- Ethereum selling pressure was dominating Binance.

- ETH has fallen 18.61% over the past month.

After hitting a recent high of $3746 a week ago, Ethereum (ETH)) experienced strong downward pressure.

During this period, ETH fell to a local low of $3,157. Altcoins have shown moderate gains but are still in decline.

At the time of writing, Ethereum is trading at $3,196, down 2.17% on the daily chart. ETH also fell 12.67% on the weekly chart and 18.61% on the monthly chart.

According to CryptoQuant, this decline across ETH charts is primarily due to increased selling pressure.

Selling pressure on Ethereum is dominant.

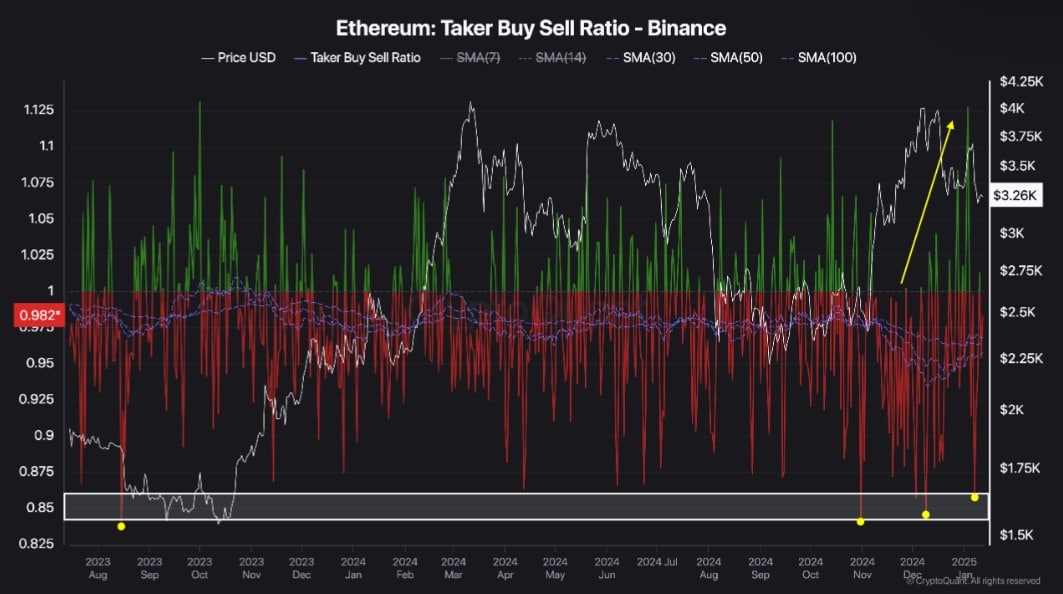

According to CryptoQuant analysis, ETH is under strong selling pressure on Binance. As such, Ethereum has been exerting significant selling pressure on exchanges since November 2024.

Source: CryptoQuant

The growing dominant selling pressure on Binance is evidenced by the taker buy/sell ratio of ETH. This indicator has remained negative since November 2024, indicating a higher volume of sell orders compared to buy orders.

During this period, taker buy/sell ratios have fallen to levels not seen since August 2023, reflecting the prevailing bearish sentiment.

The downward momentum strengthened in December, with sellers quickly regaining the upper hand while buyers attempted to seize control.

Sustained selling pressure over the past few months highlights market weakness and caution.

On the other hand, rising selling rates present a potential buying opportunity for long-term holders.

Will this affect the ETH price chart?

As observed above, Ethereum is experiencing strong selling pressure, which has negatively impacted the price movements of the altcoin.

Source: TradingView

First of all, selling pressure may increase as ETH Chaikin Money Flow (CMF) turns negative. If the CMF is at -0.08, it means that sellers are controlling the market.

This market behavior is confirmed by the relative strength index (RSI) falling, settling at 38, almost oversold. This decline means sellers are controlling the market.

