- Demand for ETH has weakened as funds have flowed out of Ethereum ETFs, indicating less investor interest.

- Open interest has plummeted, but major traders are long, suggesting there may be changes ahead.

Ethereum (ETH) ETFs have been experiencing sustained outflows recently, despite previous high expectations that the ETF would drive demand.

Many analysts have observed this phenomenon, and some believe that this could be the reason why ETH has been weak.

Woo Blockchain reported that net outflows from Ethereum spot ETFs peaked at $15.114 million on September 17.

Next, Ethereum ETF data showed that most ETFs did not have positive flows during the week. Outflows dominated the week.

Ethereum ETF outflows may have had a significant impact on ETH’s recent performance. The latter coincided with depressed sentiment, which in turn contributed to lower network activity.

Investors’ low excitement is evident in ETH’s recent price action, with Bitcoin up more than 14% from its current monthly low, while ETH is up only about 7.7%.

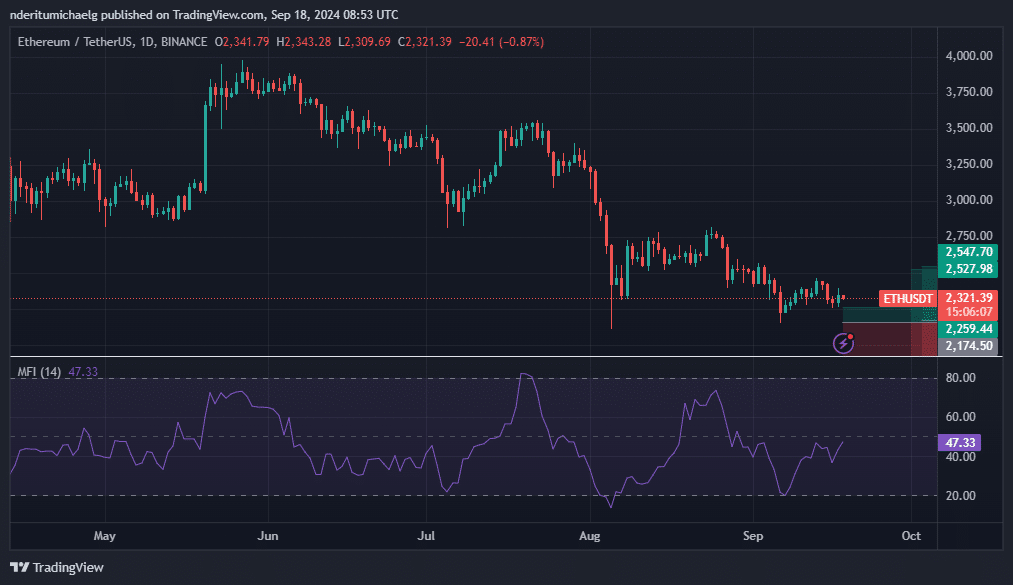

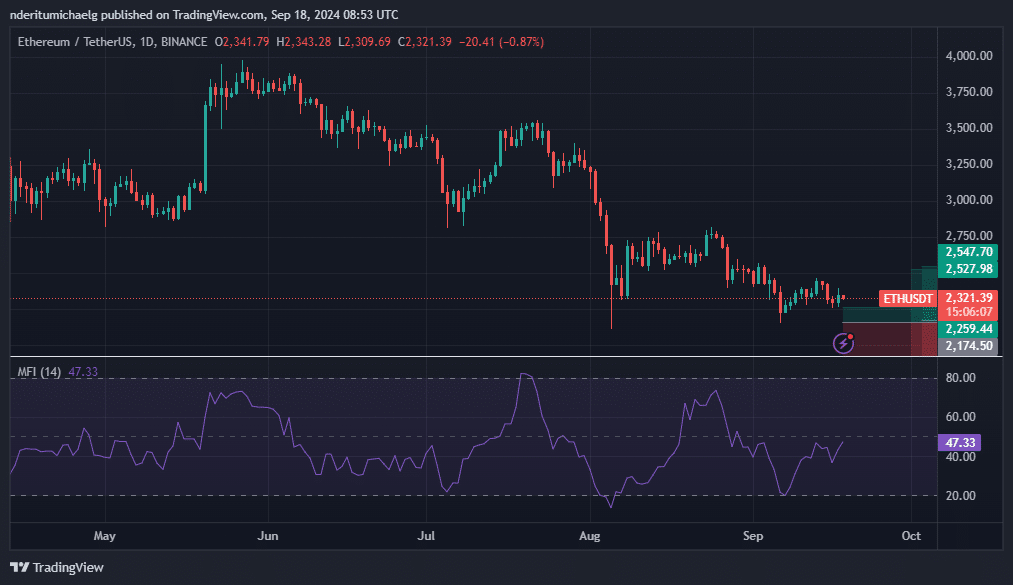

This highlighted the decline in demand for ETH, which was trading at $2,321 at the time of writing.

Source: TradingView

ETH’s RSI is struggling to break above the 50% level, confirming the weak bullish momentum. Nevertheless, the MFI shows that there is still some liquidity flowing into the coin, albeit in small amounts.

Can ETH Make a Strong Comeback?

A strong rally is not entirely out of the question. ETH’s current predicament is the culmination of a number of factors, including ETF outflows and low on-chain activity.

However, a shift in these factors could potentially see strong demand return, especially if healthy inflows into Ethereum ETFs occur.

The current price level of ETH can also be considered healthy. However, there is a lot of uncertainty at the moment, and this has also affected the performance of the derivatives sector.

