- Recent data shows that the popularity of Ethereum has increased significantly.

- As prices remained stable, staking participation increased.

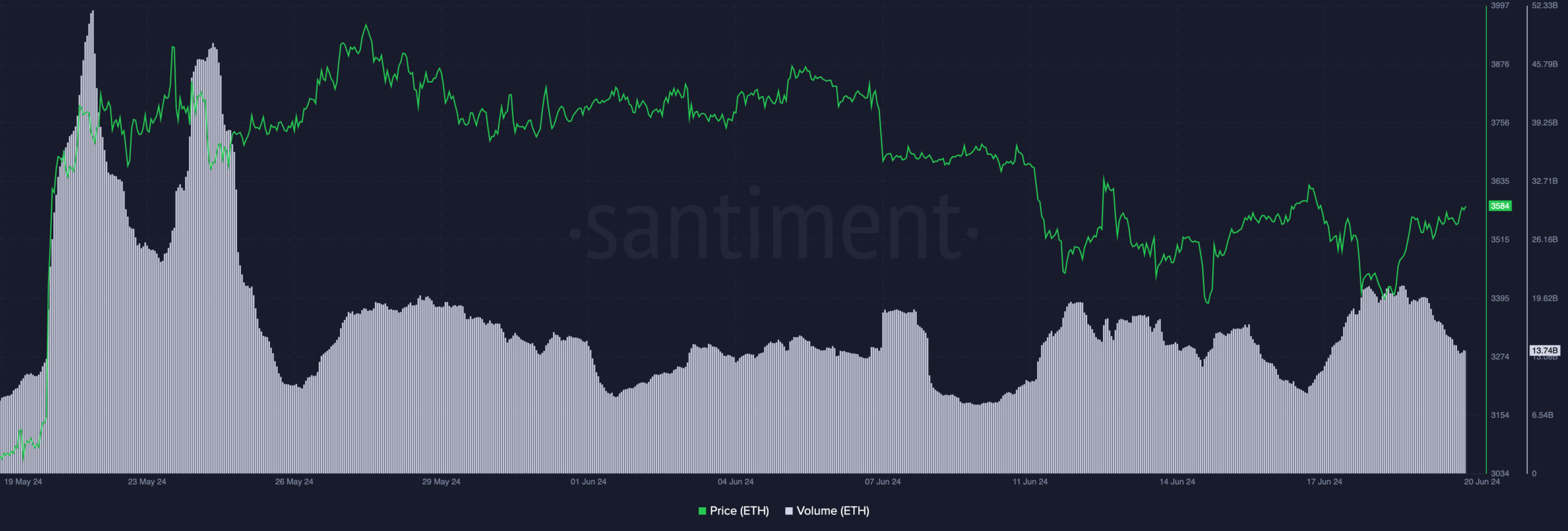

Ethereum (ETH) price has remained stagnant over the past few days. Nonetheless, traders showed interest in altcoins.

Ethereum is growing in popularity.

