- Ethereum on-chain activity has reached new highs.

- Ethereum is seeing increasing trader participation in DEXs.

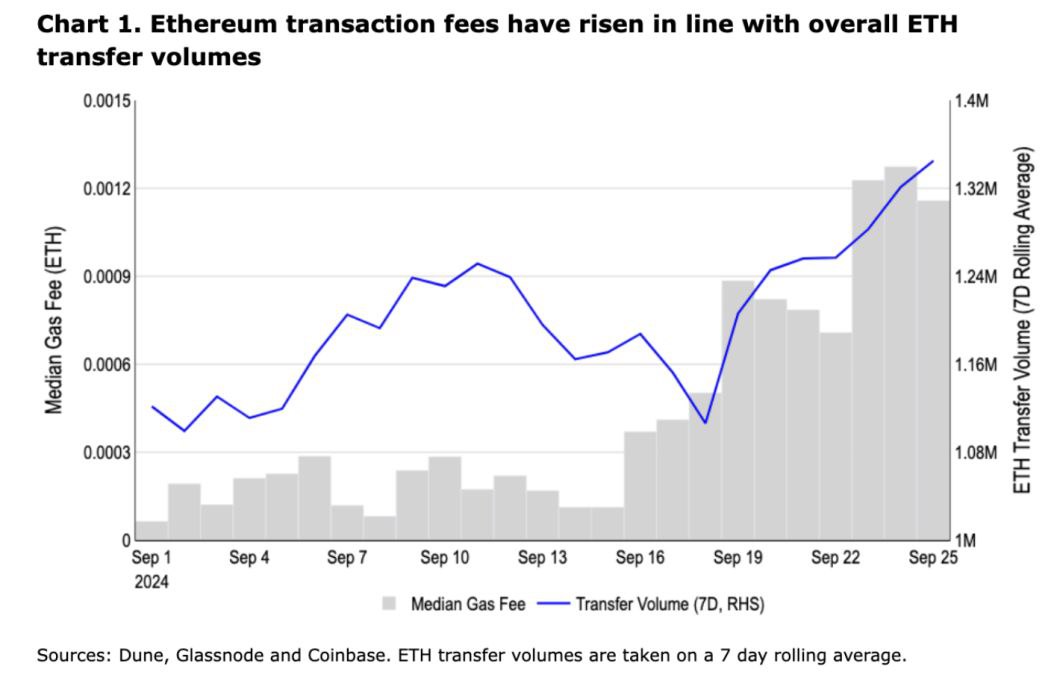

Ethereum (ETH), the leading blockchain for smart contracts, is seeing increasing on-chain activity. In particular, as more traders utilize decentralized finance (DeFi) platforms that rely on the Ethereum network, this increase has led to higher transaction fees.

ETH has been on an upward trajectory, mirroring the broader cryptocurrency market as it looks forward to a strong final quarter.

As Ethereum gains traction and generates large trading volumes, soaring fees are raising concerns, especially as trader participation increases.

Source: Dune, Glassnode, Coinbase

Although analysts did not attribute this surge to one single cause, the increase in decentralized exchange (DEX) trading volume and increased use of the ETH network have largely contributed to the rise in trading fees.

Active Address Elevation

One of the key on-chain metrics contributing to rising fees is Ethereum address analysis. Daily active addresses are growing rapidly, up 29%, and new addresses are up 43%.

Zero-balance addresses also increased by 28%, but active addresses remain at the highest level. This means increased network activity as more transactions are conducted simultaneously.

As the network becomes more active, transactions become more difficult to confirm, resulting in higher transaction fees.