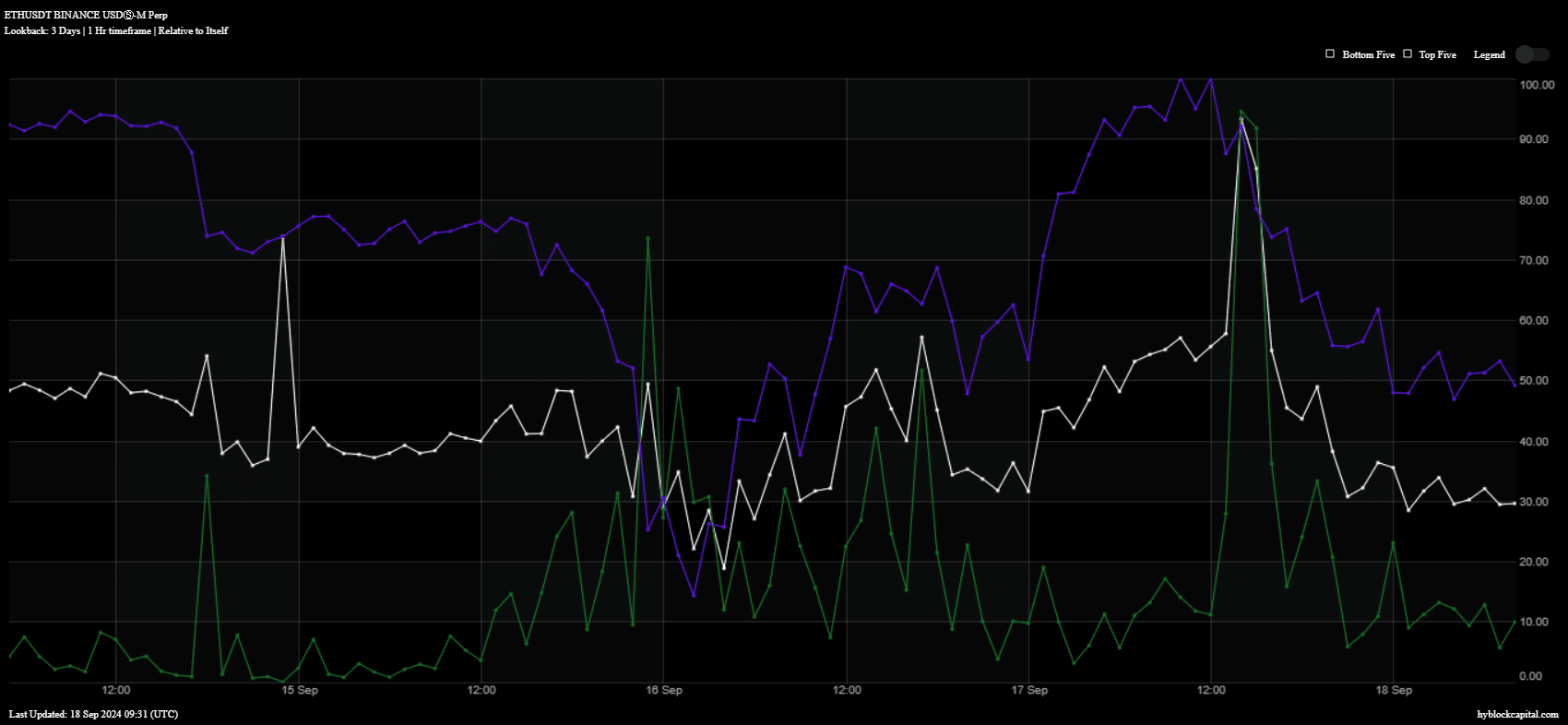

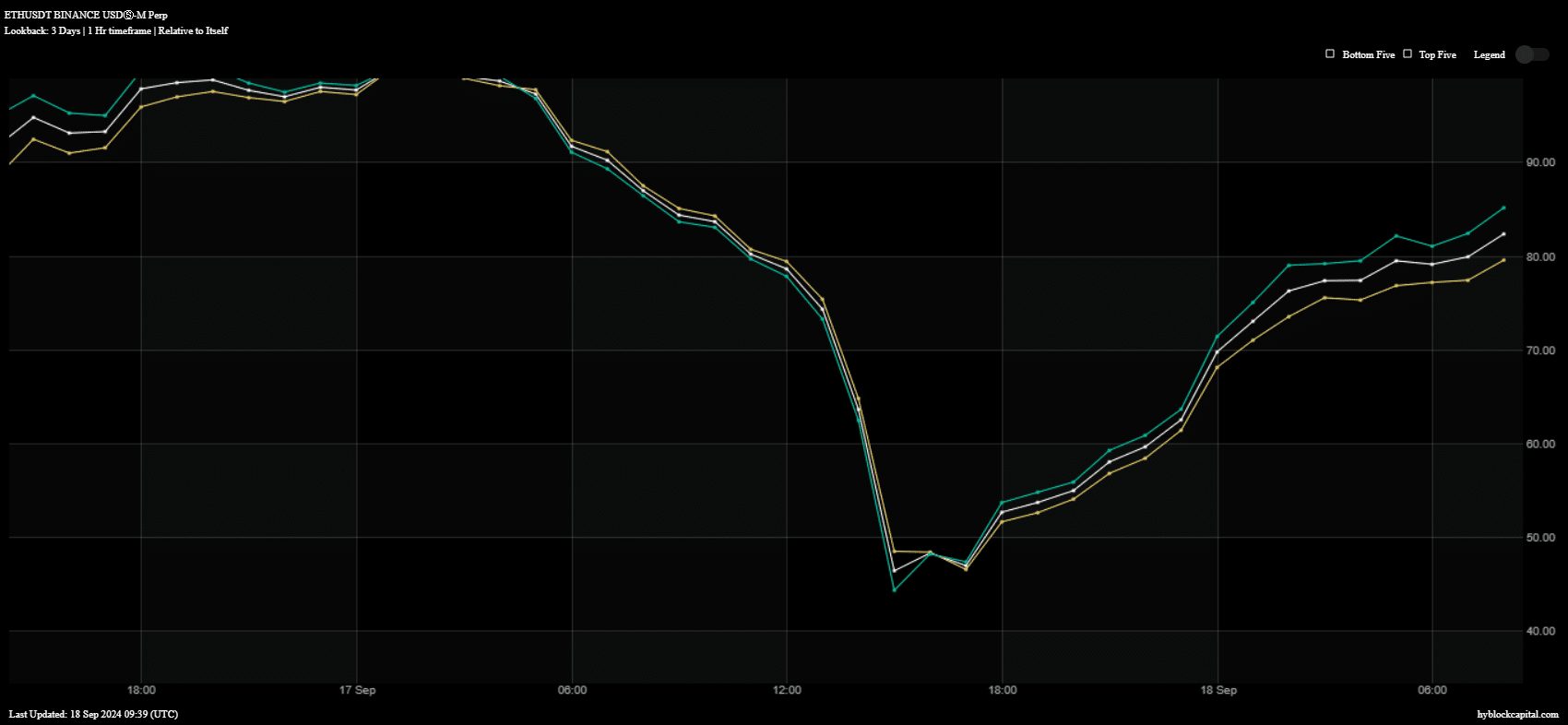

For example, the level of open interest (blue) has plummeted over the last 24 hours. We also observed a decrease in buying volume (green) over the same period.

