- The US government has joined institutional investors to mass -sell ETH, adding pressure on prices.

- The retailer also joins the waves, but the ETH faces the possibility of a rapid market loss.

Ether Leeum (ETH)Investors began to face the weakness of the market as large -scale sales were recorded.

In the last 24 hours, assets have been reduced by 5.75%and much lower.

AmbCrypto’s analysis shows that there is no more historical trend that the selling ETH is no longer. Overall, if the market participants continue to sell, the loss will be strengthened.

The US government sells on a large scale, and ethics ignores past catalysts.

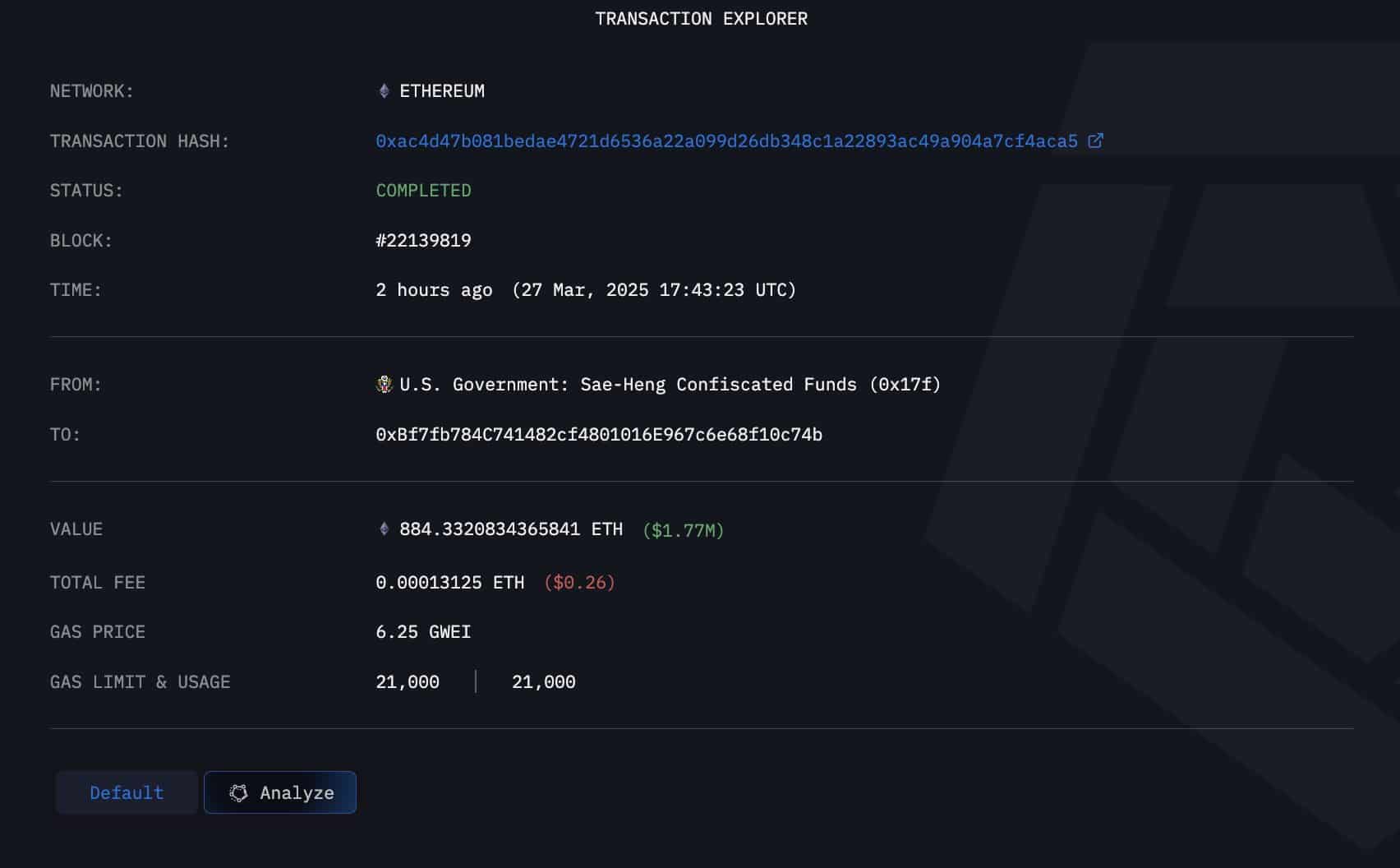

In the last 24 hours, the US government has sold a large amount of ETH of 884.33 ETH at $ 884.33 at the time of trading.

