Main takeout

- As the ETH decreased by more than 10%, Ether Leeum Whale faced a $ 160 million liquidation.

- Ether Leeum’s decline was part of a wide range of cryptographic market downs that affect BTC, XRP, and BNB.

Share this article

Whales saw Etherrium of 67,570 dollars of about $ 166 million. As Lockonchain reported by Lockonchain, the ET dropped more than $ 1,500 from $ 1,800.

like $ eth Plunge, 67,570 $ ethThis whale owns ($ 106m) #maker clearing! https: //t.co/kxskkh1h0p pic.twitter.com/idjzbq8p3z

-LOOKONCHAIN (@Lookonchain) April 7, 2025

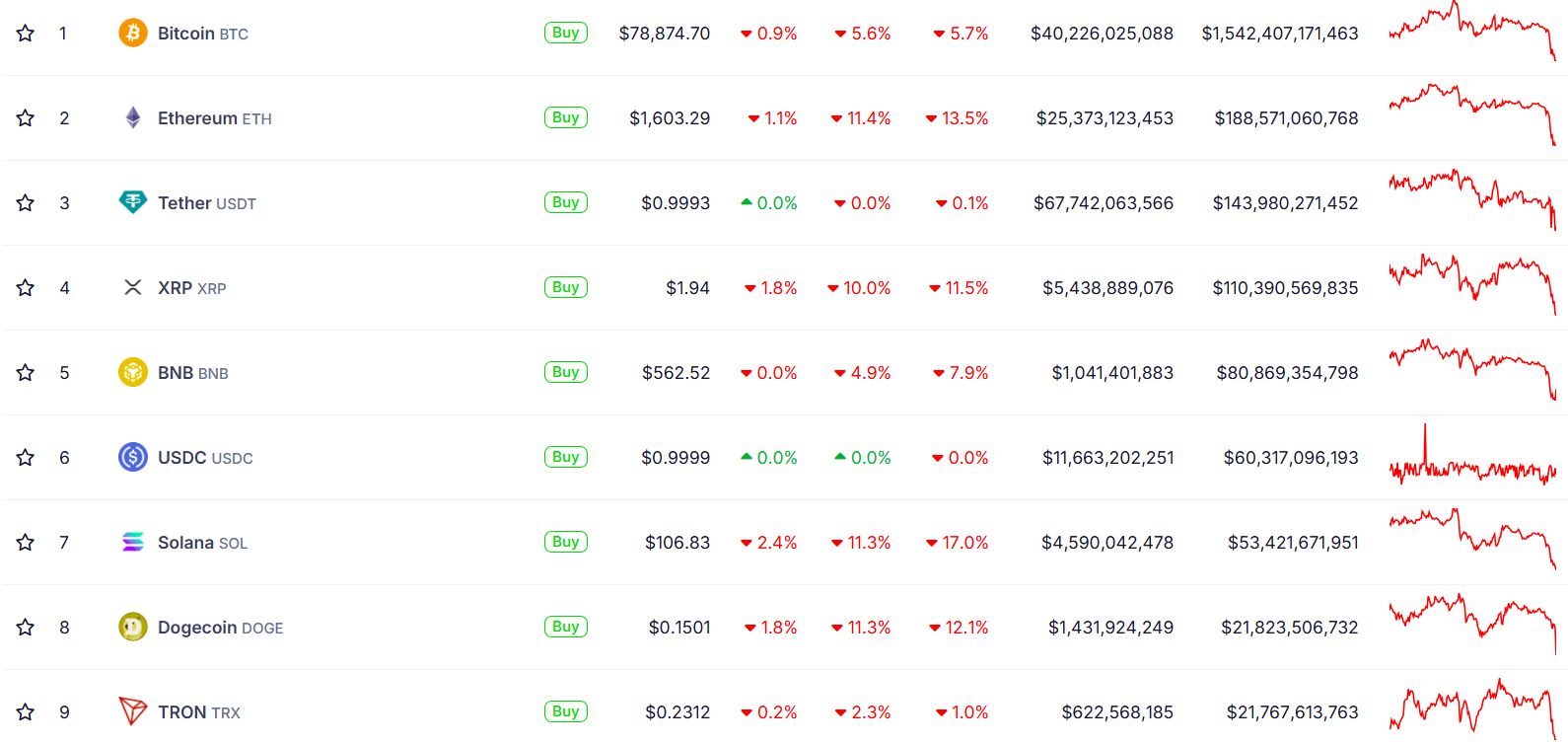

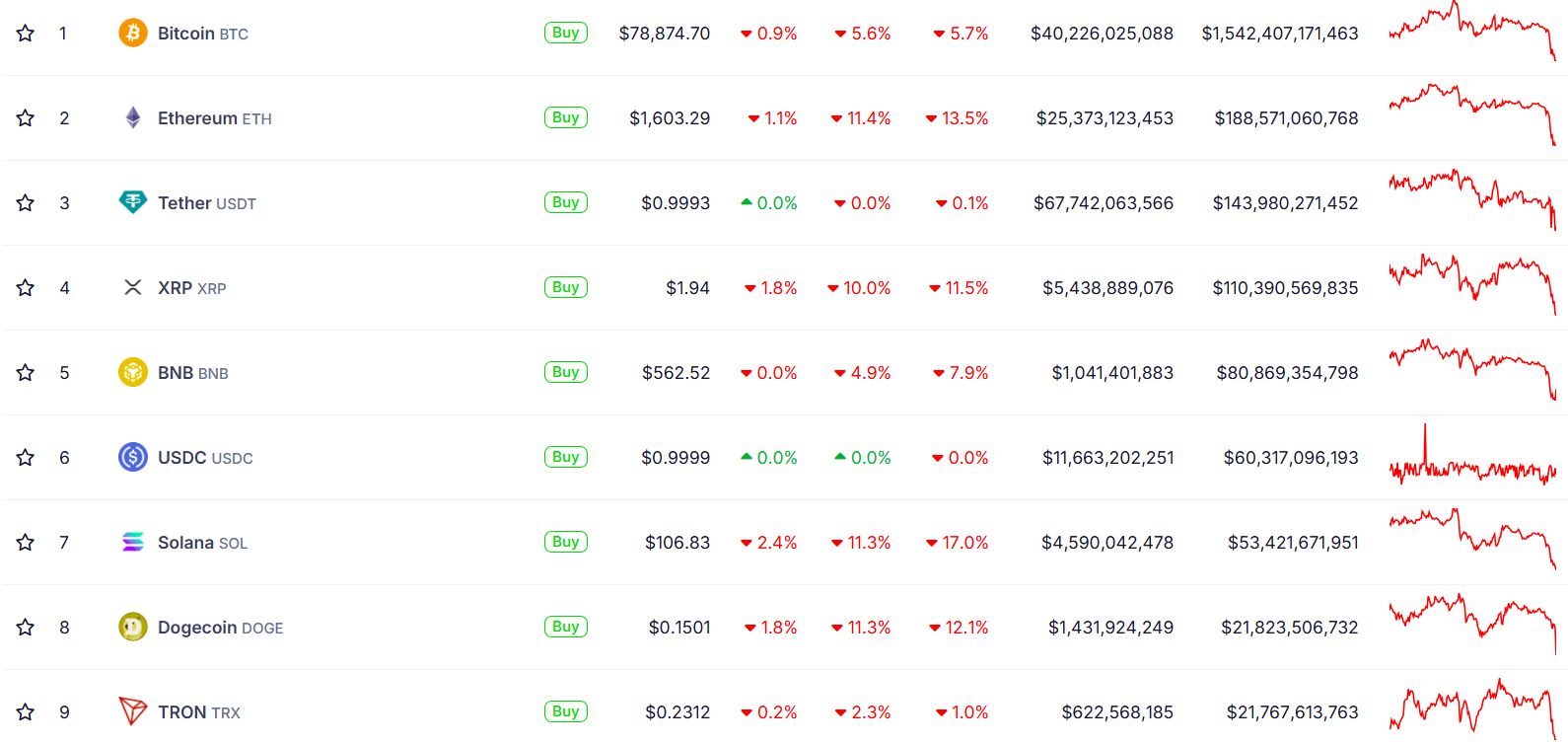

The encryption market faced a renewed sales pressure after showing elasticity due to the decline in the US stock market on Friday. According to Coingecko, the weak sentiment of President Trump’s aggressive tariffs sent a Bitcoin tumbling to less than $ 78,000.

The decrease in the encryption market has expanded beyond Bitcoin and Ether Leeum, and the total market cap has fallen from about 8%to $ 2.6 trillion.

In the last 24 hours, XRP has dropped 10% to less than $ 1.9, while BNB has fallen to $ 562 to 5%. Solana, Dogecoin and Cardano fell by about 11%, respectively. Tron showed relatively small losses at 2%.

As a result of the recent decline, the ETH/BTC transaction pair reached 0.021 on April 6, the lowest level since March 2020.

In a separate report, Lookonchain said that there is a 14,014 ETH of another $ 22 million investor this evening.

Whale panic sales 14,014 $ eth($ 22.14m) https: //t.co/2v991wuvzq for the last 3 hours pic.twitter.com/du0fq89GGI

-LOOKONCHAIN (@Lookonchain) April 7, 2025

Despite the current market turbulence, some whales see dip as an opportunity to accumulate more ETH.

Whales, widely known as “seven brothers and sisters,” recently reported that they have recently acquired $ 24,817 for $ 48 million, have increased their total remuneration to more than 1.2 million, and are currently about $ 1.9 billion.

Since February 3, the investor has spent almost $ 220 million in buying 103,543 ETHs and has lost $ 66 million in the current accumulated coins.

INTOTHEBLOCK reported that earlier this week, the second largest password asset on Thursday, when the second largest password asset plunged to less than $ 1,800 in the first trading session presentation, it accumulated 130,000 ETH.

Share this article