- ETH has increased 2.39% over the last 24 hours.

- The demand aspect of Ether Leeum is strengthened, and Altcoin is being placed for continuous benefits.

After the market recovered from tariffs, Ether Lee (ETH) was traded in an upward pattern. In fact, at the time of this article, Ether Lee was traded for $ 1610.

This increased 2.36% on the daily chart.

Before this profit, Altcoin dropped the weekly and monthly charts to 10.99%and 14.79%, respectively.

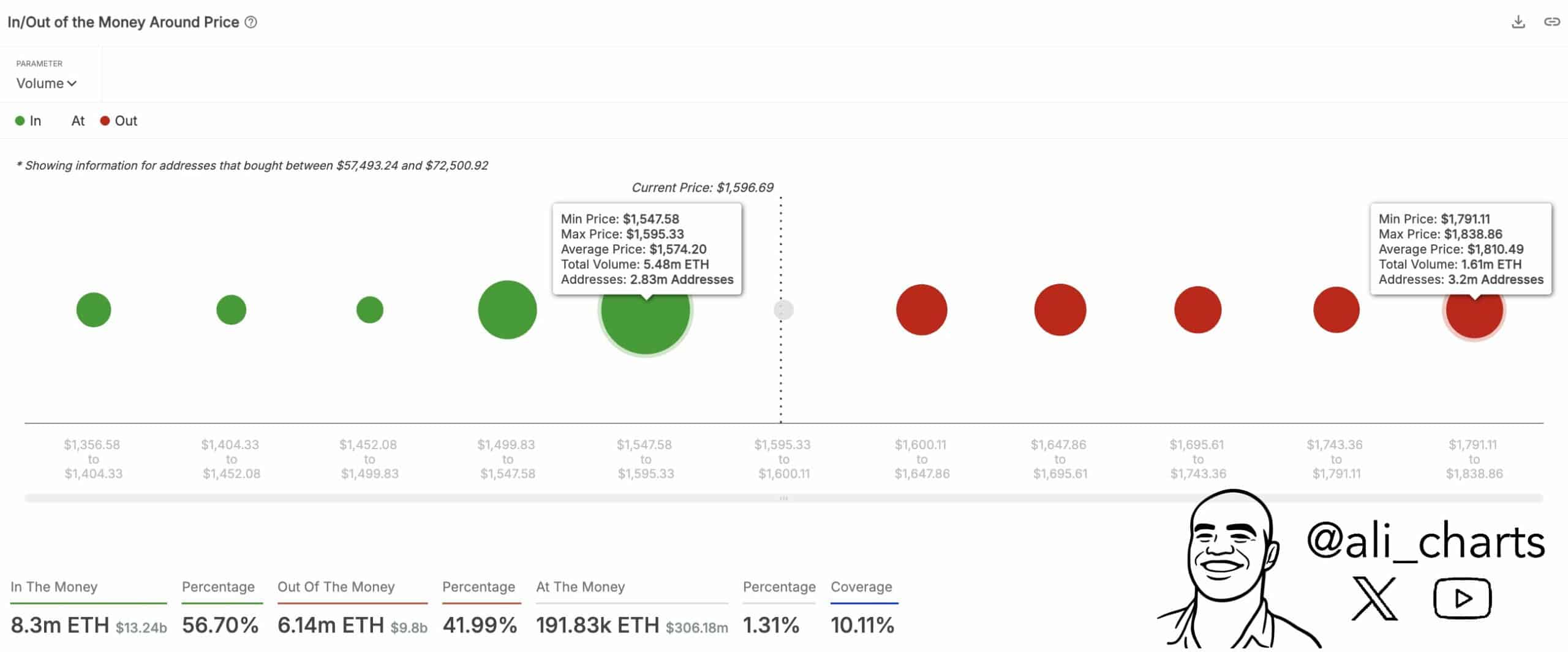

With the recent profits, stakeholders are continuously on the rise. Ali Martinez, a popular password analyst, offered a potential rally for $ 1,810.

