- Ether Lee has shown steady price behavior with strong support, whale activities and prudent investors.

- Whale accumulation suggests the possibility of escape, but about $ 2,250 resistance remains an important obstacle.

Ether Lee’s (ETH) recent price measures have been steadily, but it’s far from the absence of an incident. Under the surface, investor behavior and notable warmth movement began to define the current market structure.

As ETH is traded within the ETH range, accumulation patterns, whale activities and exchange flows are proposed at the inflection point.

It is supported, but trust is still measured.

Ether Lee is sitting in a powerful investor support pocket between $ 1,886 to $ 1,944 and more than 3 million addresses have accumulated 61.2 million ETH.

Source: X

This cluster is now a major psychological and technical foundation. If ETH slides down, it can cause wider sales.

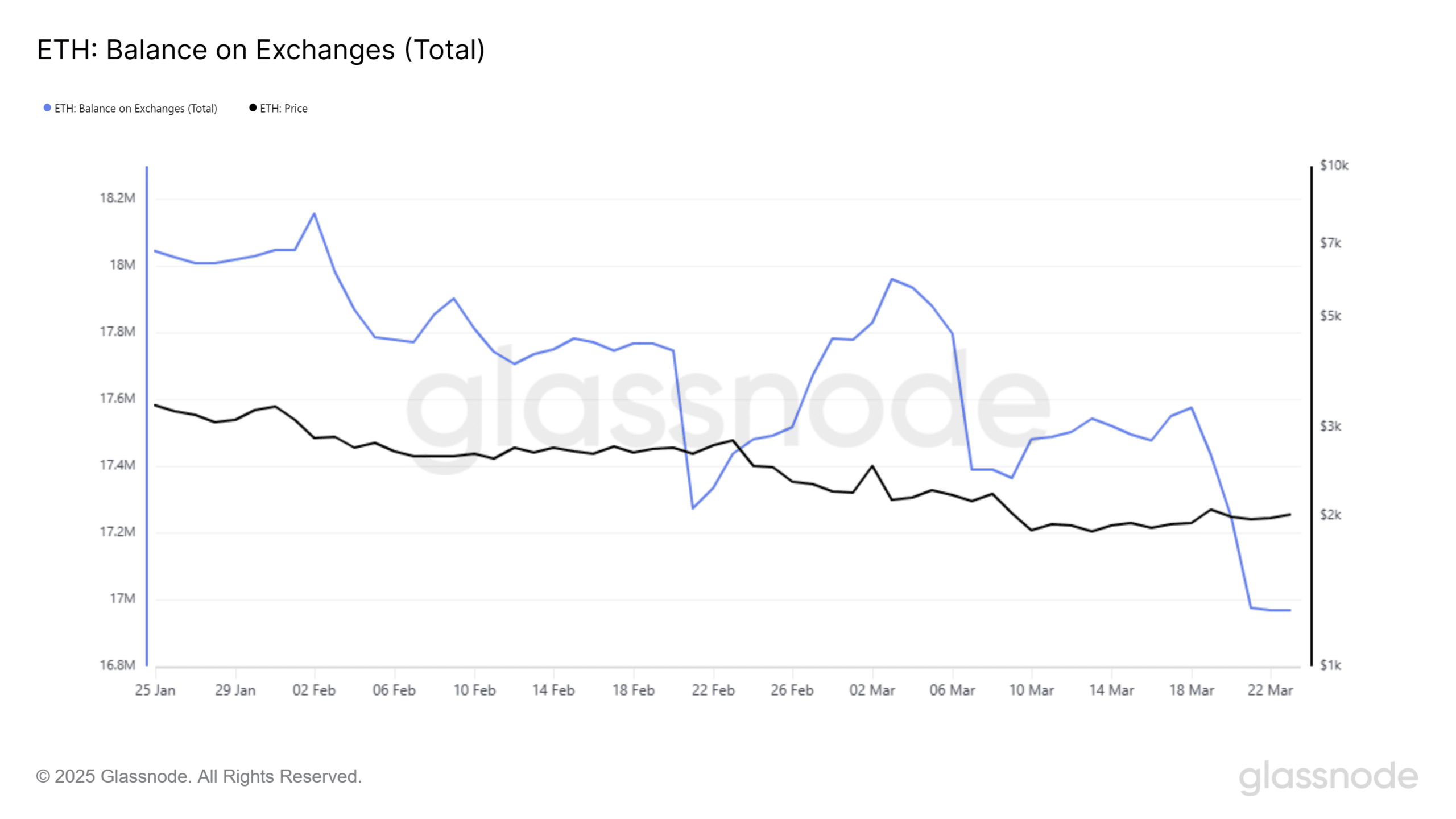

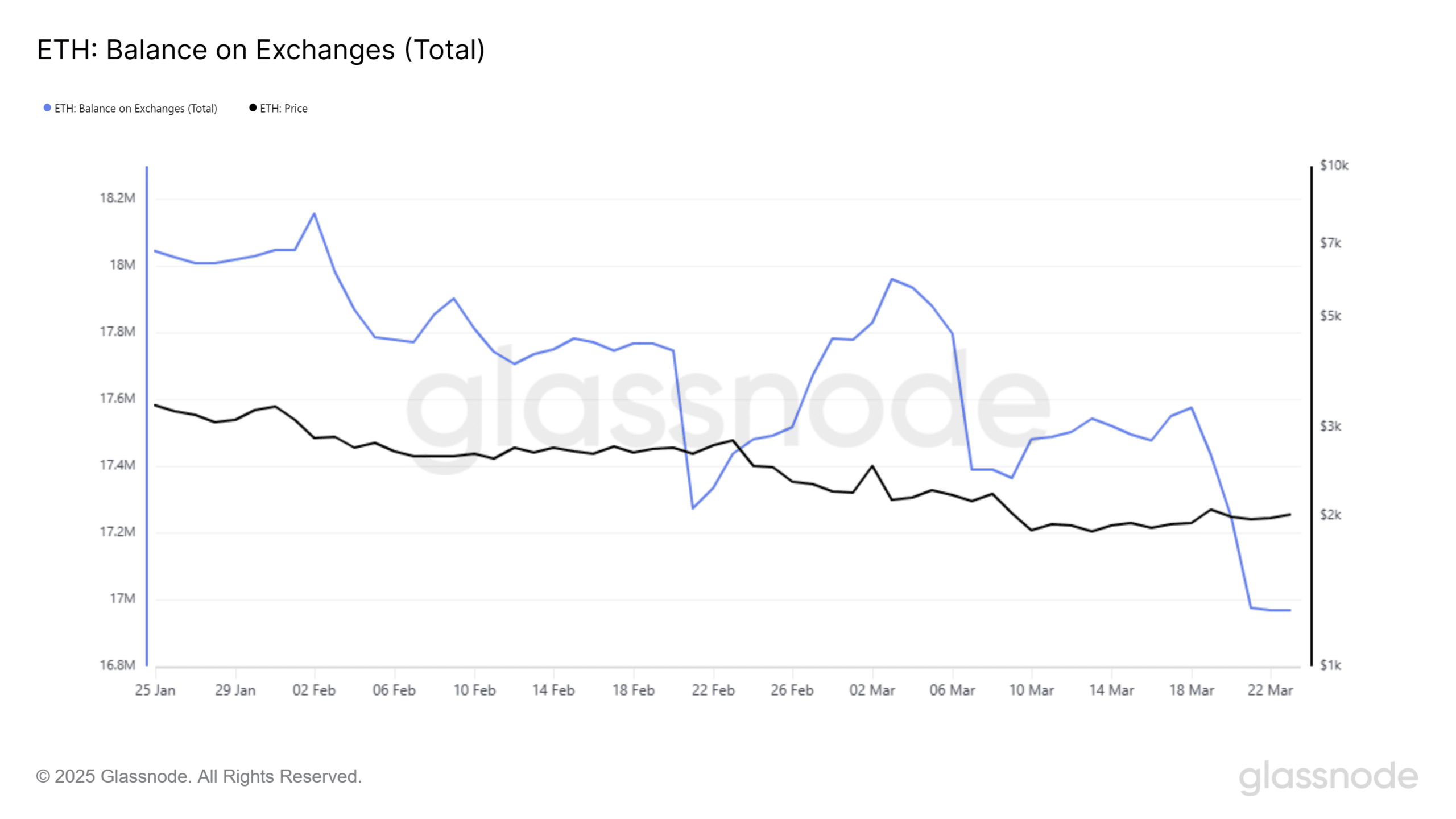

In terms of supply, more than 12 million ETHs have been quietly exchanged over the last 48 days, resulting in short -term sales pressure.

Source: Glass Node

However, the price is largely maintained and suggests that even if the investor owns, he does not rush to buy. In this environment, stability can talk more about attention than beliefs.

