trader digests both rally and upgrade news.