- Ethereum gas prices have fallen, but fees paid to validators have risen.

- ETH price fell, but network growth soared.

The recent market decline has had a major impact on Ethereum (ETH), with the price of ETH falling below the $3400 level.

Low Ethereum Gas, High Fees

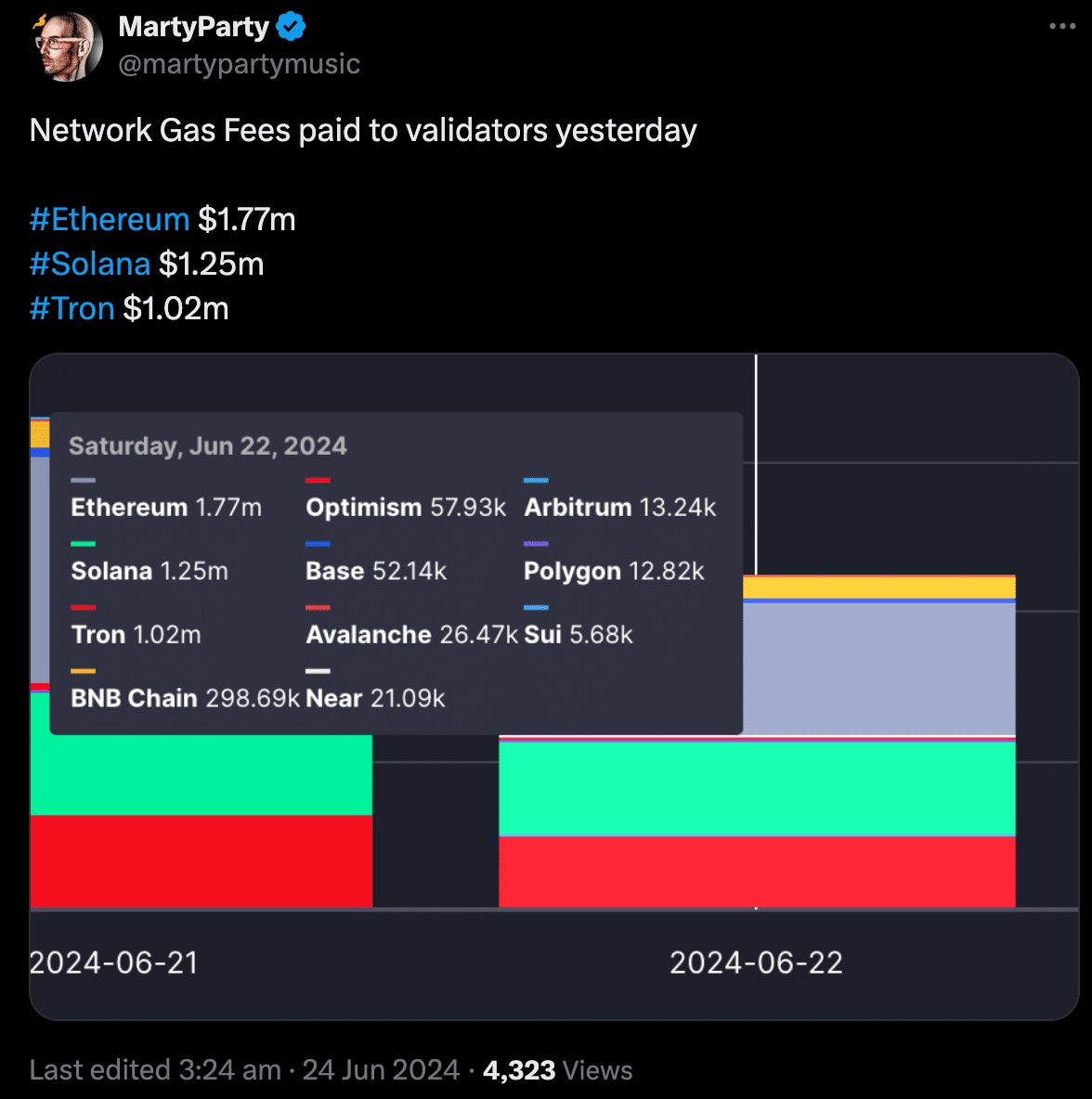

At the same time, Ethereum gas prices also fell. Despite falling gas prices, Ethereum continues to outperform other networks such as Solana (SOL) and Tron (TRX) in terms of fees paid to validators by a wide margin.