Notable selling from large -scale investors such as the US government has a balance of 59,965 ETH, and generally indicates that there is a lack of trust in assets, tends to have a negative impact on a wider market.

Source: Arkham Intelligence

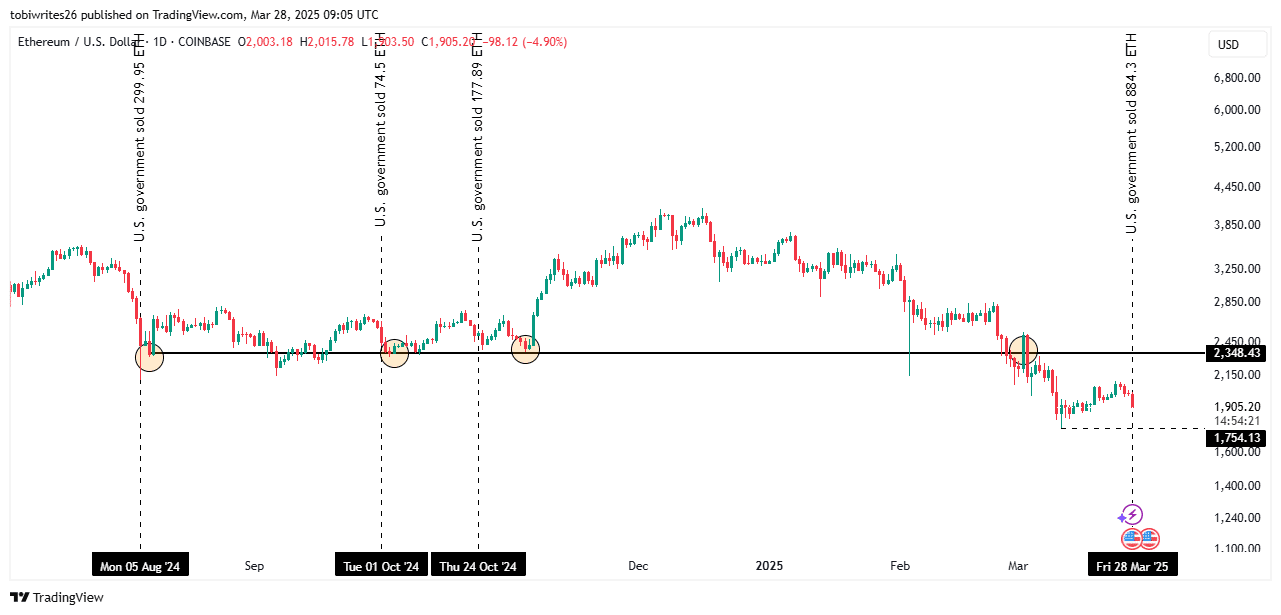

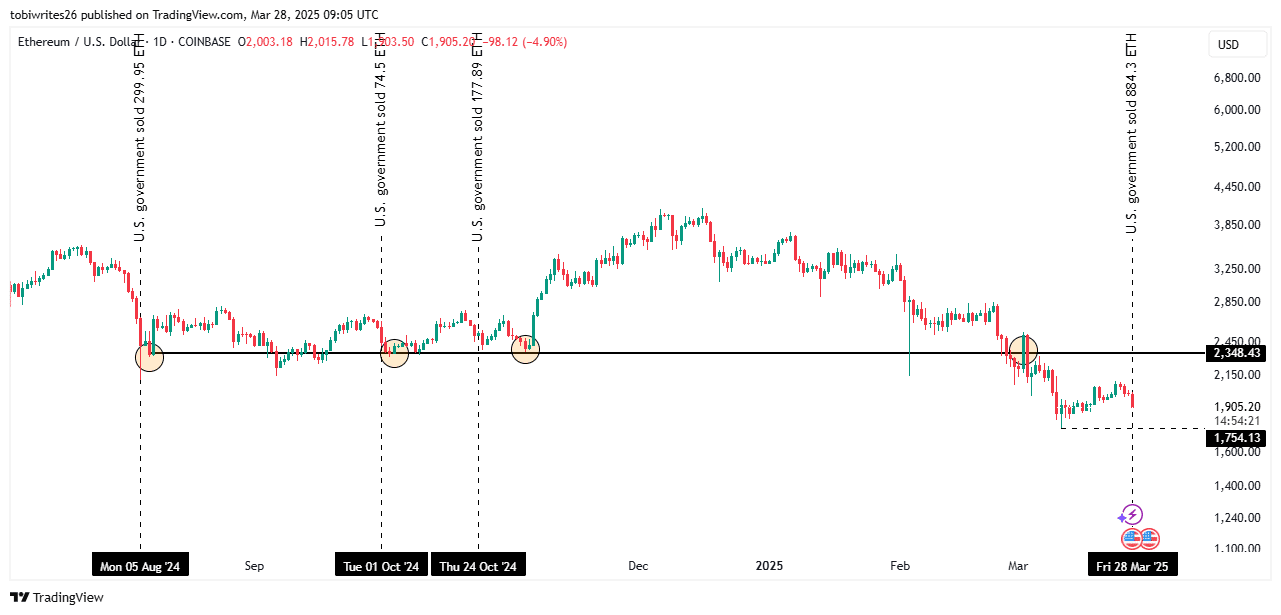

To understand this impact, AmbCrypto has studied the US government’s effects on ETH sales and markets.

In general, the US government is sold when the market is already decreasing. This is the present case. Unlike before, ETH may not see the bounce again.

