As the cryptocurrency market slump deepens this week, Ethereum price remains above $2,200 support, with on-chain signals highlighting increased demand from whales.

On January 22, the cryptocurrency market experienced significant bearish headwinds as the price of Bitcoin (BTC) teetered below $40,000 for the first time in 50 days. As of press time on January 25th, global cryptocurrency market capitalization had declined by 7%, with $108.5 billion in valuation wiped within the weekly period.

Ethereum (ETH) remained a relatively more resilient performer than the industry average from January 22nd to January 24th, with the price dropping 5%.

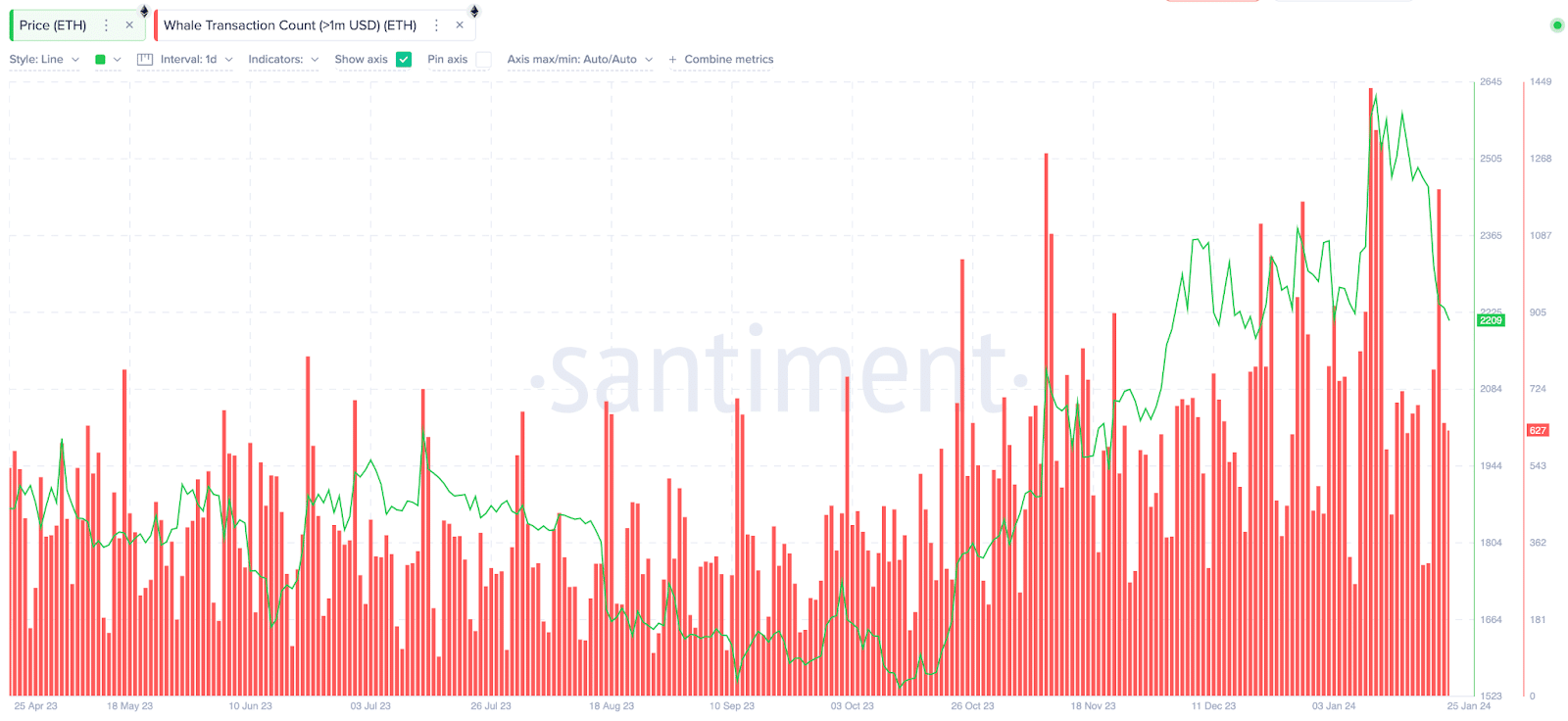

Ethereum whale activity remains high despite downward trend

Ethereum prices managed to keep losses below 5% this week, while Bitcoin and global cryptocurrency market caps each fell by up to 7% before recovering modestly. The increased level of whale trading activity recorded on the Ethereum network this week has played a pivotal role in ETH’s resilient price performance, according to on-chain data trends.

