- The spot Ethereum ETF was approved for trading on July 23.

- Despite ETH’s underperformance at the time of publication, the bullish momentum continues.

After much anticipation and multiple revisions, a spot Ethereum (ETH) ETF finally received full and final approval to begin trading in the United States on July 23.

SEC Approves Spot Ethereum ETF

The U.S. Securities and Exchange Commission (SEC) has approved ETH ETFs from companies including BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy.

This approval follows the SEC’s final approval of the S-1 registration statement on July 22, which will allow these ETFs to be listed on major exchanges, including the Nasdaq, New York Stock Exchange and Chicago Board Options Exchange.

The incident comes just a day after President Joe Biden announced he would withdraw from the upcoming election.

Will ETH’s response be delayed?

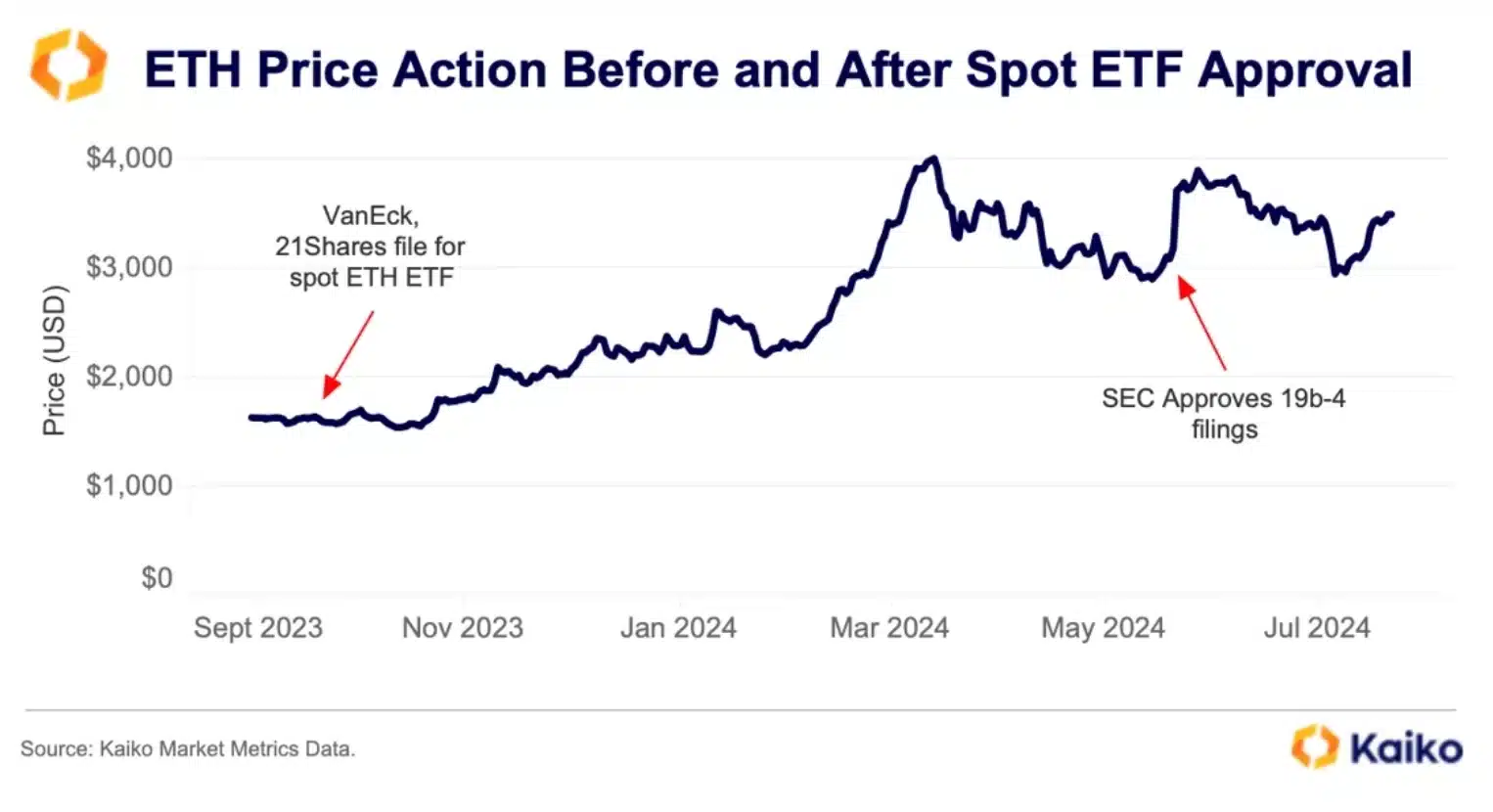

However, this news has not had a significant impact on the price of Ethereum as of the time of writing.

At the time of writing, ETH is up more than 1% over the past 24 hours, trading at $3,521, according to CoinMarketCap. Despite this slow performance, investor sentiment remains bullish.

Crypto analyst RunnerXBT, who encourages investors to remain strong, said:

“Honey, don’t go. ETH ETF inflows will be better than expected.”

Kaiko’s Market Forecast

However, cryptocurrency analytics firm Kaiko estimates that ETH prices will not rise more than 24% by the end of the year due to weak demand for spot ETH products.

