Ethereum (ETH), the second largest cryptocurrency based on its market cap, has suffered continuous difficulties throughout the year.

Despite several attempts to regain the driving force, Ethereum sometimes fell below $ 3,000, reflecting that it could not continue to recover. This lack of upward movements caused investors’ attention, and many people sold their assets to secure profits.

Ethereum investors lack patience.

Investor emotions surrounding Ethereum have noticeably changed, and as the theories of skepticism are growing, the holders are moving to dispose of their assets. Last week, more than 410,000 ETHs, or more than $ 1.3 billion were sold. Selling is clearly in the increase in ETH supply in the exchange, which is a clear signal that investors are using recent price movements rather than long -term benefits.

This increase in selling pressure emphasizes that the trust of market participants who are not convinced of Ethereum’s ability to maintain meaningful recovery is weakening. Since there is no strong price increase measure, uncertainty has been increased further, and it has been converted to profit pursuit.

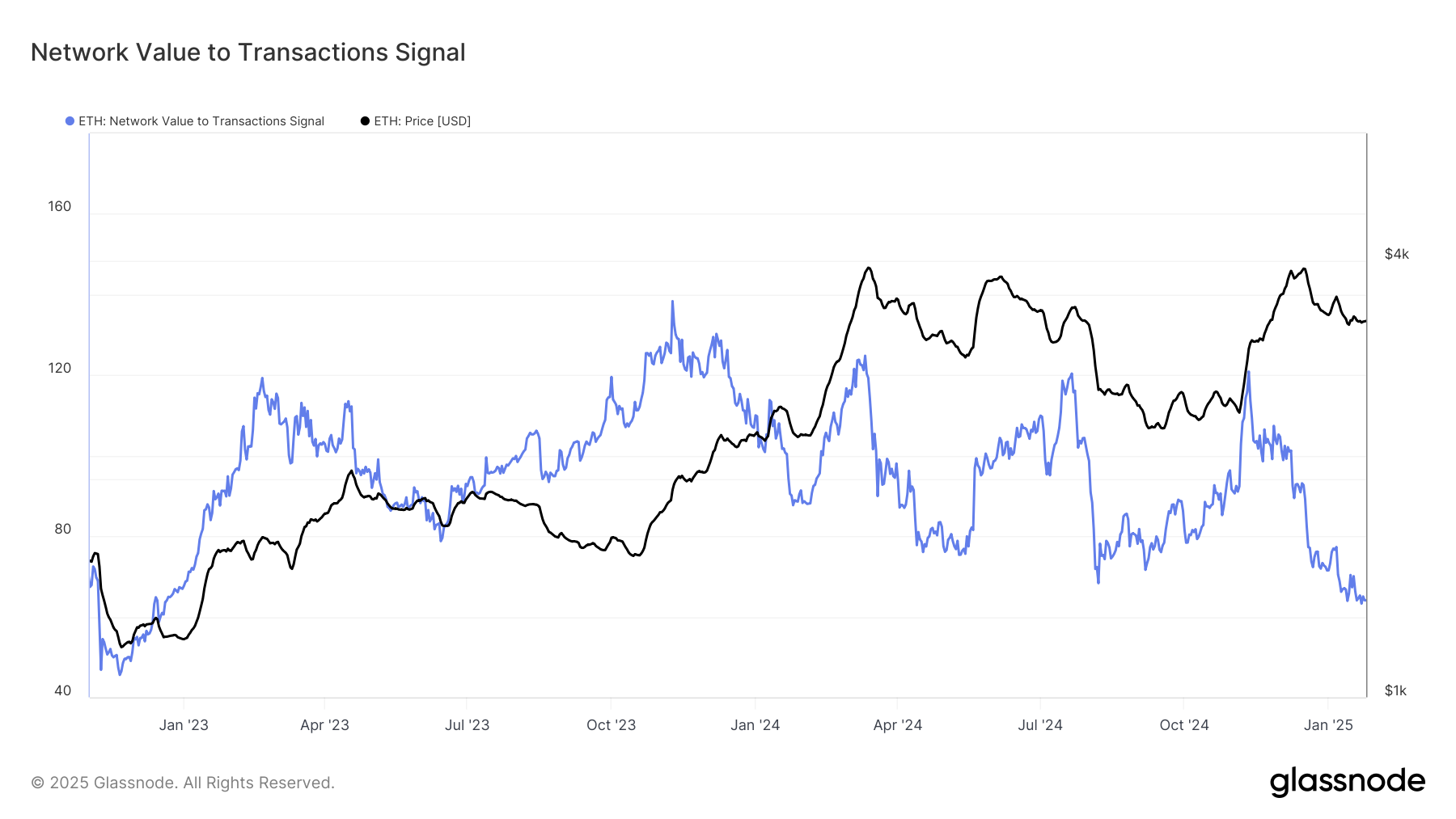

Ethereum’s macroscopic momentum presents a mixed view. The Network Value to Transaction (NVT) signal, a key indicator for valuation, fell to the lowest level in 25 months. This suggests that Ethereum is currently undervalued, indicating the possibility of recovery and rebound in the mid- to long -term.

The undervalued at the NVT signal can provide hope for the reversal of emotions by preventing Ethereum from experiencing rapid adjustment. If this undervalued state attracts new attention, ETH will stabilize and have the opportunity to cross the current barrier.

ETH price forecast: invalidation of barriers

The price of Ethereum is now more than $ 3,303 after attempts to break through the $ 3,530 barrier. Last week, cryptocurrency fell to $ 3,131, emphasizing continuous efforts to maintain strong momentum.

Considering the current situation, Ethereum is likely to be integrated under the $ 3,530 resistance level. If this important barrier is not recovered, the ETH will fall back to $ 3,131, which can lead to a weakening market reliability.

On the other hand, a successful violation of $ 3,530 can be a turning point for Ethereum. This movement is likely to increase the price to $ 3,711, which is likely to restore investors’ trust and invalidate weak prospects. But in order for this scenario to develop, continuous buying and friendly market conditions will be important.

disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is provided only for the purpose of providing information and should not be considered as financial or investment advice. Beincrypto is doing its best for accurate and prejudice, but the market situation can be changed without notice. Always conduct an investigation and consult with an expert before making financial decisions. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.