- A bullish triangle pattern could see ETH break above $3,350.

- Unenthusiastic demands can hurt your chances of breaking through

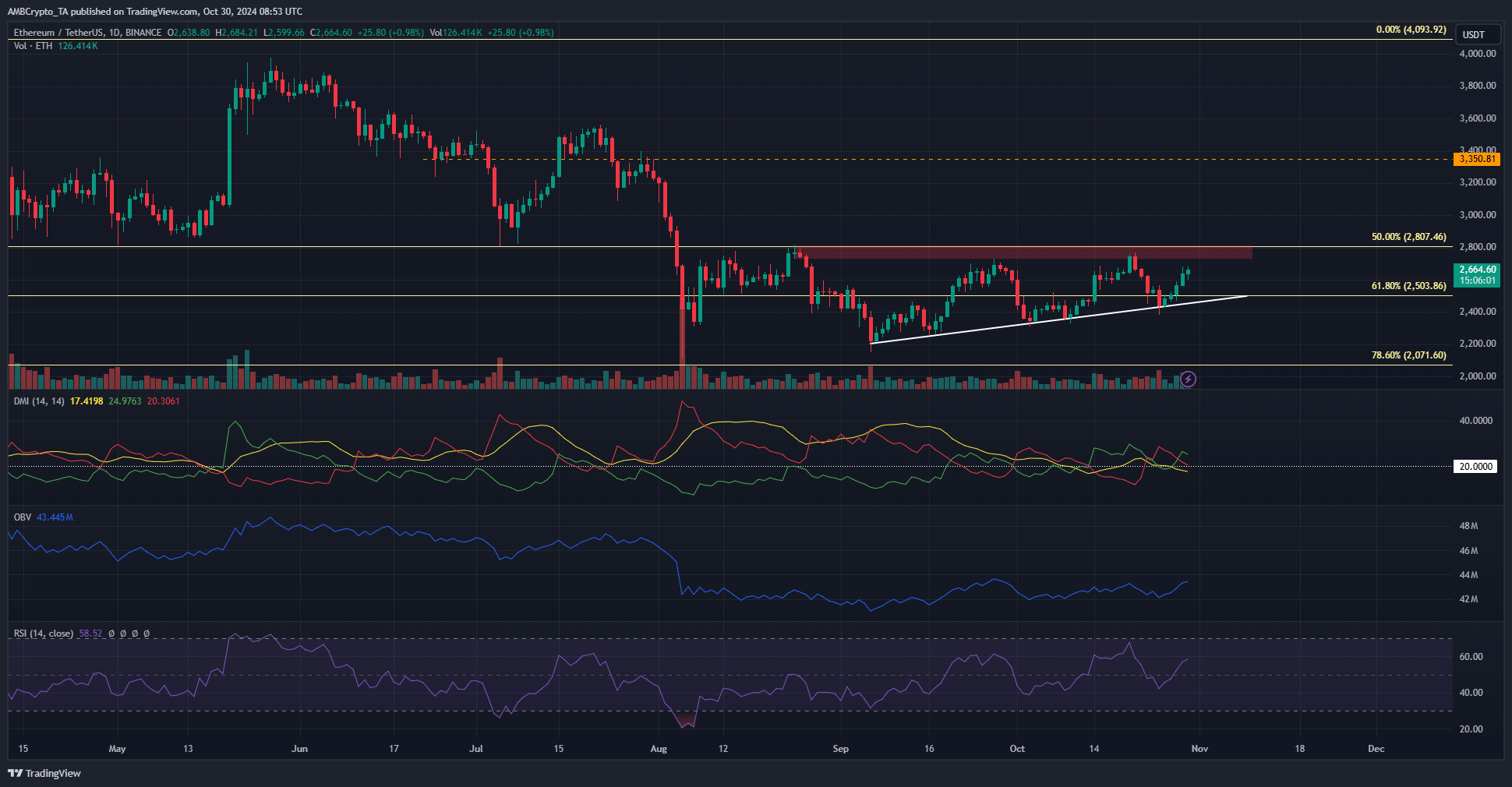

Ethereum (ETH) is trading below resistance at $2.8k, unbeaten since August. The recent upward trend has been slow and lacked explosive momentum, but it has been gradually rising since September.

Negative exchange net flows indicated accumulation was underway, but it was unclear whether this would be enough to push prices above three-month highs.

Ascending triangle pattern promises $3.3,000 for ETH

Source: ETH/USDT on TradingView

Since September, Ethereum has been making a series of higher lows. It failed to break above the $2.8,000 resistance zone, forming an ascending triangle pattern. OBV has been trending slowly upward over the past two months, but remains well below the levels it maintained in June and July.

