Ethereum (ETH) is an indicator of the ebb and flow of the industry. As of press time, Ethereum is trading at $3,174 and the price is trying to reach the critical $3,000 mark. But beneath the surface of these seemingly stable waters lies a complex interplay of market forces and investor sentiment.

Source: CoinMarketCap

Aether’s challenging trajectory

Since last week, the psychological threshold of $3,000 has been repeatedly violated in the sub-period, and enthusiasm surrounding the altcoin king has waned significantly.

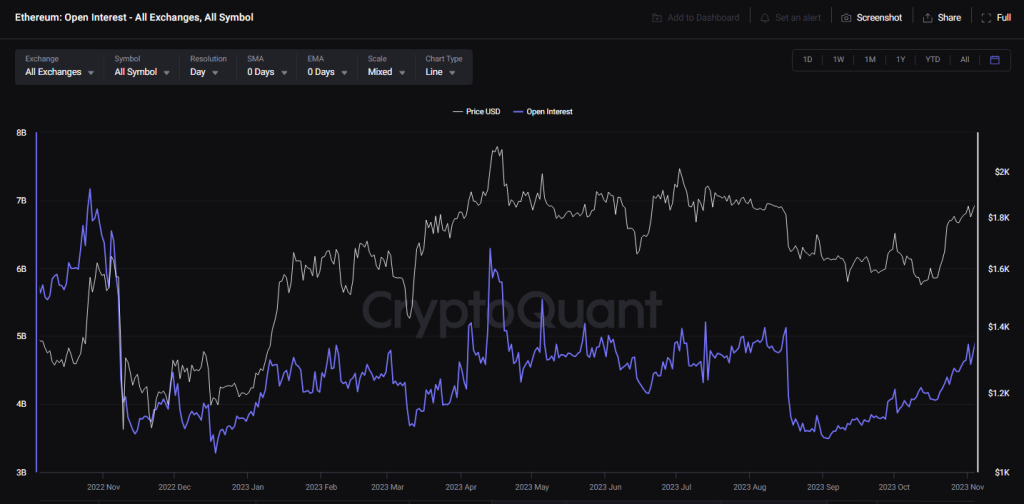

This downward pressure is further emphasized by the significant decline in open interest (OI) behind the ETH futures contract. OI plummeted from $10 billion to $7 billion in April alone.

This decline signals a rebalancing of futures markets and potentially a period of cooling in speculative trading activity.

Source: CryptoQuant

Navigating choppy waters

However, even amidst the uncertainty, there is a glimmer of hope in the ETH uptrend. Historical precedents, such as the mid-February 2021 correction, provide insight into the resilience of the Ethereum price.

Ethereum, which suffered a similar decline from its all-time high of $1,900 to $1,400, experienced a V-shaped reversal, demonstrating the market’s tendency toward a quick recovery. This historical context serves as a guide for investors navigating the treacherous waters of cryptocurrency volatility.

Total crypto market cap currently at $2.3 trillion. Chart: TradingView

In terms of social sentiment, Ethereum’s trajectory is divided into two parts. There was very positive sentiment in February and a brief period of positive sentiment in mid-March, but as prices entered a correction phase, negative sentiment dominated. Factors such as high gas fees on the Ethereum network have likely contributed to this change, highlighting the impact of practical considerations on market sentiment.

Ethereum: Basic Metrics

Examining Ethereum’s fundamental indicators can provide additional insight into its current state. Network growth has slowed in recent months, suggesting a possible decline in demand. But a closer look reveals something hopeful. The 90-day average coin usage period has been trending steadily higher since late March, indicating an accumulation of ETH across the network.

Ether price action in the last 24 hours. Source: CoinMarketCap

As Ethereum continues to navigate these turbulent waters, all eyes are on key resistance levels. A break above the $3,300 barrier could instill confidence among traders and investors, potentially signaling new bullish momentum. But uncertainty mounts, especially when considering broader market dynamics and selling pressure on Bitcoin, Ethereum’s perennial counterpart.

While challenges are numerous and uncertainty persists, Ethereum’s historical performance and fundamental strengths offer hope for a brighter future. As investors brace for both potential headwinds and opportunities, Ethereum is poised to weather the storm and emerge stronger on the other side.

Featured image from Pexels, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.