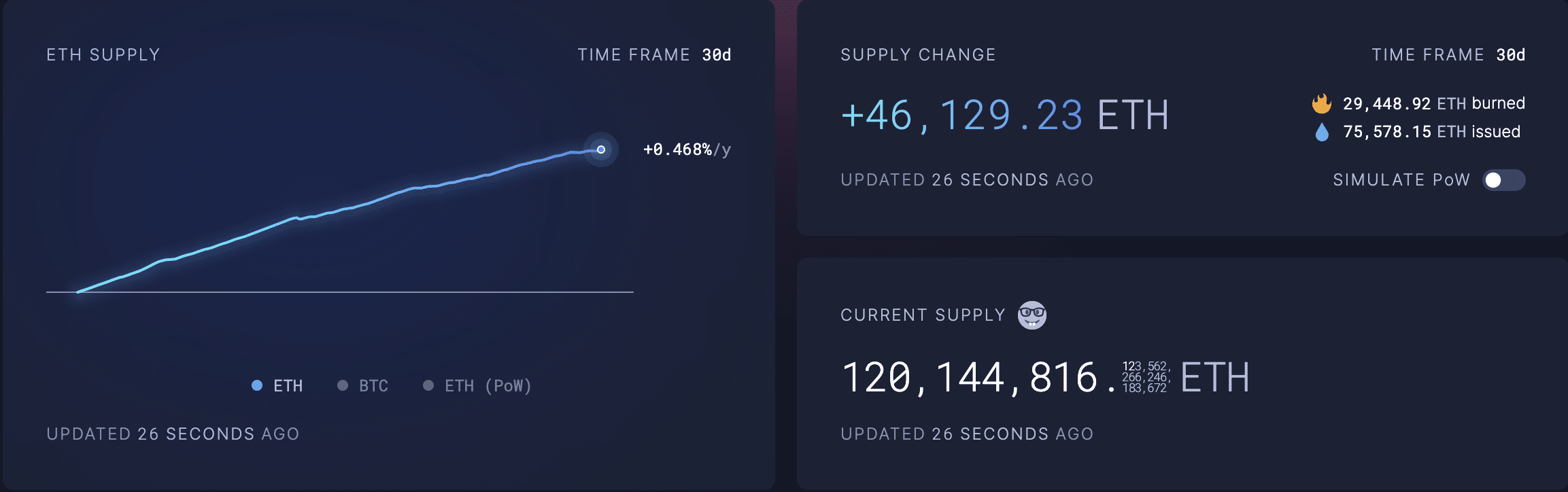

- Ethereum supply has surged in the past month.