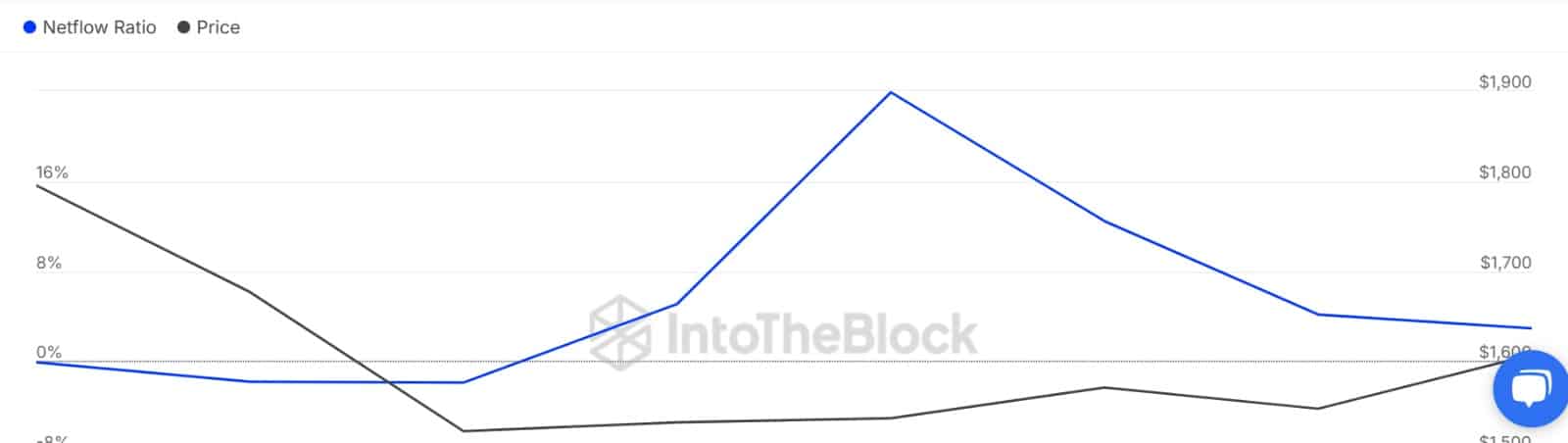

Source: INTOTHEBLOCK

In his analysis, Martinez insisted that ETH has recovered the major support level of $ 1574, so that Altcoin can rally if the demand zone is held. Therefore, the pending above this rally will see Altcoin recovering the $ 1,810 resistance level.

The problem is that Ether Lee can continue to benefit to regain higher resistance levels.

Can Ether Leeum see a continuous rise?

According to AmbCrypto’s analysis, Ethereum is recovering in terms of demand.

