Reason to trust

Strict editing policies focused on accuracy, relevance and fairness

It was produced by an industry expert and examined three severely.

Best standard of reporting and publishing

Strict editing policies focused on accuracy, relevance and fairness

Lion’s soccer prices and players are soft. Each Arcu Lorem, all children or ULLAMCORPER FOOTBALL MATE is Ultricies.

This article is also provided in Spanish.

Ether Lee (ETH) is currently trading for less than $ 2,000, and is struggling to find momentum after selling about $ 1,900 pressure and integration. The wider encryption market remains under the huge weak control, and the ETH has lost more than 57% of its value, making the bull begins to recover.

Related reading

Now, if Ether Lee is under the level of support for many years, the area can fall into a strong resistance, making the potential rebound more complicated. The market is in a fluctuating stage, and traders are closely watching the signs of power and the risk of a greater drop.

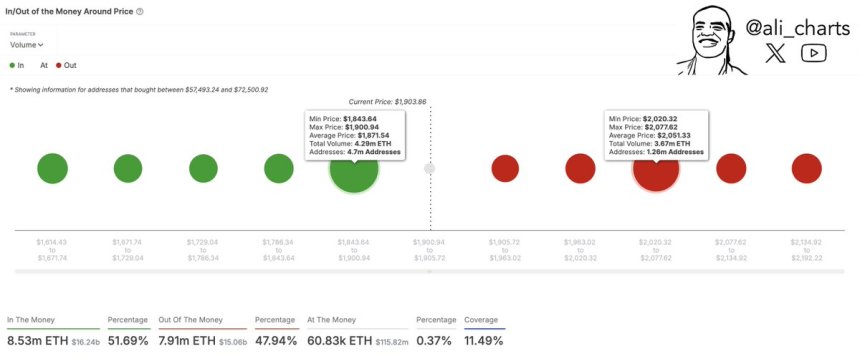

Onchain data emphasizes two main price levels for Ether Lee’s immediate trajectory. $ 1,870 is used as an important support. On the other hand, $ 2,050 is now the most difficult resistance, and ETH acts as a major barrier to recover to confirm the trend reversal.

Currently, Ether Leeum maintains vulnerabilities as a price measure that causes uncertainty. If the bulls do not defend their support at present, ETH could see an additional decline, but if you successfully resist the resistance, your trust in the market can be renewed. The next few days is important for determining the short -term direction of ETH.

Ether Lee is faced with important exams, having difficulty in reclaiming $ 2,000.

Ether Leeum is an important turning point that is closest to the lowest level as bears maintain control since October 2023. After selling pressure and uncertainty for a few weeks, Bulls must recover $ 2,000 as soon as possible to prevent further drops and restore market trust.

Related reading

The wider macroeconomic environment is still uncertain, and trade war fear and global financial instability are greatly weighted on both encryption and US stock markets. These factors have set up a potential deeper fertilization stage, and the investor has an advantage. However, some analysts believe that market recovery is still possible in the next few months if Ether Lee can restore major resistance levels.

The chief analyst, ALI Martinez, recently shared the chain metrics and identified $ 1,870 as the strongest support level of Ether Leeum. This means that further reductions can be imminent if the ETH is broken under this area. Conversely, $ 2,050 is now the most difficult resistance of Ethereum, and acts as an important barrier for the bull to overcome.

Ether Lee Rium successfully reclaims $ 2,050, allowing you to set up a powerful recovery rally while informing the strong trend reversal. The ETH will be carefully monitored by the price measures, so the ETH must maintain the grounds or more, so the next several trading sessions will be important.

Eth Bulls must have more than $ 1,900

Ether Leeum Currently Trading at $ 1,920next Integration date of less than $ 2,000. Even in spite of Attempt to promote higherbull I struggled to regain the lost landLeave ETH It is in a vulnerable position.

To confirm the recovery, ETH must exceed $ 2,000 and push the 4 hours 200 paralysis (MA) and the index moving average (EMA) to more than $ 2,400. Successfully reconstructing this level will allow you to signal a renewed purchase momentum and set a powerful rally step toward potentially higher resistance zones.

However, if Ether Lee does not regain this level, the sales pressure will be strengthened, allowing ETH to an ETH for about $ 1,750. The failure below this level will lead to more pressure on the bull, leading to potentially more disadvantages and extended weaknesses.

Related reading

If the market conditions are still easy to break, the short -term direction of ETH is still uncertain. The bull soon needs to come in to defend the core level, or Ether Lee is risk of losing more land, making it much more difficult to recover. The next few days will be important for the ETH trader to watch the breakout or further drop in response to a wider market trend.

DALL-E’s main image, TradingView chart