Source: Kaiko

It is important to note that the Kaiko study was conducted before President Biden decided to withdraw from the election.

Kaiko’s Head of Indexes Will Cai added:

“A futures-based ETH ETF was launched in the US late last year, but demand has been weak, and all eyes are on the ETF launch, with high hopes for rapid asset accumulation. The full picture of demand may not be apparent for several months, but ETH prices may be sensitive to first-day inflows.”

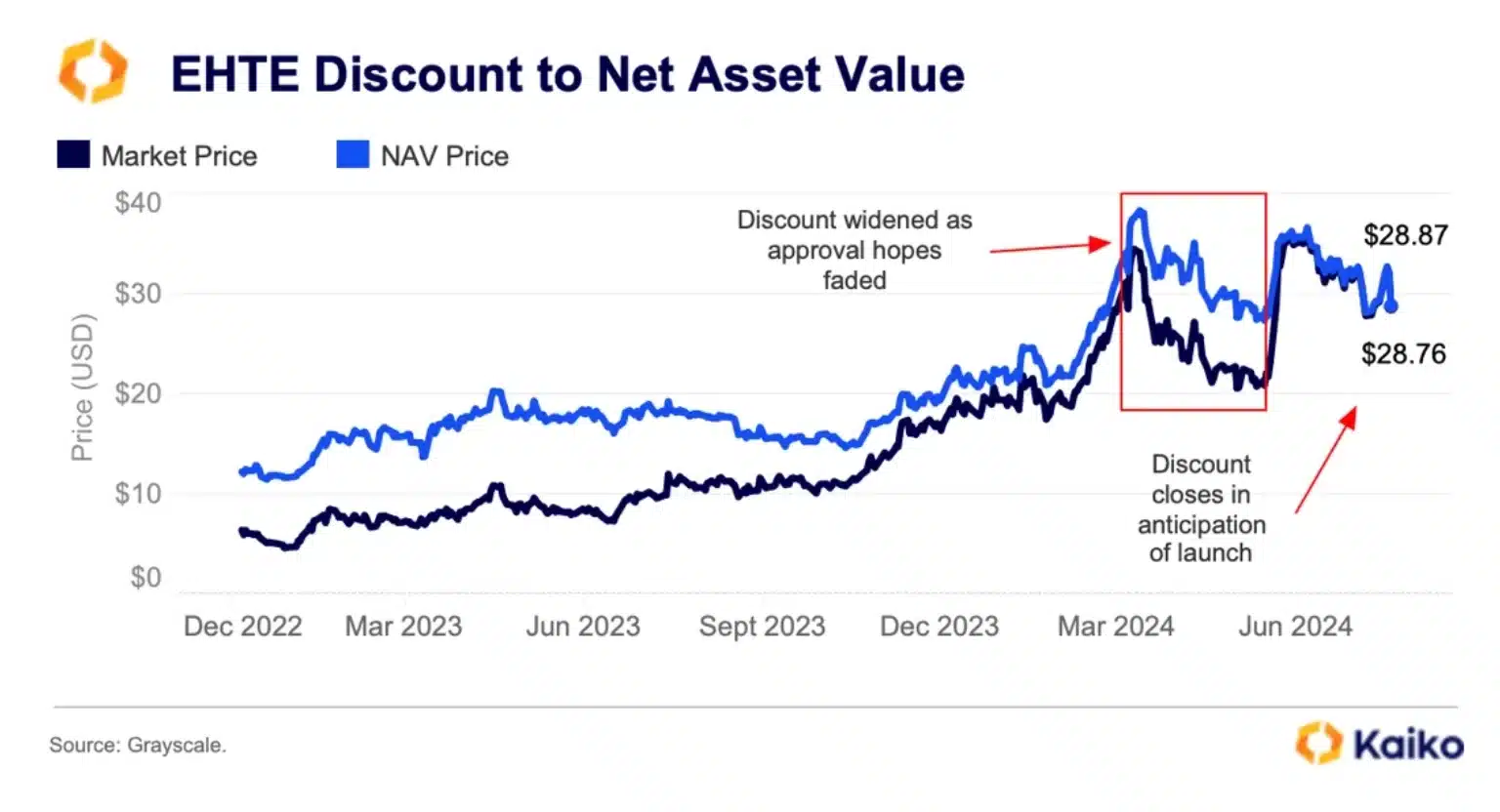

Additionally, Kaiko analyzed how the approval of a spot ETH ETF is expected to have a significant impact on the Grayscale Ethereum Trust (ETHE) and its price movements.

One notable effect is that there may be outflows from ETHE as investors move funds into newly launched spot ETFs.

Source: Kaiko

Before the launch, ETHE shares were trading at a narrow discount to their NAV, indicating that they were trading closer to their true value. When ETHE converted to a spot ETF on July 23, liquidity increased, leading to many investors selling.

With this change, and the discount narrowing, traders are ready to cash out at the full Net Asset Value (NAV) price and realize their profits.

In conclusion, AMBCrypto’s technical analysis of ETH, including indicators such as RSI and CMF, indicates that bullish momentum continues to outpace bearish pressure.

Source: TradingView