- Ether Lee has a strong support of more than $ 2,600, and the rally is $ 3,200 or $ 4,000.

- Potential rising prices signaled when institutional interest and increased use of active networks increased.

Ether Leeum (ETH) It has shown more than $ 2,600 strong support and indicates that it can continue in the upward trajectory. In Press Time, Ether Leeum is $ 2,702.21, reflecting an increase of 0.67% over the last 24 hours.

But the actual question is whether ETH can maintain the amount of exercise for a long time enough to penetrate these important levels.

ETH Technology Analysis: Does the momentum continue?

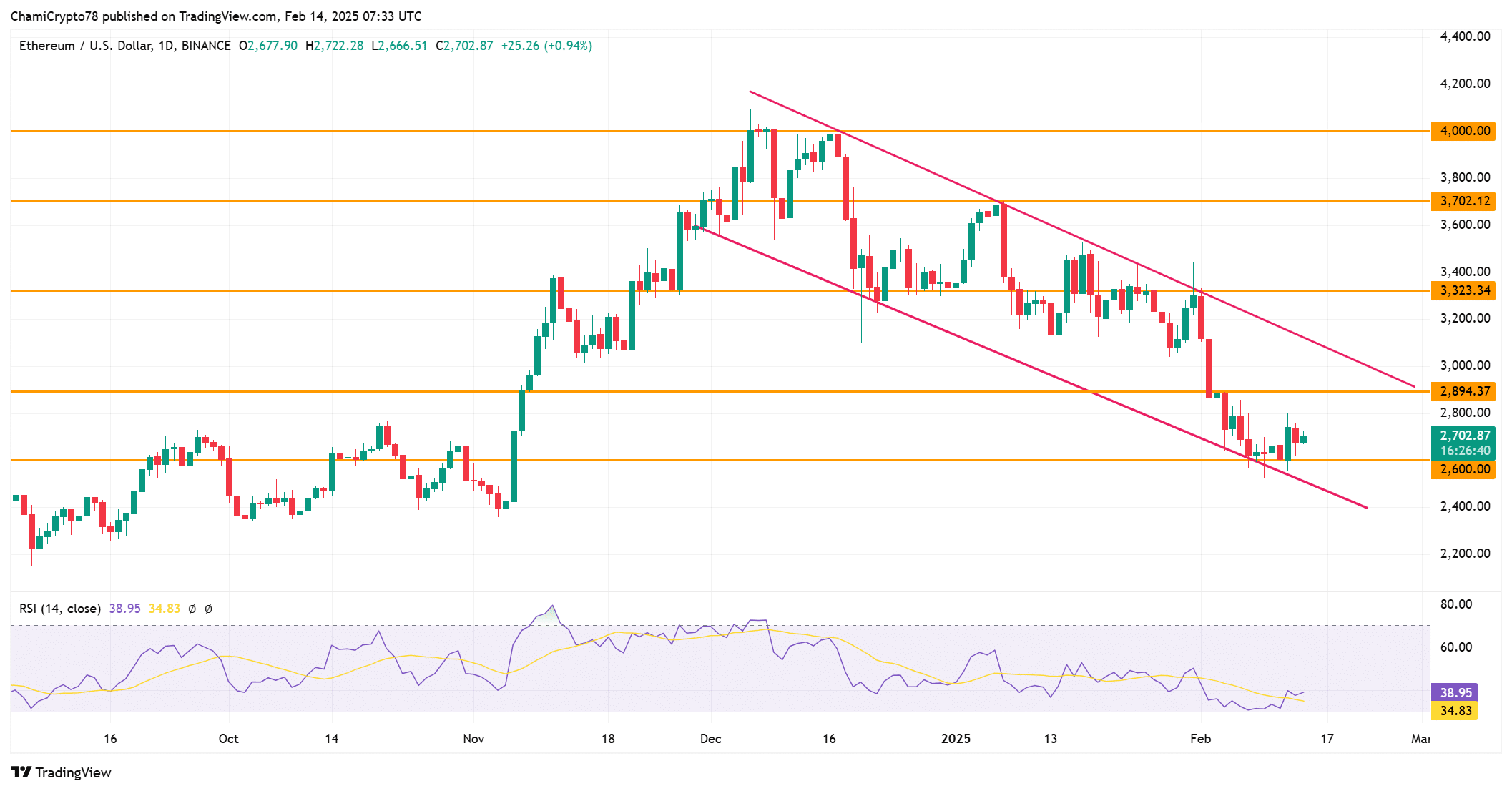

ETH’s recent price movement suggests that it can enter an optimistic stage. This chart shows Etherrium transactions within a well -defined channel and has significant resistance to $ 2,800, $ 3,200 and $ 3,400.

If ETH can stand beyond $ 2,800, you can open a way for a rally for $ 3,200 or $ 4,000. At the time of writing, the RSI is 38.95, indicating that there is still room for the possibility of ascending.

However, Ether Leeum must increase the level of major support in order to overcome the problems raised by the downward slope channel and to maintain a strong trend.

