Hopes for a surge in Ethereum are fading as the price of the top altcoin has fallen significantly over the past four days. Between October 20 and 23, the price of ETH fell 9.6% after experiencing rejection at the $2,700 resistance level. This price drop wiped out any Ethereum profits made over the past 10 days. Currently, the price of ETH has stabilized at the $2,500 level.

At the time of writing, ETH is trading at $2,519 ETH/USDT. to Gate.io exchange. However, in the last 24 hours its value has fallen by 2.2%. However, looking at the year-to-date chart, we see an increase of around 37.2%. Despite the increase in trading volume last week, its value decreased by 3.82%. The following graph shows the price movement of ETH over the last 7 days.

Ethereum Price Action – CoinMarketCap

As you can see in the image, the current ETH price downward trend started on October 10th and is expected to continue. There is still a lot of bearish pressure.

Reasons for ETH price decline

With market optimism low, the chances of ETH rebounding above $2,800 are diminishing. There can be many reasons for the poor performance of the #1 altcoin. However, the biggest reason for Ethereum’s poor market performance is likely its high transaction fees. Huge trading fees force cryptocurrency investors to invest in other altcoins such as Solana, BNB, and Cardano (ADA). Of course, the list of attractive cryptocurrencies is growing every day. For example, FET, SEI, TON, NOT, and WLD are performing relatively better than ETH.

Ethereum’s past price performance also influences current market activity. For example, the recent decline in Ethereum’s market capitalization is another factor in the price decline. This is because pessimism has arisen among investors due to the decline in market capitalization. For example, from October 22nd to 23rd, the ETH market cap decreased by 5%. And in the last 24 hours it has fallen 2.32%, making an already dire situation even worse.

Congestion on the Ethereum network is also contributing to poor market performance. What makes the situation even worse is that developers are spending a lot of time trying to solve problems that users have been experiencing for a long time. Therefore, investors are reallocating their funds to more user-friendly blockchains such as Solana, Polygon, Avalanche, and Arbitrum. The issues mentioned may not have much of an impact on smart investors, but they do have a huge impact on people who use them on a daily basis, such as traders.

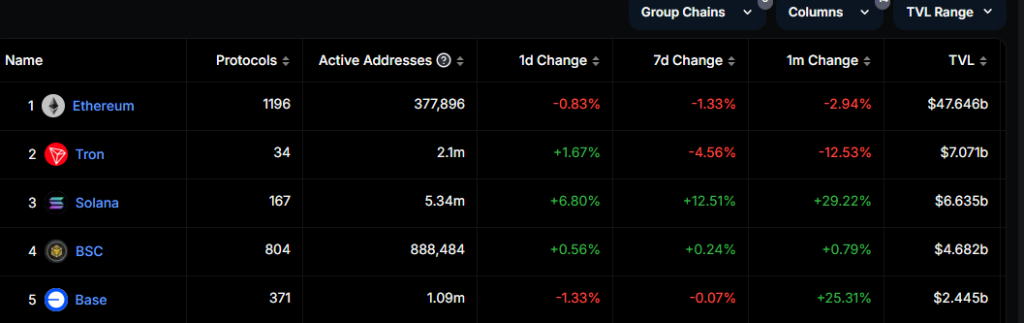

To illustrate the decline in network activity on Ethereum, we can compare it to what is happening on other blockchains such as Solana and Binance Chain. Solana recorded $13.4 billion in trading volume over the past seven days, according to data from Defilama. This is a whopping 67% higher than the Ethereum trading volume during that period. Additionally, the total locked-up value of Solana is increasing as shown in the following photo.

Solana Total Value Locked – Defilama

The total value locked in Solana is increasing, while Ethereum’s TVL is decreasing. This clearly shows the challenges facing the Ethereum blockchain. The following graph shows the current trend of the total value of Ethereum locked.

Ethereum Total Value Locked – Defilama

In comparison, Ethereum TVL increased by a smaller percentage than Solana. And that’s not all. Other blockchains such as Binance Chain and Avalanche have performed better than ETH in various ways. More importantly, trading volume on decentralized exchanges on the Ethereum blockchain is also decreasing. For example, in the seven days ending October 23, trading volume on the DEX fell 13%. This followed a significant decline in trading volumes on Curve Finance and Uniswap, which operate on the Ethereum network.

A decrease in the overall locked value of the network may create negative feelings among users. In particular, the decline in the number of depositors shows a negative development in supply and demand dynamics. This becomes even more serious if the validator unstakes ETH. There are other indicators of Ethereum’s poor performance. For example, on Ethereum, the number of active addresses has decreased.

Change Active Address – Defilama

We have discussed several metrics that show that Ethereum is not performing as expected. This may be contributing to the current bearish pressure.

Ethereum price analysis

ETH is facing a lot of resistance around the descending channel. This has led to a steady decline in prices over the past few days. As of October 24, the price of ETH fell below the 50-day exponential moving average (EMA) of $2,564. This may have seen an increase in sales activity. The current concern is that if seller activity remains high, the price could fall further to $2,461. On the other hand, a bounce above the 50-day EMA could lead to the August 24 high at $2,820.

Currently, ETH has broken the ceiling of the descending channel. This could mean that the downward trend is slowing down. However, there is a high possibility that prices will continue to fall.

Ethereum Price Action – Investech

As can be seen in the graph, the price of ETH has crossed the trend line and has risen slightly. The near-term strength it has shown is supported by the rising relative strength index. The current reading for RSI is 58. Considering ETH’s performance over the past seven days, the price rise above the trend line may turn out to be a false breakout.

Gate.io P2P: Enhancing Ethereum accessibility

One of the key ways Gate.io has improved the accessibility of Ethereum is through its peer-to-peer (P2P) trading platform. that Gate.io The P2P service allows users to trade Ethereum. and other cryptocurrencies trade directly with each other using local currencies, eliminating the need for intermediaries. This feature provides a seamless and cost-effective solution for users in various regions, especially countries with limited access to traditional financial systems.

Gate.io P2P’s integration into the Ethereum ecosystem is especially beneficial during times of high market volatility. By offering competitive pricing and secure trading, we enable investors to quickly enter or exit Ethereum positions. Additionally, the platform’s escrow mechanism ensures transactions are secure and transparent, building trust among users.

As Ethereum faces issues like high transaction fees and congestion, Gate.io P2P provides an alternative route for users to earn ETH without incurring high network fees. This ease of access could play a key role in maintaining user engagement and supporting widespread adoption of Ethereum despite ongoing challenges.