- Ethereum hit an 8-week high as RSI increased buying pressure.

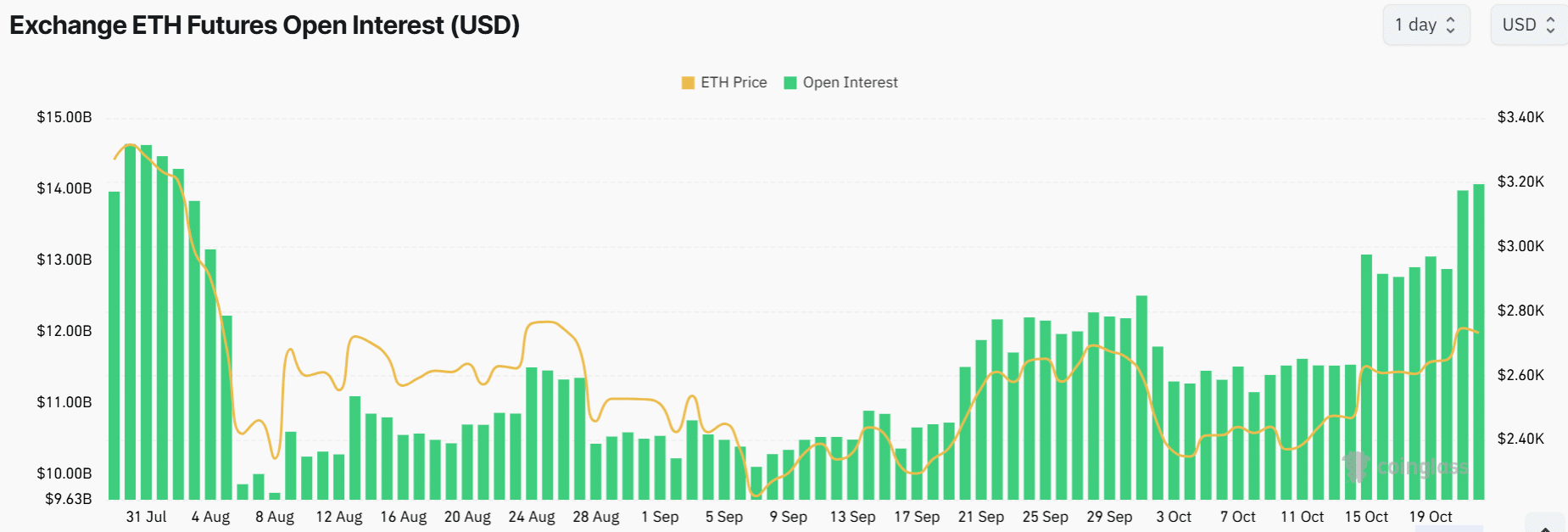

- Open interest of $14 billion reflects increased market participation by derivatives traders.

Ethereum (ETH) It was trading at an eight-week high of $2,735 at press time, after rising nearly 4% in 24 hours. According to CoinMarketCapMarket interest is increasing with trading volume increasing by more than 100%.

These gains gave ETH the highest short-term liquidation amount across the cryptocurrency markets. At press time, more than $23 million in ETH short positions were wiped out. coin glass.

A high number of short sell liquidations is a bullish sign as it means short sellers are turning into buyers to liquidate their positions. A look at Ethereum’s daily chart shows that this bullish trend may continue.