Source: Hyblock Capital

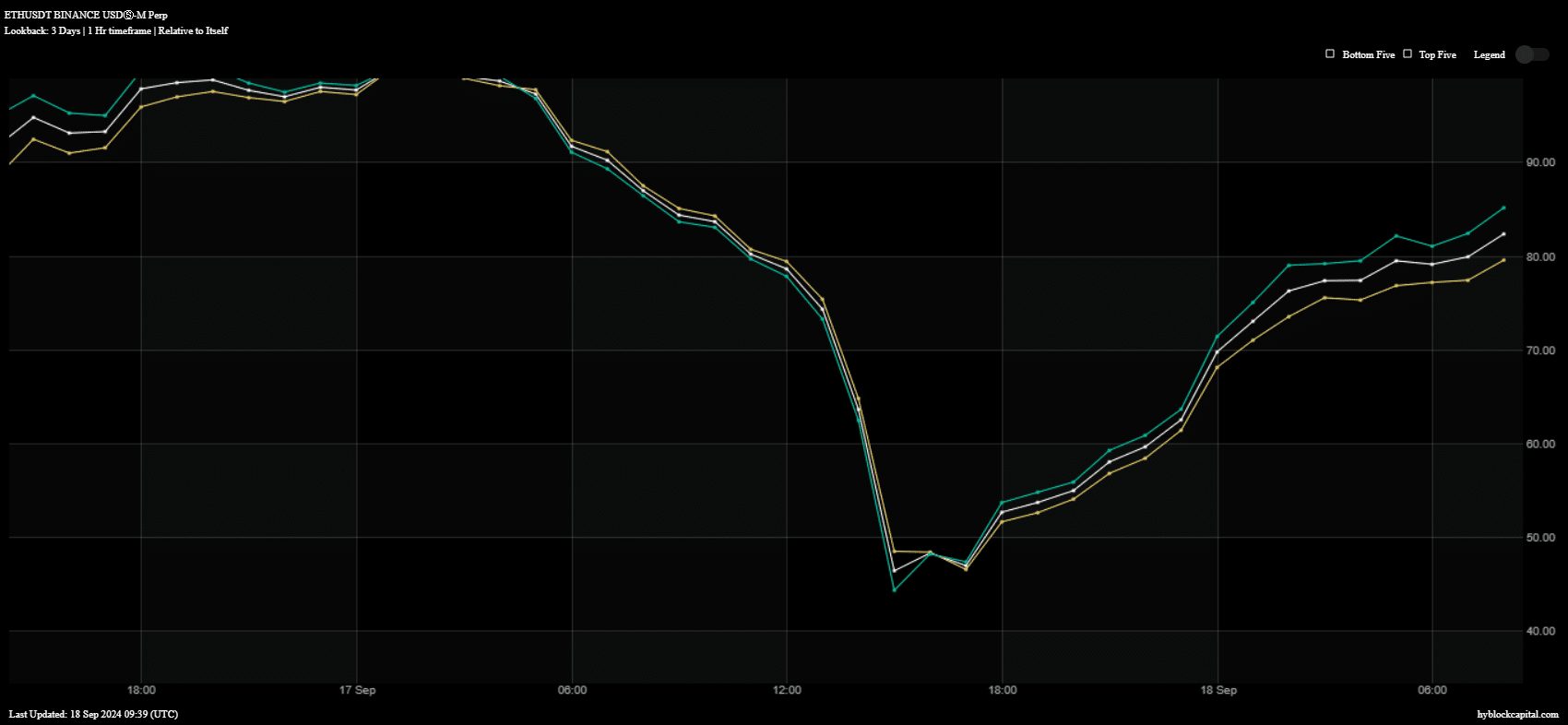

There were also signs in ETH performance that these results could be related to whale manipulation, with the number of long positions held by top traders decreasing during Tuesday’s trading session.