This tepid demand could dampen the size of the breakout. As things stand, a daily session closed above $2.8,000 would ideally reach the $3,350 level.

This breakout may not be imminent and may take a few days to materialize. There was also a possibility of a drop to $2,500. RSI was bullish but did not show a clear trend in October. DMI agreed and at press time ADX (yellow) had fallen below 20.

More volume concerns in lower periods

Source: Coin Analysis

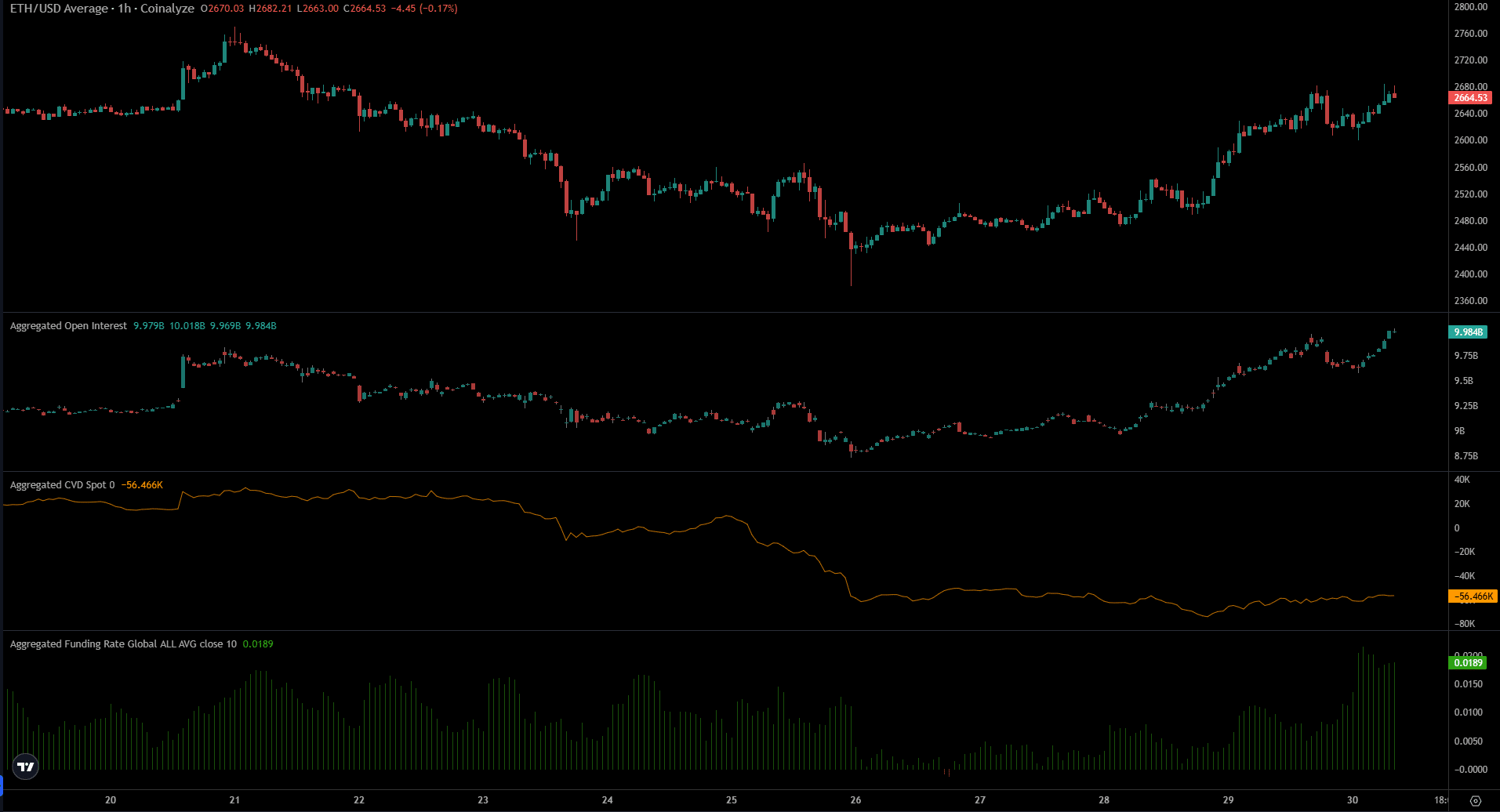

Open interest and price have shown a strong upward trend over the past three days. The funding rate also surged over the past 24 hours. Together they expressed a solidly optimistic belief in the lower period.

Is your portfolio green? Check out our Ethereum Profit Calculator

However, despite ETH rising 9.4% since October 26, spot CVD has failed to rebound. The lack of spot demand coupled with the weakness shown by OBV has raised questions about the strength of the bulls.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.