Ethereum shows bullish signals

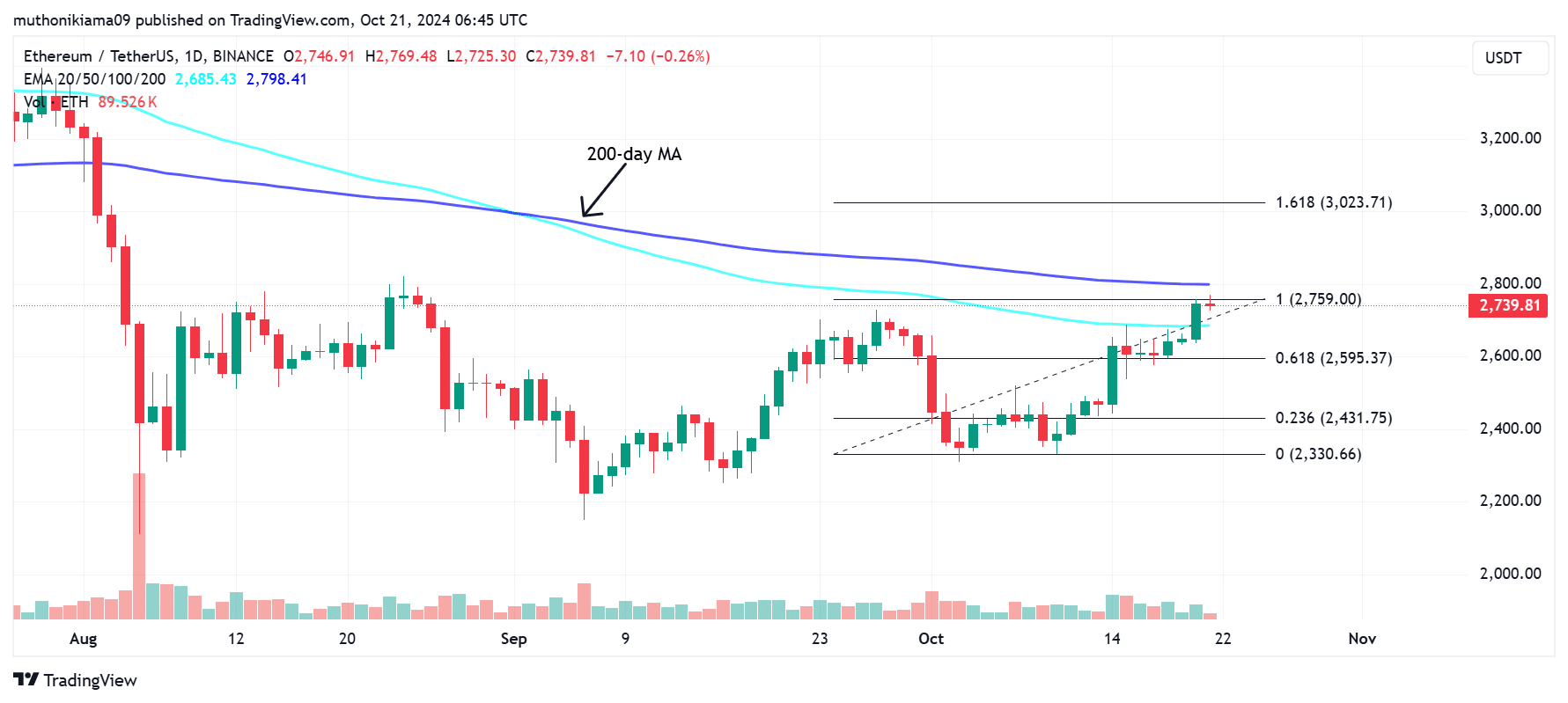

ETH reversed its 100-day exponential moving average (EMA) at $2,685 as its upward trend strengthened. The uptrend then encountered resistance as ETH approached the 200-day EMA.

The 200-day EMA, currently around $2,800, is a psychological level for traders. If ETH breaks this resistance line, the altcoin could enter a long-term bullish trend and rebound towards the 1.618 Fibonacci level above $3,000.