Source: IntoTheBlock

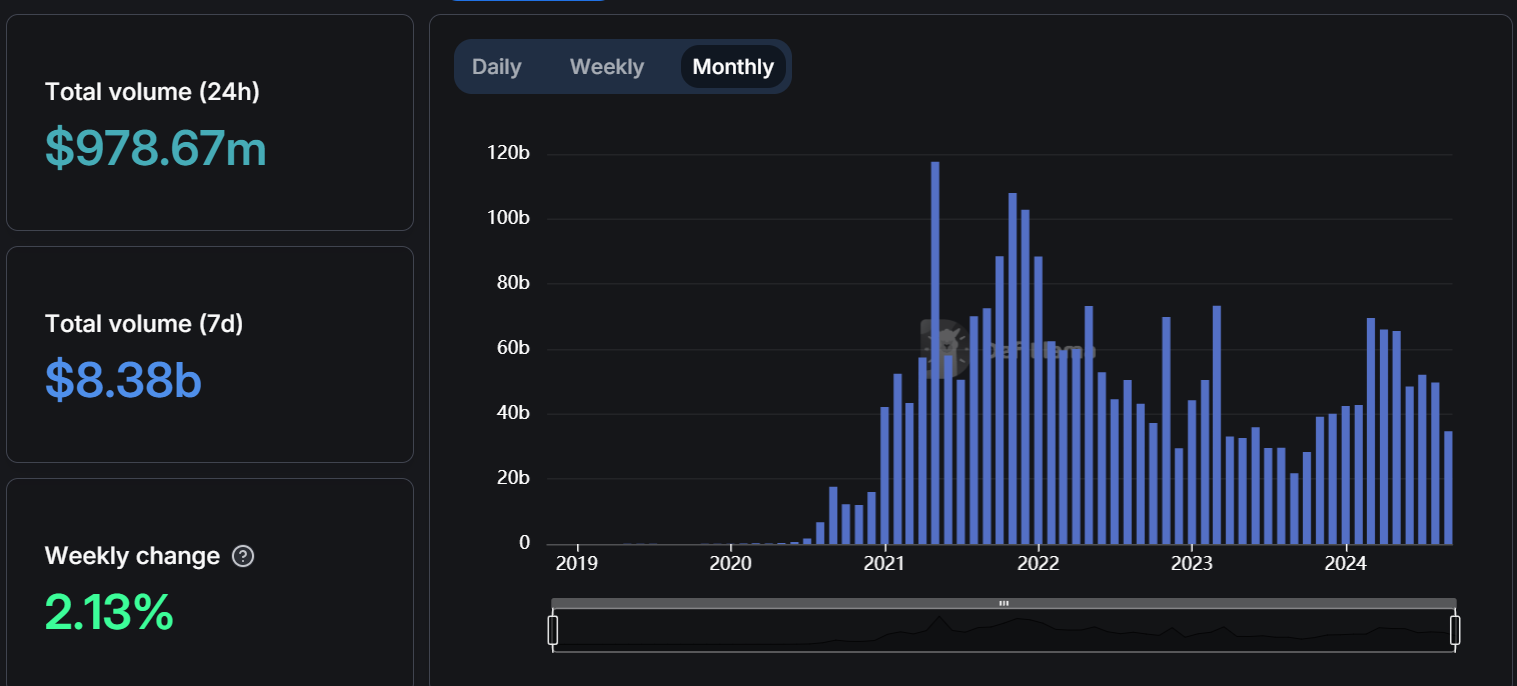

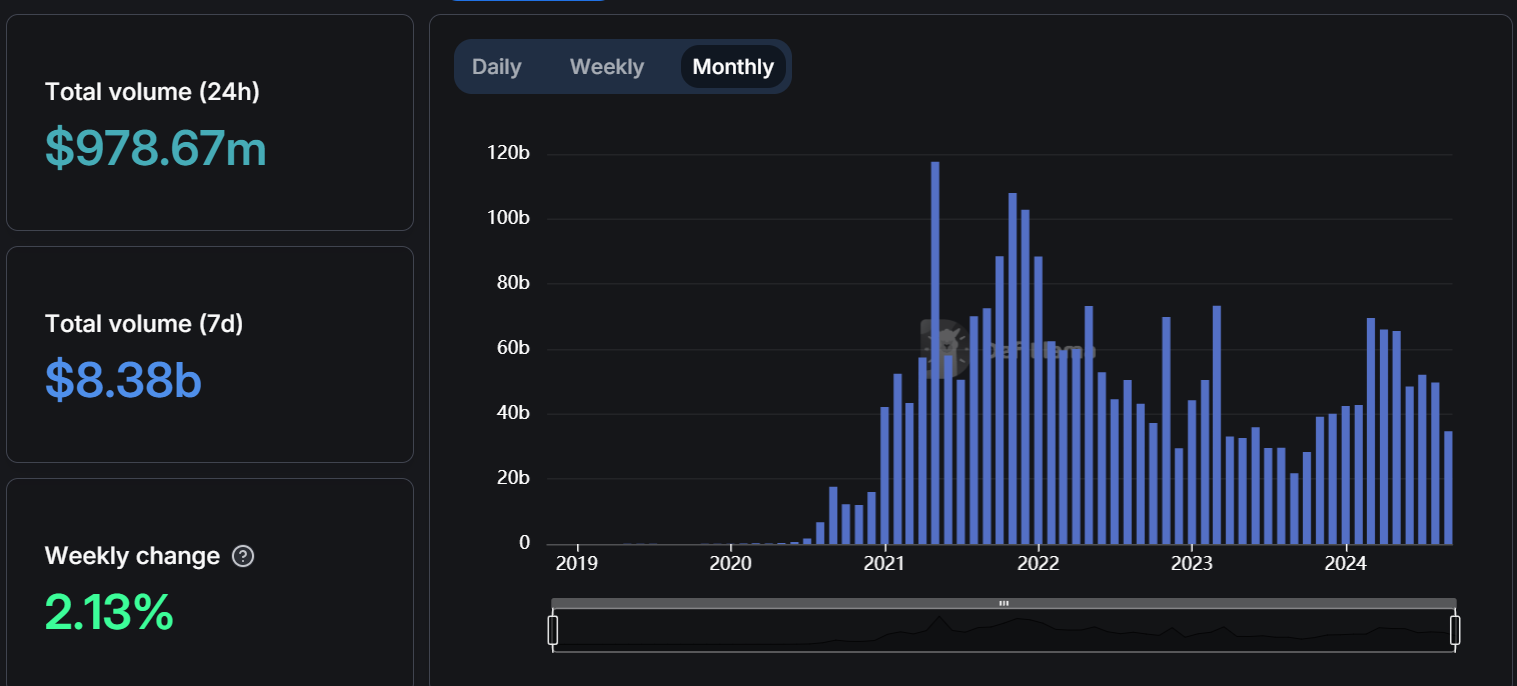

DEX trading volume surges

Another factor in the rise in Ethereum transaction fees is the surge in DEX trading volume. The total volume of ETH traded on DEX in the last 24 hours was $978 million, with weekly volume increasing by 2.13% to $8.38 billion.

The monthly volume bar also indicates steady growth in ETH transactions across DEXs. Since decentralized exchanges play an important role in Ethereum’s network activity, their growth leads to more congestion, which increases transaction costs.