The US government sold 299.95, 74.5 and 177.89 ETH, respectively, respectively. Each time, assets decreased to $ 2,348.43 to a major support level, which served as a catalyst for bounce.

Source: TradingView

But this time it is different. ETH is currently trading below this support level, forming a series of low lows. If sales are strengthened, the ETH risk will drop to less than $ 1,754. If it does not protrude again at this level, additional reductions may occur.

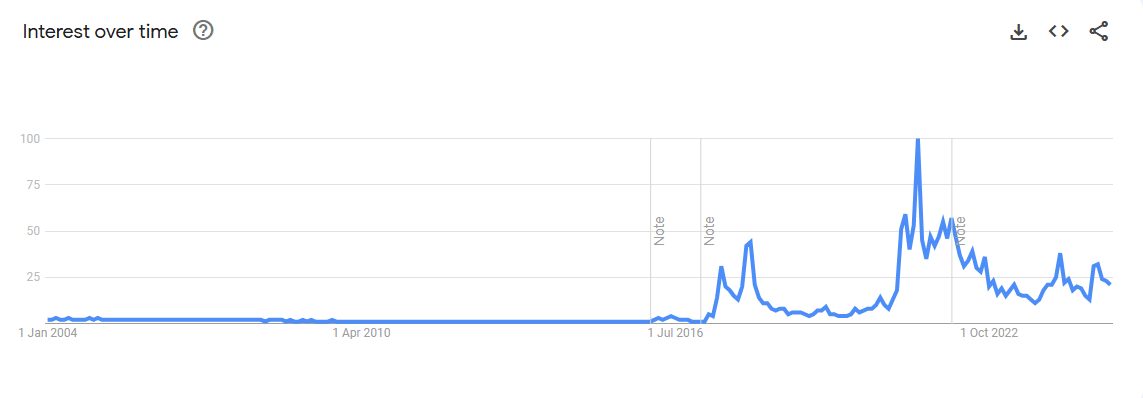

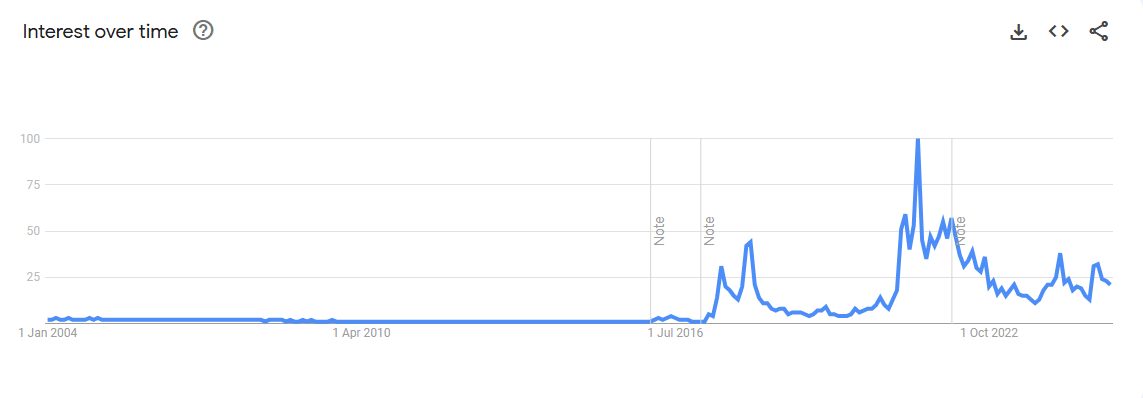

AMBCRYPTO’s further analysis shows that continuous decrease may be the current market trend as the retail feelings of assets reached a new low level, a year ago.