Despite falling gas prices, high validator fees could mean that network usage remains robust on Ethereum.

Even if the per-transaction fee is low, higher transaction volumes can result in higher total fees for validators.

Current validator fees may be high, but may not be enough to offset Ethereum’s overall price decline.

Source: X

As of this writing, ETH is down 4.14% in the last 24 hours. One of the reasons for the decline in ETH price may be its correlation with BTC, which has fallen significantly over the past few days.

AMBCrypto’s analysis of IntoTheBlock’s data shows that the correlation between ETH and BTC is as high as 0.78.

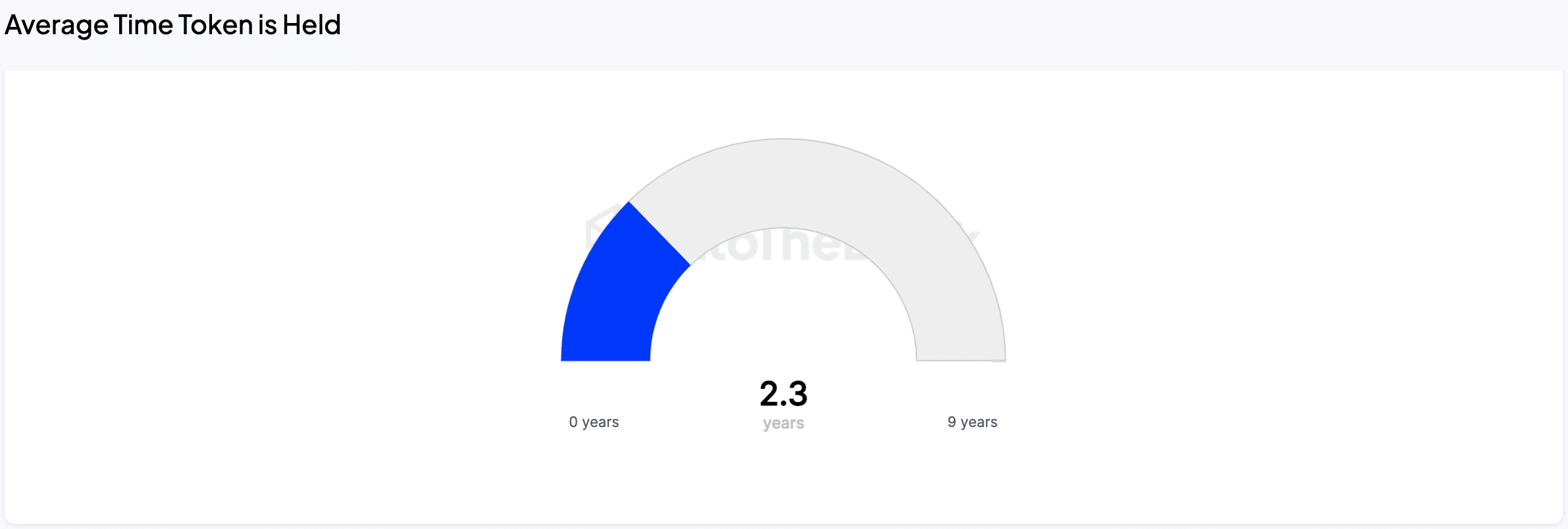

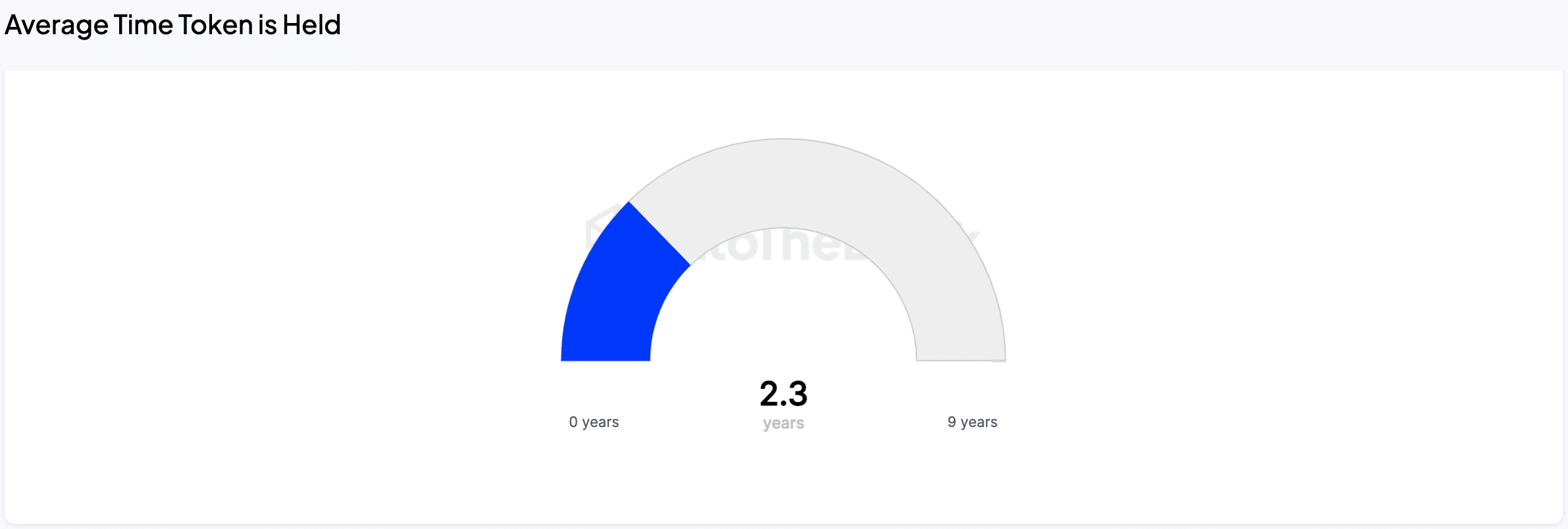

Even if the price of Ethereum (ETH) drops significantly, a significant portion of holders appear to be holding on to it for the long term. On average, investors have held ETH for a whopping 2.3 years.

This long-term view is further supported by the fact that actively traded coins are still held for an average of two months, making them reluctant to sell.

The average holding time of traded coins provides valuable insight into investor confidence.

Holding a coin for a long period of time means that the investor believes in the long-term potential of Ethereum and is comfortable holding the asset.

Conversely, frequent trading activity may indicate a focus on short-term profits and low faith in the future of the market.

