- ETH hit a hurdle near $2700 after recovering in October.

- The options market estimates that ETH is less likely to reach $3,000 before the US elections.

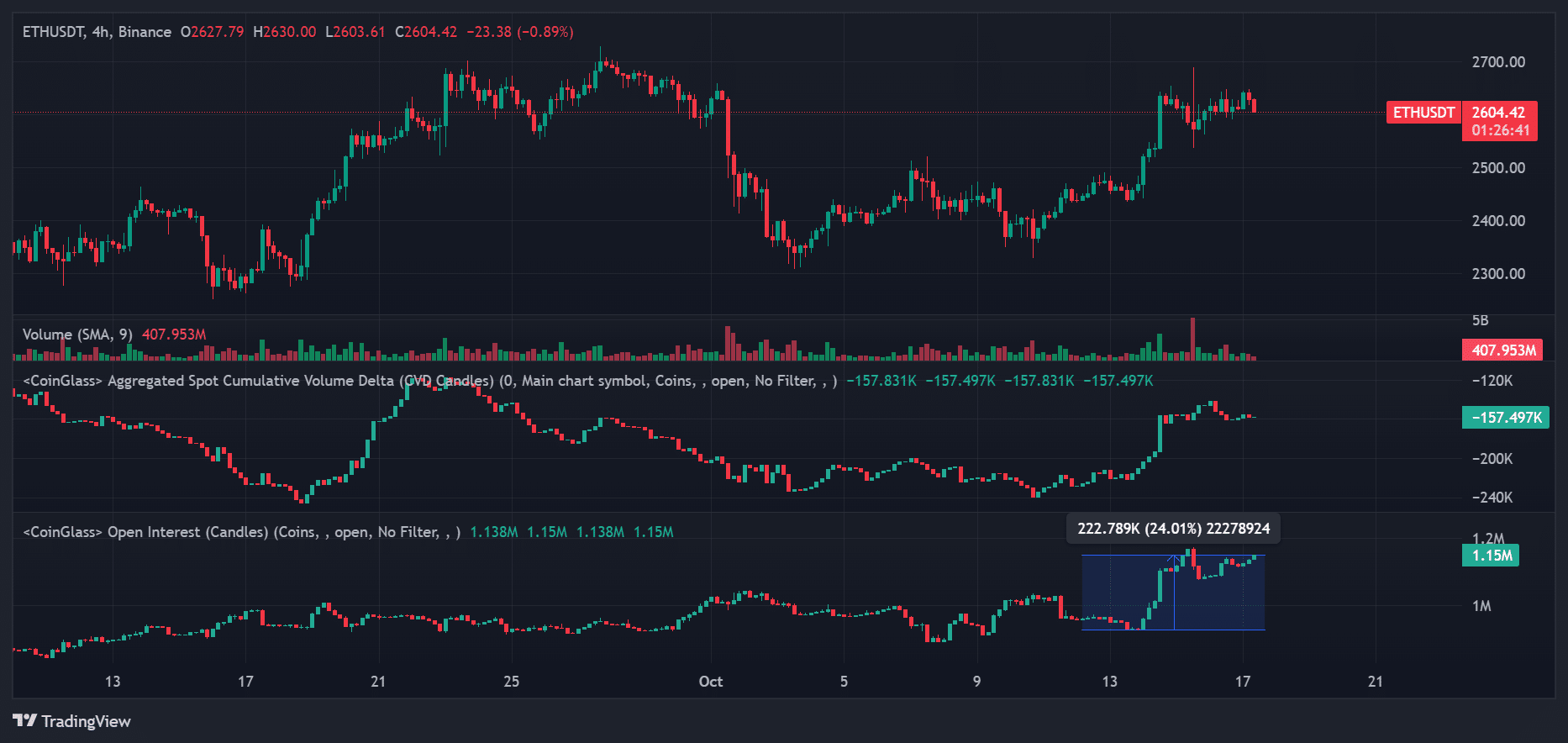

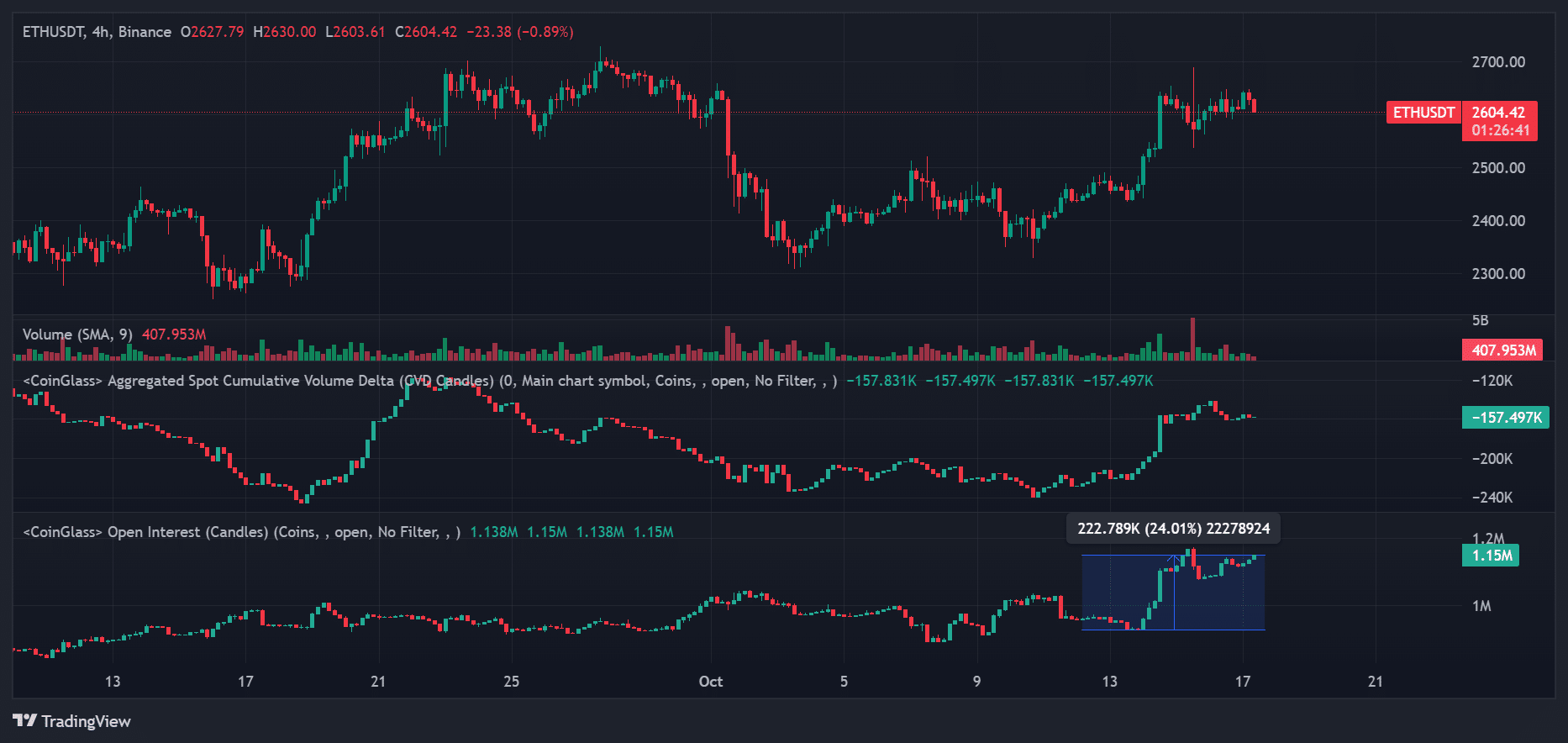

Ethereum (ETH) After reversing losses in the first half of October, it recovered to $2.6K. The largest altcoin recorded a recovery gain of around 12% after rising from $2.3K to over $2.6K.

At press time, ETH was worth $2,614, but has hit a major hurdle below $2,700.

Ethereum price prediction

Source: ETH/USDT, TradingView

Since October 9, ETH has recorded increased capital inflows, as evidenced by the rise in Chaikin Money Flow. However, indicators have eased over the past two days, suggesting a slight decline in inflows.

This could derail ETH’s strong move above the hurdle and supply zone (shown in red) that doubles as a bearish order block. The supply zone has also joined the trendline resistance (white dotted line).

This means that a roadblock could trigger a price rejection against the 50-day exponential moving average (EMA) at $2.5K (blue line).

However, if Bitcoin (BTC) continues its strength above $68,000, ETH may attempt to overcome the hurdle. Then you can put in an additional 8% once ETH reaches $2.9K.