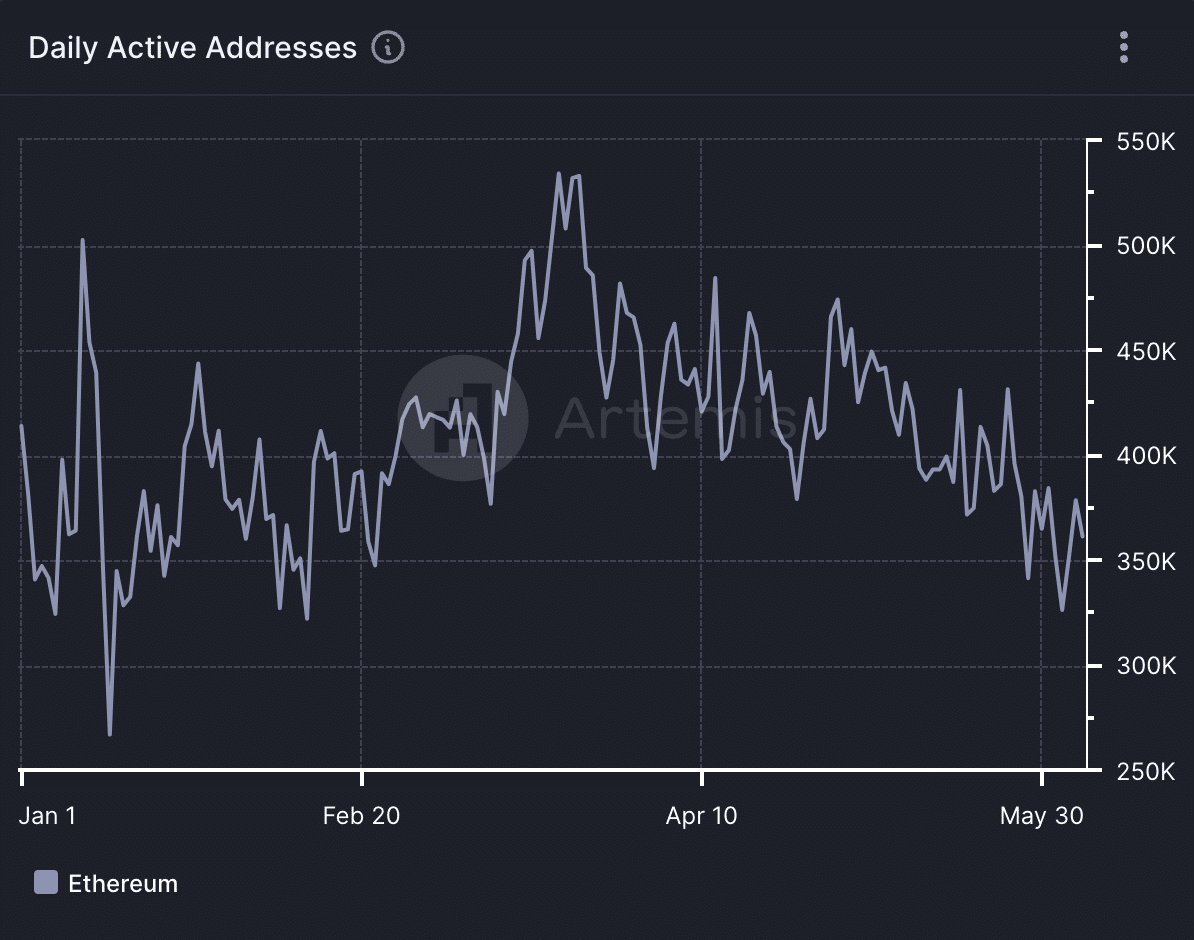

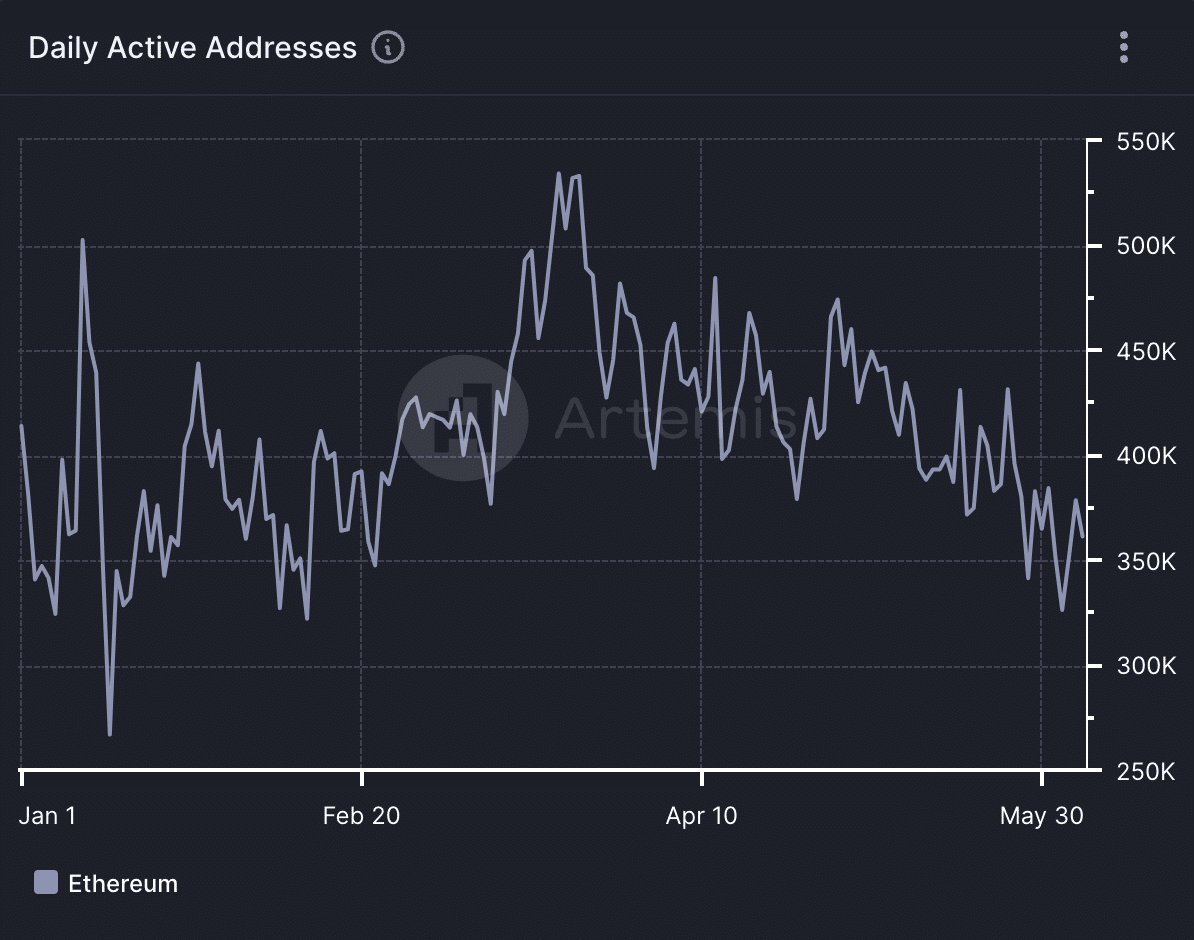

- This was caused by a decline in daily active addresses on the network.

At the altcoin’s press time price, 46,138 Ethereum (ETH), worth approximately $176.22 million, was added to circulation last month, pushing the altcoin’s circulating supply to a 30-day high of 120.14 million ETH. ultrasound.money showed it

Source: Ultrasound.money

The steady surge in the number of ETH coins in circulation means that the supply of altcoins is currently in a state of inflation. This happens when you see a decrease in user activity on your network.

Data from AMBCrypto confirms this decline. Artemis We have seen a decline in the number of daily unique addresses interacting with the Ethereum blockchain over the past 30 days.

As of June 5, 361,200 addresses have completed at least one single transaction on Ethereum, according to the on-chain data provider. This is a 14% decrease from the 421,000 unique addresses traded on the network on May 8.

In fact, during the period under review, the number of daily active addresses plummeted to a three-month low of 326,200 on June 2.

The last time Ethereum’s daily active address count was this low was on February 8, according to data from Artemis.

