NFT trading volume begins to decline.

Over the past month, total sales of Ethereum NFTs have decreased by 55%. Popular Ethereum NFT collections such as Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Crypto Punks have seen significant declines of over 40% in terms of sales and floor prices.

NFTs on other networks such as Solana and Bitcoin were gaining traction compared to the Ethereum network.

Source: Crypto Slam

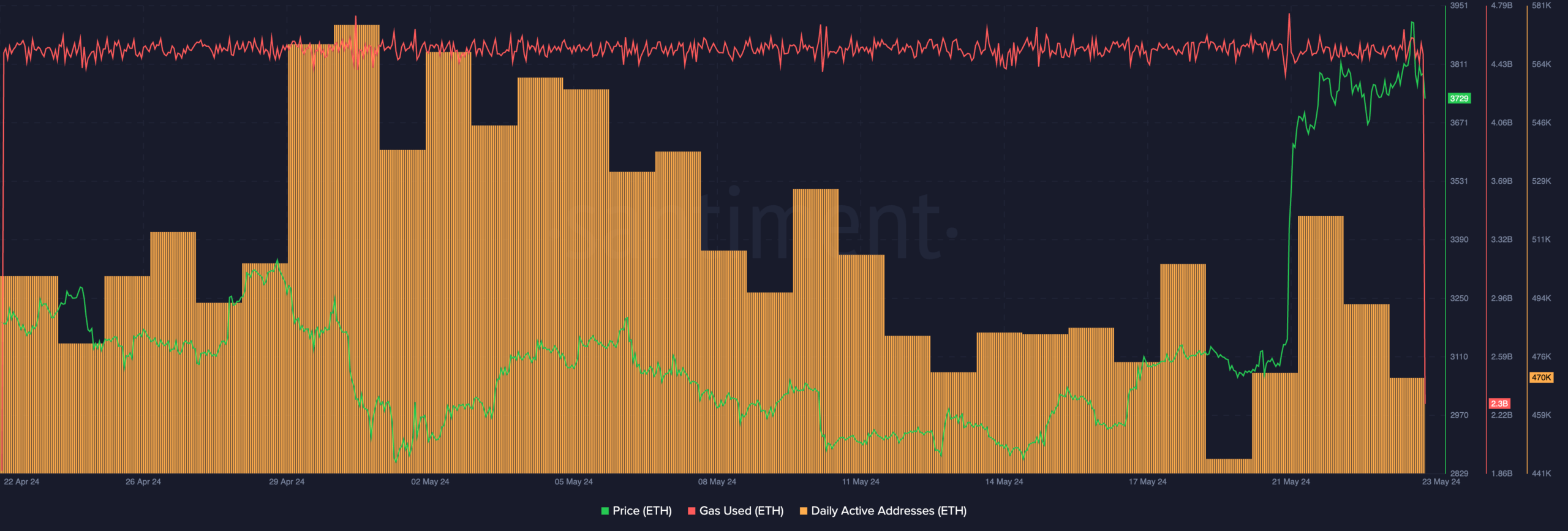

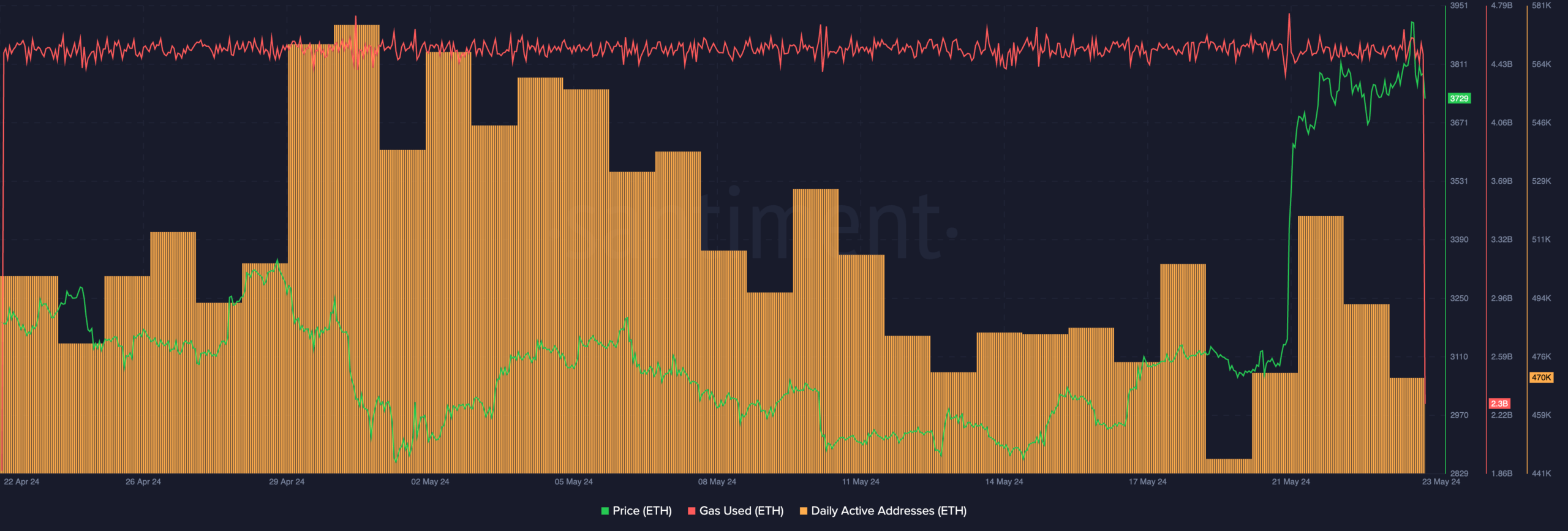

Moreover, daily active addresses on the Ethereum network have also decreased significantly over the past few days, along with the network’s gas usage, implying a decrease in overall activity in the Ethereum ecosystem.

This could be a sign that the popularity of Ethereum as an ecosystem is waning significantly.

Even though the hype surrounding the ETF has increased interest in ETH and its price has risen, a decline in interest in the Ethereum ETF could spell trouble for ETH in the long run.