Source: DefiLlama

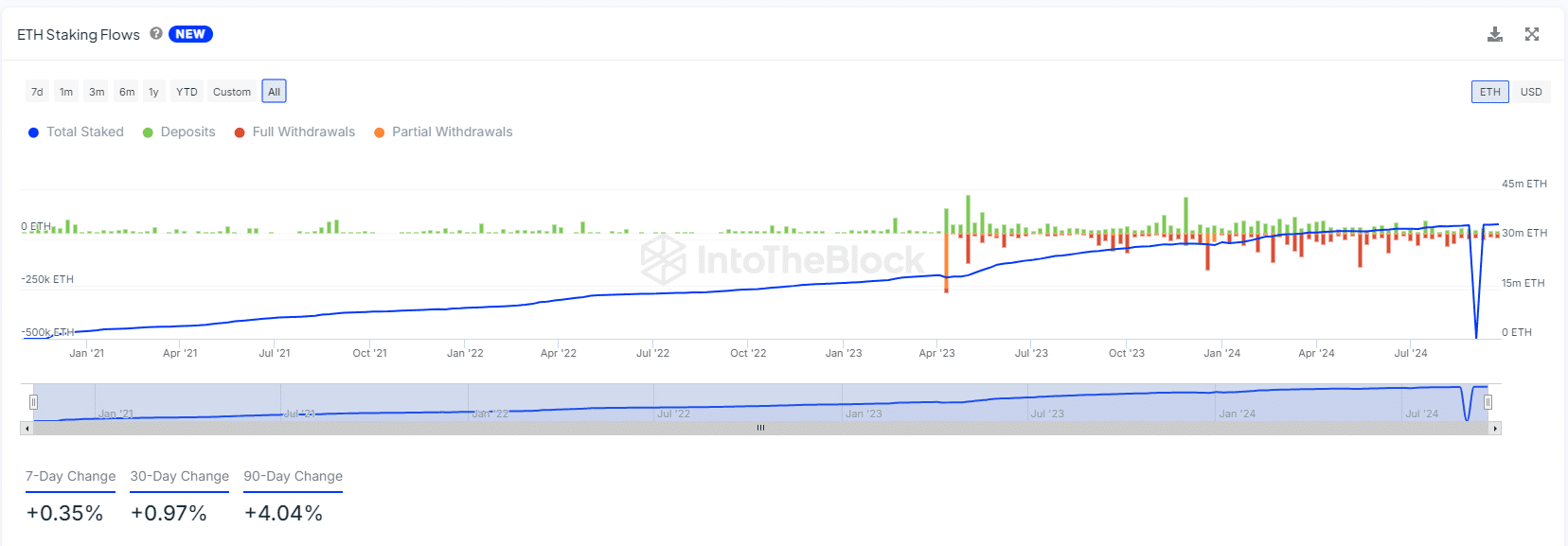

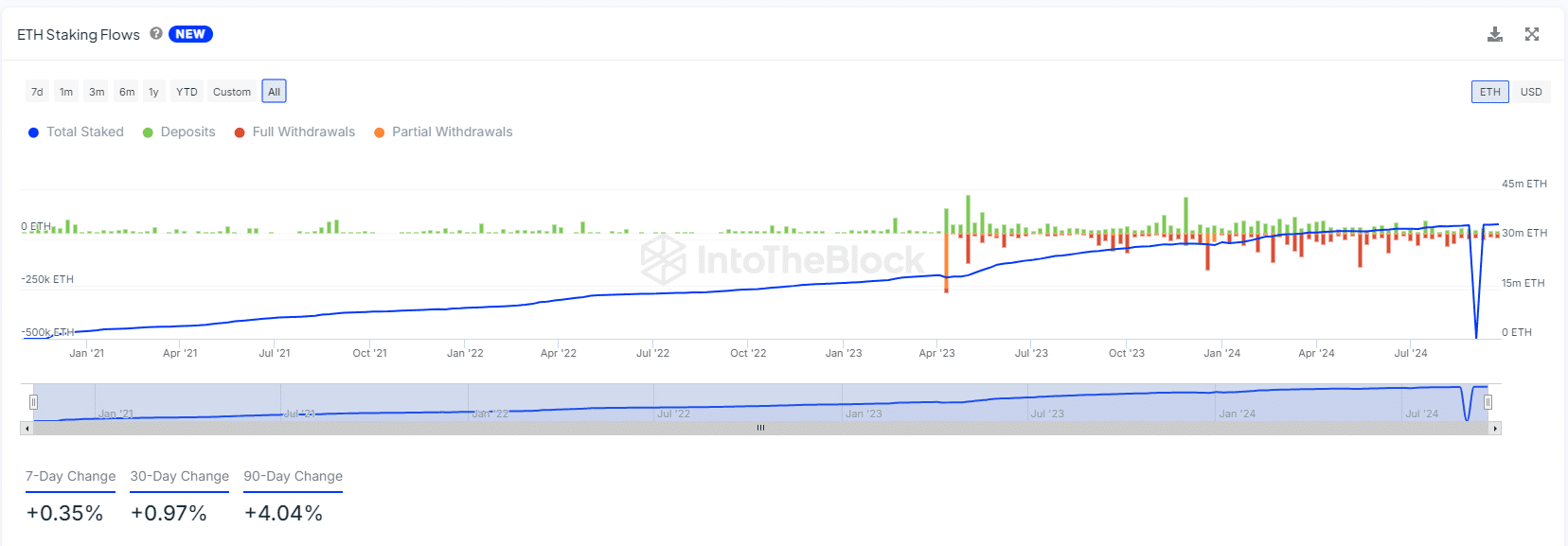

ETH staking flow

Additionally, recent changes in ETH staking flows are also contributing to fee increases. During the bear market, outflows dominated the staking landscape, reflecting the falling ETH price.

However, with outflows now balancing out inflows, there has been a shift that has led to a renewed interest in staking. Increased staking activity will result in more transactions on the Ethereum network, increasing strain and increasing transaction fees.

The total amount of staked ETH has now recovered to an all-time high after seeing a sharp decline during the previous market crash. As more people participate in staking, network congestion increases and costs increase further.

Read Ethereum (ETH) price prediction for 2024-25

Source: IntoTheBlock

Ethereum’s current price trajectory reflects increased network activity along with rising transaction fees. Key on-chain metrics such as active addresses, DEX volume, and ETH staking all influence recent price movements and fee increases.

With the broader cryptocurrency market expected to boom in the fourth quarter, Ethereum could continue to see higher prices even as users struggle with rising fees.