- ETH attracted lower investor interest compared to BTC and SOL.

- ETH could see renewed interest in 2025, according to a cryptocurrency hedge fund.

Ethereum (ETH) Record FUD is making this cycle difficult and investor attention has shifted elsewhere.

According to Zaheer Ebtikar of cryptocurrency hedge fund Split Capital, ETH is lagging behind other companies due to “middle school syndrome.”

“$ETH suffers a lot from middle-aged syndrome. “This asset is out of vogue among institutional investors, has fallen out of favor in the crypto private capital community, and you will never see retailers bidding on it at this scale.”

Investors Abandon ETH

Among the cryptocurrency majors, ETH has only offered investors 8% on a year-to-date (YTD) basis. Bitcoin (BTC) and Solana (SUN).

Ebtikar linked the poor performance to investors focusing on BTC and other ETH competitors such as SOL. SUI.

He noted that there are three sources of capital in the cryptocurrency industry: institutional (via ETFs/futures), private capital (liquid funds, VCs), and finally retail. But for now only the first two mattered.

He added that institutional capital is concentrated in BTC (via ETFs). The ETH ETF is as follows: net negative flow It was emphasized that interest was low at $546 million since its debut last July.

On the other hand, Ebtikar said private capital viewed ETH as overvalued and redirected capital to other ETH competitors that were perceived as undervalued, such as SOL, Celestia (TIA), and SUI.

“$ETH can simultaneously support other index assets such as $SOL and other large-caps such as $TIA, $TAO, and $SUI, while also being too large for the underlying capital to support.”

Coinbase analysts also echoed The September report echoes the sentiment above.

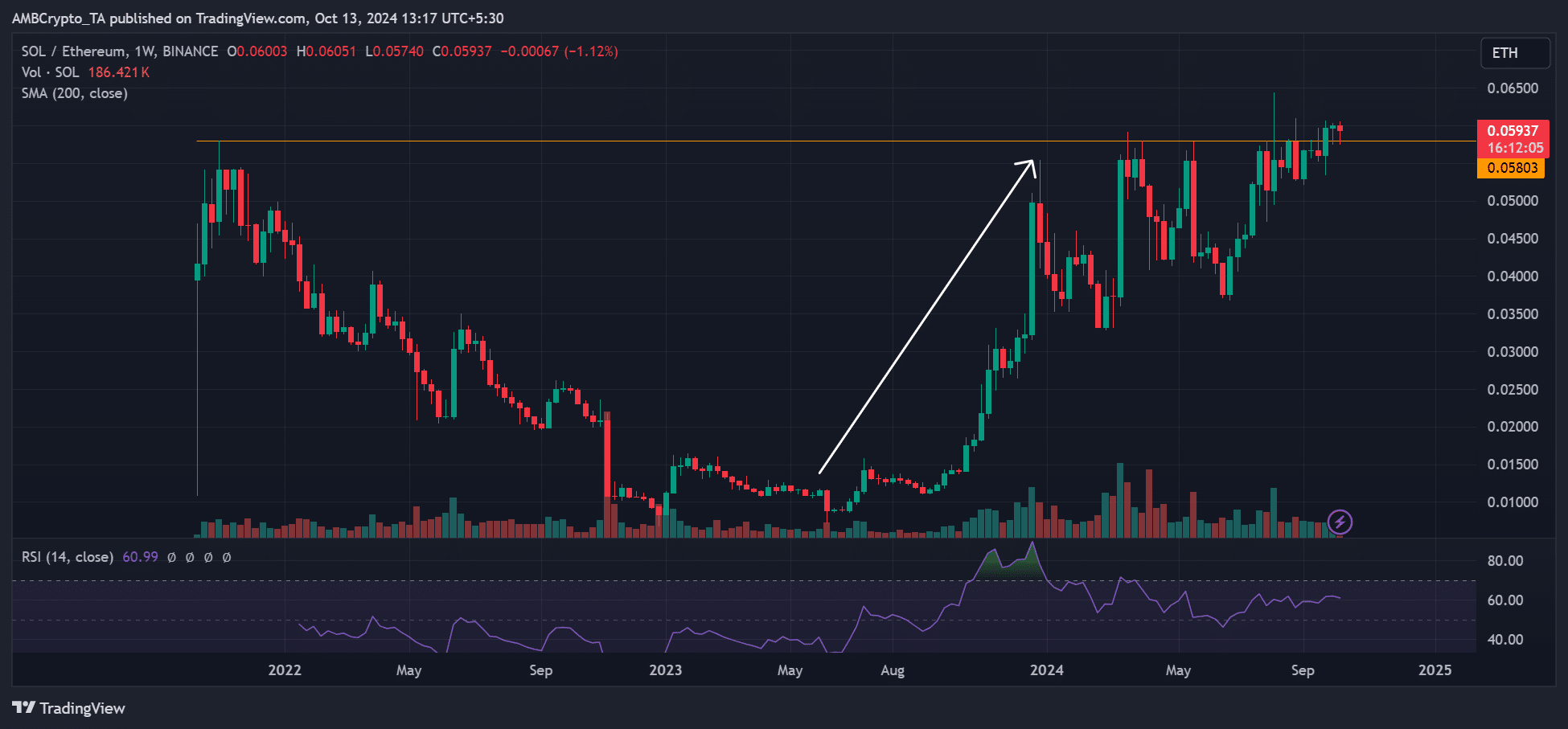

Source: SOLETH Ratio, TradingView

The SOLETH ratio, which tracks the value of SOL against ETH, has exploded since last year, solidifying Ebtikar’s claim that investors may have switched from ETH to SOL.

That said, Ebitaker acknowledged that ETH is the only altcoin with an approved ETF in the US.

He therefore expects that from 2025 onwards, this asset could receive renewed interest, especially from institutional investors.

He cited increased demand from ETF buyers, changes within the Ethereum Foundation, and Trump’s victory.

At press time, ETH was valued at $2.4,000 and has been consolidating between $2.3,000 and $2.5,000 since early October.

Source: ETH/USDT, TradingView