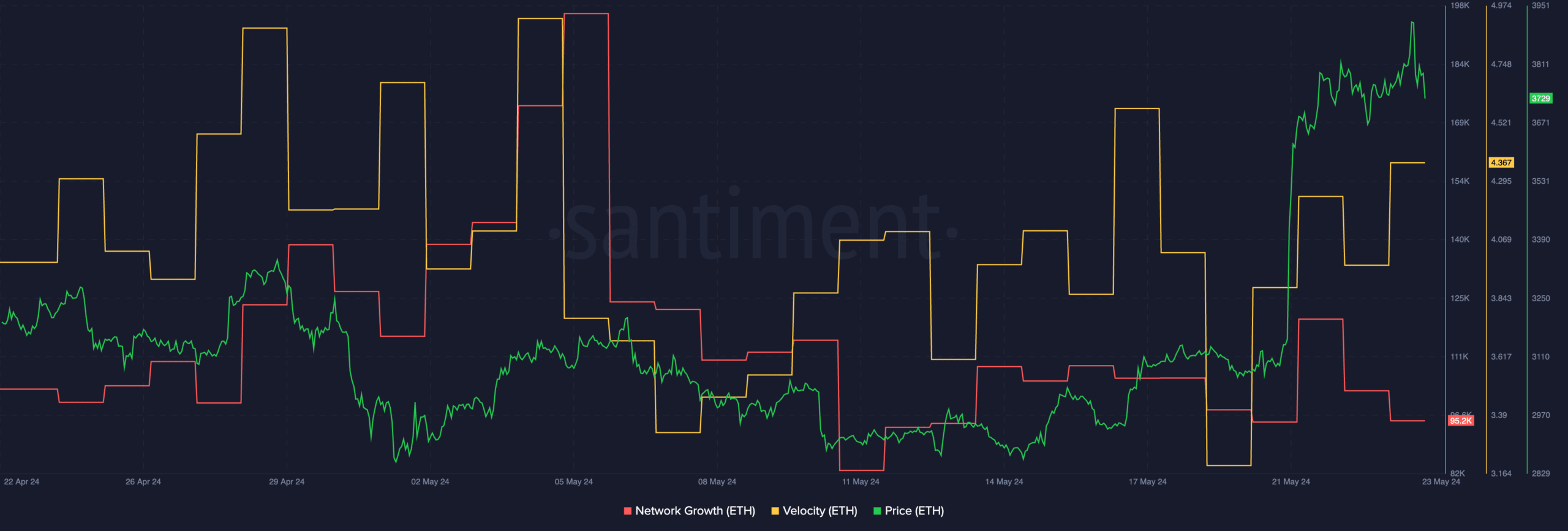

Source: Santiment

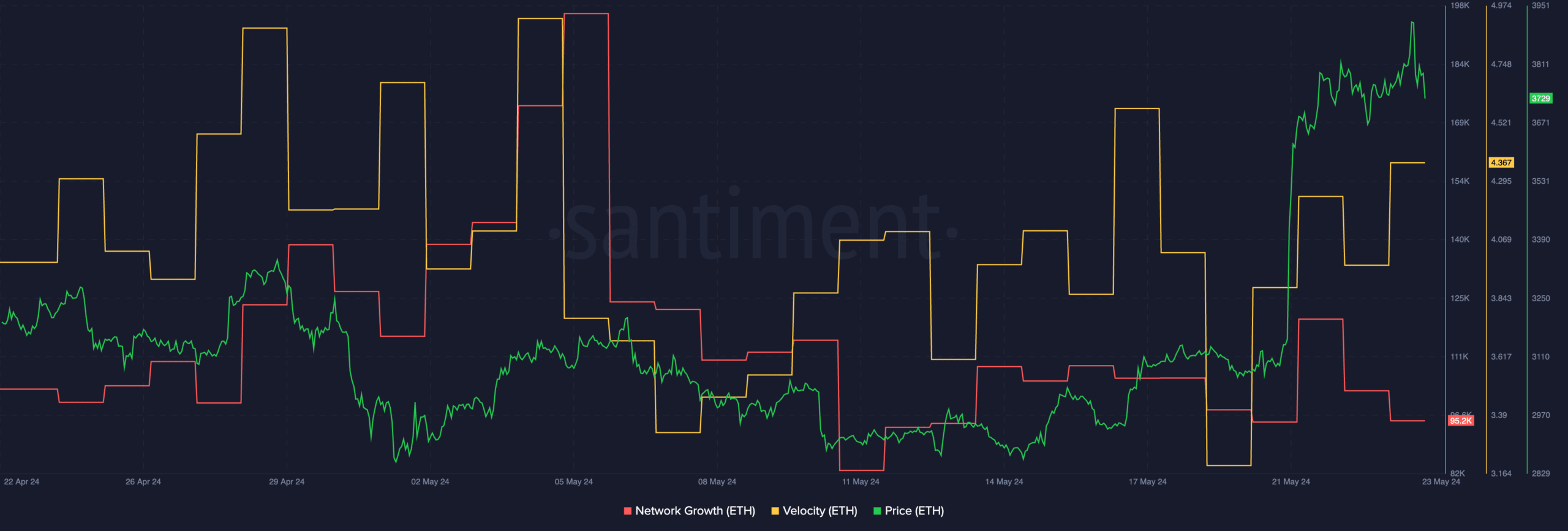

At press time, ETH was trading at $3,786.76, down 0.68%. Network growth around the ETH token has decreased significantly, meaning the number of new addresses interested in ETH has decreased dramatically.

The lack of interest in new addresses means that the market is not ready to buy ETH at current prices.

Some bulls may wait for a correction before accumulating more ETH in the future.

Additionally, the speed at which ETH is being traded has increased, indicating that the frequency at which ETH is being traded has increased.