Santiment’s Whale Transaction Count indicator tracks the number of daily transactions involving a specific cryptocurrency exceeding $100,000.

On January 23, Ethereum whale trading volume exceeded 1,190. A closer look at the chart below shows that this is the highest price since ETH price soared to a 20-month high of $2,690 on January 11.

Despite widespread market retreats, corporate entities accumulate significant amounts of ETH. This could be due to investors and fund sponsors looking to acquire Ethereum ahead of the upcoming ETH spot ETF ruling.

An increase in whale trading during market downturns positively impacts cryptocurrency asset prices in two main ways. First, it provides market liquidity, allowing bearish panic sellers to execute trades at favorable prices. This also strengthens trust among small retailers.

These factors have played a key role in ETH competing to stay above the $2,200 support level amid the market-wide sell-off this week.

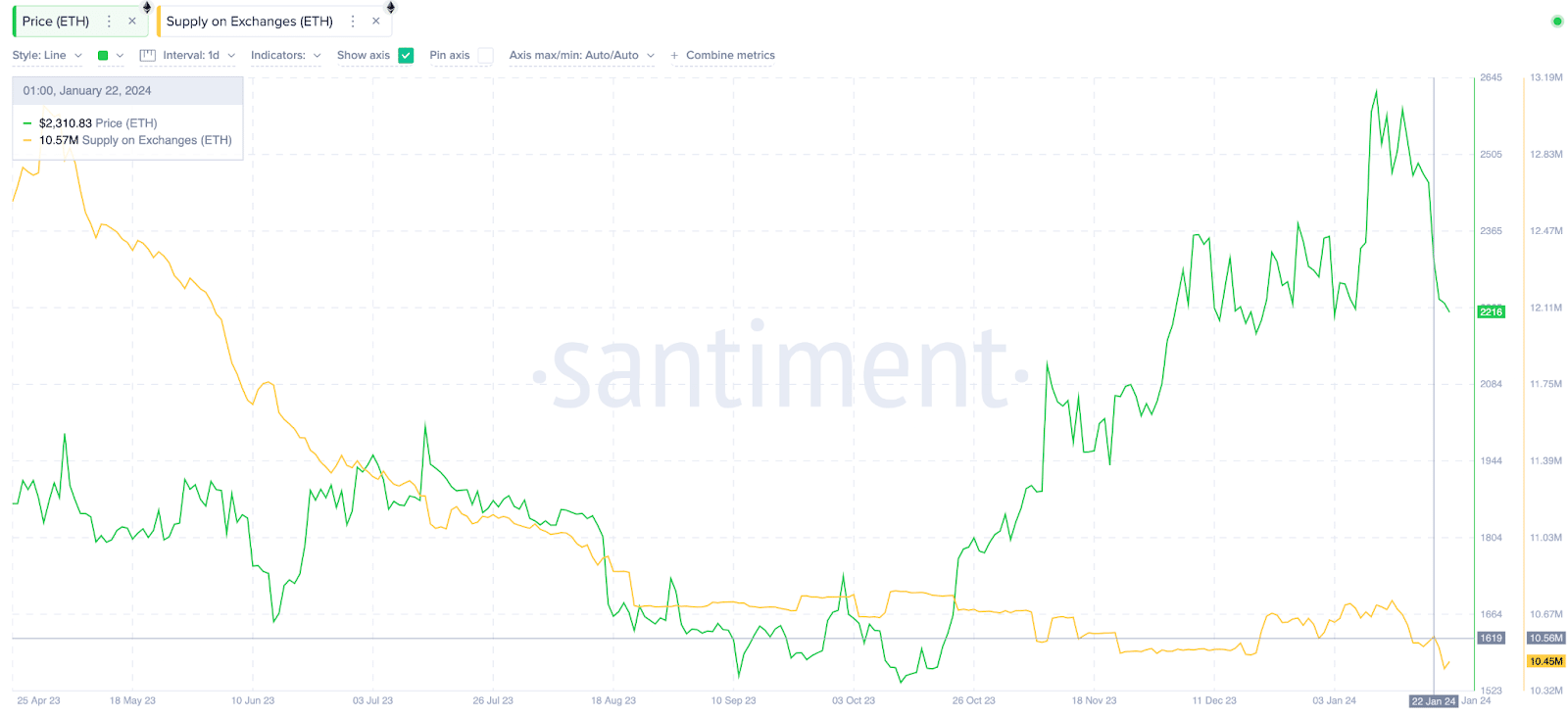

Ethereum investors choose long-term storage

Additionally, Ethereum has recorded a steady decline in exchange reserves this week, which may be related to increased whale activity.

