- ETH may see a relief rally in September.

- However, according to analysts, losses are likely to occur for the altcoin in the fourth quarter.

Ethereum (ETH) The price has been consolidating above $2,500 for more than a week, which is a boring situation for cryptocurrency traders who buy on volatility.

However, according to renowned cryptocurrency analyst Benjamin Cowen, the largest altcoin could only experience a brief recovery in September before seeing further losses in Q4. Cowen’s projection Based on similar ETH patterns observed in 2016.

‘#ETH / #USD monthly candles are tracking 2016 perfectly. If this continues, #ETH will be green in September and red in October-December.’

Source: X

What will happen to the price of ETH in the future?

However, QCP Capital warned that ETH could fall further if the Fed makes a significant downward adjustment in September.

‘A significant downside correction or a particularly dovish Powell could see a two-week rally reverse and #BTC and #ETH fall below support levels.’

Interestingly, the above Mixed ETH views have been prevalent across the crypto community for some time now, with both the ETH bear and bull camps making strong arguments about the price outlook, adding to the uncertainty.

However, Cowen pointed out that there is a possibility of a significant increase in ETH in early 2025.

‘Then in 2025 #ETH will briefly turn green.’

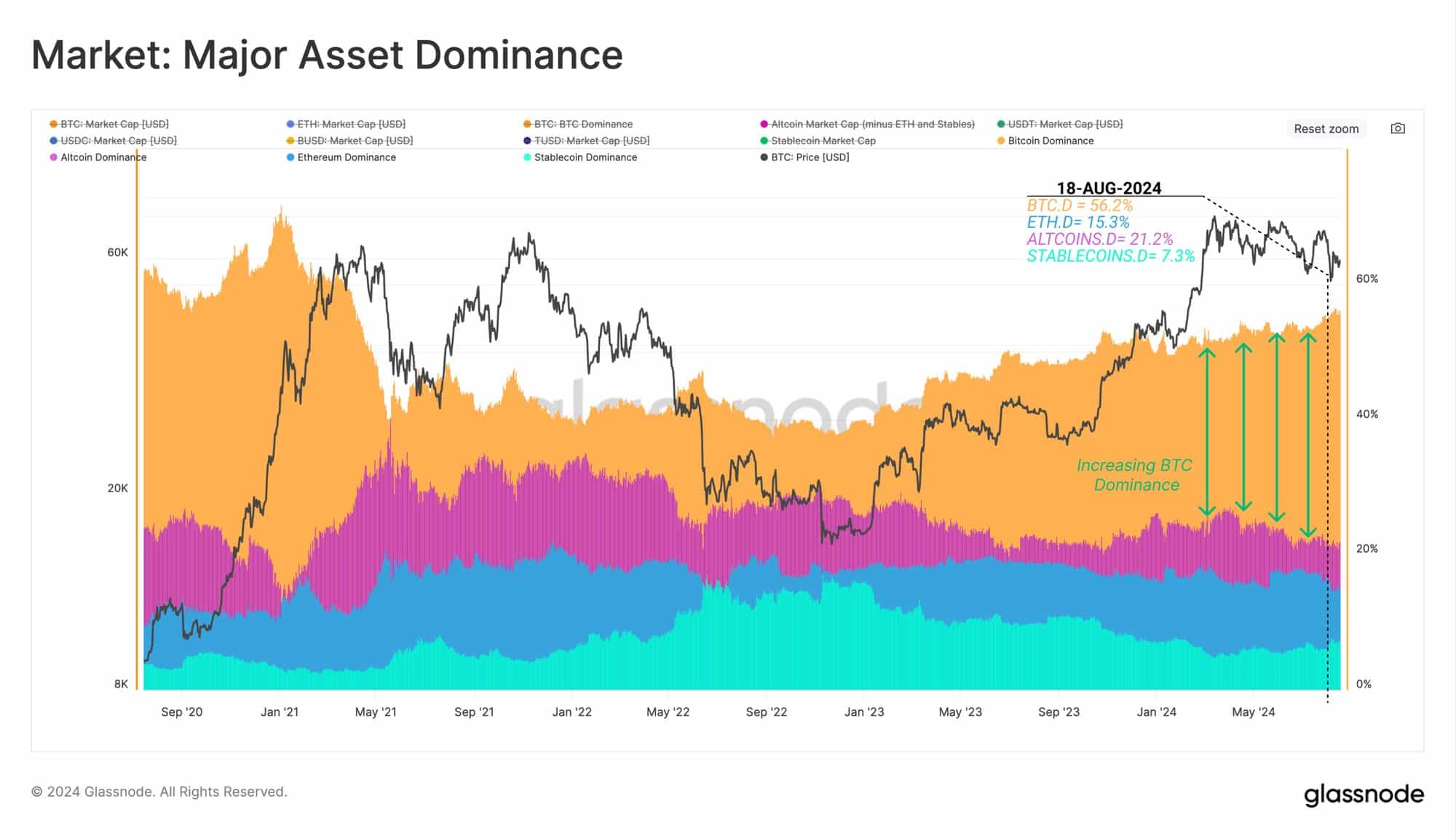

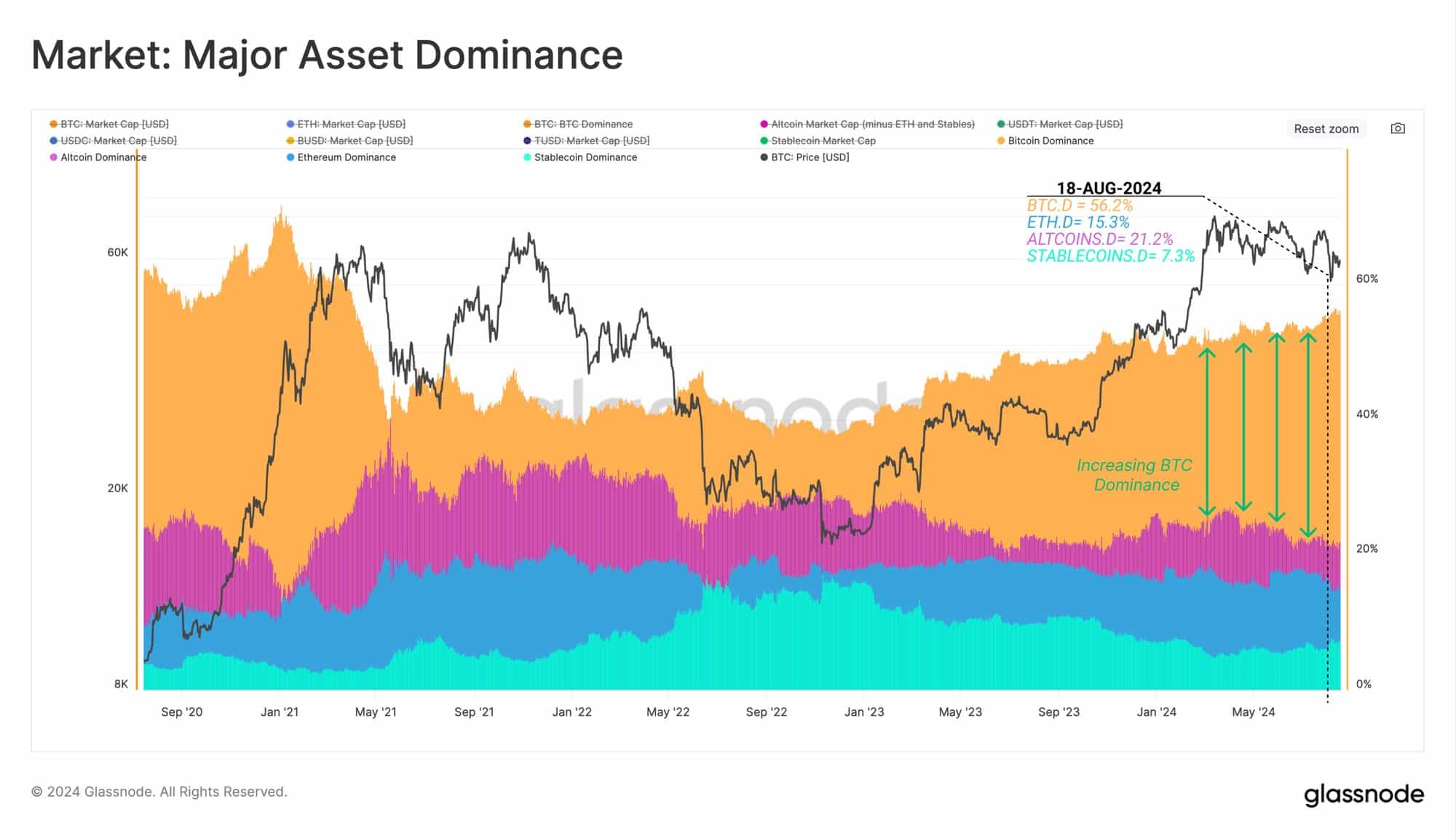

Meanwhile, Glassnode Highlighted Ethereum’s market dominance has fallen from 16.8% to 15.2% since the cryptocurrency bottomed in late 2022.

‘Ethereum, the second largest asset in the ecosystem, saw a 1.5% decline in dominance, remaining relatively flat over the past two years.’