Source: TradingView

Institutional interest is rapidly growing. How will it affect the price?

Ether Lee is especially increasing institutional interest in 21Shares. filing In the case of Ether Leeum Steaking ETF. This move can increase the demand for Ether LIM because institutional investors can dangerous ETFs through ETFs.

Successful approval can further strengthen the role of Ether Lee in the institution market and increase prices.

Considering that the supply of Etherrium can be further limited due to the staying, the demand increases, which may cause more rise.

ENT Daily Active Address: What do they mean to us?

Ether Leeum’s network consumption is still strong and the active address exceeds 524,000 every day. This indicates healthy participation and an increase in adoption, both of which are important for long -term price recognition.

Strong network activity signals can increase the demand for ETH by increasing trust in Ethereum’s distributed applications.

Therefore, the consistent rise of the active user can be an important factor in Ether Lee’s price potential.

Source: Santiment

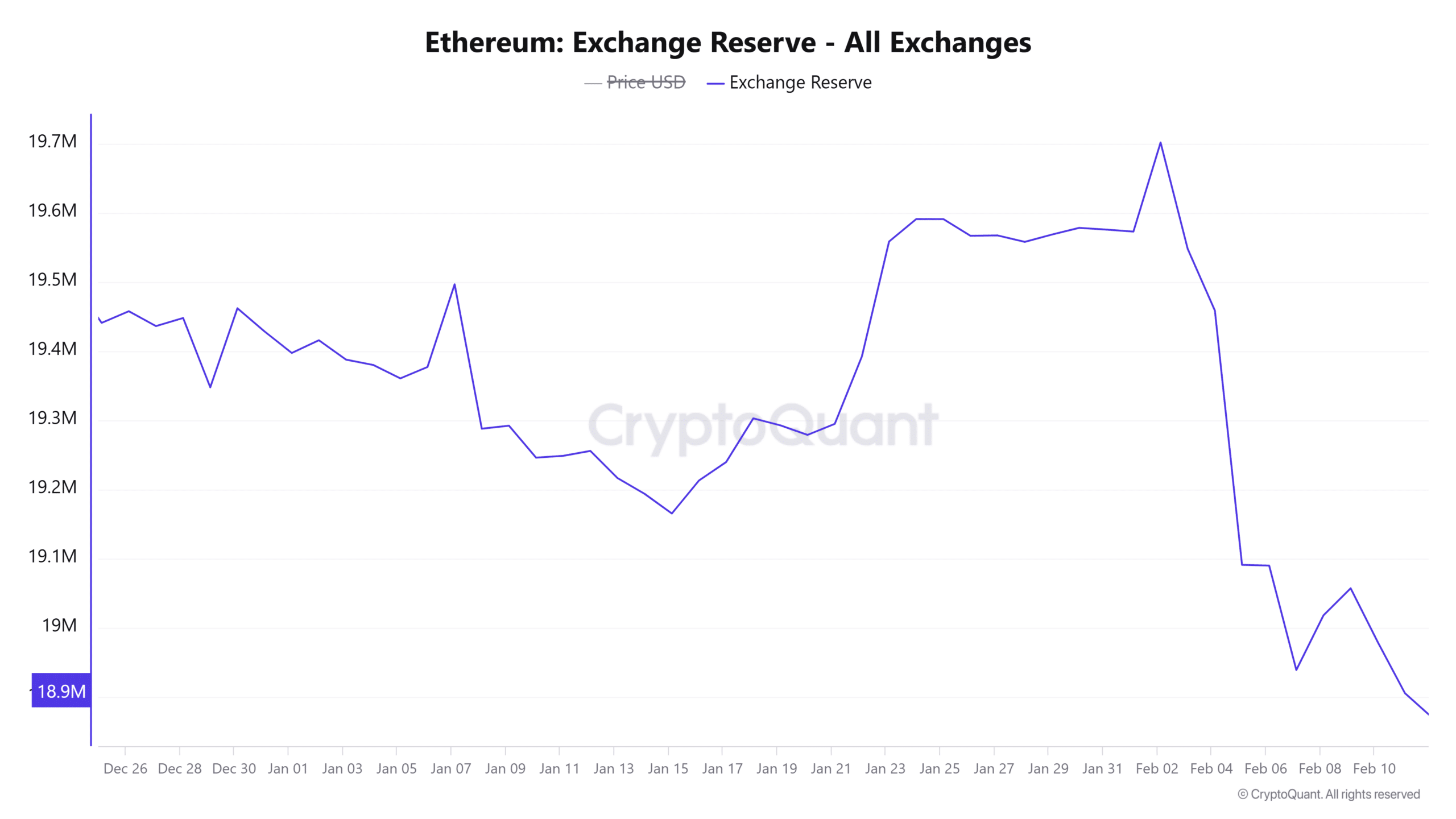

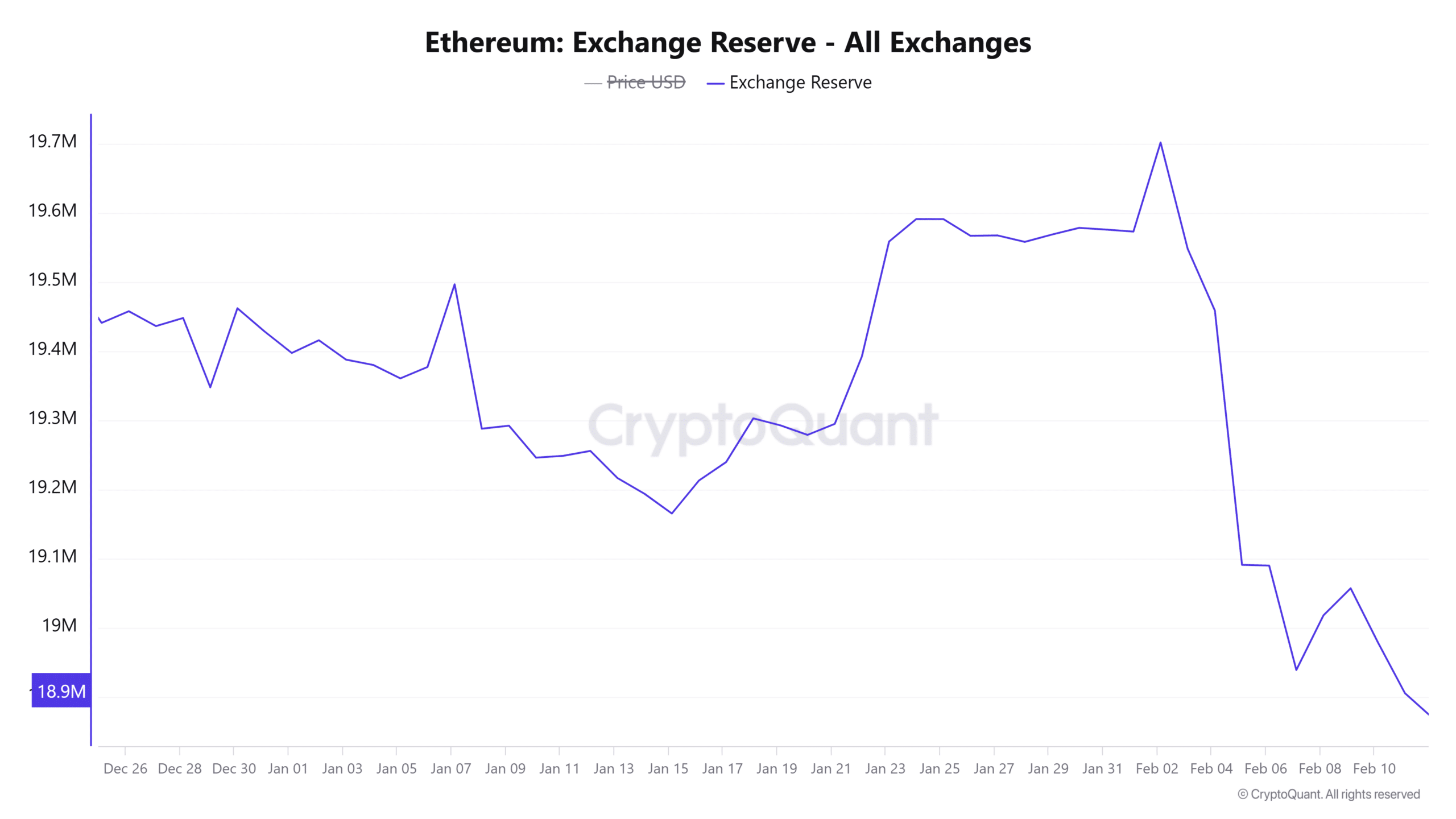

ETH Exchange holding: What do you know about the market?

Currently, the exchange reserves of Ether Leeum, which are 18,841 million ETH, have increased 0.02%. Exchange rises generally indicate higher sales pressure as merchants deposit more ETHs in exchange for potential sales.

In general, the increase in reserves can increase market volatility and price fluctuations.

As the reserve increases, the liquidity may increase, but the market volatility, which can affect short -term price fluctuations, emphasizes the possibility of increasing market volatility.

Source: cryptoquant

Bull and Bear: Which is advantageous?

Currently, the market sentiment for Ether Lee is greatly strong, and there are 114 bulls compared to 105 bears. This indicates that investors are generally optimistic about ETH’s short -term prospects.

However, if the price is shaken and you can experience a sharp fullback, the weak feelings can increase.

Therefore, Ether Leeum should control the bull and maintain the amount of upward exercise towards higher levels.

Source: INTOTHEBLOCK

Considering the strong support of $ 2,600 Ether Leeum, the increase in institutional interest, the use of active networks and the increase in exchange reserves, it will maintain optimistic momentum.

If Ether Lee continues to increase the level of support, it is likely to reach $ 3,200 or $ 4,000.

Thus, Ether Leeum’s price is likely to stop these major resistance.