Source: Google Trend

This has been confirmed by the Google search interest over time, which shows that the retail search interest in ETH has dropped significantly.

Temporary trends between retail and institutional investors

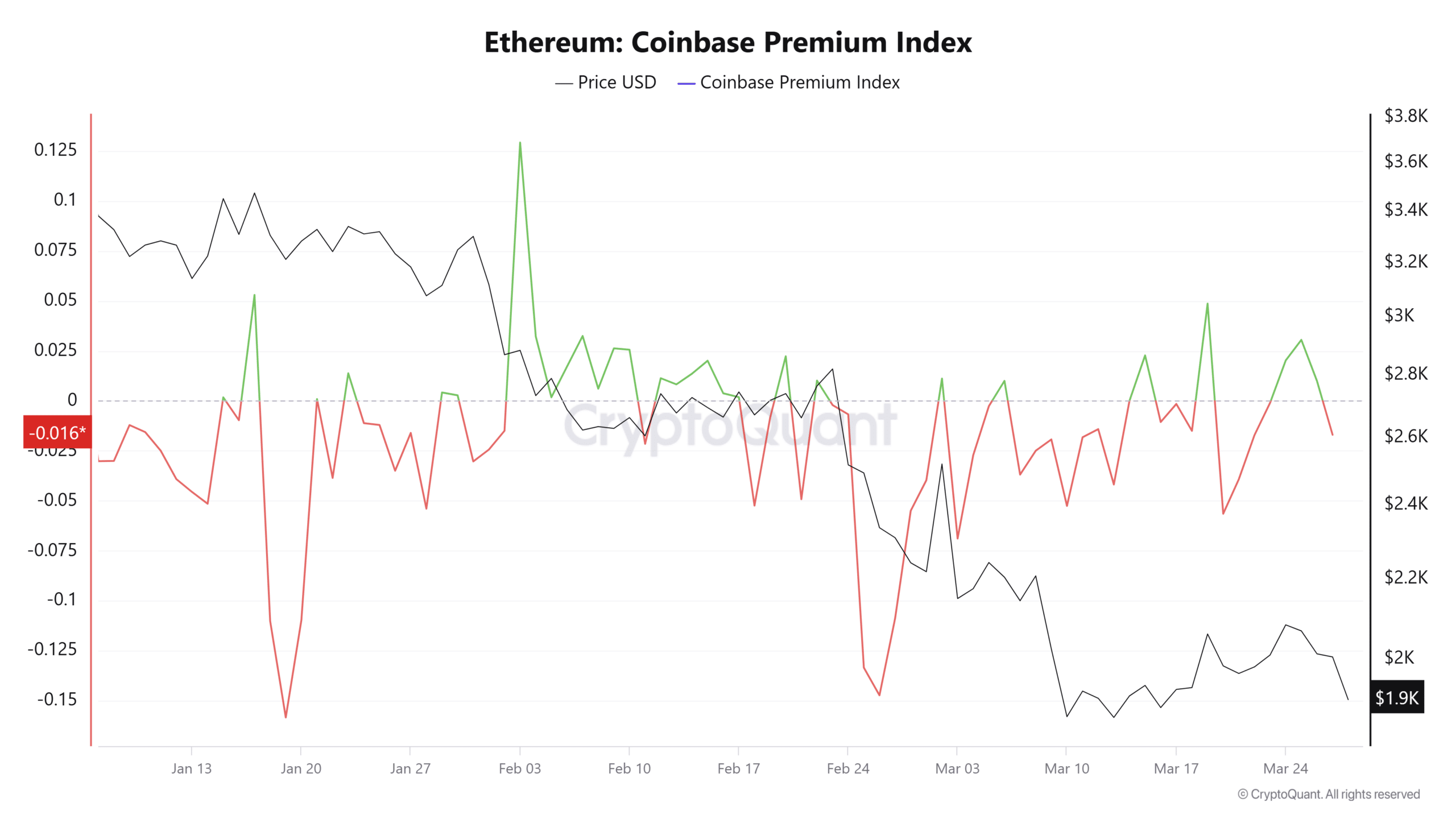

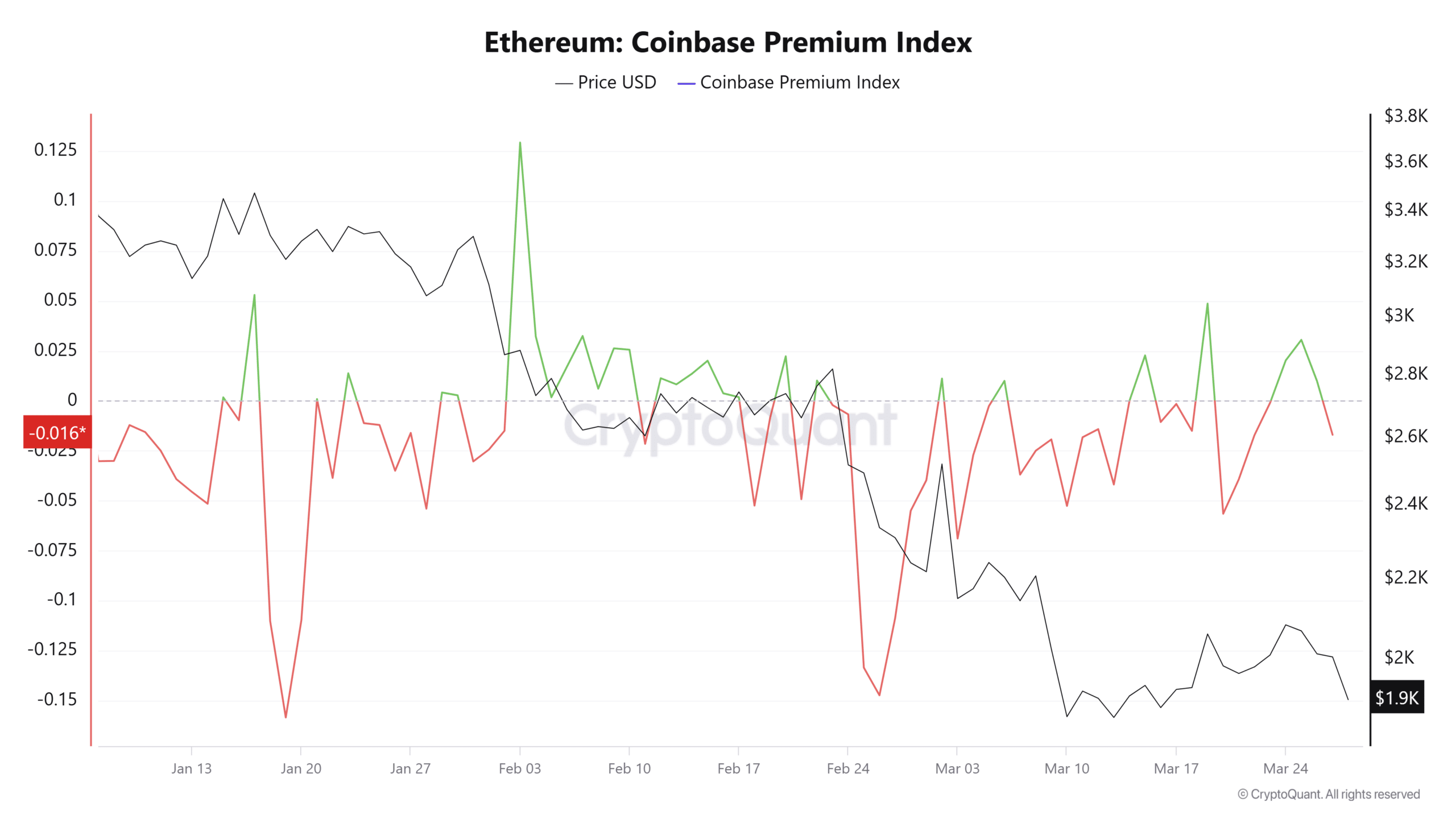

The US government’s selling forced the country’s retailers to actively start selling. According to Coinbase Premium Index, which tracks this behavior, this is the first time that the trader Cohort has been selling since March 23.

It is clear whenever the index is in a negative area. I read -0.0016 in the press time, indicating that the sales pressure is gradually mounted.

Source: cryptoquant

Institutional investors, which have about $ 88.3 billion worth of Etherrium as management assets, have been sold since early March, adding a downward pressure on assets.

On March 3 and now, Etherrium worth $ 468 million was sold.

If the institutional investor continues to sell, it can reach the target level of $ 1,754 as the ETH is displayed on the chart.