Source: Glassnode

In contrast, Bitcoin (BTC) dominance surged from 38% to over 56% over the same period, highlighting the potential for capital to circulate to the largest digital asset.

Interestingly, even the approval of a US spot ETH ETF did not increase ETH’s market dominance, despite the ETF posting net profits. outflow Since its debut, BlackRock’s ETHA has seen a massive rally, with ETHA recording $1 billion in net inflows in a month.

ETH Price Analysis

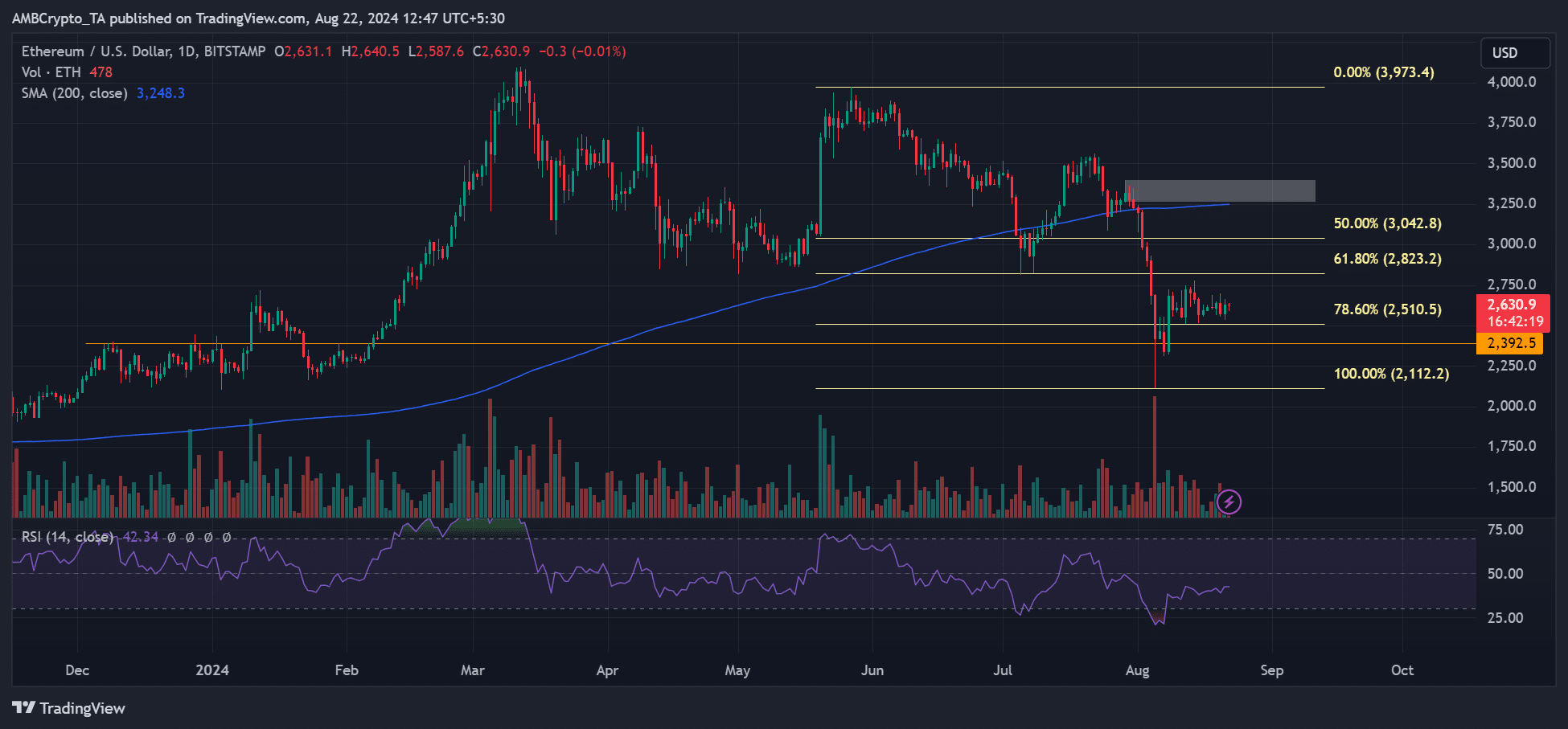

Source: ETH/USD, TradingView

On the price chart, demand has improved since the August 5 crash, as shown by the RSI (Relative Strength Index), which has risen above the sell-off zone. However, demand is not above average, indicating a lack of strong momentum in price.

So the key short-term support levels to watch were $2500 and $2300, which are on the downside of the price action. Conversely, if sentiment improves, $2.8k and $3k are important short-term bullish targets.