- ETH was facing strong sales pressure as the price rose recently.

- Ether Leeum Whale had $ 14.3 million with 5,677.7 ETH tokens.

After the market recovery, Ether Leeum (ETH) prices have soared from $ 1.7K to maximum of $ 2.6K. But after this level, Altcoin returned to record losses for three consecutive days.

In fact, Ether Leeum was traded at $ 2457 for Press Time. This decreased 3.97% on the daily chart.

What is the price drop as ETH starts to fall?

Ether Lee’s sales activity increases rapidly

AmbCrypto’s analysis emphasizes strong profits among Etherrium investors. After entering the water for two months, they are now profitable.

This trend is especially noticeable among Ether Leeum whales, and Onchainlens reports significant selling.

One whale withdrew from AAVE V3 to 4,677.7 Weth and sold for $ 2,463 per ETH for 11,152 million USDC. The whale originally purchased an ETH token for $ 6.8 million a month ago, gaining $ 47 million in profits.

Another whale has deposited $ 10 million in $ 10 million in Krake for four years.

Initially, the whale received 2,693 ETHs of $ 5.7 million from the Binance us, Coinbase and Tornado cash wallets. After a recent trading, whales still have 1,693 ETHs of $ 4.13 million.

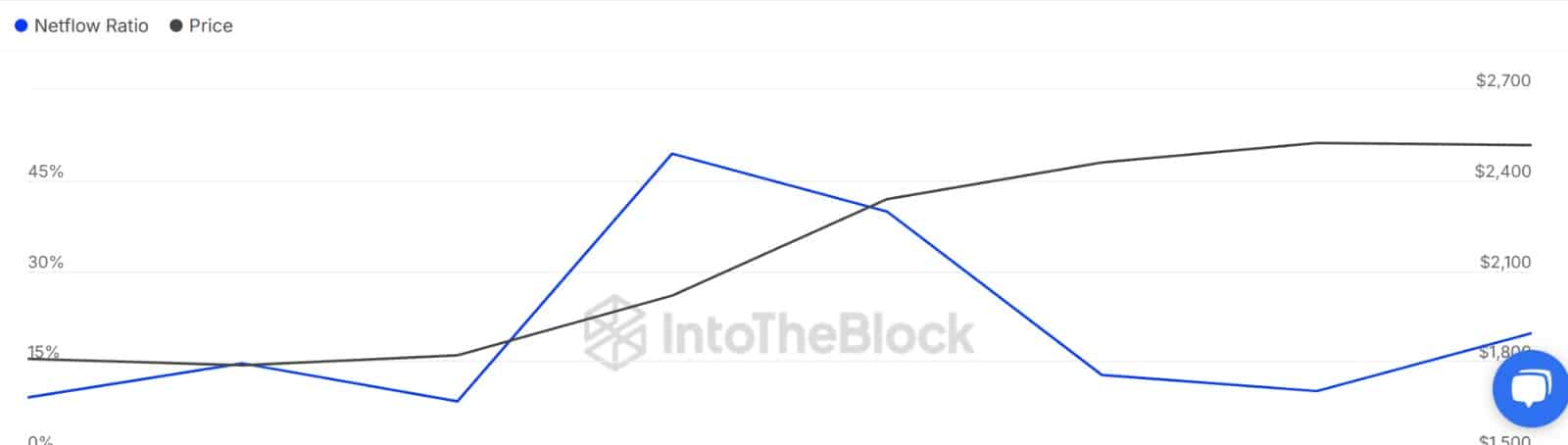

Source: INTOTHEBLOCK

Sales activities seem to be widely spread among the big holders of Ether Leeum. When the ETH reached $ 2.5K, the large holder Netflow to Netflow fell to 10%.

As prices fell, large -scale holders resumed sales and the whale exchanges were pushed up to 19%. This was a 9% increase in whale-exchange activities last day, strengthening sales pressure.

Source: cryptoquant

As whales change to sales, most market participants, even retailers and sharks are sold. If we look at the Ether Leeum Exchange Net Flow, we have changed positively after four consecutive days.

Positive net flow suggests that the exchange is experiencing more deposits than withdrawal, reflecting higher sales activities.

Source: Santiment

Thus, the lack of Ether Leeium decreased as the amount of ETH available for sale increased.

Therefore, the ETH inventory flow rate decreased from 47 to 18 per share at the time of writing. This reflects the increase in the supply of exchanges, which is a weak signal because the oversupply lowers the price.

What is ETH next?

The increase in whale sales has had a negative impact on the ETH market, as shown in recent trends. In general, as investors offset to secure profits or avoid deeper losses, the higher the sales pressure, the lower the price.

If the current sales activity persists, the ETH can potentially receive $ 2,188 in terms of further reduction. But when the buyer returns to the opportunity, ETH still has growth potential.

In this case, it can rise to $ 2,864.