- ONDO has experienced significant trading activity as metrics suggest further price appreciation in the near term.

- The protocol’s TVL also surged, suggesting that trust in the project has strengthened.

ONDO price rebounded shortly after the U.S. SEC announced that it had approved eight Ethereum (ETH) spot ETFs. The token price before approval was $0.92.

However, the price of ONDO is up 13.26% in the last 24 hours as the token crosses the $1 psychological zone. Well, you might be wondering what temperature has to do with Ethereum to have a strong impact on its development.

AMBCrypto will explain. In a previous article, we mentioned how ONDO could be a big beneficiary of the tokenization of real-world assets (RWA) despite its one-time split from ETH.

Are ONDO and ETH a couple now?

But beyond that, the project team, Ondo Finance, recently moved its assets to BlackRock’s BUIDL tokenization fund. For context, the fund operates on the Ethereum blockchain.

Like Ondo’s products, BUIDL allows users to earn returns on their US dollar holdings. Therefore, this indirectly makes ONDO, rather than Ethereum L2, the beta of the blockchain.

Interestingly, some market participants seem to have anticipated this move. 6 days ago, on-chain data shows traders exchanging 1,870 ETH for ONDO at an average price of $0.95.

Additionally, another participant who purchased tokens in February still holds the cryptocurrency despite an unrealized gain of 288%. Actions like this suggest that the token price could rise above $1.08 in the future.

AMBCrypto also looked at ONDO’s volume. At press time, that figure hit a monthly high of $449.5 million, according to data from Santiment.

Source: Santiment

The increase in trading volume was evidence of growing interest in the token. When placed in conjunction with price movements, it indicates that ONDO may become more valuable in the near term.

Why the price is set to reach $2

In this case, it could soon be trading at $1.20. However, ONDO’s upward trend may weaken if volume decreases while price rises. Therefore, especially if profit taking becomes severe, it may fall below $1.

For long-term potential, Total Value Locked (TVL) can play an important role. TVL shows the dollar value of assets locked or staked in a project.

This metric allows you to measure how healthy your protocol is. An increase in TVL means that the liquidity added to the protocol is impressive, which indicates good health.

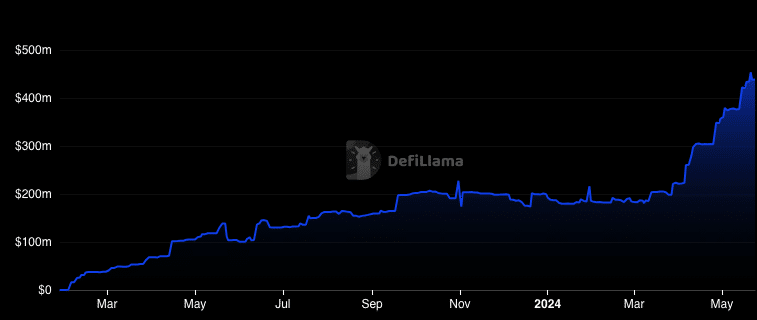

The downtrend, on the other hand, showed otherwise. According to DeFiLlama, Ondo Finance’s TVL has grown exponentially, reaching $438.42 million at the time of this writing.

This increase suggests that market participants considered the project credible, with high expectations of good returns. Looking at recent increases, this indicator could reach $1 billion in a few months.

Source: DeFiLlama

Realistic or not, ONDO’s ETH market cap is as follows:

In this case, the price of ONDO can also benefit and rise from $2 to $4.

According to the project’s official website assessment, the annual return on US dollar deposits is 5.20%, and the annual return is 4.96%. U.S. Treasury bonds.