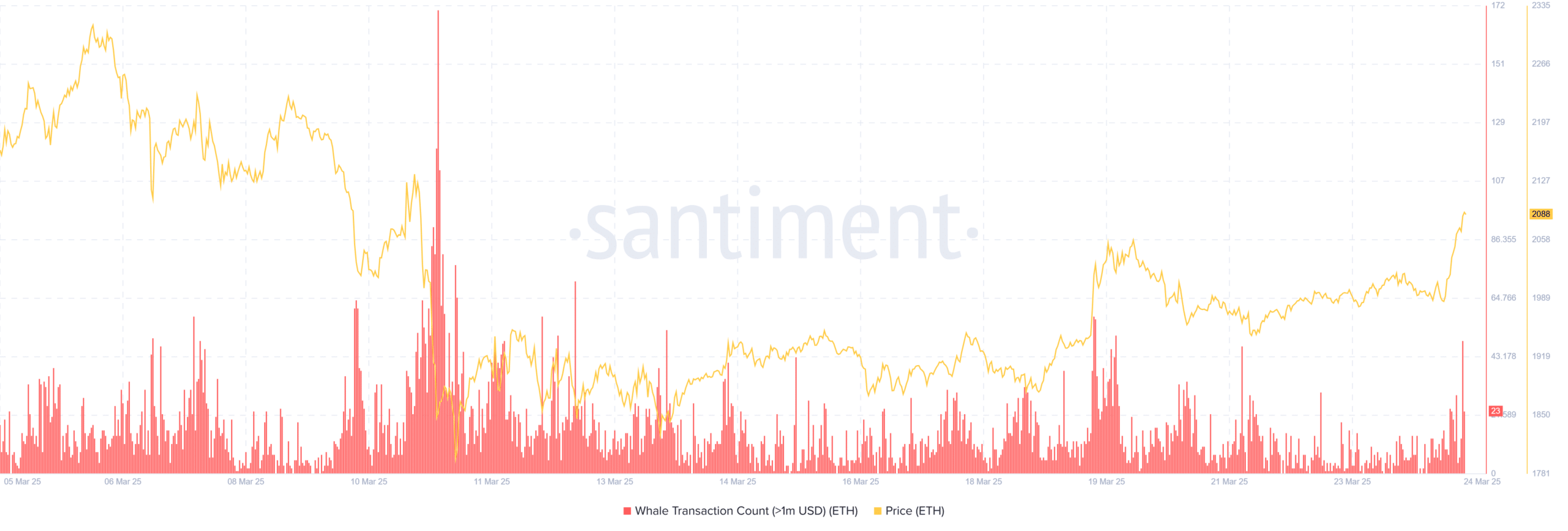

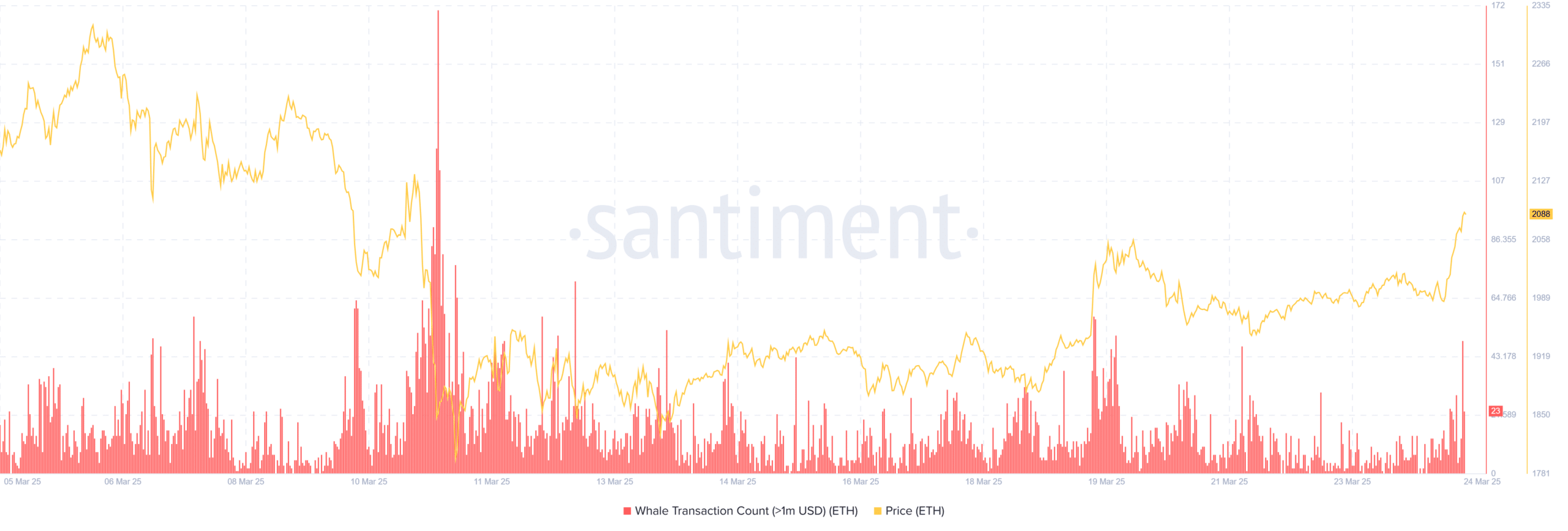

As ETH crosses $ 2K, whale accumulation increases rapidly.

Source: Santiment

Ether Leeum Whale stimulated nearly 470,000 ETHs last week and actively increased.

As ETH has recovered $ 2,000, the surge in large -scale value trading suggests that whales are positioned before potential escape.

Santiment Data has shown a sharp rise in the number of whale trading numbers since March 19, and the organization and noble players have added weight to the idea that the current price is not the best region but the accumulation area.