Source: TradingView

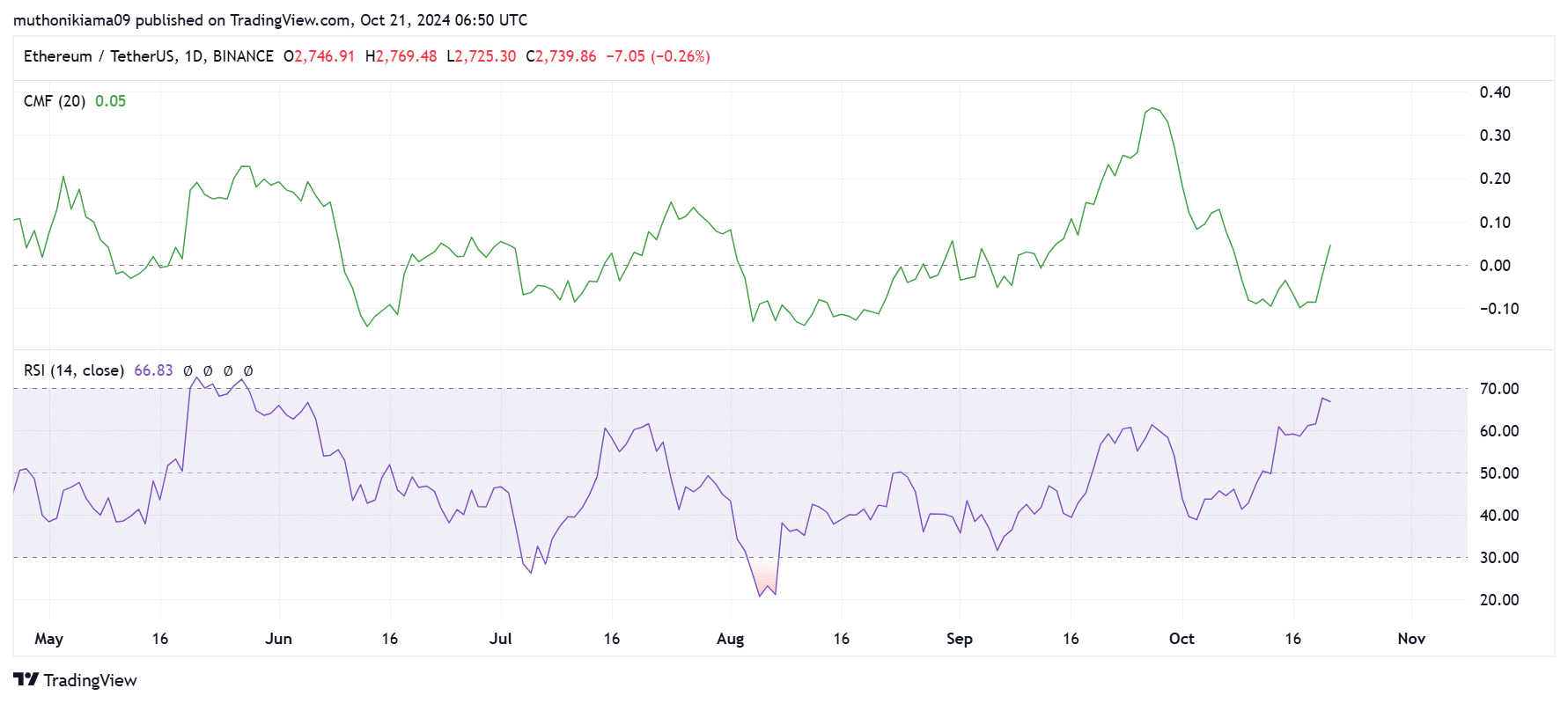

Technical indicators suggest that a breakout of the 200-day EMA is likely. Chaikin Money Flow (CMF) has flipped positive for the first time in almost two weeks, showing that more capital is flowing into ETH.

Additionally, the Relative Strength Index (RSI) continues to increase its highs, reaching its highest since June, showing high buying pressure.

Source: TradingView

Despite the influx of buyers, Ethereum’s RSI is 66, showing that it is not overbought. This indicates that there is room for growth.