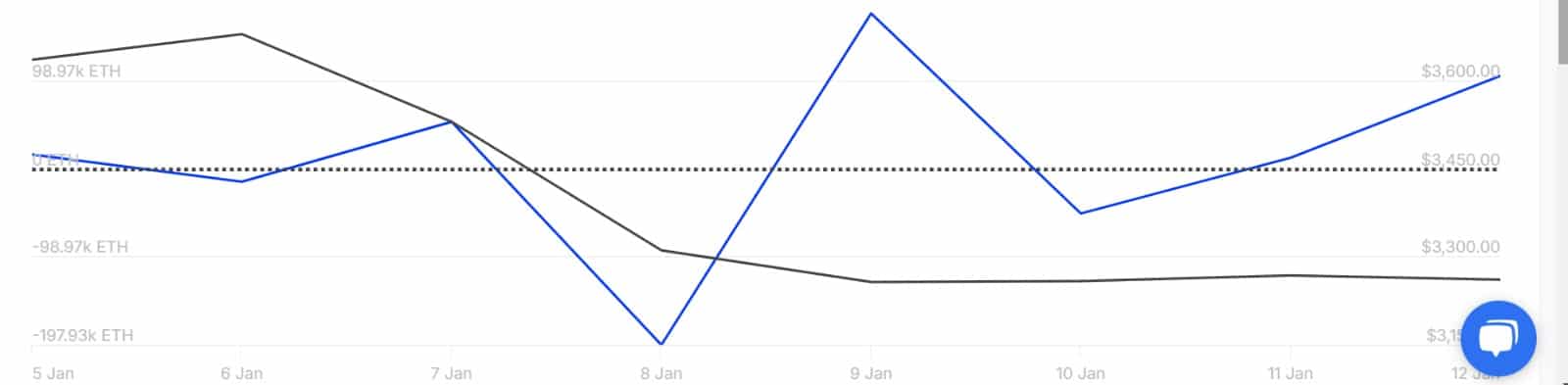

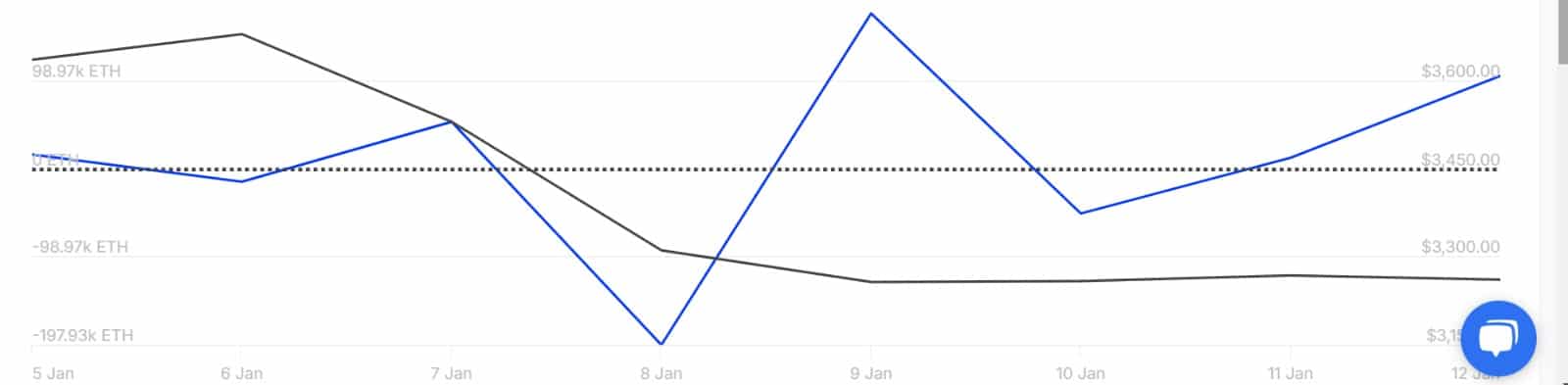

Source: IntoTheBlock

Looking more closely, Ethereum has seen a surge in exchange inflows over the past week. It surged from -50.77k to 103.77k, indicating more ETH inflows to exchanges than outflows.

As investors generally tend to sell when making these trades, more inflows into the exchange increase selling pressure.