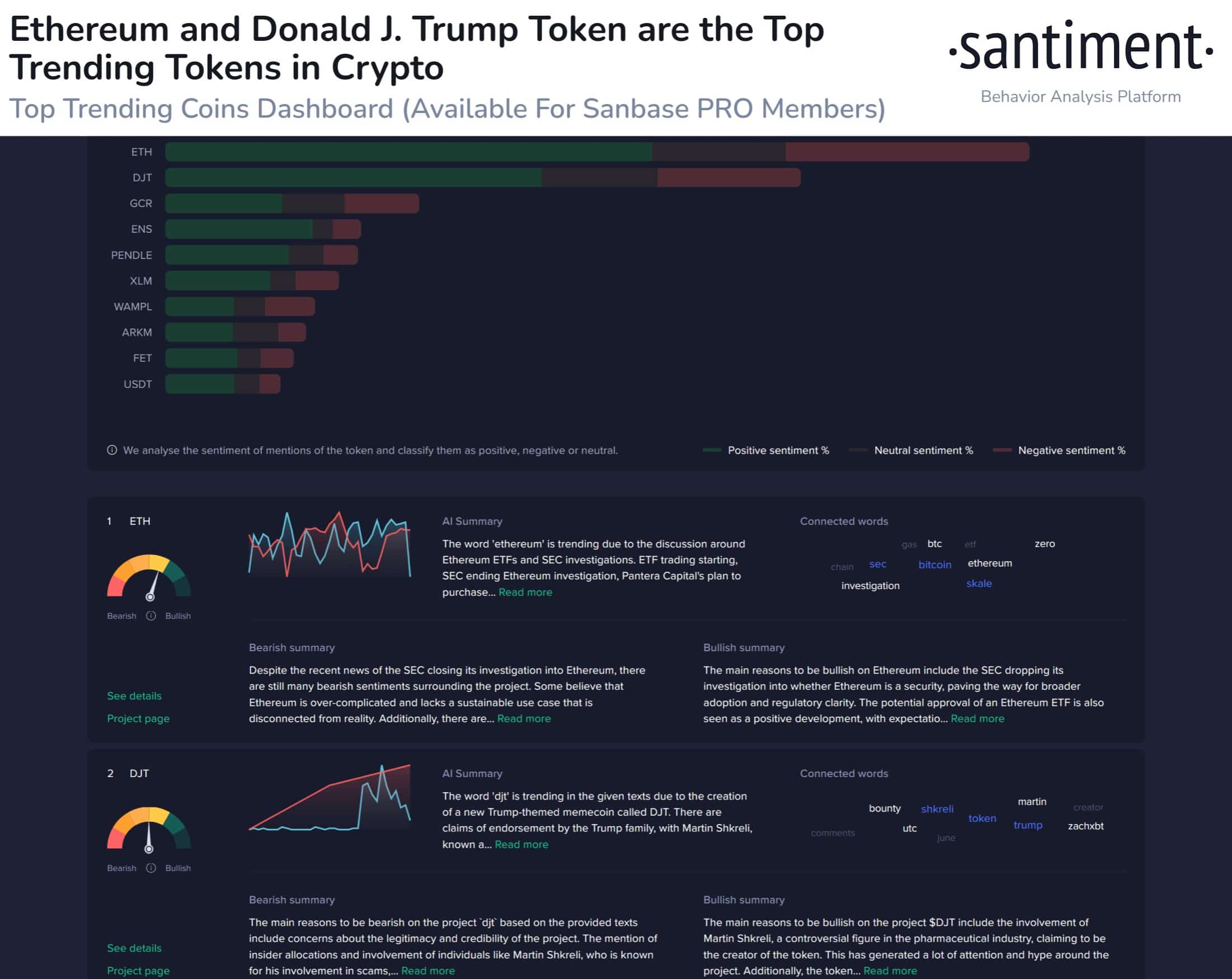

According to data from Santiment, the popularity of ETH has soared significantly over the past few days.

The current debate surrounding the Ethereum ETF, the SEC investigation, regulatory developments, and Consensys’ advocacy efforts regarding the status of Ethereum are likely contributing to this increased interest.

As interest in Ethereum grows, there have been both bearish and bullish outlooks that could lead to its popularity.

According to data from Santiment, the bearish concerns are driven by the SEC’s possible classification of Ethereum as a commodity.

The fact that the SEC is willing to track the coin despite pausing its investigation could spell trouble for the network. This could also create a hurdle for the approval of other Ethereum ETFs, which is a key driver of interest at the moment.

Additionally, the ongoing regulatory battle between Ripple and the SEC has cast a shadow, as similar actions against ETH could dampen market sentiment.

Uncertainty surrounding Ethereum’s regulatory status and potential limitations acts as a headwind for the project.

From an optimistic perspective, there were many things in Ethereum’s favor. For example, it was a huge boost when the SEC stopped its investigation and effectively cleared the ETH sale into securities.

This news led to a surge in ETH-related altcoins and a more stable market environment.

Additionally, the development of cross-chain bridges connecting Ethereum with other blockchains has seen continued growth and adoption within the Ethereum ecosystem.

Source: Santiment

Staking Status

In terms of staking, it was observed that ETH’s staking participation rate increased significantly. However, the volatility of staking returns has expanded significantly.

In general, higher participation rates are better, but high volatility in returns can be a deterrent for some stakers looking for predictable returns.

Read Ethereum (ETH) price prediction for 2024-2025

This volatility may be caused by factors such as changes in network fees (MEV) or changes in the total amount of ETH staked.

Source: IntotheBlock

At press time, ETH was trading at $3,587.52. In the last 24 hours, the price of ETH has increased by 0.67%. However, during the same period, ETH’s trading volume decreased by 27%.

Source: Santiment