But the bounce back showed that major traders were back in a bullish mood.

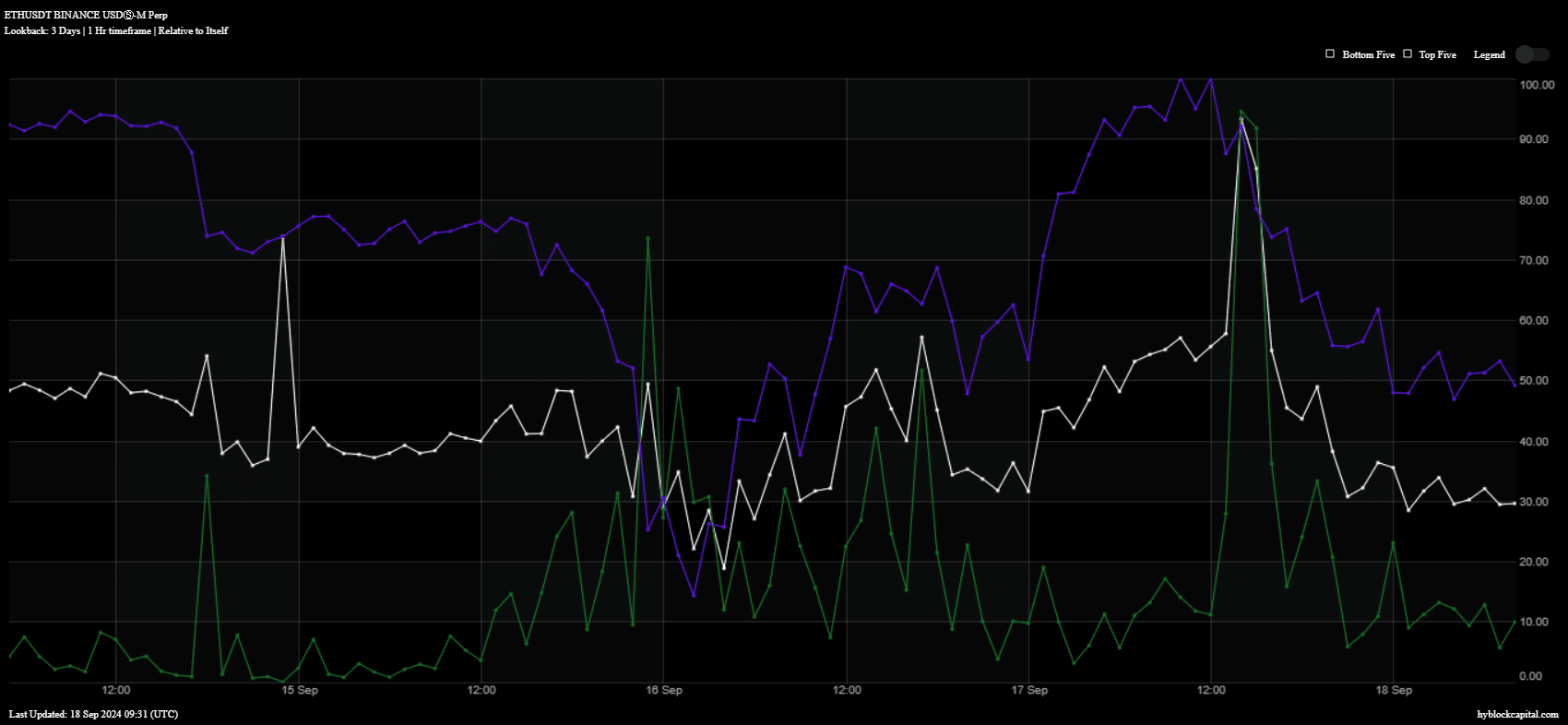

Source: Hyblock Capital

Read Ethereum (ETH) Price Prediction 2024-2025

Among the top addresses (green), ETH longs and global longs (yellow) have bounced significantly over the past 24 hours, suggesting that ETH bulls could be flexing their muscles heading into the weekend.

However, this depends on whether ETH can build enough demand and momentum to push the price back onto an upward trajectory.