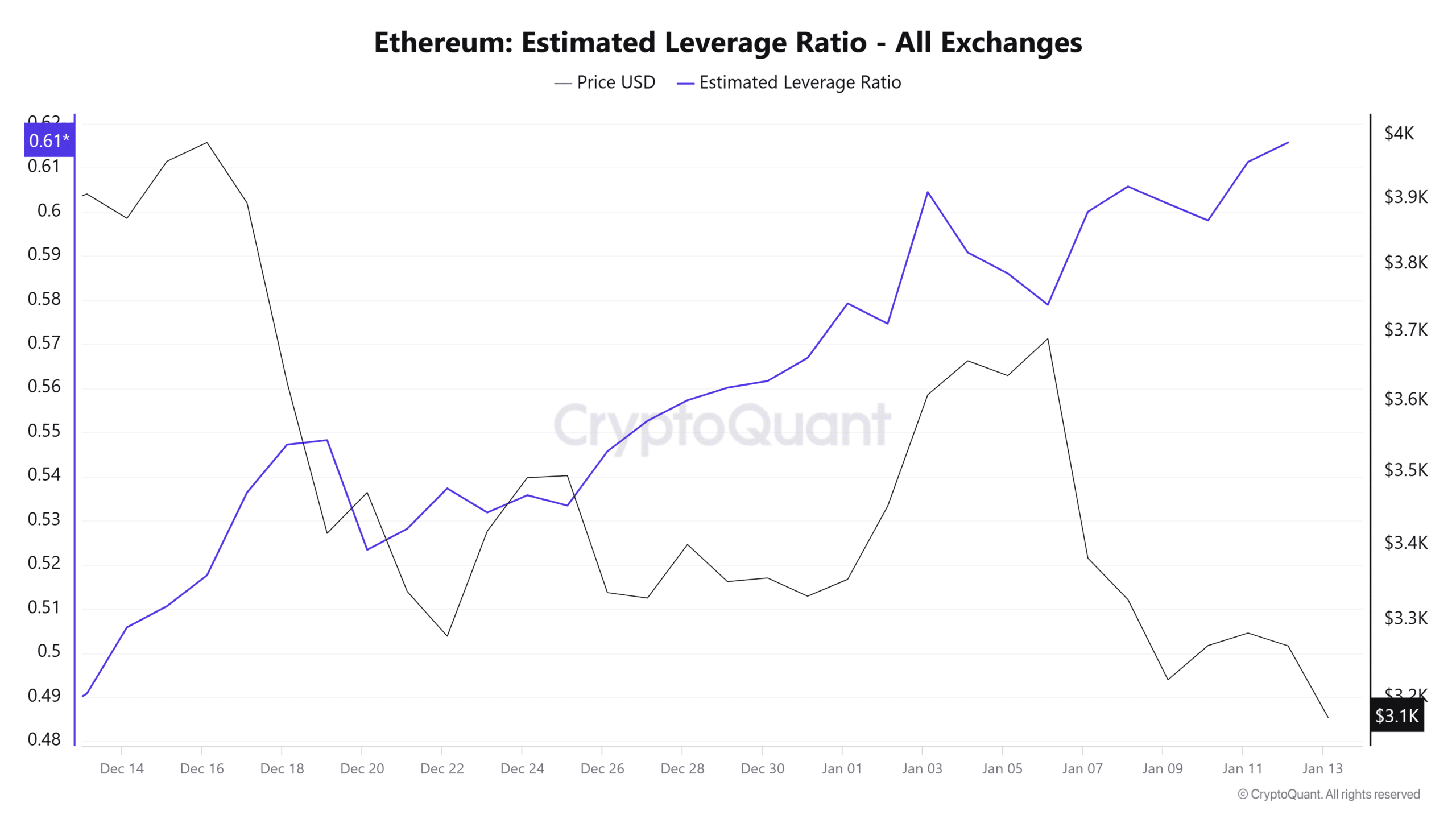

Source: CryptoQuant

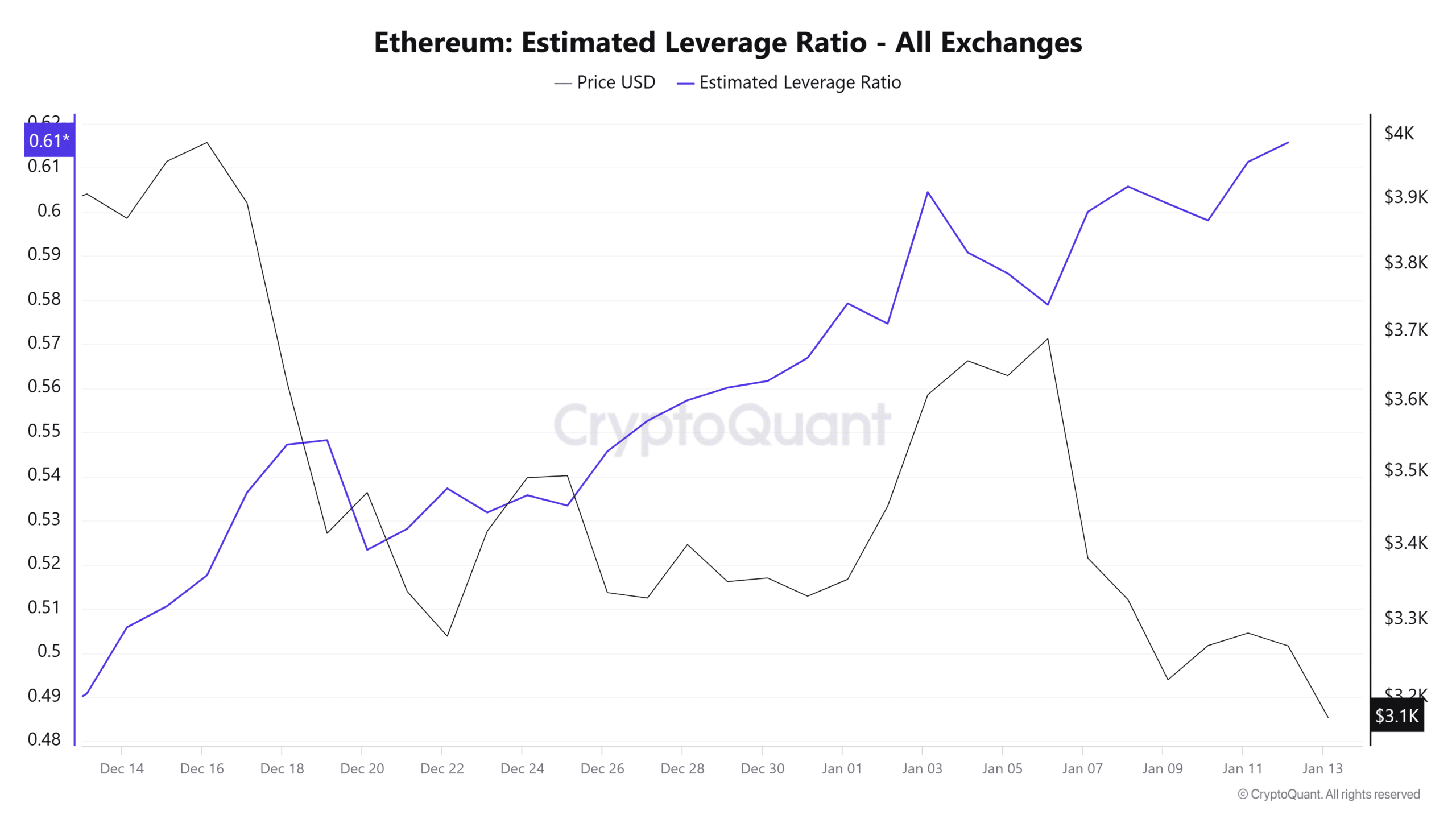

Ethereum’s Expected Leverage Ratio (ELR) has experienced a steady increase over the past month. A rising ELR during a downtrend signals bearish sentiment and increases the risk of a long-term squeeze.

If the price falls further, long positions may be liquidated, causing a buying squeeze and causing the price to fall further.

Read Ethereum (ETH) price prediction for 2025-2026

In conclusion, Ethereum is under strong selling pressure as bearish sentiment continues. If current market conditions continue, ETH could fall to $3,030 and potentially fall below $3,000 to find support around $2,810.

However, if the downtrend is exhausted and a reversal occurs, the altcoin could reclaim $3,300.