Ethereum’s Layer 1 network revenue has been in steep decline, plummeting 99% since March 2024.

According to data from Token Terminal, network revenue peaked at over $35 million on March 5. However, by September 2, daily revenue had plummeted to around $200,000, a yearly low.

Market observers attribute the decline to the growth of Layer 2 (L2) networks and the March Dencun upgrade, which reduced L2 transaction fees and restructured Ethereum’s revenue structure. Token Terminal said:

“A key indicator of how lower transaction fees on L2 have driven increased usage, but reduced revenue on L1.”

Since the upgrade, trading activity has shifted from the Ethereum mainnet to the L2 network, which has led to an increase in the platform’s daily trading volume and active users.

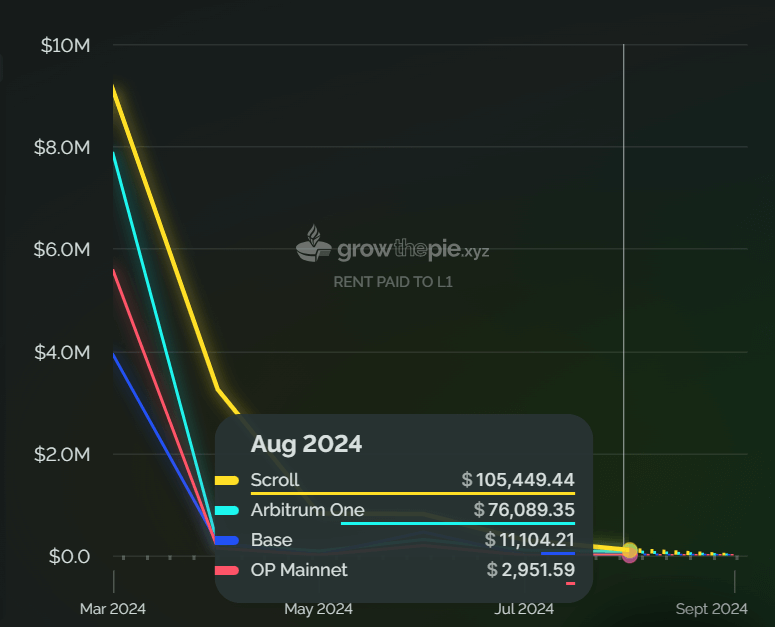

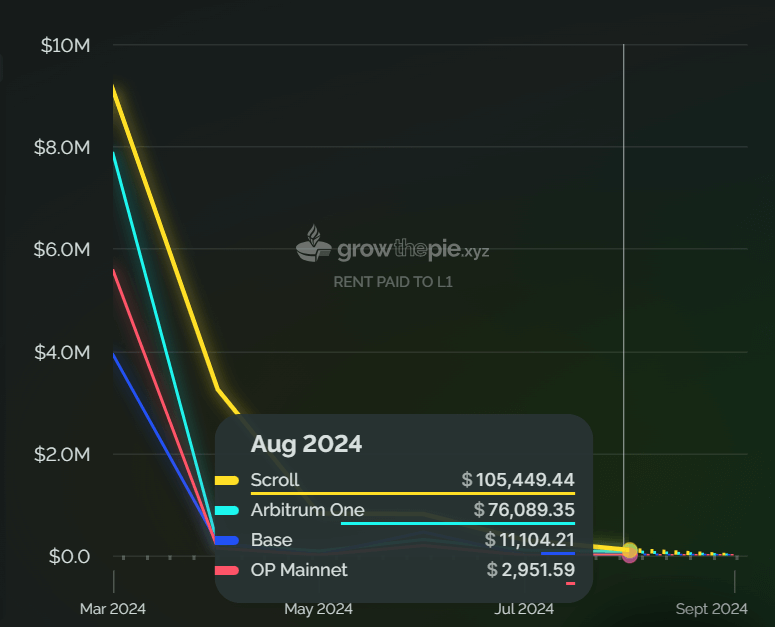

However, this migration has had a significant impact on Ethereum’s fee revenue. For example, Coinbase’s L2 network, Base, generated $2.5 million in revenue in August but only paid $11,000 to settle on the mainnet, highlighting the shift in value on Ethereum’s base layer.

Crypto analyst Kuhn warned that if this trend continues, L2 networks could dominate and potentially abandon the Ethereum mainnet, especially for consumer applications. He stressed that Ethereum needs to develop valuable use cases on the mainnet or it risks serious valuation problems.

He added:

“Either ETH L1 needs a valuable use case on the mainnet that can’t be sieged, or the L2 usage is so large that you basically need 100,000x the usage on L2 to get the same value you got on the mainnet, which creates a valley in the valuation problem.”

‘Spiral of Death’

Bitcoin investor Fred Krueger echoes these concerns, saying that if Ethereum’s low yields continue, it could face a “death spiral.”

He noted that Ethereum currently generates $200,000 in daily fee revenue, which equates to $73 million annually and is nowhere near enough to sustain a market cap of $300 billion.

Kruger argues that a more realistic valuation could be closer to $3 billion, highlighting the disconnect between Ethereum’s fee revenue model and its market valuation. He said:

“(Ethereum) is not the equivalent of a company that makes $73 million a year in profit, and it’s not the equivalent of a company that makes $73 million a year in revenue. That $73 million is Not enough “It’s about buying back all the inflation that naturally occurs to ETH validators.”