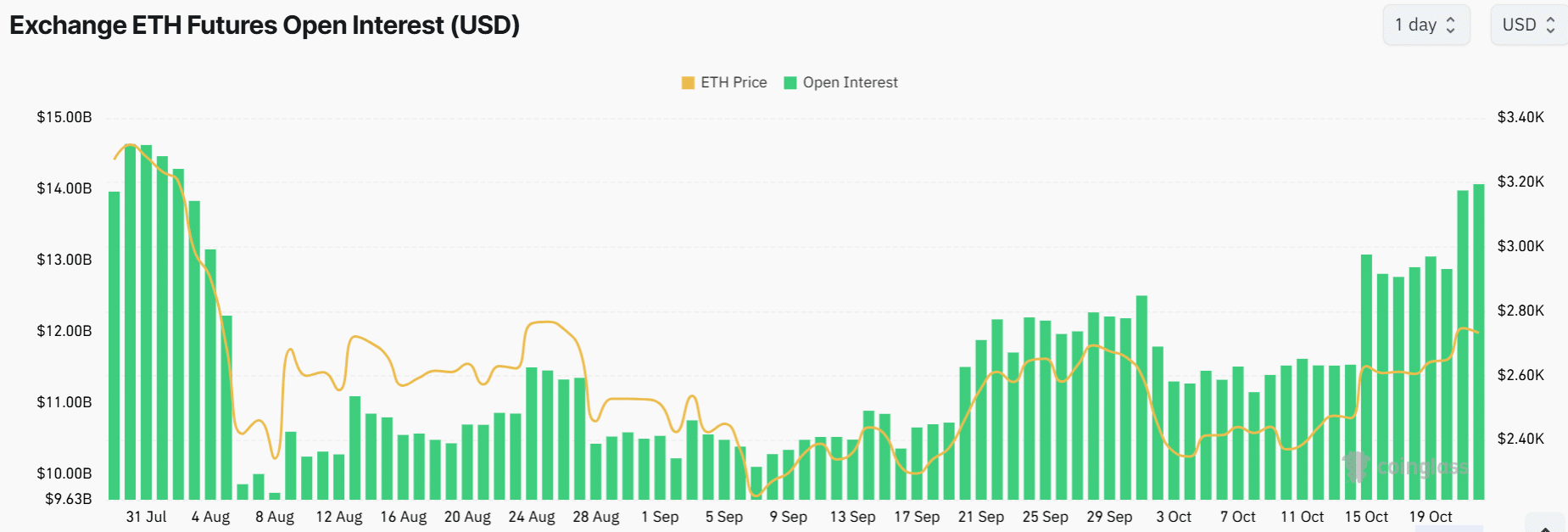

Open interest and leverage ratio surge

Public interest in Ethereum has grown to its highest level since August, according to data from Coinglass. This figure stands at $14 billion at press time, indicating a large number of market participants and capital flowing into ETH.

Source: Coinglass

An increase in open interest is generally bullish when a trader initiates a long position. However, this increase may also result in price volatility.

