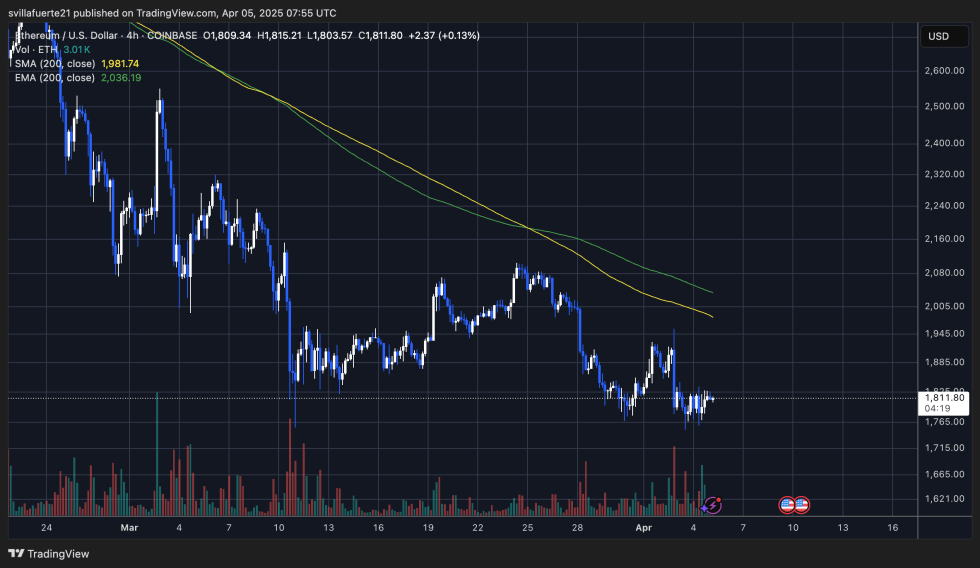

Ether Lee is trading for less than $ 1,900 as sales pressure continues to increase, and there is concern that the recent decline may be extended. After losing $ 2,500’s important support at the end of February, Bulls had a hard time to regain control. Starting with minor fullbacks, it changed to a wider correction, disappointing investors who expected the optimistic 2025 for ETH.

If the core level is not regained, the trust in the market has eroded and the price behavior will weaken during the short and medium periods. The lack of a simple recovery of Ether Leeum has strengthened the weak feeling of grasping the encryption space in recent weeks.

In addition to the negative outlook, Santiment’s new data shows that whales have sold about 500,000 ETH in the last 48 hours. This massive distribution by large -scale holders emphasizes obvious lack of trust among the most influential players in the market.

As ETH moves to less than $ 1,900, all eyes are about whether the bulls can defend the remaining level of support, or whether the continuous sales from whales and extensive market uncertainty will fall for the next few days.

Ether Lee Whale Sales Fuel Bear Lish

Ether Leeum decreased by 55% in December, and price behavior continues to reflect the wider market weakness. As macroeconomic uncertainties and global instability increases, sales are sharp and consistent. The waves of the latest volatility were triggered by US President Donald Trump’s new tariff threat and unpredictable policy direction, which surprised the financial market and moved capital from high risk assets.

As a result, Ether Leeum, a core Altcoin, with a deep relationship with speculative emotions, has become one of the most difficult major cryptocurrencies. The bull is struggling to maintain support near $ 1,800, and all attempts for rally have been met with new sales pressure. Without clear changes in the trend, ETH remains vulnerable to more shortcomings in the short term.

The chief analyst, Ali Martinez, has added to the weakness and shares data that shows that whales have sold 500,000 ETH over the last 48 hours. This large -scale distribution in a large wallet suggests that even the experienced market participants are becoming more and more careful. These activities are especially prior to deeper corrections, especially with weaker technologies and wider risk feelings.

If Ether Lee Rium regains the level of key resistance and does not show signs of accumulation, the current trend may continue to prefer the seller. As the market digests macro development, ETH holders are closely watching the worst situation. But at this time, the pressure remains tightly.

As the Bulls defends important support, Ether Lee is trading at $ 1,810.

Ether Lee is trading at $ 1,810 after repeated failure to recover $ 1,900. The price continues to face strong resistance, and in recent weeks, the strong momentum has weakened. The bull is currently in an important location and is currently emerging as the most important support level in the cycle. The decisive breakdown under this mark can cause deeper corrections, which can potentially send $ 1,550 ETH.

The wider encryption market is under pressure and Ether Lee’s price measures reflect this. Emotions measured the weight of macroeconomic headwinds and aggressive sales of whales, adding to the difficulty of restoring the bull. Nevertheless, if ETH can be stabilized and higher in the upcoming session, hope remains.

Brake outs of more than $ 2,000 show significant changes in the amount of momentum and can trigger strong recovery rally. That level remains a psychological and technical threshold of potential trend reversal. Until then, Ether Leeum continues to take tightrope between integration and a larger decline, and the bull must hold all $ 1,800 to avoid terraced loss. The next few days is important for determining the short -term direction of ETH.

DALL-E’s main image, TradingView chart

Editorial process Bitcoinist focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.