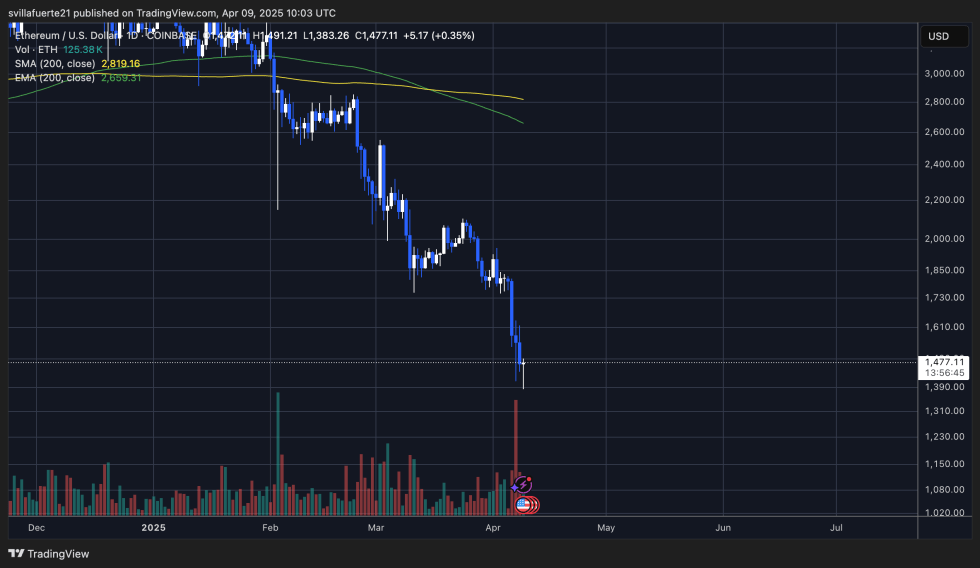

Ether Lee was another hit this week, and the invisible level since March 2023 slipped to a fresh lowest level of about $ 1,380. The ongoing decline was more and more interested in investors, and many questioned that ETH’s long -term optimism was still damaged. The market situation remains harshly due to continuous macroeconomic tension, global instability, and uncertainty caused by US trade and fiscal policy.

The feelings of crossing the encryption space continue to deteriorate, and Ether Lee’s price measures reflect the anxiety. After struggling to maintain the level of support for several months, the failure of less than $ 1,500 was added to the fear that deeper modifications could be developed.

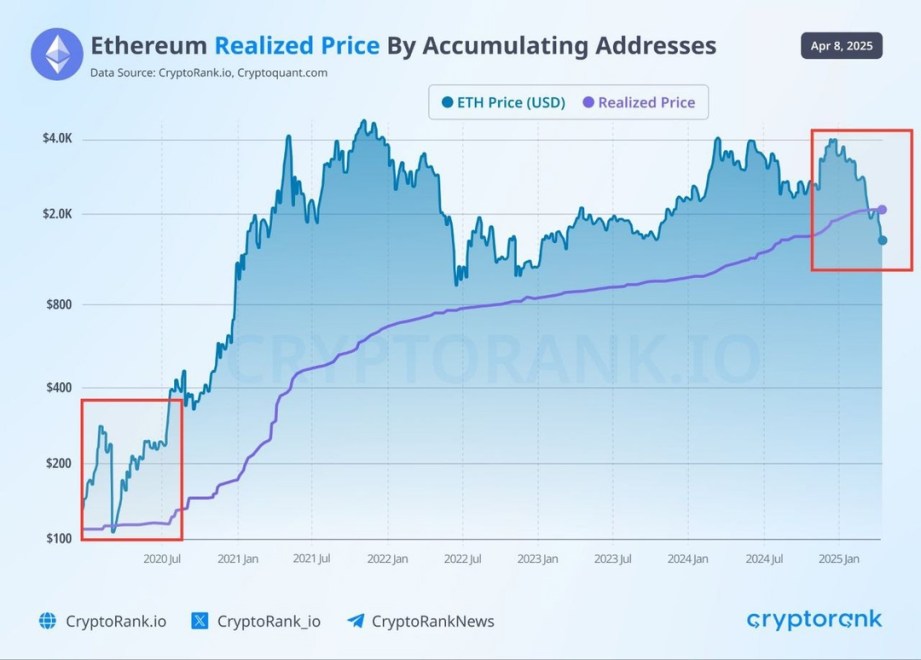

But there may be silver lining in the middle of depressing. According to Cryptorank Data, Ethereum is trading below the current price. This is historically related to the market floor and powerful recovery stage.

Short -term prospects are still uncertain, but these rare warmth signals can indicate that Ether Lee is entering the main area. The upcoming few days and a few weeks are important to determine whether this is under another leg or the beginning of a long -term reversal.

As fear occupies the market, it is synced below the price of Ether Leeum realized.

Ether Lee has lost more than 33% of the value since the end of March, causing deep concerns between investors and analysts. Price plunge has reduced ETT to invisible levels for two years, and once 2025 was expected to be the year of Altcoins. Instead, Ether Leeum has become a symbol of market vulnerability as the wider macroeconomic environment continues to deteriorate.

Trade war fear, inflation pressure and potential global recessions are shaking the financial market at the core. In this climate, high -risk assets such as Ether Leeum are one of the first assets to suffer. As the capital was in favor of a safer shelter, ETH’s selling was just accelerated and investor trust was seriously hit.

But hope can be faint in data. CARL RUNEFELT, the top encryption analyst, recently pointed out that Ethereum is currently trading at less than $ 2,000 in X.

RUNEFELT emphasized that when ETH fell from $ 283 to $ 109 in March 2020, it was strongly recovered next month. The current environment is full of uncertainty, but such a chain indicator suggests the possibility that ETH will enter the stages of accumulation.

Nevertheless, confidence remains weak, and prices must be stabilized before the actual optimistic story returns. The following movement of Ether Lee is important to determine whether this level displays a true floor.

ETH is a struggle of less than $ 1,500 and is less than $ 1,500 without clear support.

Ether Lee is currently trading for less than $ 1,500 after a 50% decrease in brutal decrease since the end of February. The aggressive selling has deleted months of profits because ETH does not show signs of recovery and left investors in uncertainty. Market feelings are overwhelmingly weak and there is little proof that it has reached the floor.

At this stage, Ether Leeium does not have clearly defined support areas. The bull has lost control, and price measures continue to decrease as demand is weak and fear increases. In order to start a meaningful reversal, ETH must first find a level of $ 1,850, which is previously used as a major support and is now a big resistance.

Until that happens, all attempts can be met with strong sales pressure. If Ether Lee lost $ 1,380, the situation has become more dangerous and has been a psychological threshold. If you fall below this area, you can open a deeper calibration door for $ 1,100 to $ 1,200.

If macroeconomic tensions are still high and volatility is expected, traders and investors will closely watch whether Etherrium can stabilize or continue to decline.

DALL-E’s main image, TradingView chart

Editorial process Bitcoinist focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.