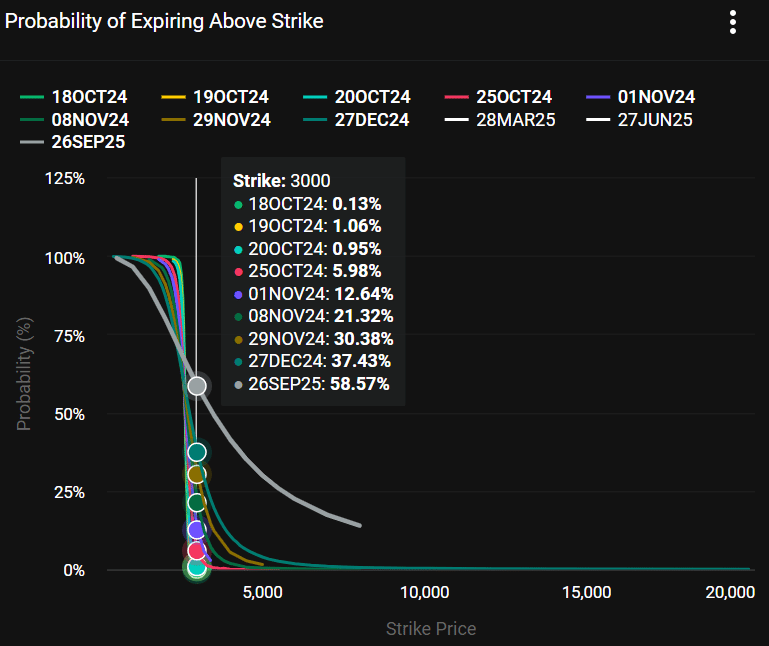

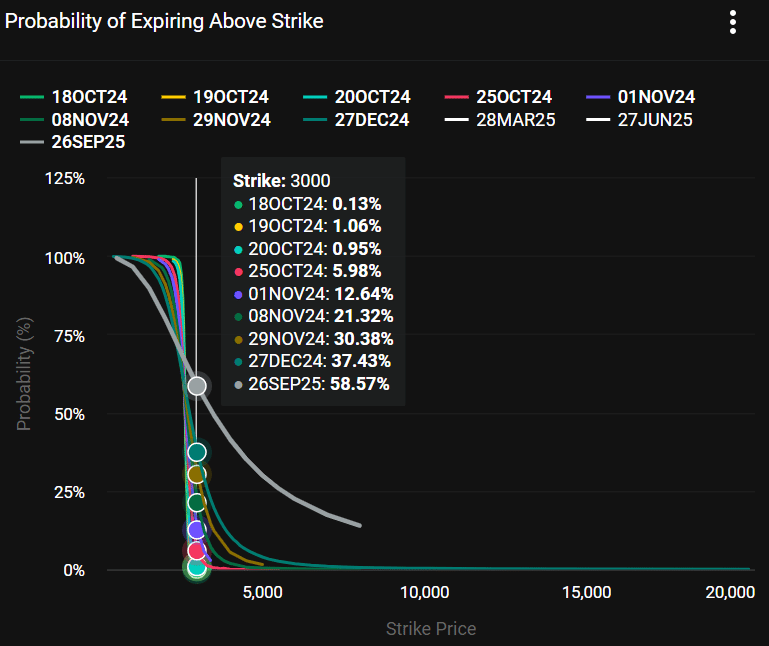

Option data…

Source: Deribit

That is, depending on the options data On Deribit, ETH may not see a strong breakout in October. The options market was less optimistic about ETH rising 6% to $3,000 before the end of the month.

Conversely, on November 8th, right after the US election, the probability of $3,000 per ETH was 21%.

Put differently, a strong move for ETH above $3,000 may only be possible after the US elections, as the next administration will decide on DeFi regulation.

Meanwhile, the 8% gain this week added more than 220,000 ETH to open interest on the Binance exchange.

While this represents a bullish bet, it does not indicate future price direction for ETH given the rising price and increasing spot demand (CVD).

Read Ethereum (ETH) price prediction for 2024-2025

However, high leverage means a high level of liquidation risk, especially if ETH price moves lower and sells off harder.

Therefore, support at $2300, 50-day EMA and hurdles could be the key levels of interest in the near term.

Source: TradingView

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.