Source: IntoTheBlock

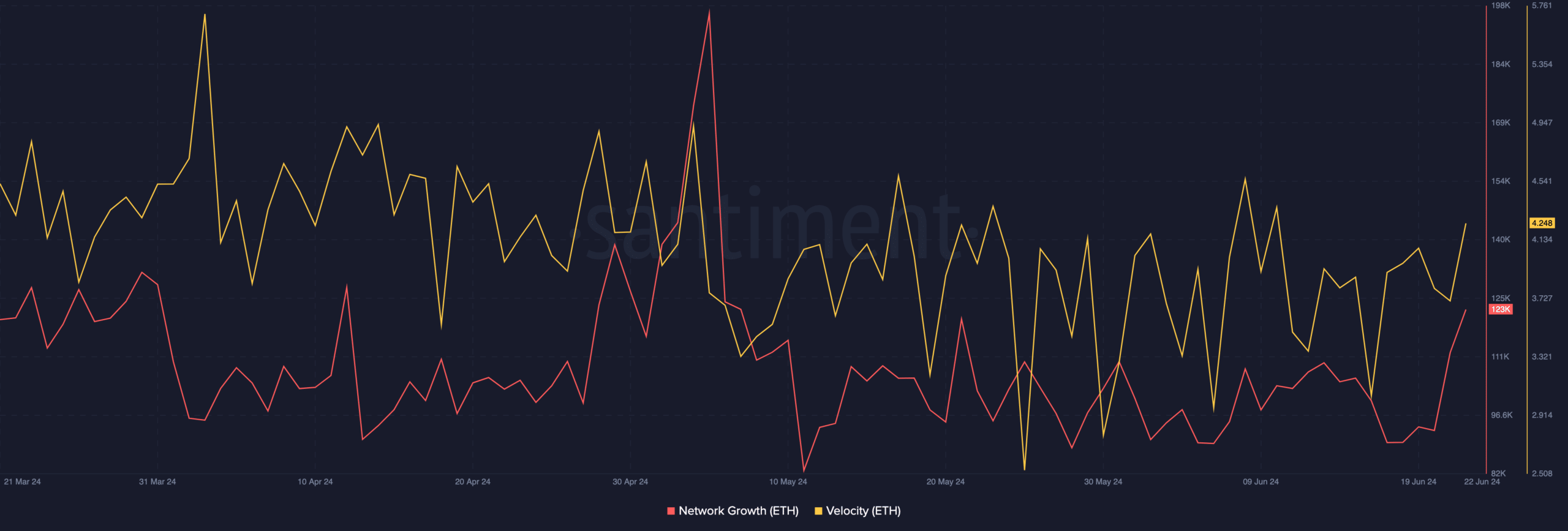

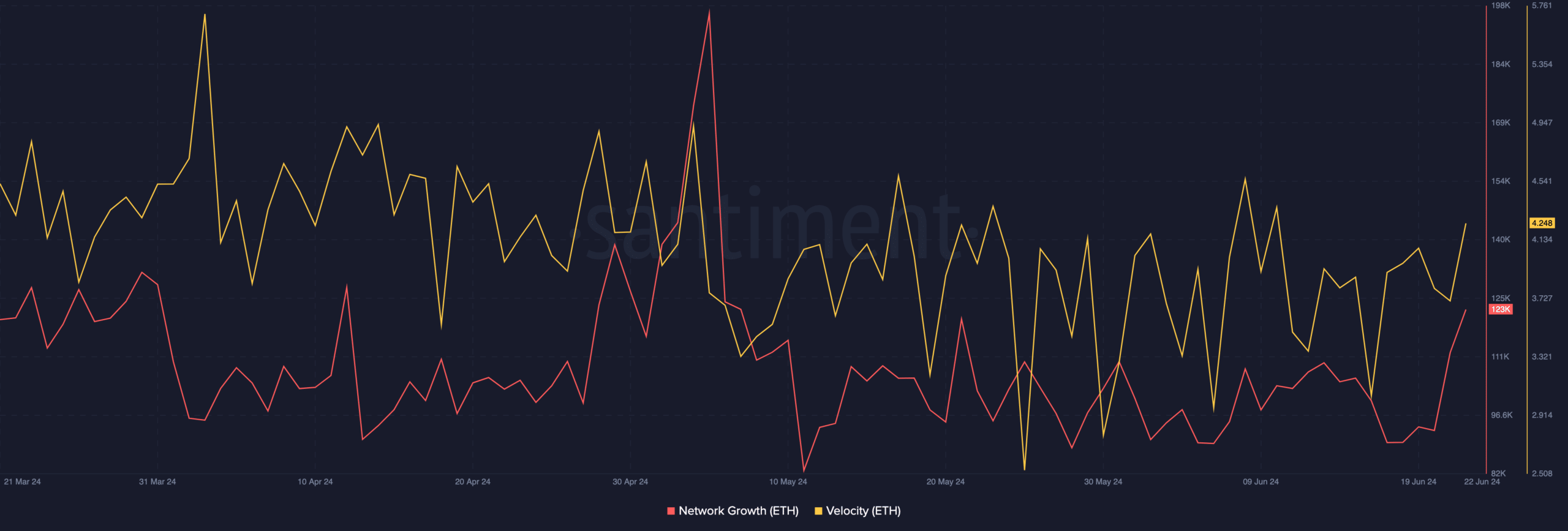

On-chain data

ETH’s network growth has increased significantly over the past few days.

Read Ethereum (ETH) price prediction for 2024-2025

Therefore, at the time of this writing, many new addresses were interacting with ETH, which means that many addresses are interested in buying ETH at the current discounted price.

Moreover, ETH transaction speeds have also increased, suggesting a surge in ETH transaction frequency.

Source: Santiment