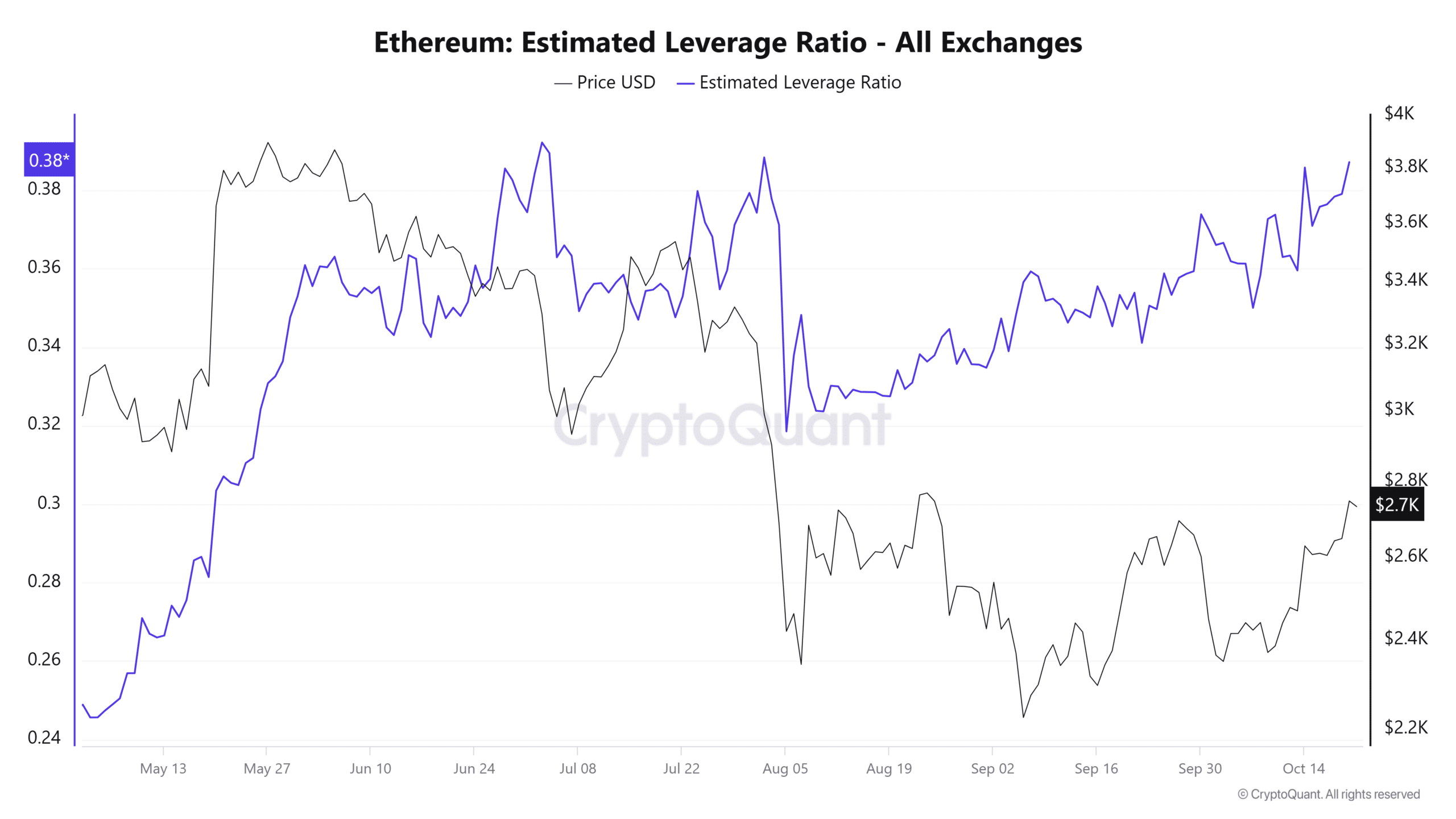

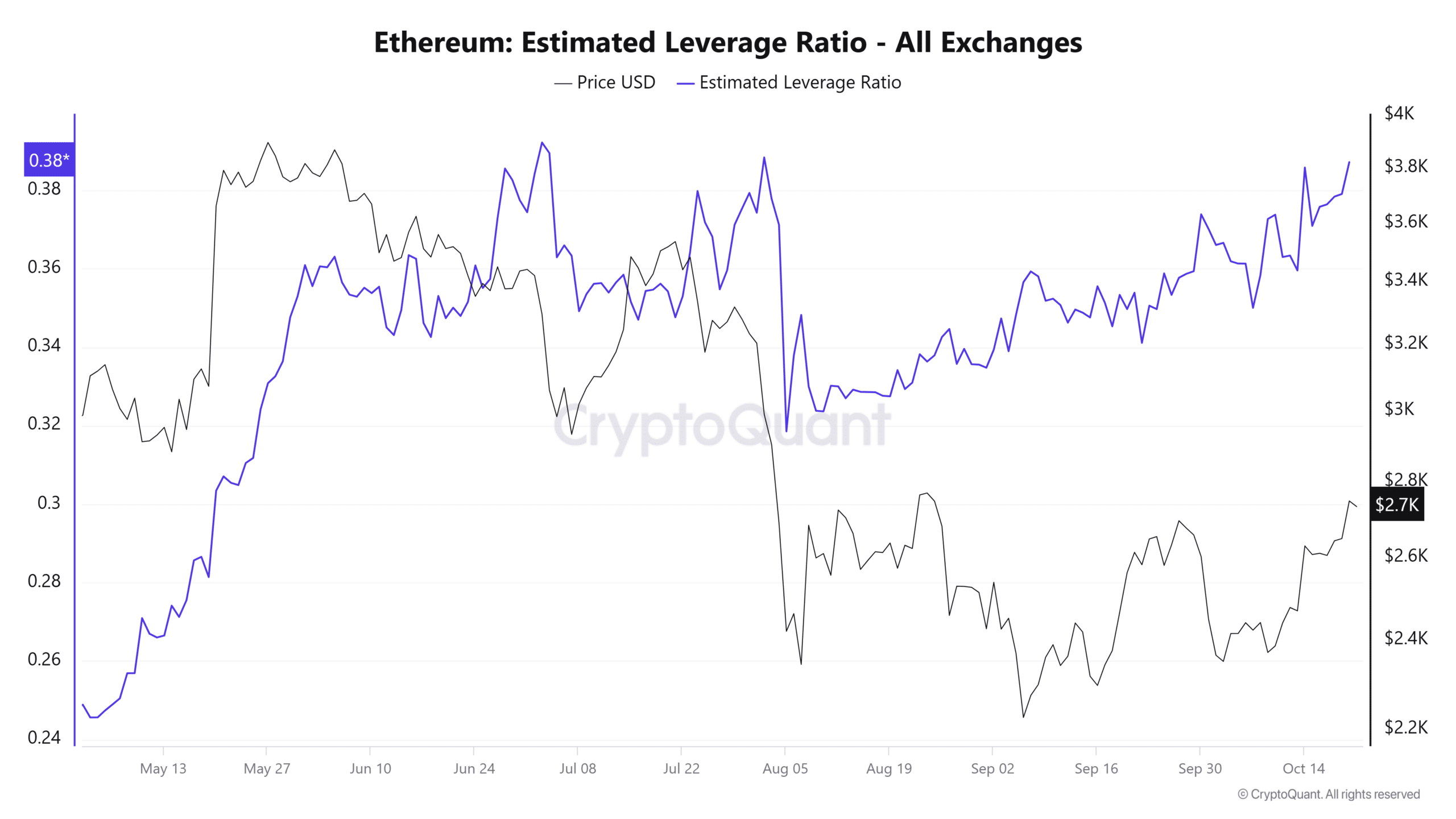

Ethereum’s estimated leverage ratio is approaching a three-month high, suggesting that leverage is flowing in. If ETH moves suddenly, volatility may increase due to many forced liquidations.