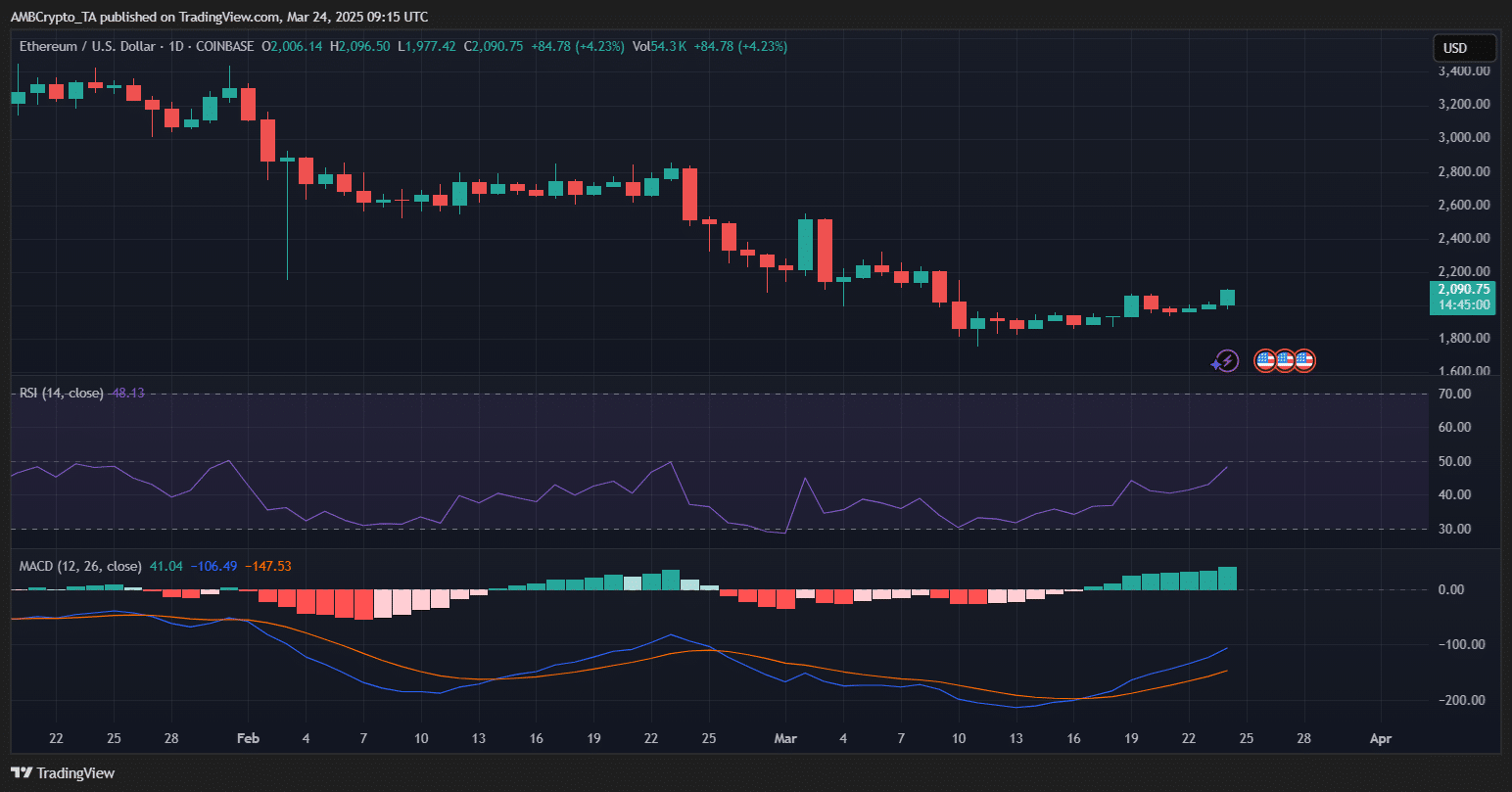

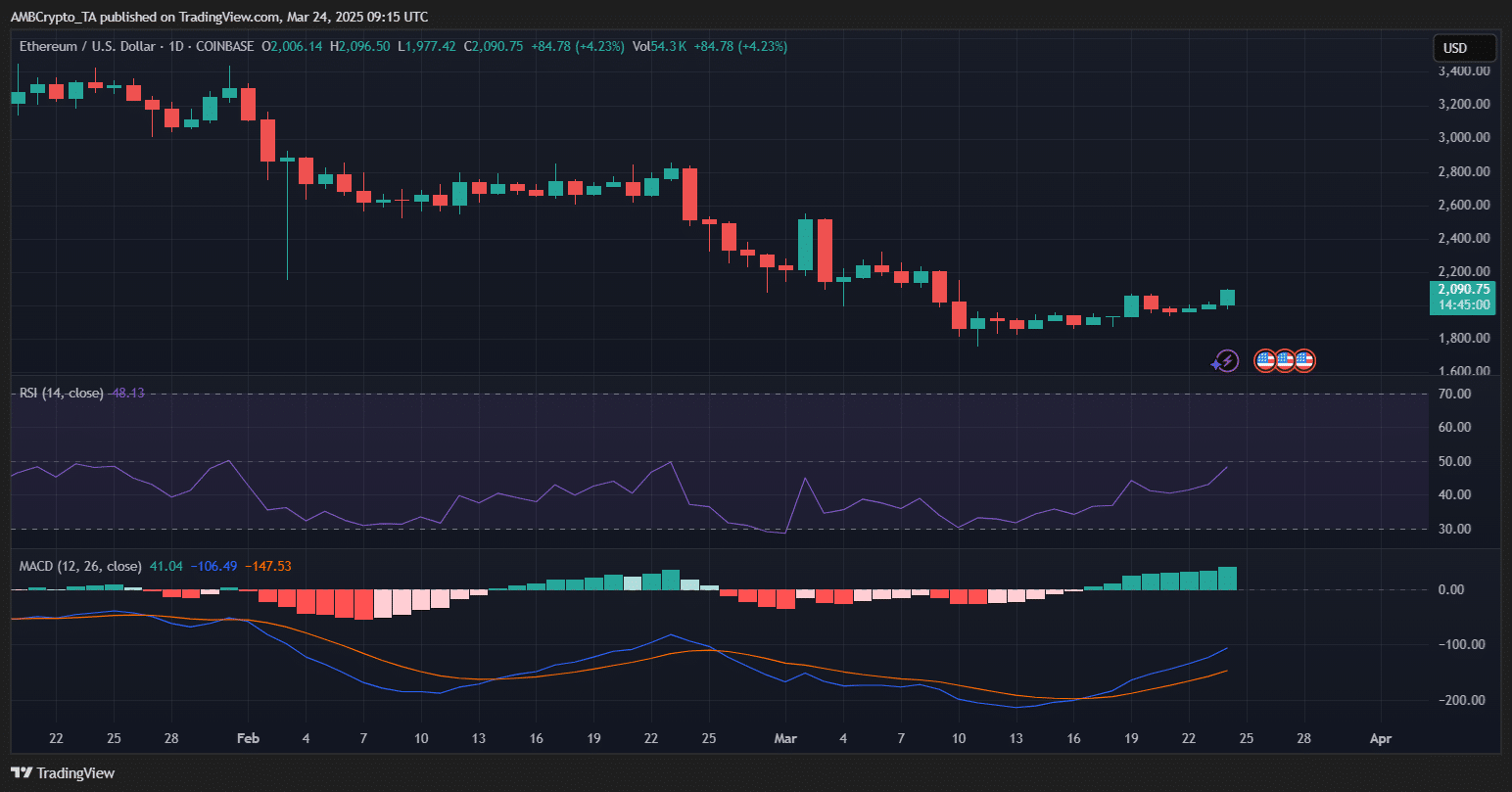

Ether Lee’s price behavior gives hints on recovery, but resistance disappears.

Ether Lee has a 4.23%profit for a $ 2,090 deal and has a potential short -term recovery.

The daily chart shows that optimistic signals have begun to form. The MACD has been turned over with green territory, and the MACD line crosses the signal line and is often considered optimistic crossover.

In addition, RSI has risen to 48.43, and has not yet violated the condition of over -purchasing, and has improved the power of the buyer.

Source: TradingView

Despite these signs, ETH is still facing resistance near the $ 2,200-$ 2,250 range that can be seen last in early March. Successful finishes on this zone can open the door to the $ 2,400 level.

But if the momentum is interrupted, ETH can test $ 2,000 with support.

At present, the accumulation of whales and the improvement of chain emotions appear to provide the fuel for Ether Leeum, but it still requires a clean escape to check the wider trend reversal.