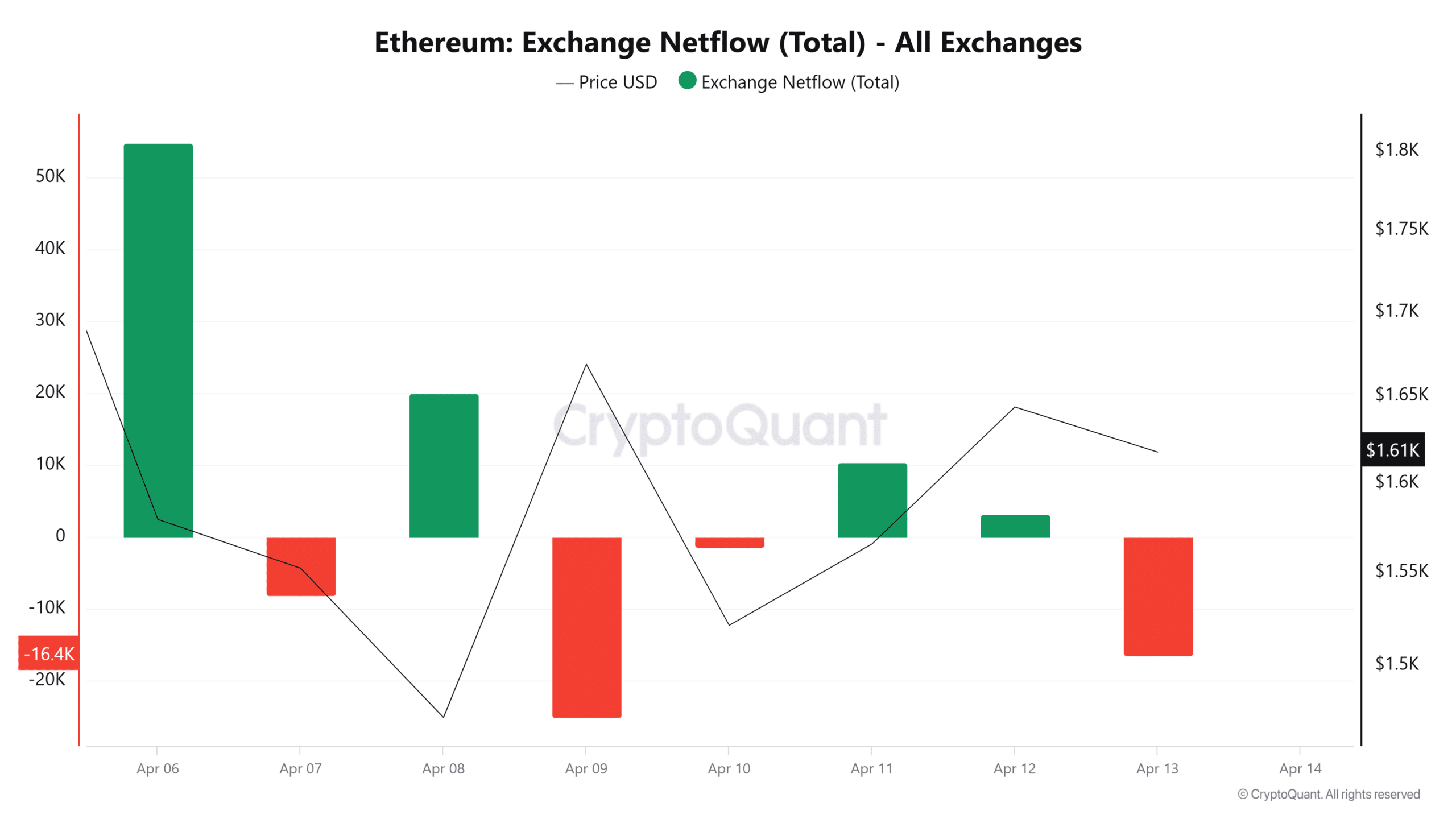

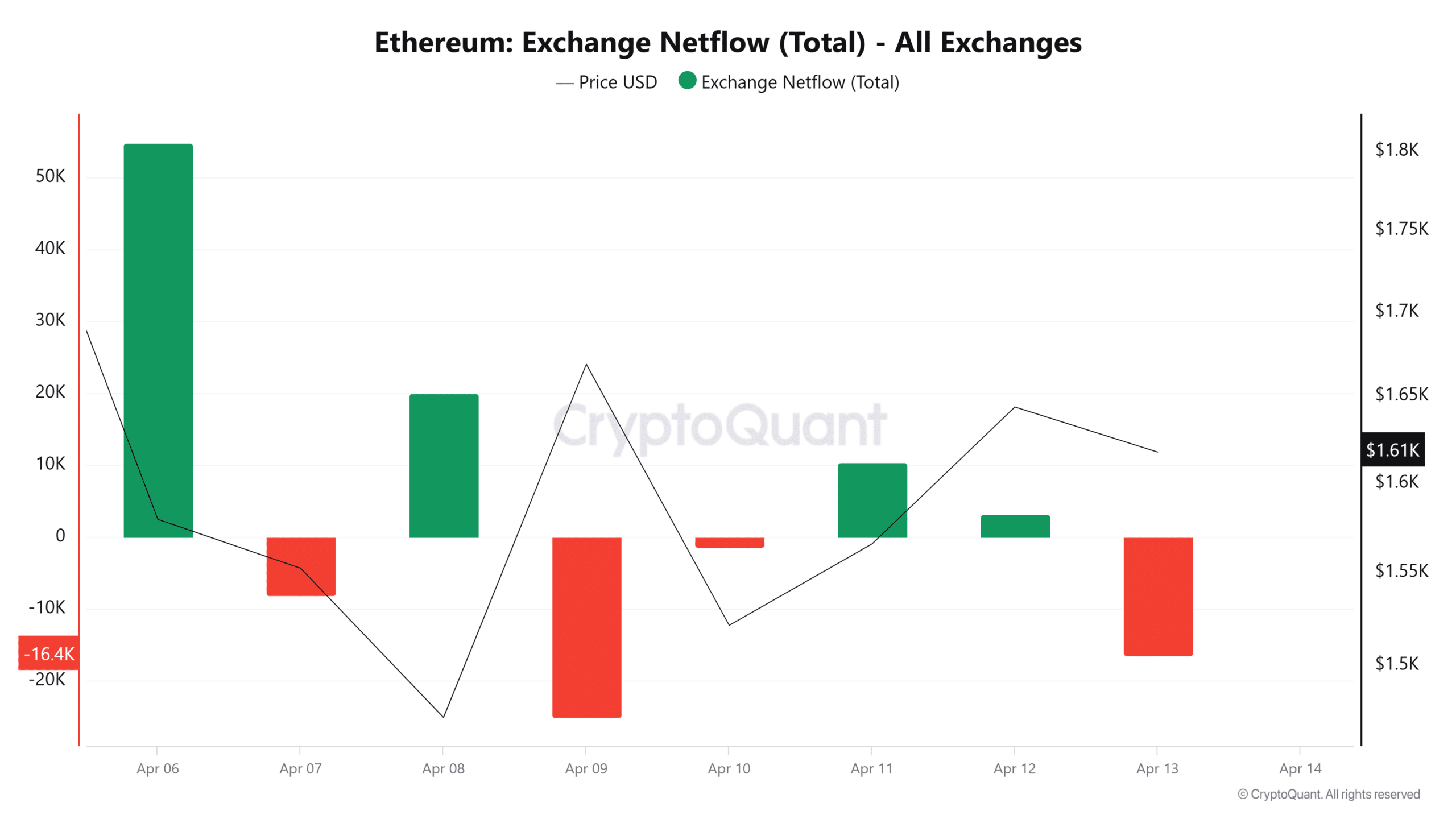

First of all, Ether Lee’s Exchange Netflow was voice due to positive flow for two consecutive days. The transition to negative suggests that investors have changed to Etherrium.

Therefore, there are more exchange leaks than the inflow water, which reflects the increase in demand.

Source: cryptoquant

Positive order imbalances further verify these aspects. It is a positive order imbalance, showing that more orders are purchased than sales orders.

This suggests that buyers are active in the market, so more exchange leaks are possible.

Source: Mobile

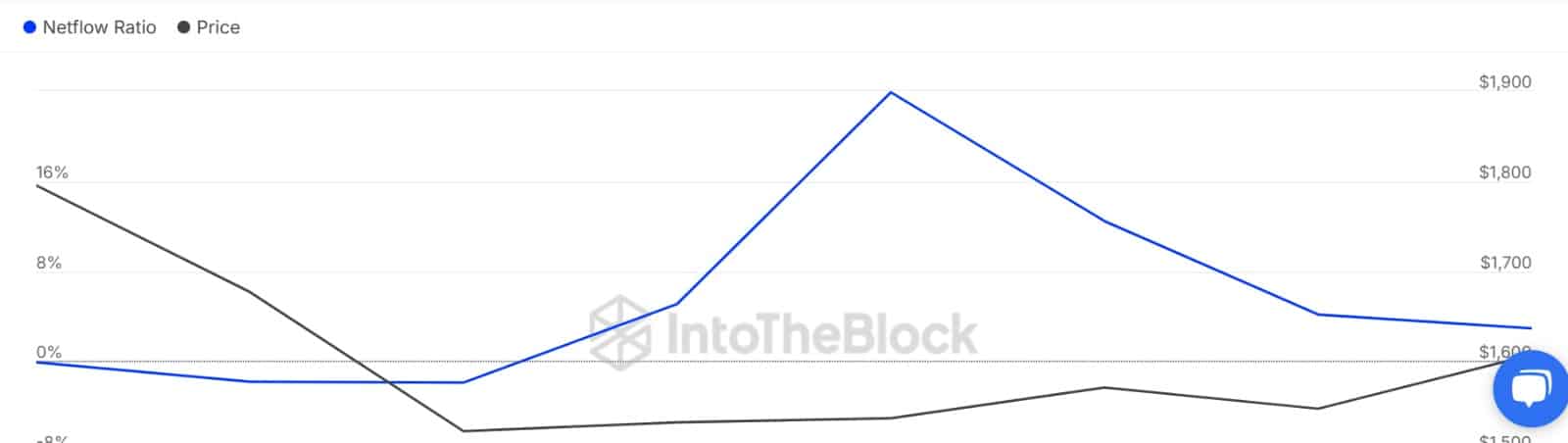

Rising demand is much more widespread among whales. Therefore, the Ether Leeum large holder is reducing the transfer to the exchange.

In terms of exchange netflow ratio and exchange rate, the exchange rate of whales dropped from 23.9%to 2.92%.

This decline suggests that we are purchasing more than whales sell.

Source: INTOTHEBLOCK

If a whale and retailer purchase it, it seems to buy Altcoin and take a long place. We can see that Ether Leeum’s aggregate funding rate has changed positively, so the demand for long positions is higher.

Therefore, most investors expect the price to rise much more.

Source: Coinalyze

In short, Ether Leeum is rapidly increasing. Historically increasing demand, the price increases. ETH gains more buyers than sellers, so you can see Altcoin backing $ 1758.

If you go up to this level, you can move to $ 1800. On the contrary, if the attempts of Bulls fail, we can see the modification of ETH return to $ 1465.