Source: CryptoQuant

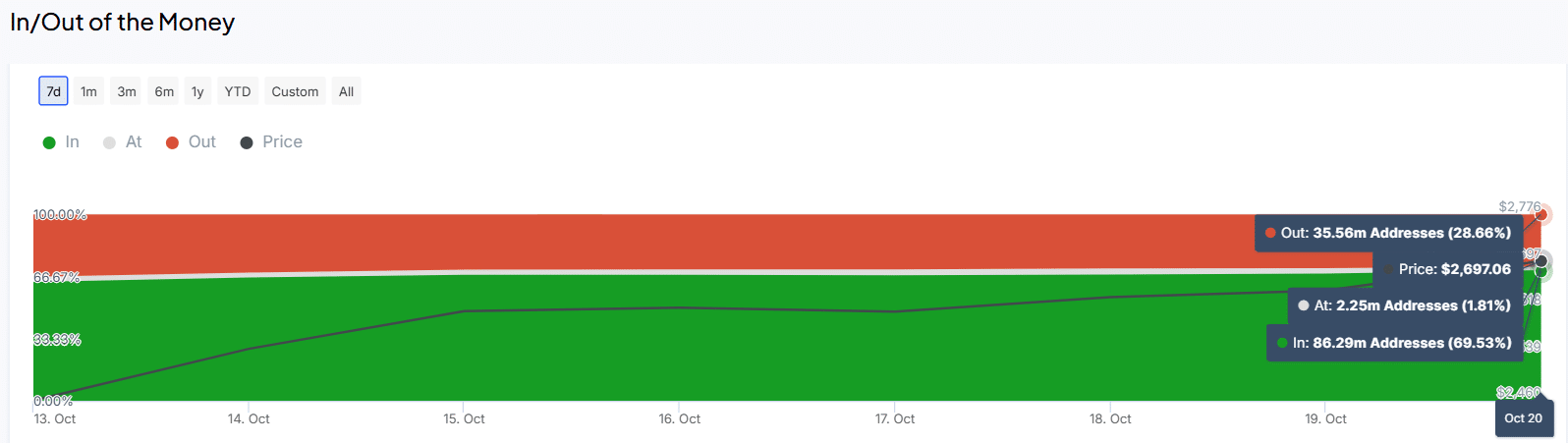

Profitable Ethereum Wallet

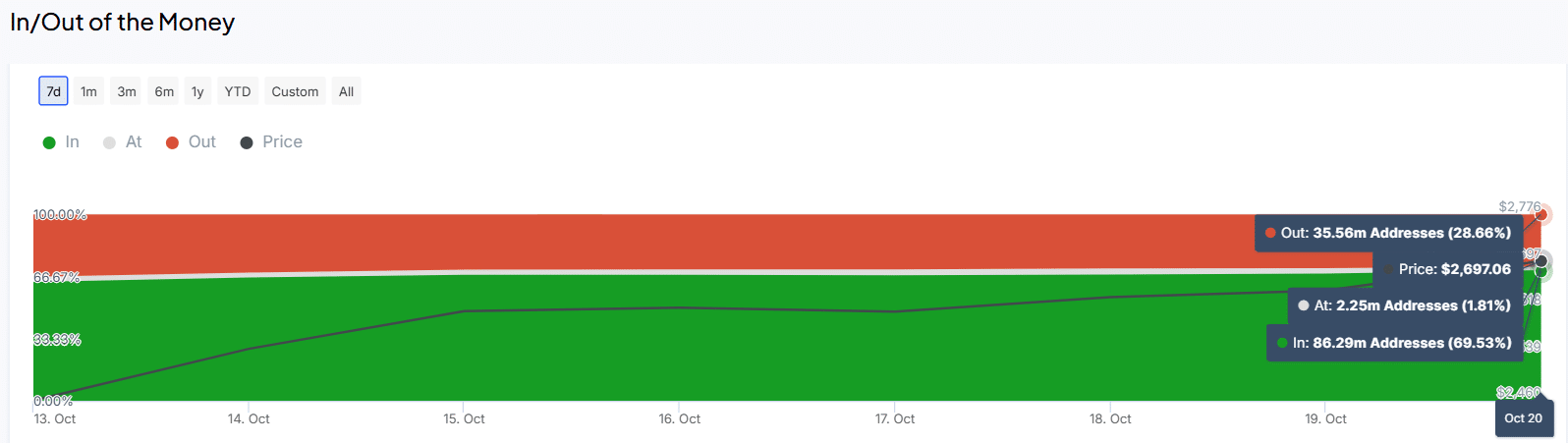

Ethereum’s recent rise has led to a surge in In The Money (profit) wallets. At press time, 69% of all ETH addresses were profitable, an increase of 6% over the past seven days.

Source: IntoTheBlock

Read Ethereum (ETH) price prediction for 2024-2025

Meanwhile, lost wallets have dropped significantly from 42 million addresses in just one week to 35 million addresses at press time.

As more Ethereum wallets become profitable, positive sentiment towards ETH may arise.