Corporations and whales are known as value investors who tend to hold for the long term. Not surprisingly, the increase in whale trading volume on the Ethereum network in recent months has led to a sharp decline in the supply deposited on exchanges.

At the beginning of the week of January 22, Ethereum supply on exchanges was 10.5 million ETH. But interestingly, that number dropped sharply to 10.4 ETH on January 25th.

This effectively means that investors converted 150,000 ETH, worth about $330 million, into long-term storage or staking contracts on exchanges and trading platforms.

Despite the bearish headwinds, Ethereum supply on exchanges has decreased by 150,000 ETH over the past four days, indicating a prevailing preference for long-term holding and passive income staking among current holders.

In particular, Ethereum exchange supply is showing a downward trend after the switch to proof-of-stake (PoS) in May 2023, which coincides with the prolonged price upward trend.

ETH Price Prediction: Can Ethereum Price Stay Above $2,000?

As exchange supply continues its downward trend, the number of ETH coins that can be easily traded on the spot market decreases. This appears to have blunted selling pressure on Ethereum this week compared to the broader altcoin market. With the steady increase in whale trading, Ethereum price is in a prime position to defend the $2,000 area.

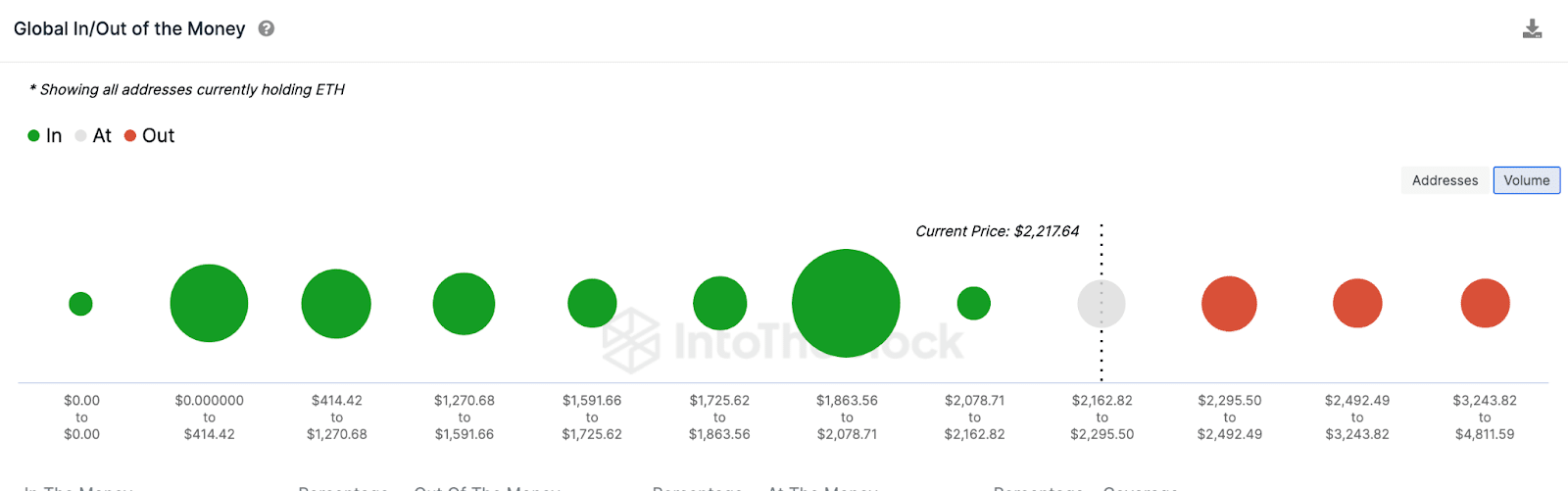

Deposit/withdrawal price data from IntoTheBlock, which groups all existing ETH holders by entry price, also confirms this position.

This shows that the largest cluster of ETH holders, 8.3 million addresses, acquired 46.5 million ETH at prices up to $2078. If the price of Ethereum falls to $2,100, many of these holders may buy like crazy to defend their positions to avoid being in a net loss position. This could effectively trigger an immediate Ethereum price rebound.

On the positive side, Ethereum bulls could reverse the bearish pressure if it regains the $2,500 area. However, with current market dynamics this seems impossible. As you can see above, a significant cluster of 3.7 million addresses acquired 7.1 million ETH at an average price of $2,400.

Ethereum could enter another correction phase if the price reaches the breakeven point and engages in some profit taking.