Source: Artemis

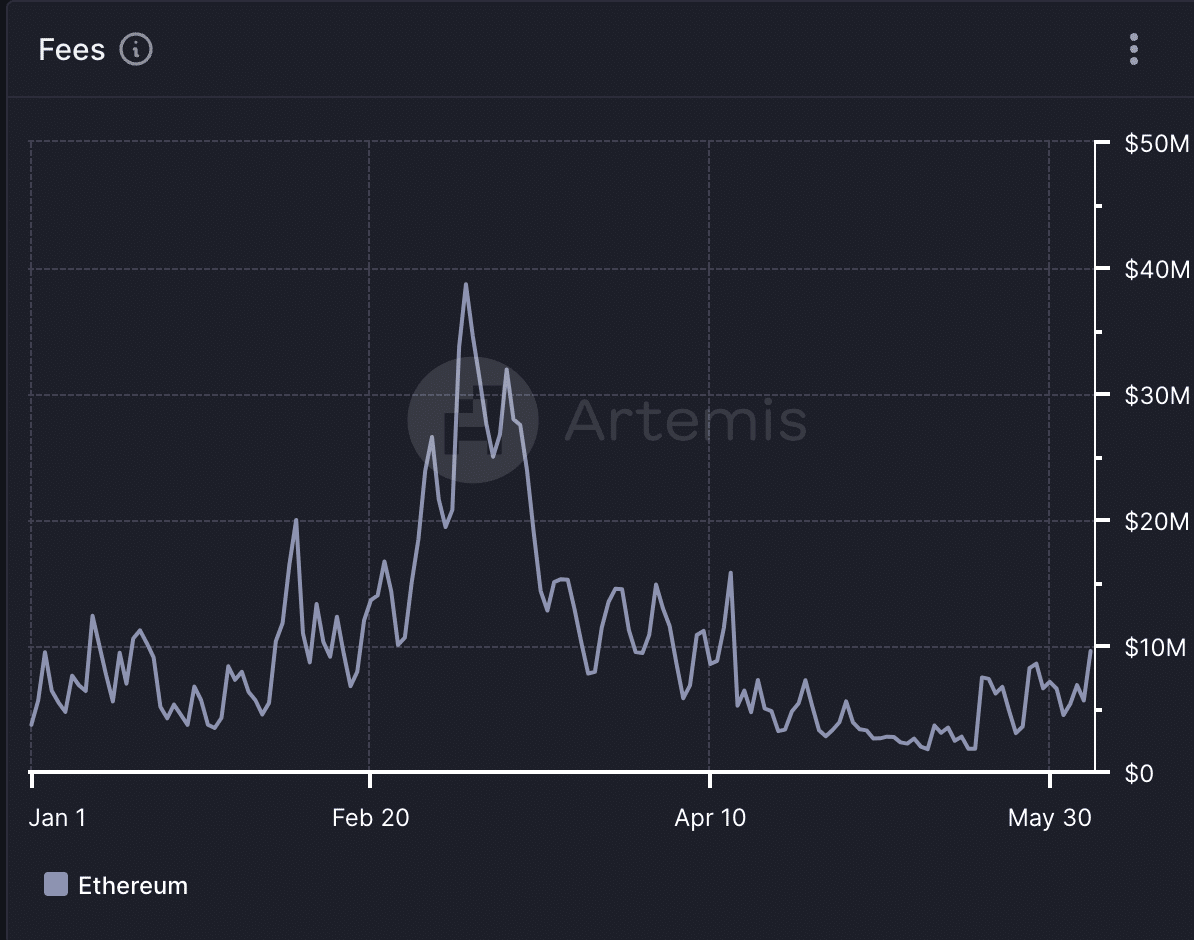

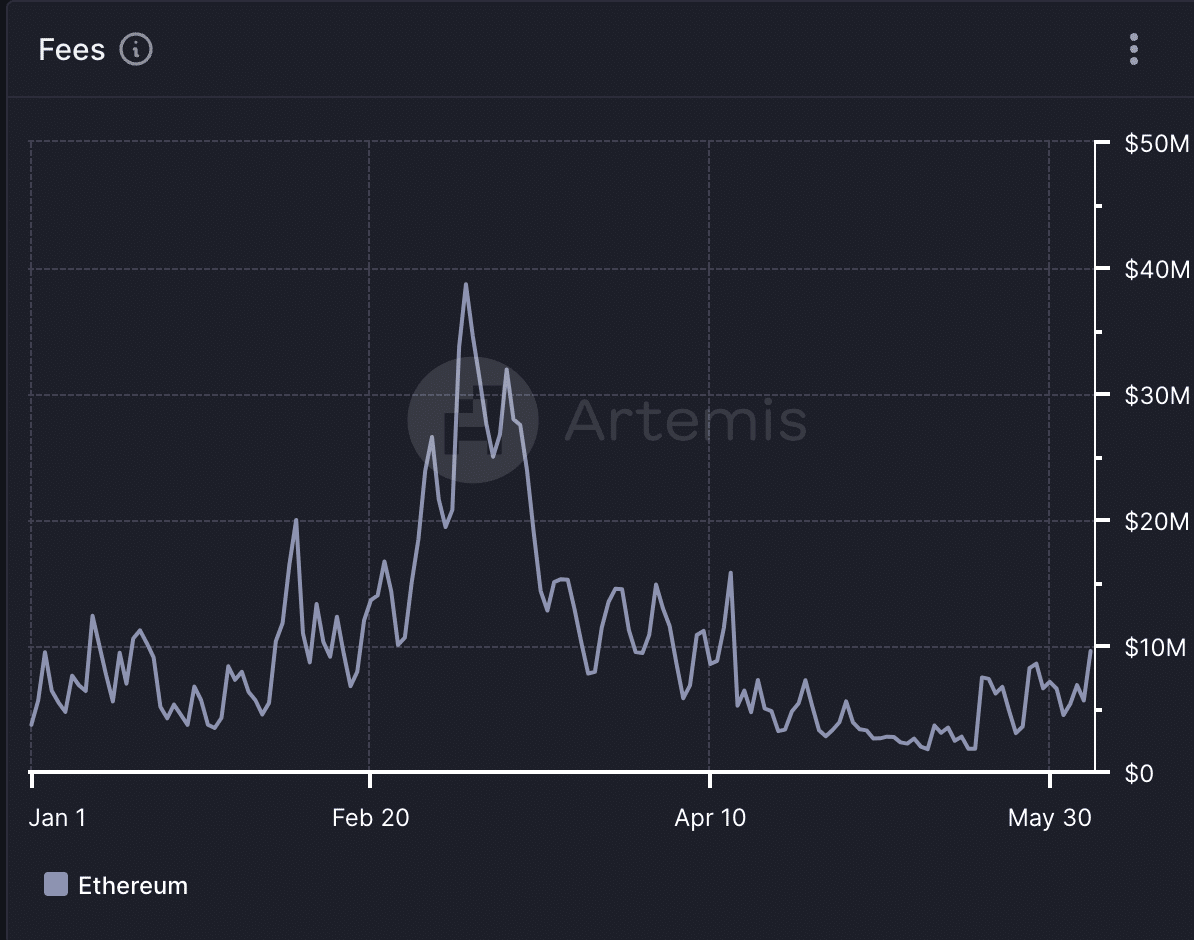

Interestingly, total transaction fees on the Ethereum network did not decrease, as ETH value surged 25% during the period under review. It showed an upward trend even while user demand was decreasing.

On June 5, Ethereum’s transaction fees totaled $10 million, the highest since April 13.

Source: Artemis

Exploring Ethereum’s DeFi and NFT Sectors

Although the number of users on the chain has declined over the past month, the decentralized finance (DeFi) ecosystem has grown significantly.

The total value of assets locked (TVL) across all DeFi protocols held on Ethereum has increased by 25.38% over the past 30 days. This makes it the second blockchain among TVL’s top five networks to record the highest growth over the period, after Arbitrum (ARB).

Read Ethereum (ETH) price prediction for 2024-25

According to data from DipilamaEthereum’s TVL is $66.33 billion at press time, its highest yearly value and highest level since May 2022.

Ethereum’s non-fungible token (NFT) segment did not register the same success during the period under review. According to CryptoSlamNFT sales on Ethereum have decreased by 56% over the past 30 days.