- Staked ETH has been for the first time since March and has increased the trust and feelings of the validation test.

- Ether Lee’s strong momentum is strengthened with a $ 2,550 breakout, but signs of excessive conditions appear.

Ether Lee’s (ETH) has returned to green. For the first time since March, Staked ETH shows unto realized profits.

But this is not just an idiot of the chart. Ether Leeum’s value capture story can be the beginning of a wider change.

As the network watches the risk of migration of L2 scaling incentives and applications, the economic foundation of the network can do great work.

Staked ETH comes back to profit

According to a recent encryption report, Ether Leeum Stator has returned to green due to an unstened loss of more than two months.

Since March, the steak ETH has been in hand and the realized price was higher than the market level. But on May 9, ETH goes beyond $ 2297 and overturns the stake back to the territory of profit.

This recovery reassures the validation tester and stews the participants to enhance the network stability of Ether Leeum. When the profit returns to the stator, it can be a signal of a greater optimistic change that crosses the Etherum ecosystem.

Ether Leeum as the largest hot chain economy

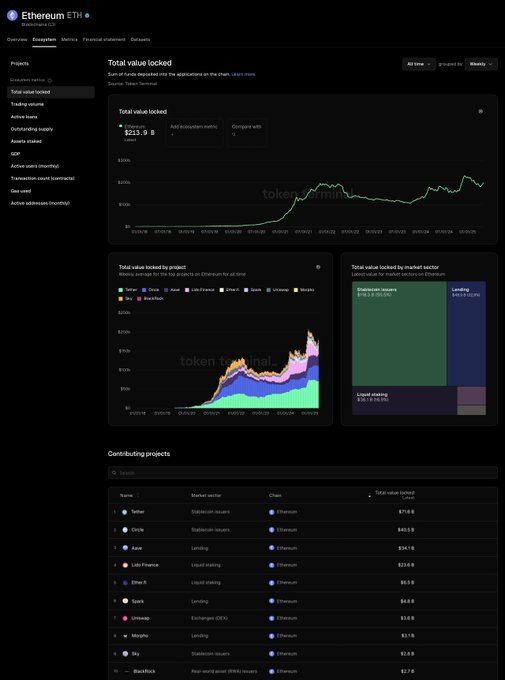

Ether Liium continues to dominate the largest chain economy of more than $ 213.9 billion on tvL in loans, staying and other sectors.

This extensive activity shows the unmatched developer -based and depot infrastructure that does not follow the following, and attracts the largest amount of app distribution and use.

Source: X

But control is not dangerous.

Incentives associated with scalability and app success create an actual threat of app migration for competitive chains.

Ether Lee’s new leadership acknowledged this risk of graduation and is working hard to ensure value maintenance as the app develops and expands.

Price momentum construction

ETH’s recent brake out has been strengthened by pushing more than $ 2,550 in the press time.

Technology supported the rally -RSI was 80.58 and showed strong propulsion, but perhaps assets were in the overpass.

MACD, on the other hand, showed a wide difference between MACD and signal lines, which is an optimistic signal that reflects the increase in purchasing pressure.

Source: TradingView

If the scale is steadily maintained and emotion is optimistic, the price of Etherrium can test higher resistance. However, the expansion of the overpretation can lead to simple integration before the next leg goes up.