Only time will tell whether the price movement of the ETH company is related to the pace of the rise, which may give bulls hope for the future.

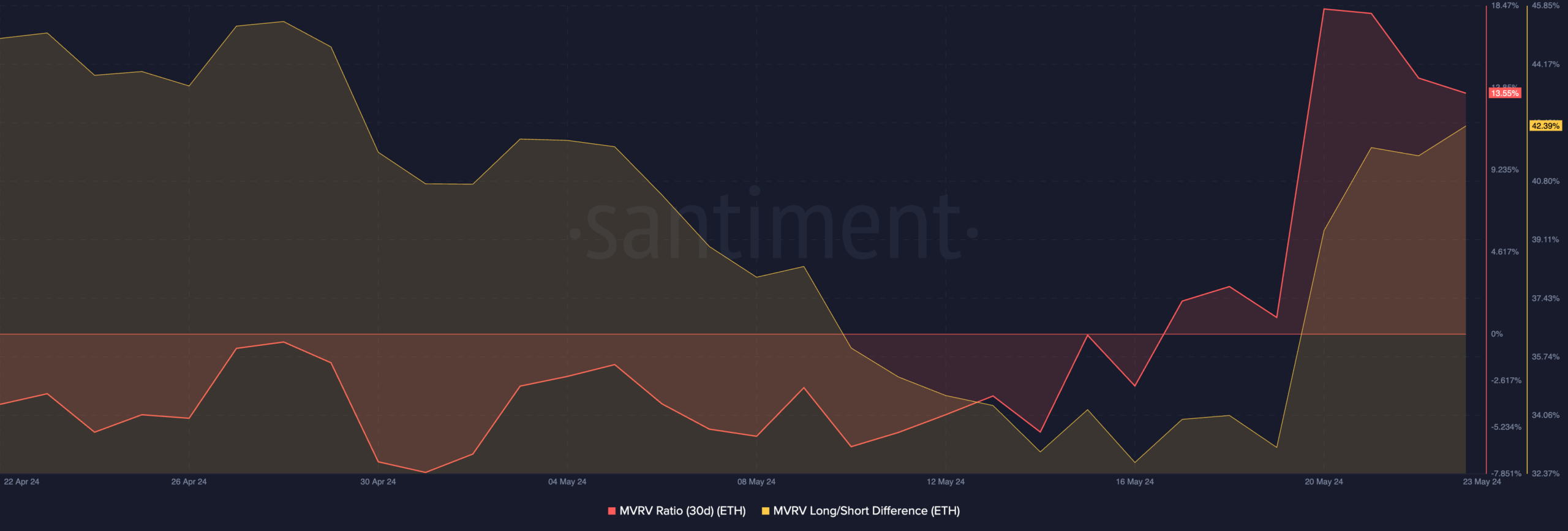

Source: Santiment

Is your portfolio green? Check out our Ethereum Profit Calculator

How are addresses maintained?

Looking at the status of holders, we see that most addresses are profitable, as evidenced by ETH’s high MVRV ratio.

A higher MVRV ratio means that more holders are incentivized to sell their holdings, but the presence of long-term holders, indicated by a high long/short differential, means that a large sell-off may not occur anytime soon.

Source: Santiment